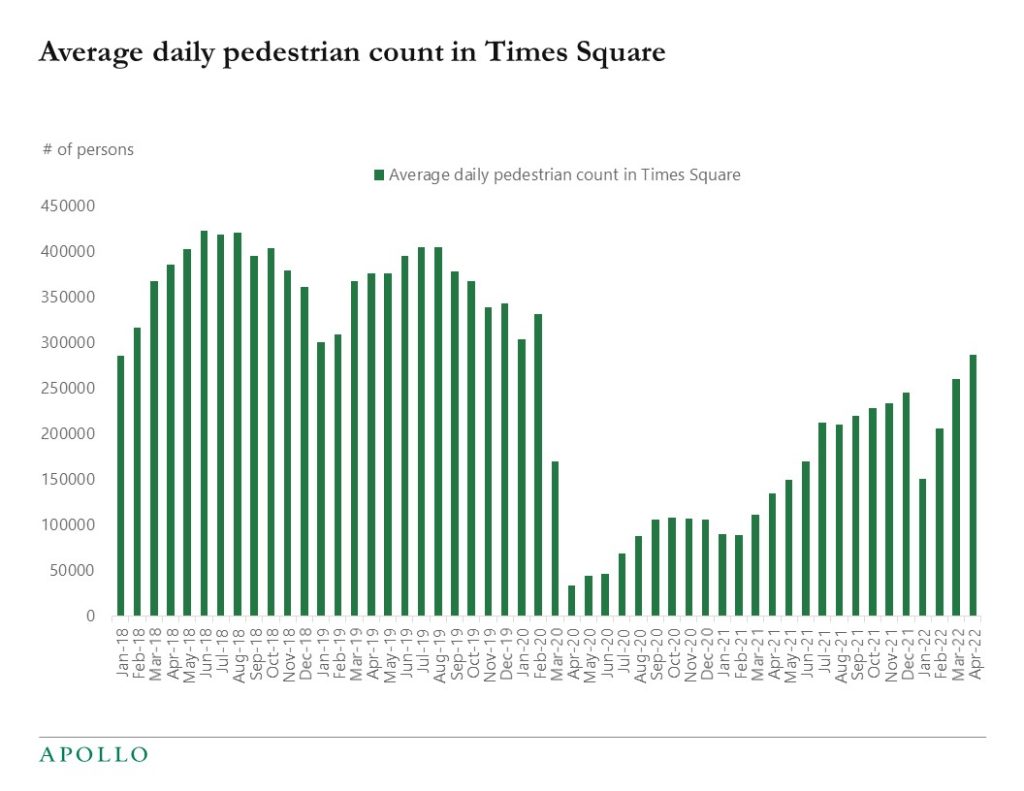

There is more pedestrian traffic in Times Square, but current levels are still 25% below normal, see chart below.

