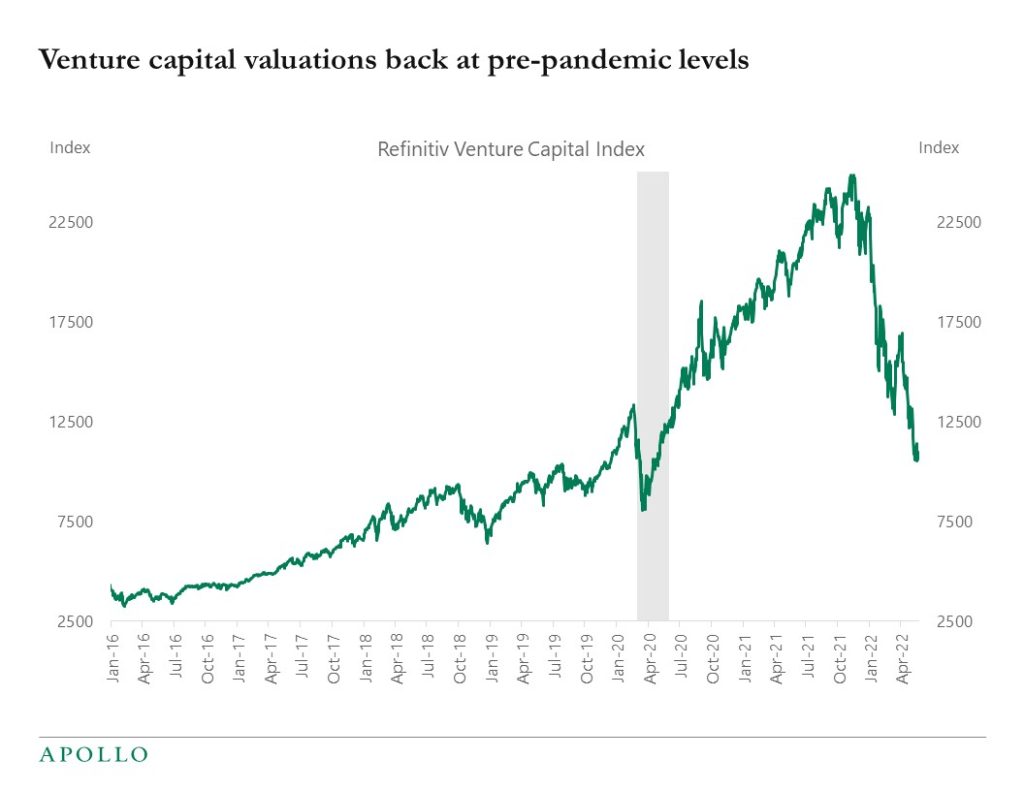

The venture capital index seen in the chart below measures the value of the US-based venture capital private company universe in which venture capital funds invest. It shows that venture capital valuations have so far fallen 56% from their peak. And there is likely more downside over the coming quarters given the consensus expectation that inflation at the end of 2022 will be 5%, which is still significantly above the Fed’s 2% inflation target. The bottom line for markets is that as long as inflation is meaningfully above the Fed’s target, we will continue to see turbulence in markets, particularly in long-duration assets such as tech and venture capital.