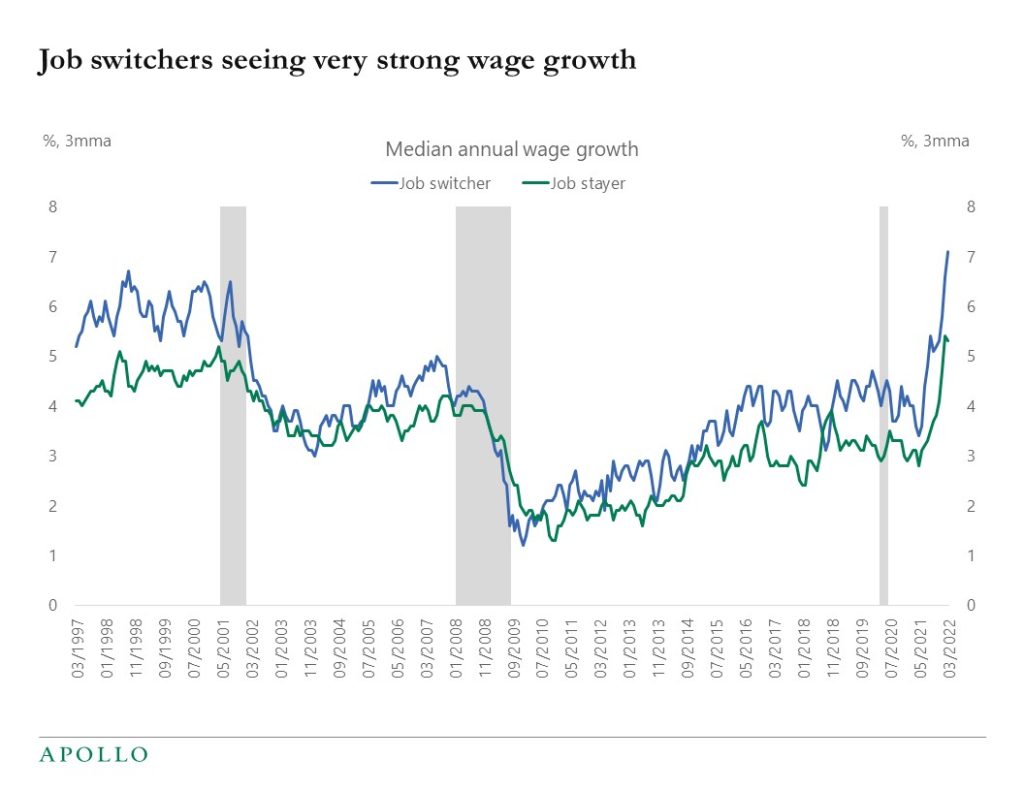

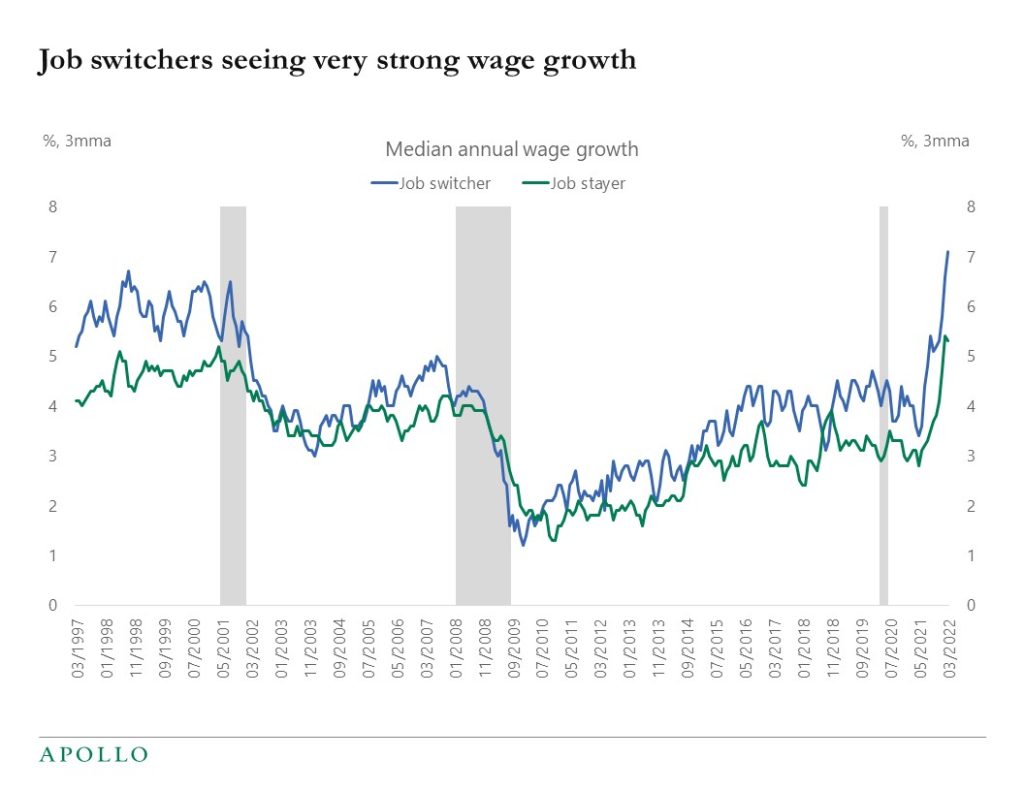

Wage growth continues to accelerate in particular for job switchers, see chart below. The labor market is overheating and the Fed is trying to cool down the economy by raising rates and doing QT.

Wage growth continues to accelerate in particular for