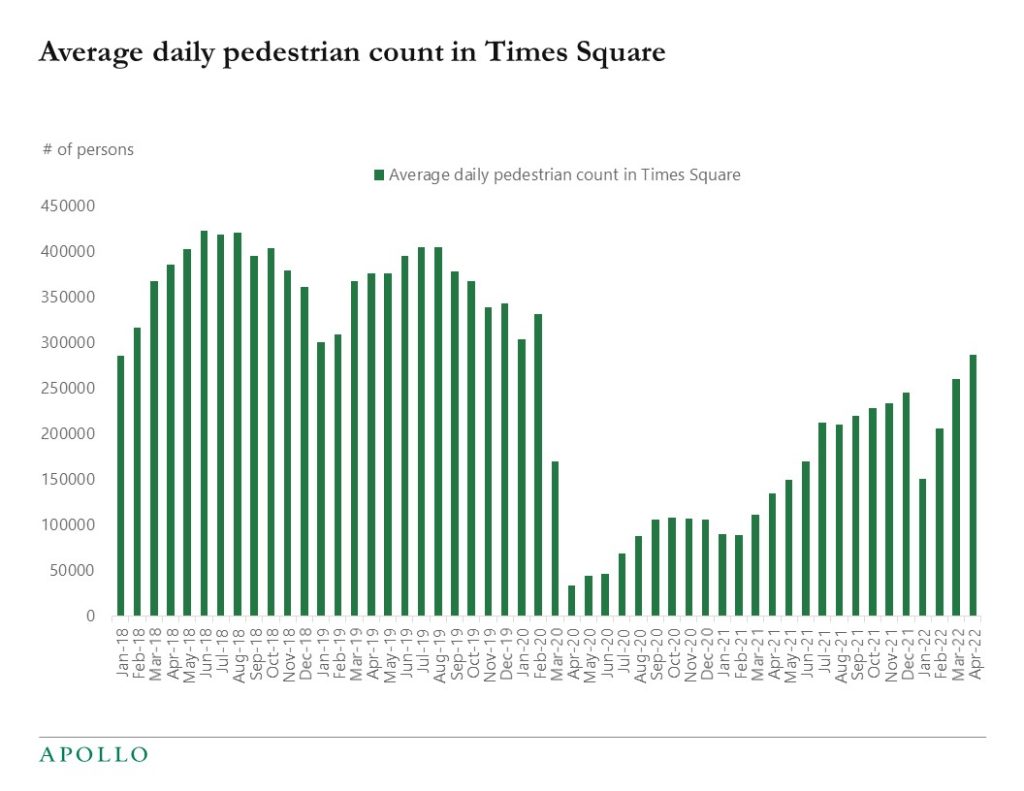

There is more pedestrian traffic in Times Square, but current levels are still 25% below normal, see chart below.

