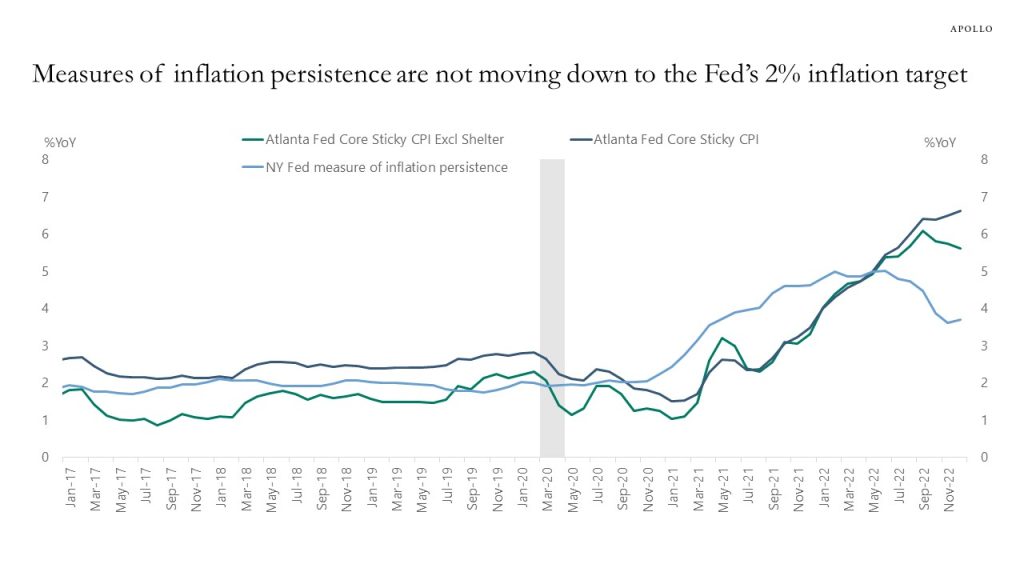

The most important feature of the no landing scenario is that inflation continues to be a problem, and the evidence is accumulating that inflation will indeed remain more persistent for the following ten reasons:

1) Fed measures of inflation persistence have stopped declining, and are moving sideways at levels around 4% to 6%, see the first chart below.

