Equity investors tend to focus on the upcoming earnings season, i.e., the next three months. This is in contrast to rates investors who normally have a longer horizon, focusing on the next few years.

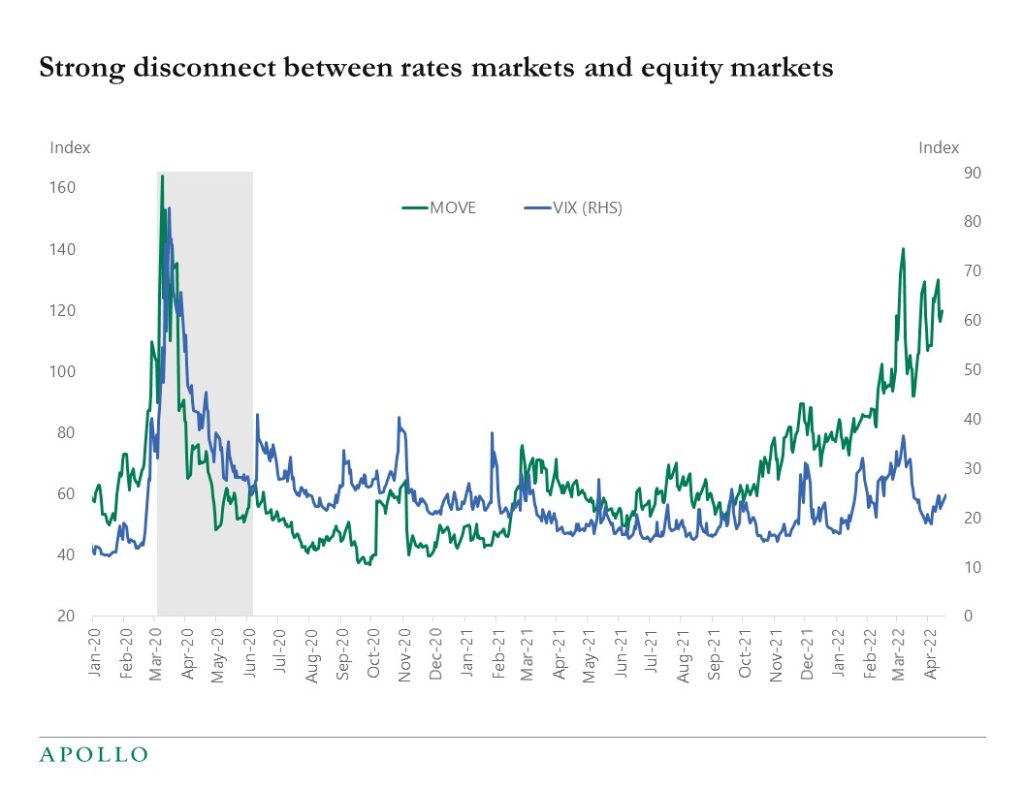

This fundamental difference in perspective is likely why the uncertainty about the inflation outlook is having a much more significant impact on volatility in rates relative to equities, see chart below.

Rates markets tell us there is a lot of disagreement about where inflation will be over the coming years. And equity markets are saying that inflation will not be a problem for corporate earnings in the future.

We are tracking this divergence in views very closely. Because if inflation is going to be a problem, it will also impact corporate earnings and hence equities.

In short, either inflation is a problem or it is not a problem. Inflation cannot be a problem in rates markets but not a problem in equity markets.