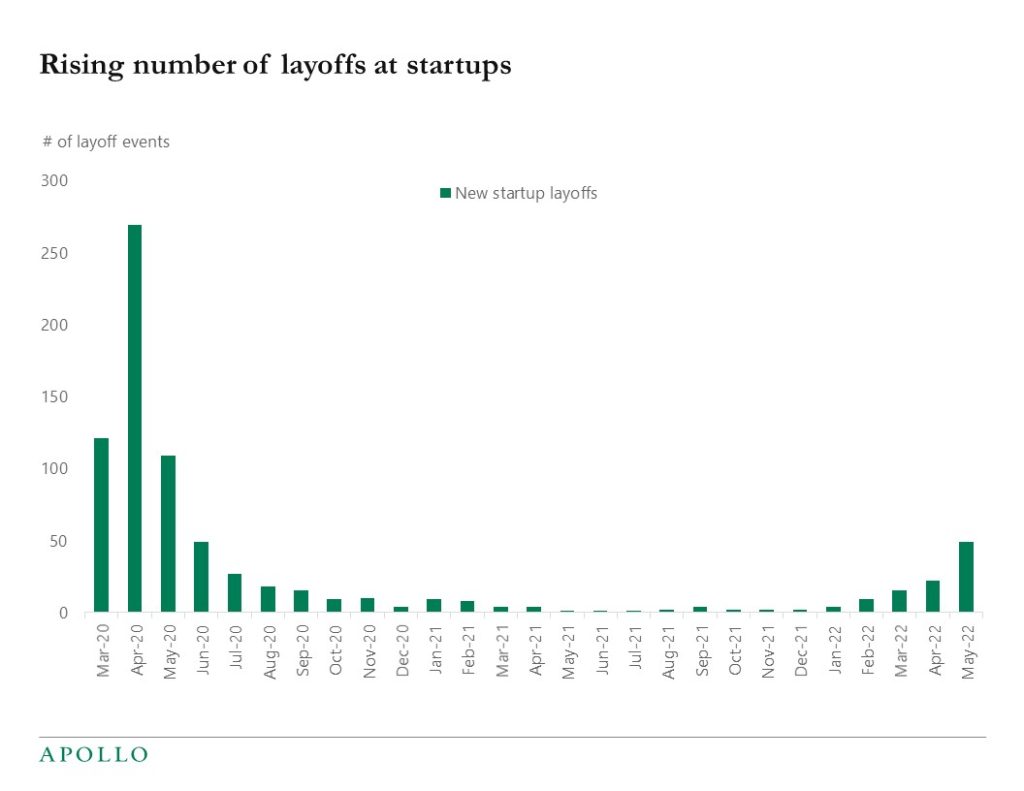

Last week brought us the FOMC minutes. No surprises there. As expected, it showed that the Fed is likely to continue to raise rates at upcoming meetings to combat elevated inflation. This Friday, the latest employment report will be released; consensus expects strong growth in May. That said, we’ve detected an important change in the technology sector in the last month. The significant stock-price declines experienced by tech companies so far this year are now starting to impact financing and hiring. In fact, we’ve observed an uptick in the number of tech companies that are announcing layoffs. In conclusion, the overall US economy remains strong—which will likely keep the Fed on their rate hike schedule—but we are starting to notice emerging signs of a slowdown, especially in the tech sector.

This presentation may not be distributed, transmitted or otherwise communicated to others in whole or in part without the express consent of Apollo Global Management, Inc. (together with its subsidiaries, “Apollo”).

Apollo makes no representation or warranty, expressed or implied, with respect to the accuracy, reasonableness, or completeness of any of the statements made during this presentation, including, but not limited to, statements obtained from third parties. Opinions, estimates and projections constitute the current judgment of the speaker as of the date indicated. They do not necessarily reflect the views and opinions of Apollo and are subject to change at any time without notice. Apollo does not have any responsibility to update this presentation to account for such changes. There can be no assurance that any trends discussed during this presentation will continue.

Statements made throughout this presentation are not intended to provide, and should not be relied upon for, accounting, legal or tax advice and do not constitute an investment recommendation or investment advice. Investors should make an independent investigation of the information discussed during this presentation, including consulting their tax, legal, accounting or other advisors about such information. Apollo does not act for you and is not responsible for providing you with the protections afforded to its clients. This presentation does not constitute an offer to sell, or the solicitation of an offer to buy, any security, product or service, including interest in any investment product or fund or account managed or advised by Apollo.

Certain statements made throughout this presentation may be “forward-looking” in nature. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking information. As such, undue reliance should not be placed on such statements. Forward-looking statements may be identified by the use of terminology including, but not limited to, “may”, “will”, “should”, “expect”, “anticipate”, “target”, “project”, “estimate”, “intend”, “continue” or “believe” or the negatives thereof or other variations thereon or comparable terminology.