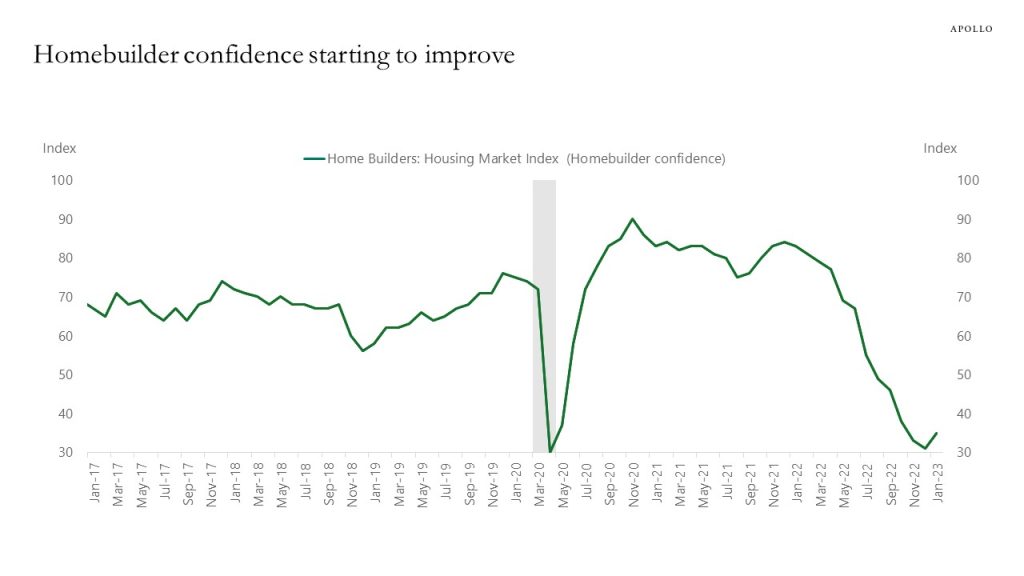

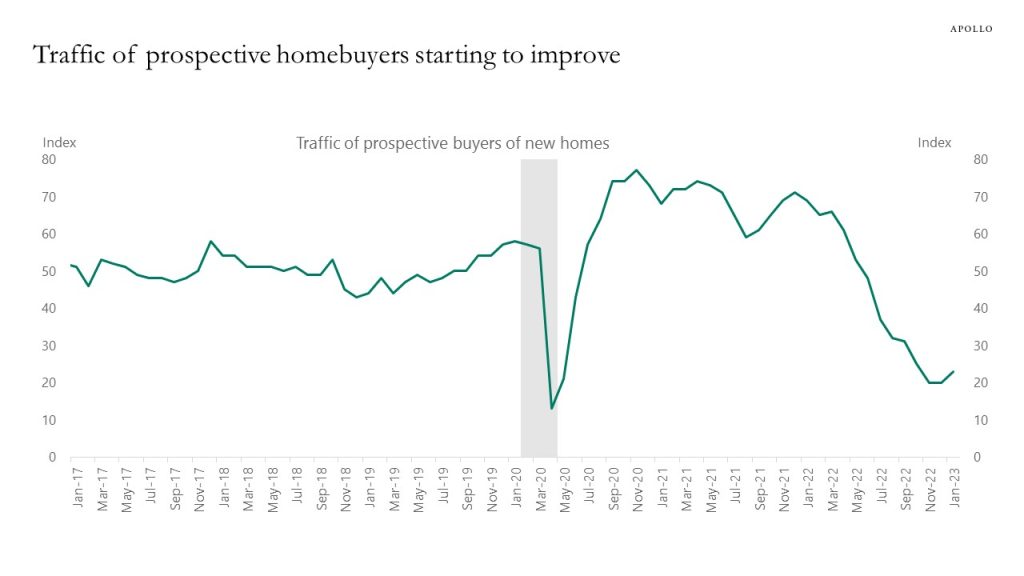

2) The housing market is starting to bottom and we are entering the spring selling season, and this will boost the shelter component of the CPI, see the second and third chart below.

3) The labor market is not showing any signs of slowing down, nonfarm payrolls is strong, the work week is increasing, the participation rate is rising, jobless claims are very low, job openings are near all-time highs, and the unemployment rate is at the lowest level in more than 50 years.

4) Used car prices have bottomed and are starting to move higher.

5) With a strong labor market and auto demand coming back, motor vehicle insurance inflation will stay strong.

6) Revenge travel continues to drive airline ticket prices higher, and travel demand remains very strong, see also here.

7) China reopening will boost prices of energy, food, iron, steel, and copper over the coming quarters, putting upward pressure on US inflation.

8) We will continue to see strong inflation in food and food away from home driven by strong restaurant demand, high wage inflation, and higher commodity prices.

9) There are capacity issues in the food and energy sectors, which will put upward pressure on inflation.

10) Financial conditions are easier than when the Fed began to raise rates, and capital markets are starting to reopen, boosting consumer spending, hiring, and ultimately inflation.

The bottom line is that the risks are rising that inflation will be sticky at the 4% to 6% level and may even reaccelerate over the coming months.

The next data point is the CPI release next Tuesday, where the consensus expects January core inflation to come in at 5.5%, down from 5.7% in December. The Cleveland Fed expects core inflation to come in at 5.6%, see also here. All these numbers are significantly above the Fed’s 2% inflation target, and the slow speed with which they are moving down toward the Fed’s 2% inflation target also points to inflation being sticky at higher levels.

If inflation stays high, it will bring back the trading environment we had in 2022 because equity and credit markets will conclude that the Fed has not succeeded yet with getting inflation down to 2%, and rates therefore need to go higher to generate more demand destruction.

In short, it is too early for the Fed to declare victory over inflation, and markets should be paying attention.