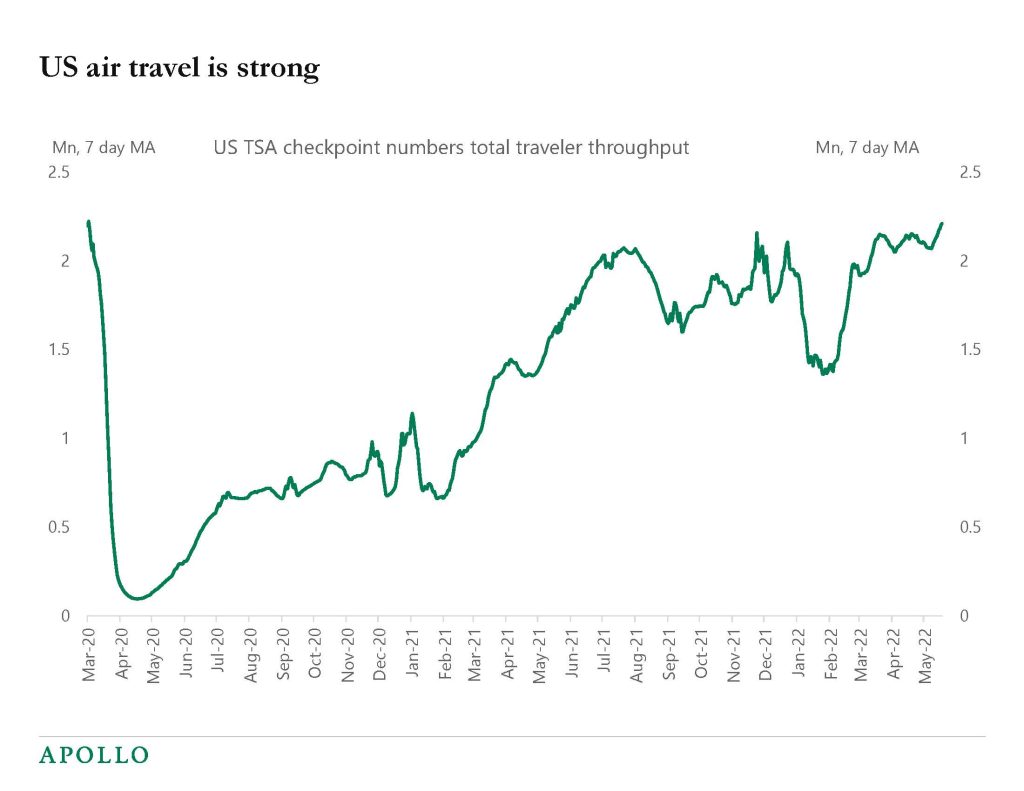

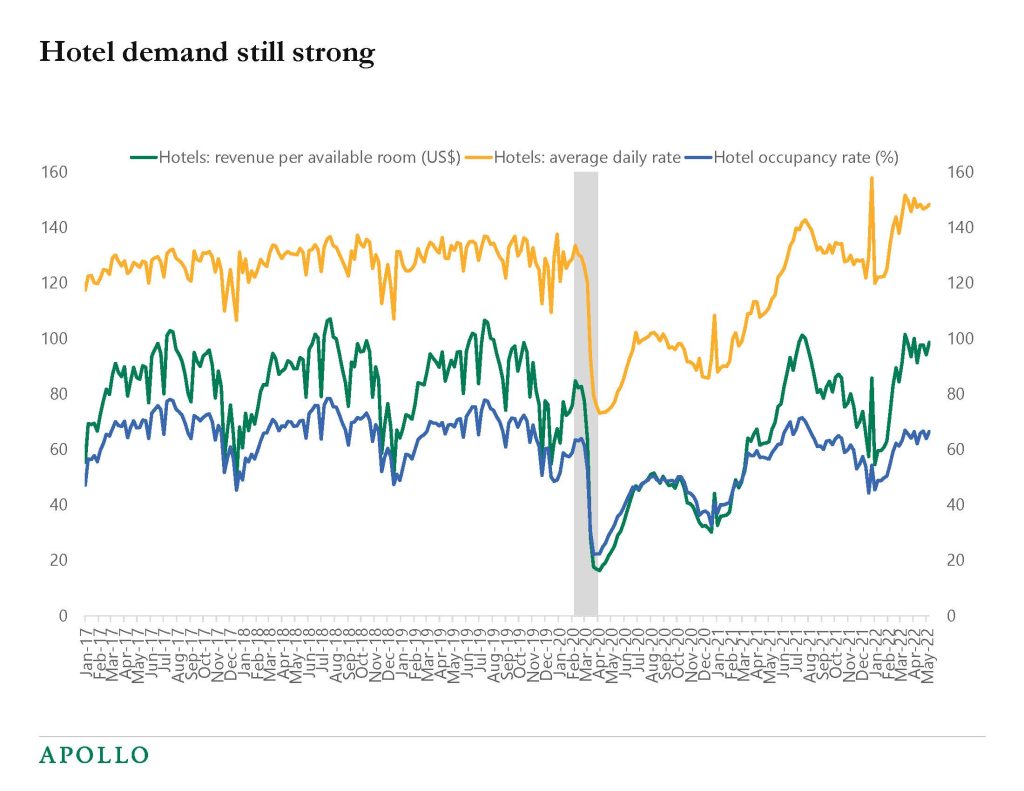

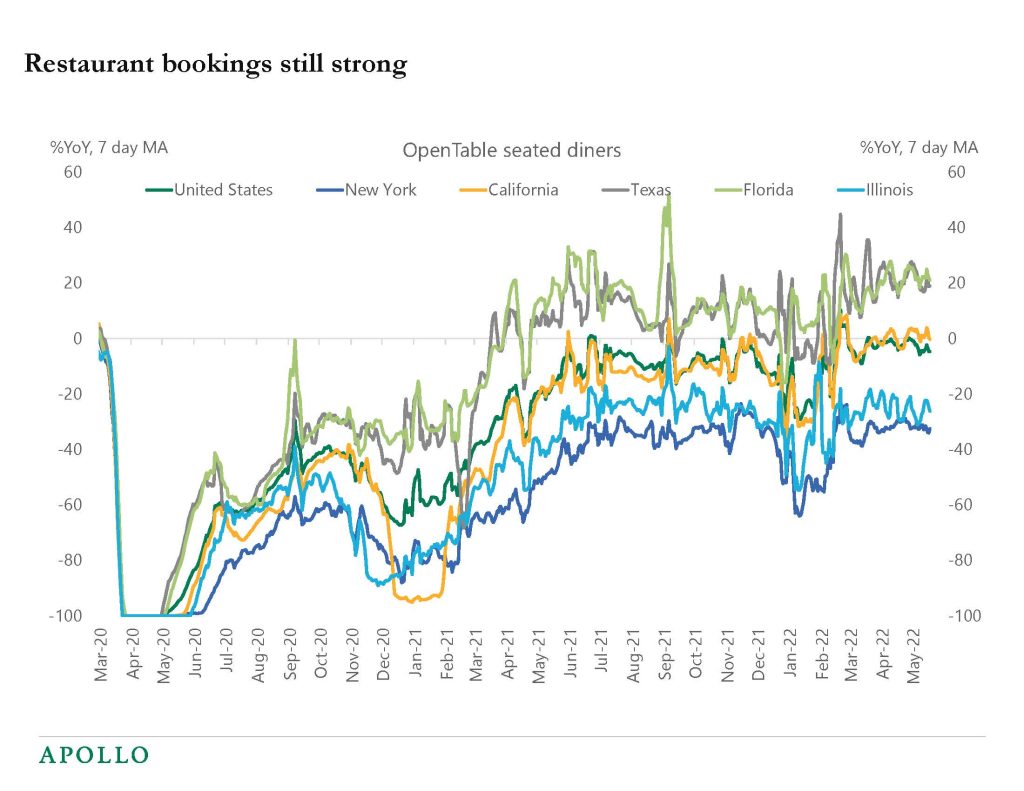

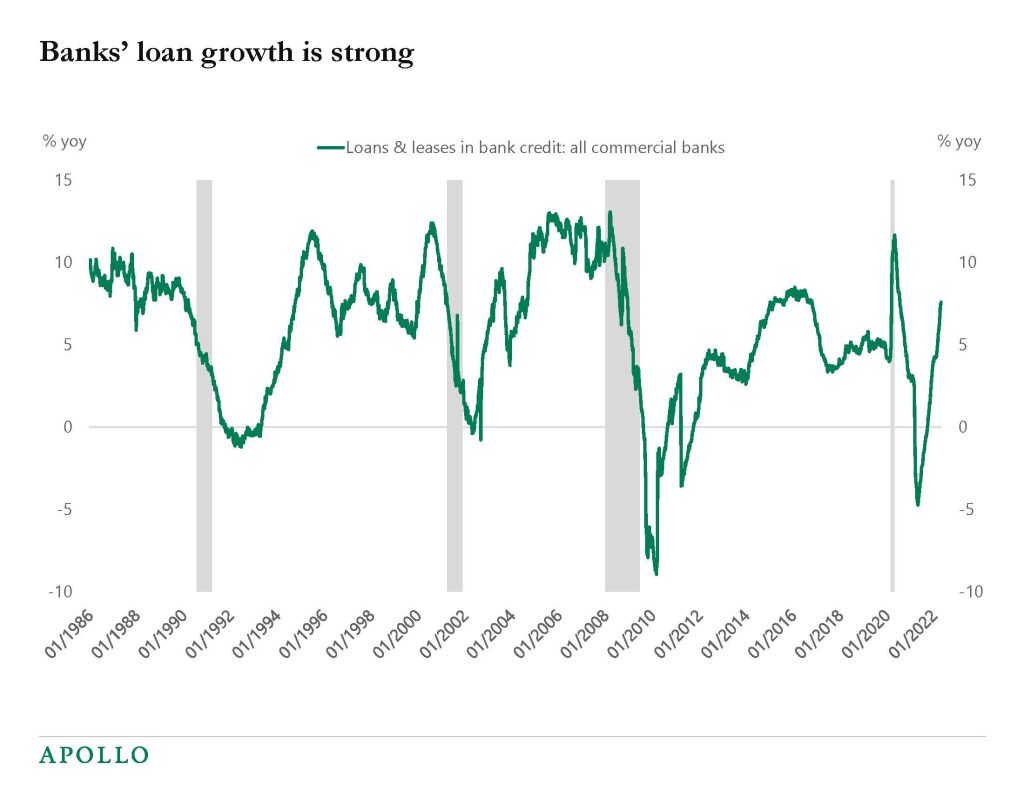

I think there is a 75% chance we will have a recession. It is just not happening yet. Our high-frequency indicators show that air travel is still strong, hotel occupancy rates are high, restaurant bookings are strong, credit card spending is still strong, and the weekly data for bank lending is also trending higher.