job switchers, see chart below. The labor market is overheating and the Fed is trying to cool down the economy by raising rates and doing QT.

My latest outlook presentation is available here.

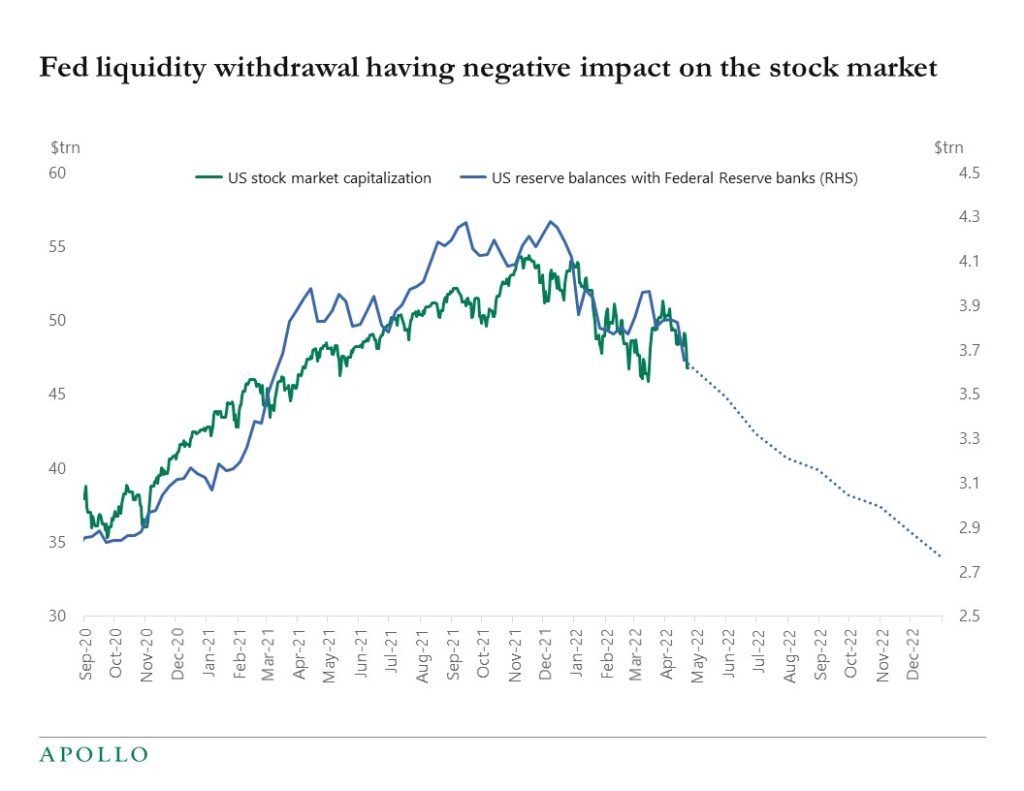

QE had a positive impact on the stock market and QT will have the opposite effect see chart below.