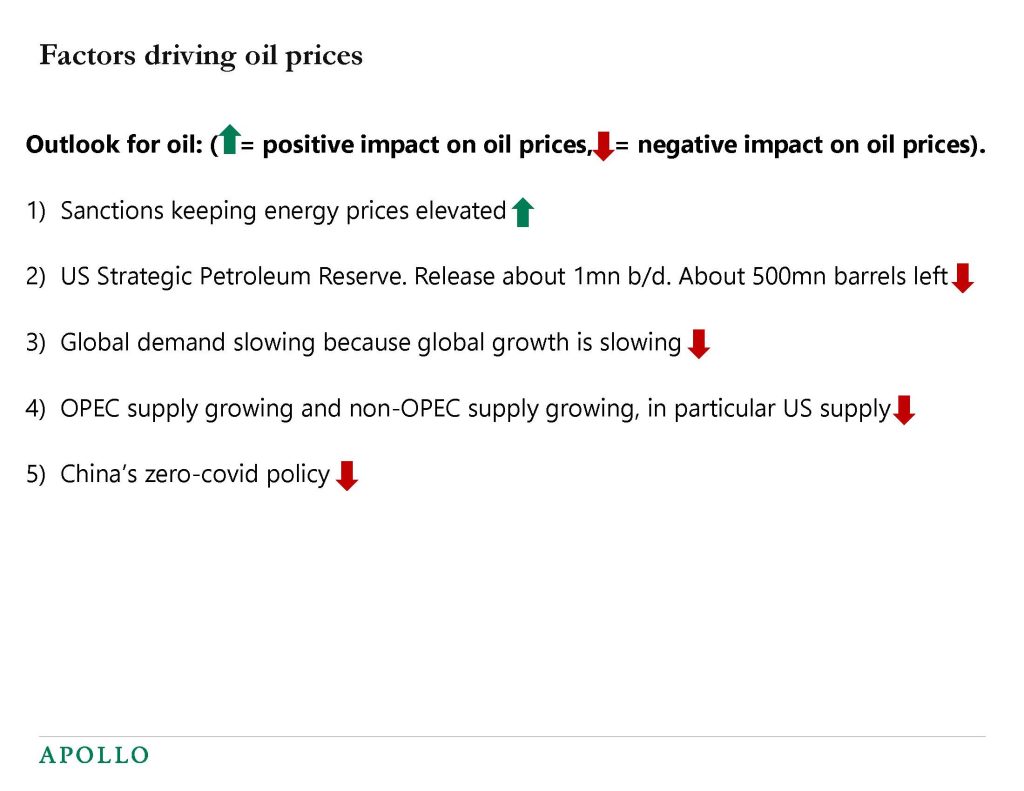

We updated our oil price forecasting model, and while sanctions continue to argue for higher oil prices, the downward pressure is significant from the Strategic Petroleum Reserve release, growing supply, and slowing global growth. As a result, our econometric model points to lower oil prices over the coming 18 months, see charts below.

U.S. Retirement Assets: Amount in Pensions and IRAs

https://crsreports.congress.gov/product/pdf/IF/IF12117

Reactions of household inflation expectations to a symmetric inflation target and high inflation

https://www.dnb.nl/media/2dzn0i2m/working_paper_no-_743.pdf

Russia Sanctions and Cryptocurrencies: Policy Issues

https://crsreports.congress.gov/product/pdf/IN/IN11939

There are some very early signs that the economy is starting to cool down, with layoffs rising in startups and some housing indicators starting to roll over from high levels. But the big picture remains that high-frequency indicators show that the economy is still strong. Most noteworthy this week was the decline in jobless claims. The solid data is consistent with the consensus expectation of nonfarm payrolls coming in at 330K next week and the unemployment rate falling from 3.6% to 3.5%.