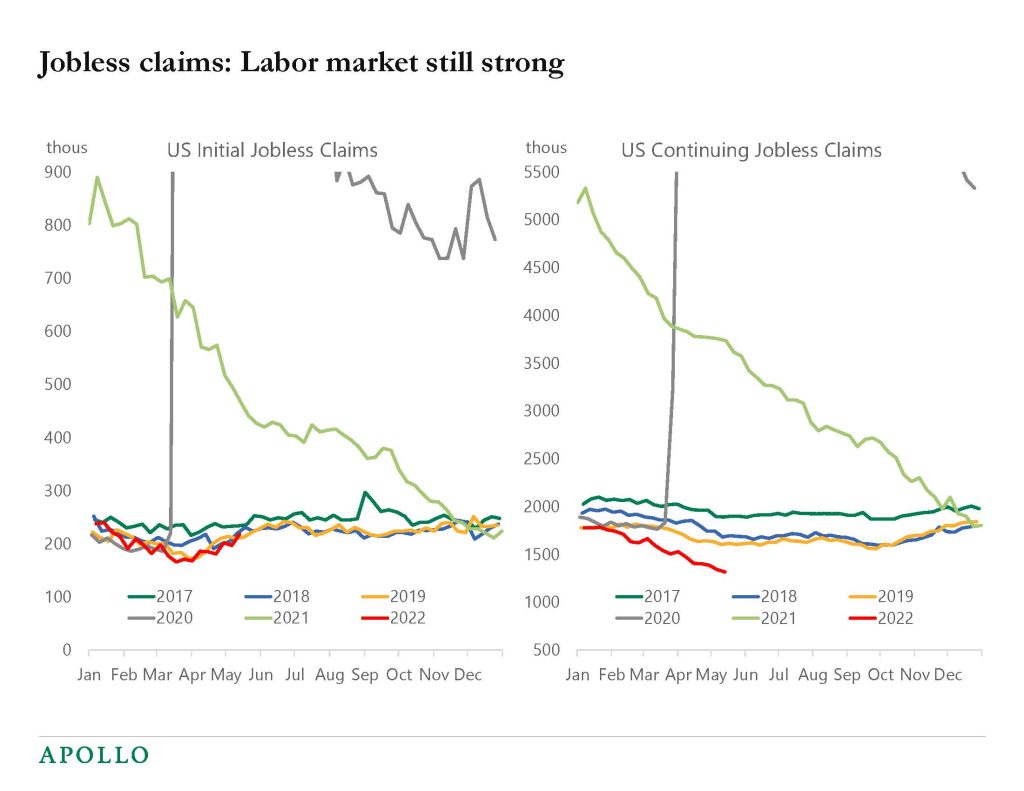

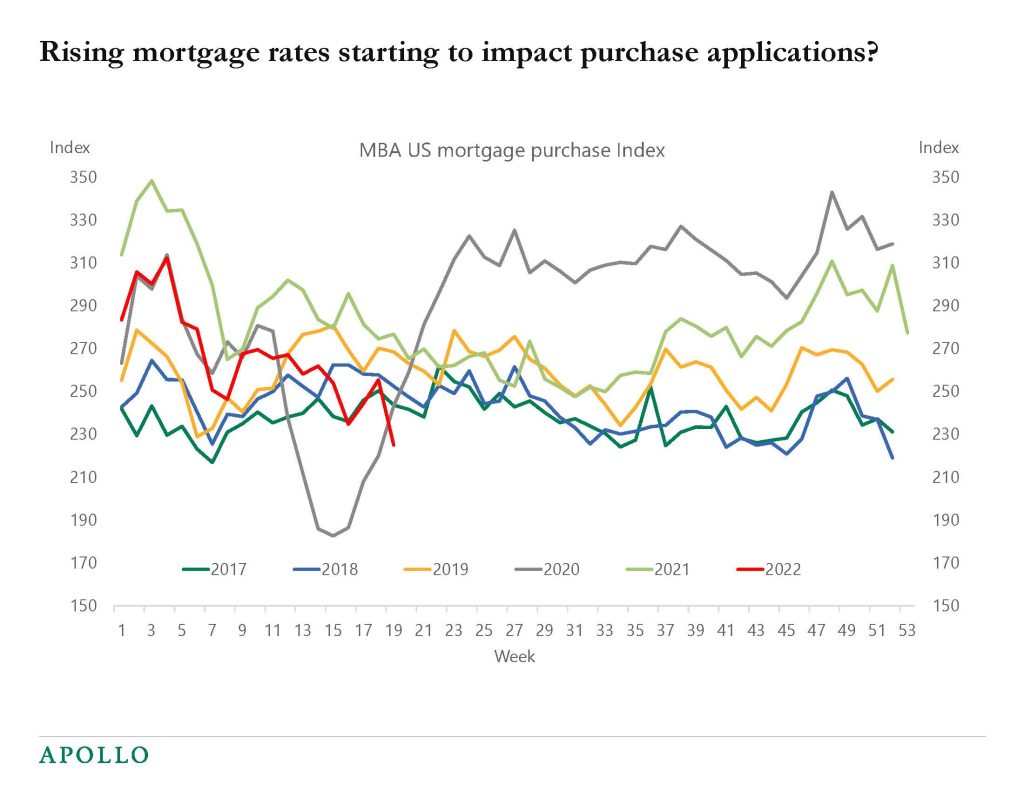

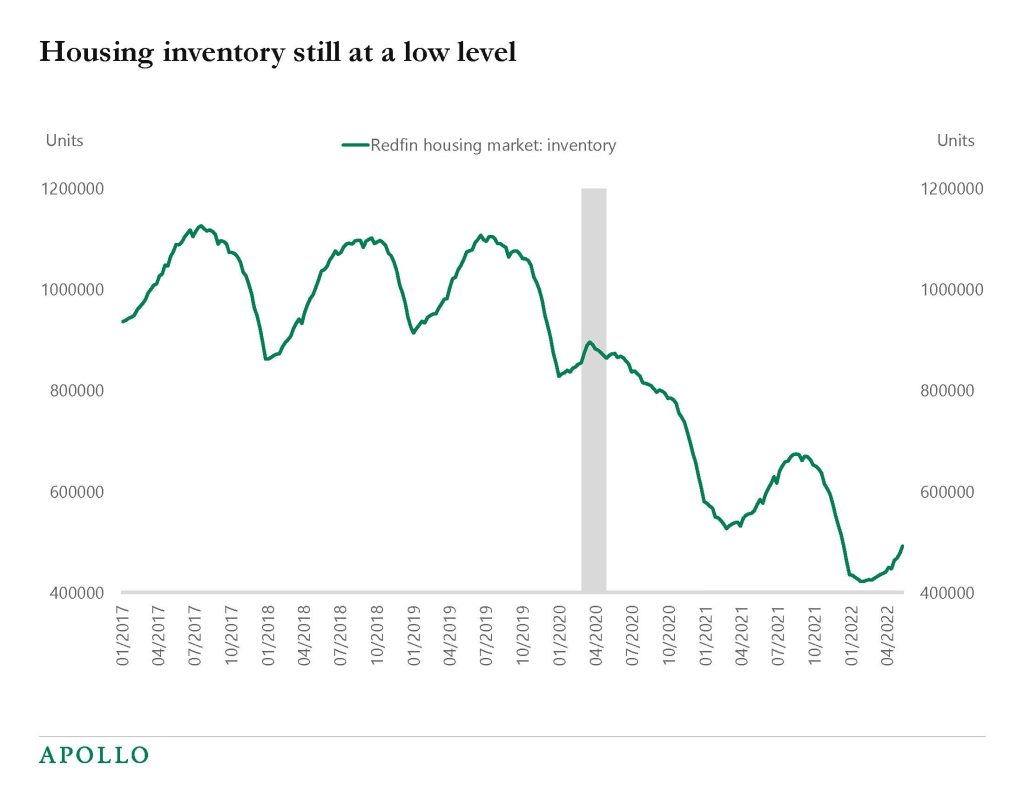

Weekly jobless claims have started to move slightly higher in recent weeks, but this is consistent with the seasonal pattern. The weekly mortgage purchase applications data is modestly weaker, and we are watching the housing market very carefully.

The Fed’s goal is to cool down all these indicators, and they will ultimately succeed, so investors should continue to prepare for the coming slowdown.