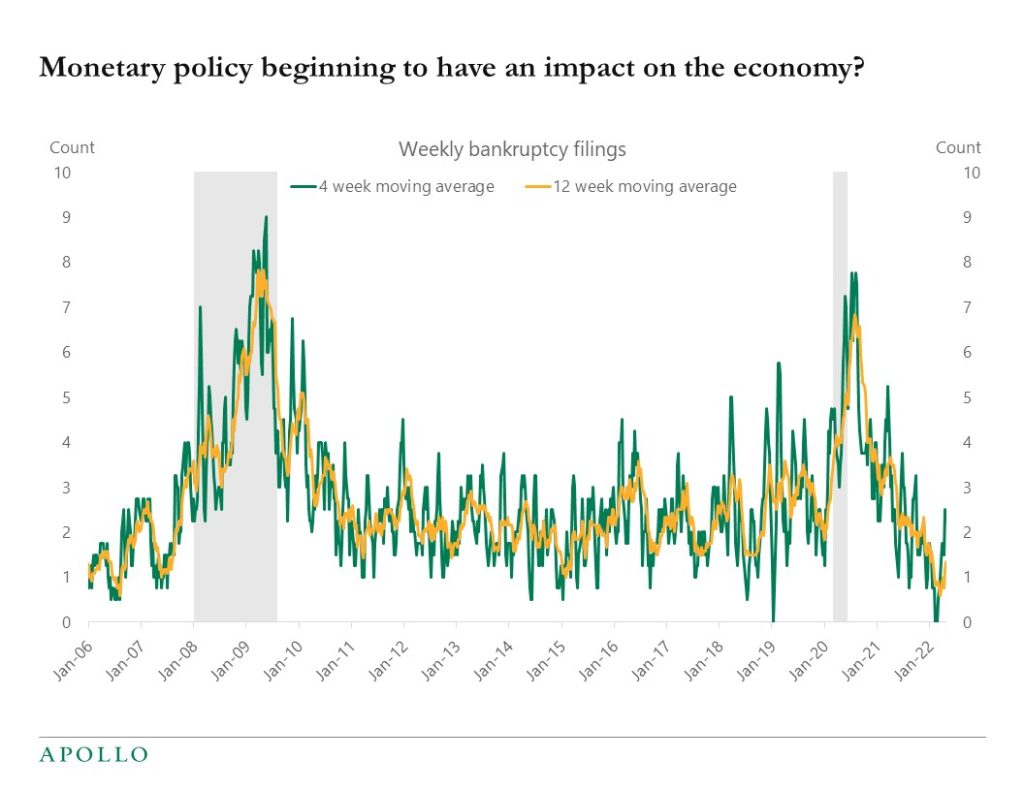

The weekly data for bankruptcy filings have shown a modest uptick in recent weeks see chart below. This data is for companies with more than $50mn in liabilities. With the Fed keen on slowing down inflation investors must monitor high-frequency data for any sign of monetary policy beginning to cool down the economy.