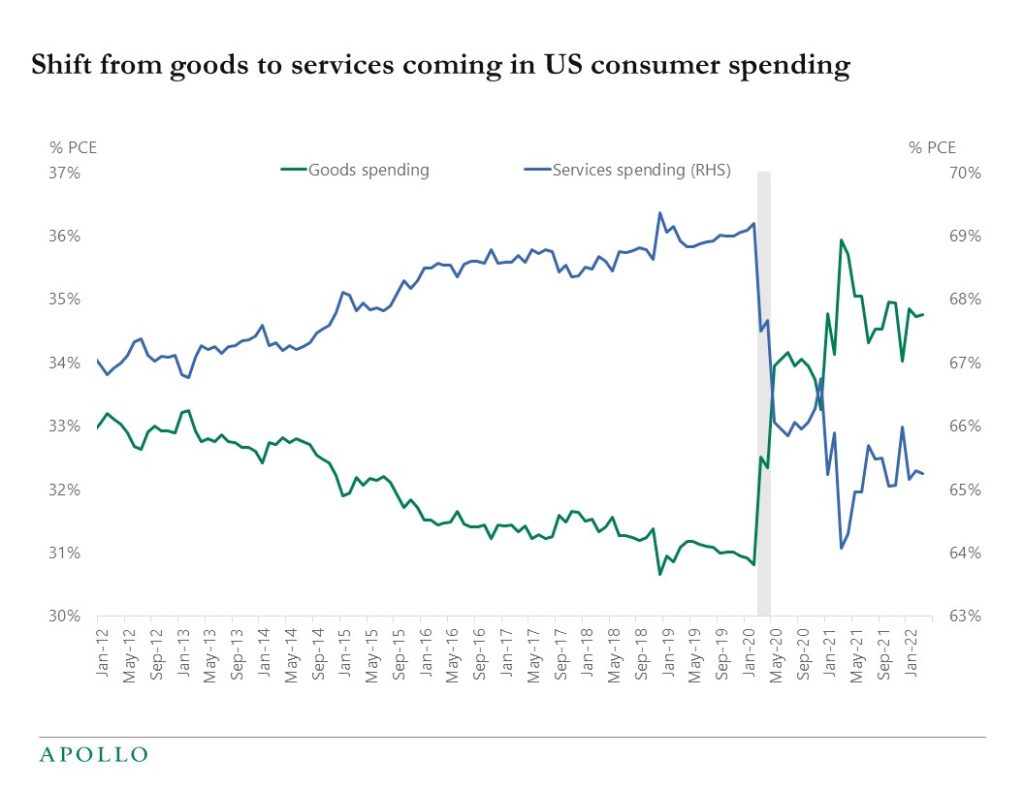

Looking ahead, with the virus subsiding, we should begin to see a shift away from goods toward services. The chart below shows that this shift has not started yet. The surprise has been that consumer goods spending has continued to be so strong. But with more people flying, eating at restaurants, staying at hotels, and going to amusement parks, we should over the coming quarters see growth in consumer services accelerate, and spending on consumer goods begin to slow down.

The trading implication for equity and credit markets is to be long consumer services and short consumer goods. For the Fed the implication is that rate hikes continue. Read our slowdown chart book.

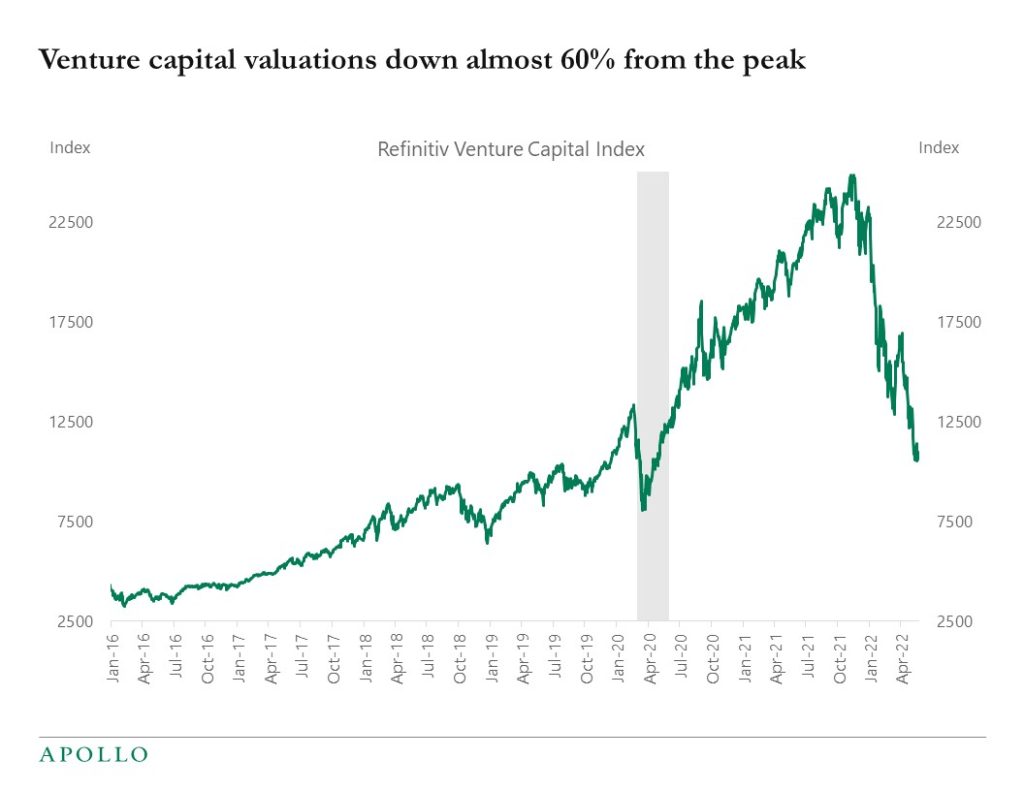

With tech and venture capital taking a severe hit, layoffs at startup companies have started to increase, see chart below. The Fed is trying to destroy demand, including demand for labor, and this is early evidence that they are succeeding.