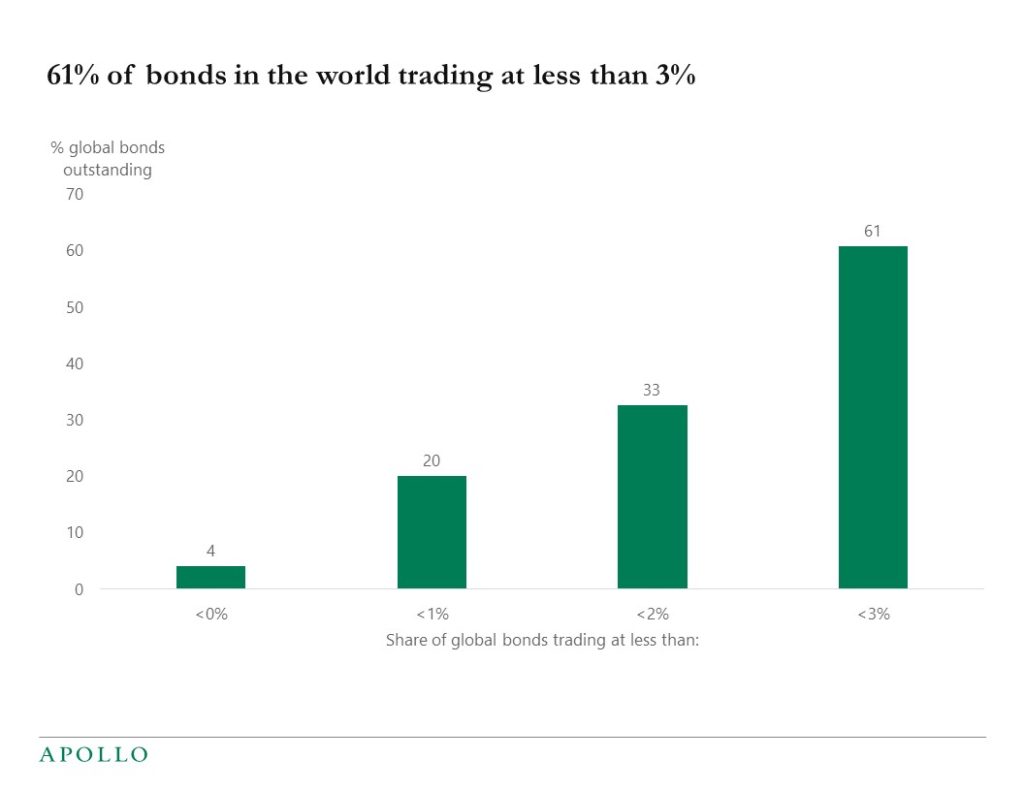

Yes, interest rates have increased, but 61% of all bonds in the world still trade at less than 3%. See chart below.

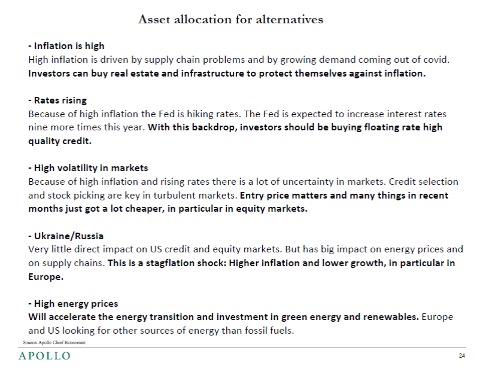

I had a 45-minute conversation with Nic Millikan at CAIS about the outlook for markets and asset allocation including for alternatives:

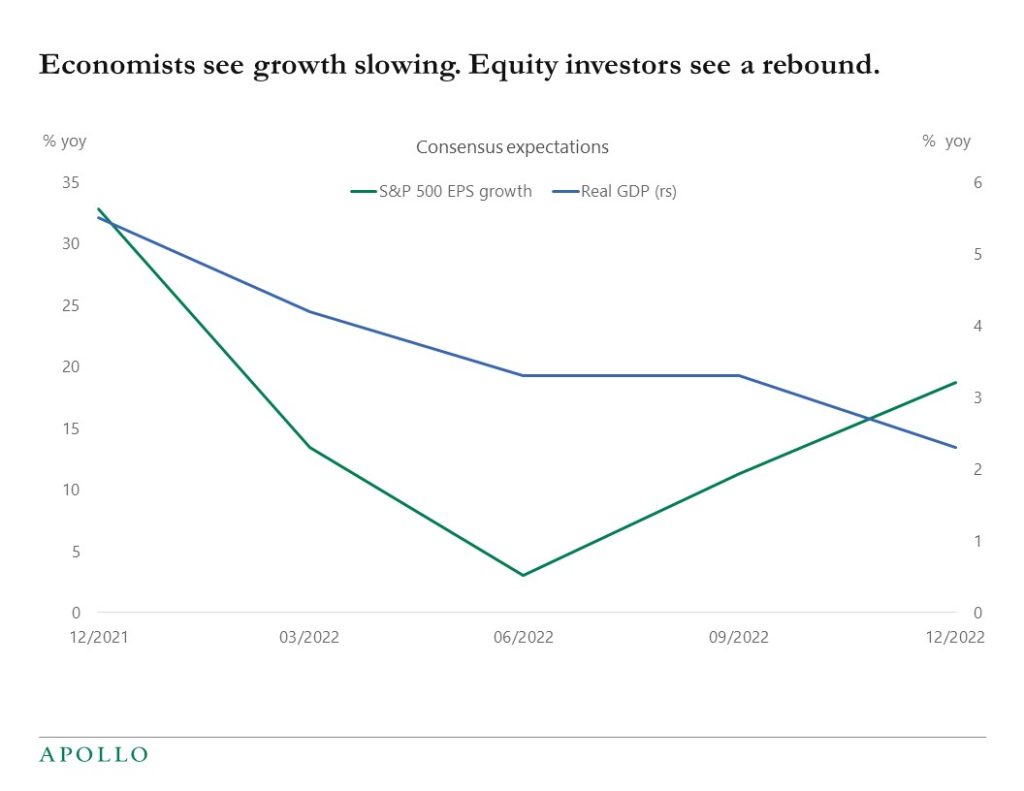

The chart below shows consensus expectations for GDP growth and consensus expectations for earnings growth over the coming quarters. Economists see growth slowing as we go through 2022. Equity investors see a rebound. This is not consistent. Either equity investors are too optimistic or economic forecasters are too pessimistic.

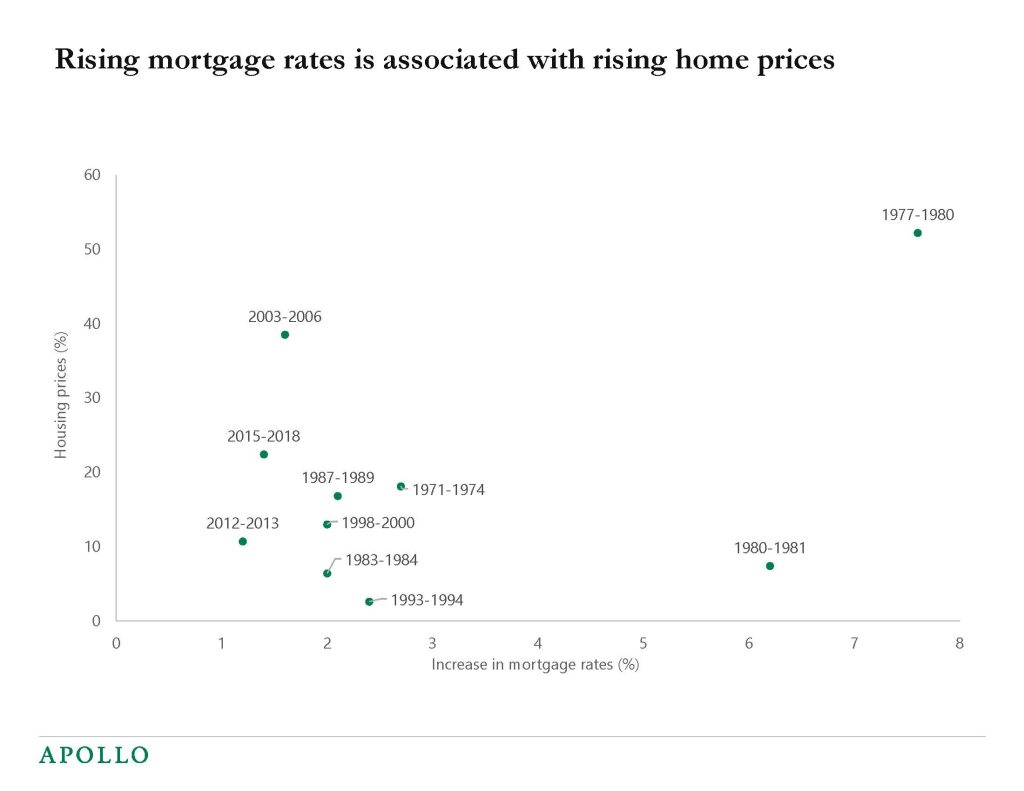

When mortgage rates go up, home prices rise. This may sound counter-intuitive, but the logic is simply that when growth is strong and incomes go up, the housing market also tends to be strong, leading to a more hawkish Fed and higher rates.

The chart below shows that episodes with a positive correlation between rising rates and rising home prices typically last several years. For more see also our US housing outlook.

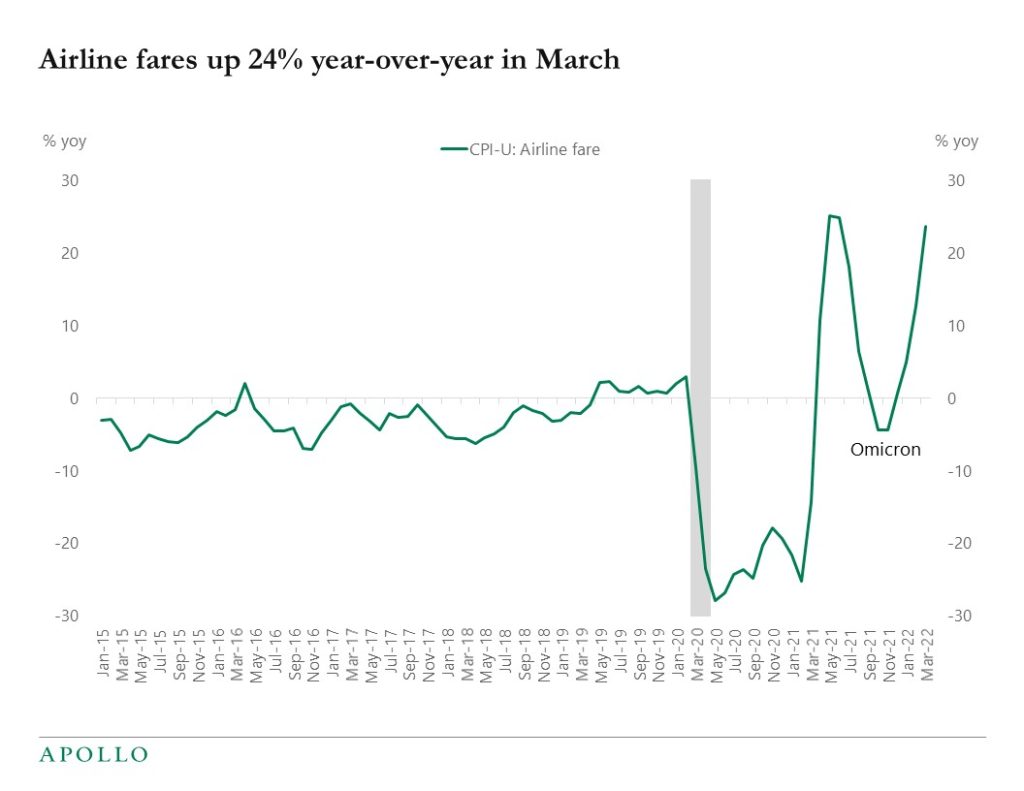

Airfares increased 10% month over month in March bringing the annual increase in ticket prices to 24%, see chart below.

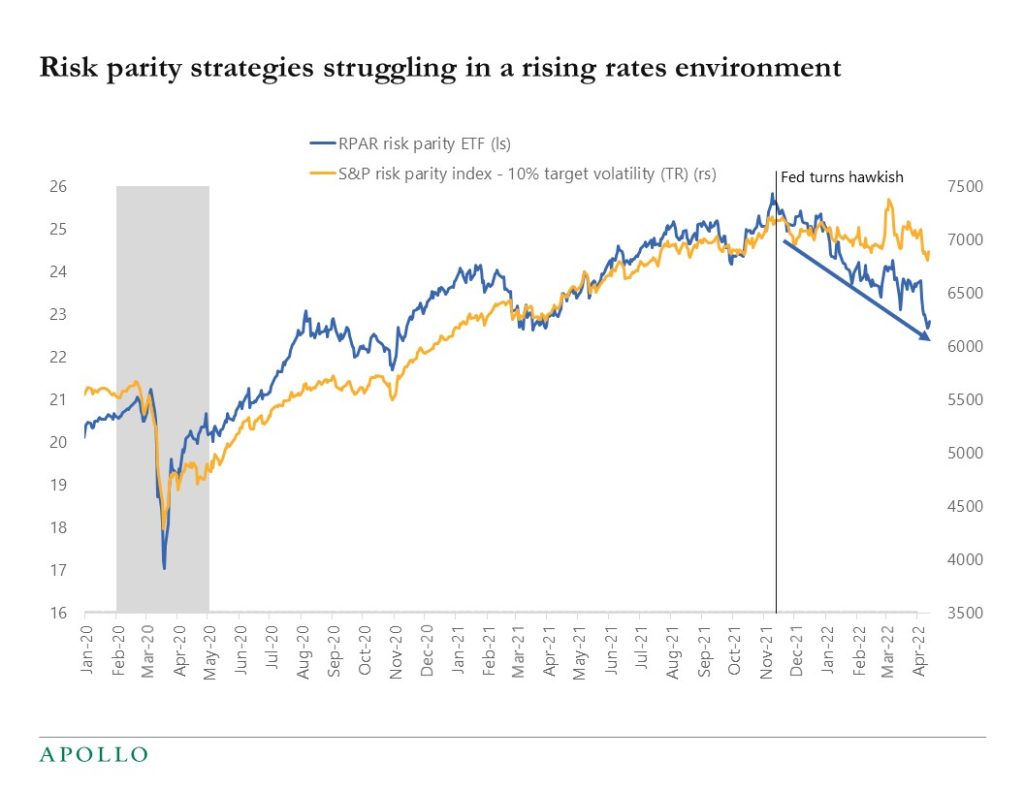

Risk parity has not worked well since the Fed turned hawkish in November, see chart below. Also, quant strategies assuming stable historical relationships are not working very well at the moment simply because they have not seen these levels of inflation before.