The total value of the US-based venture capital private company universe is down almost 60% over the past six months, and with a rising risk of a US recession, there is more downside from here. The crash in venture capital will continue until the hard landing is behind us.

Torsten joined Nic Millikan on a recent episode of CAIS CXO to share his insights on global macroeconomics and their impacts on public and private markets. Hear Torsten’s views on: · Expediting investment cycles and fundraising in private equity · Four factors primarily driving higher inflation · Getting constructive on commodities and green energy · The capital markets’ reaction to rising interest rates · An end to global monetary easing (for now)? · Three broad themes when considering investment opportunities

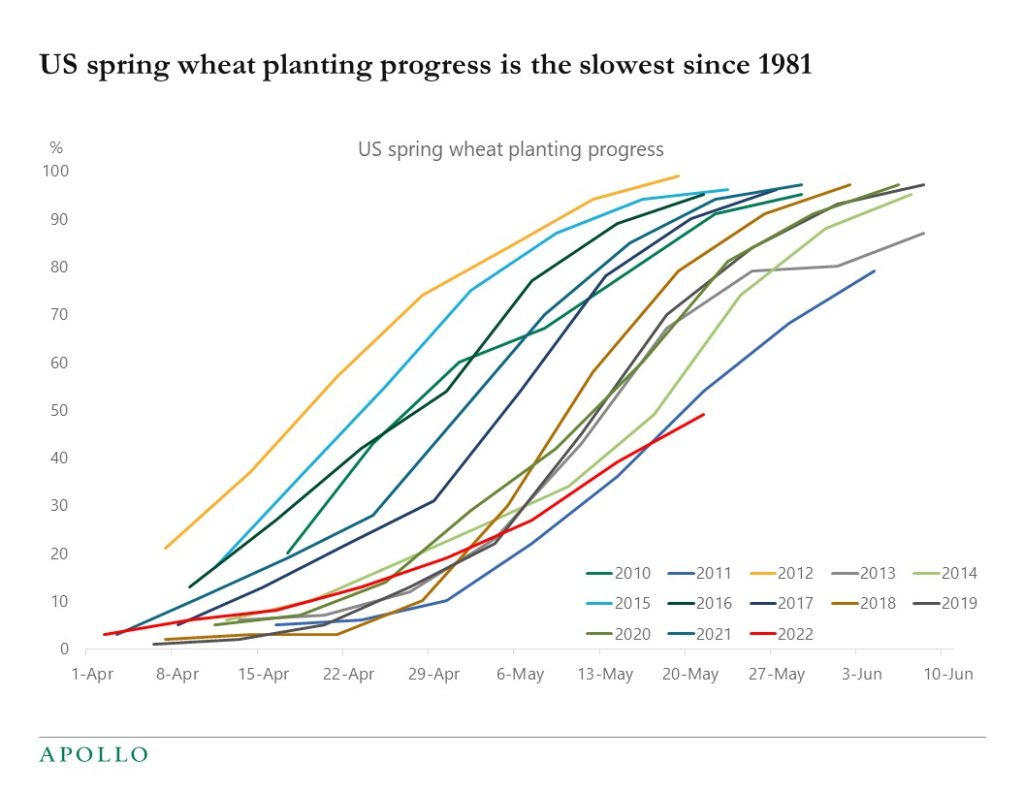

Wheat prices and barley prices are up 50% not only because Ukraine and Russia combined account for 30% of global wheat trade but also because of bad weather slowing the US spring wheat planting progress, see chart below.

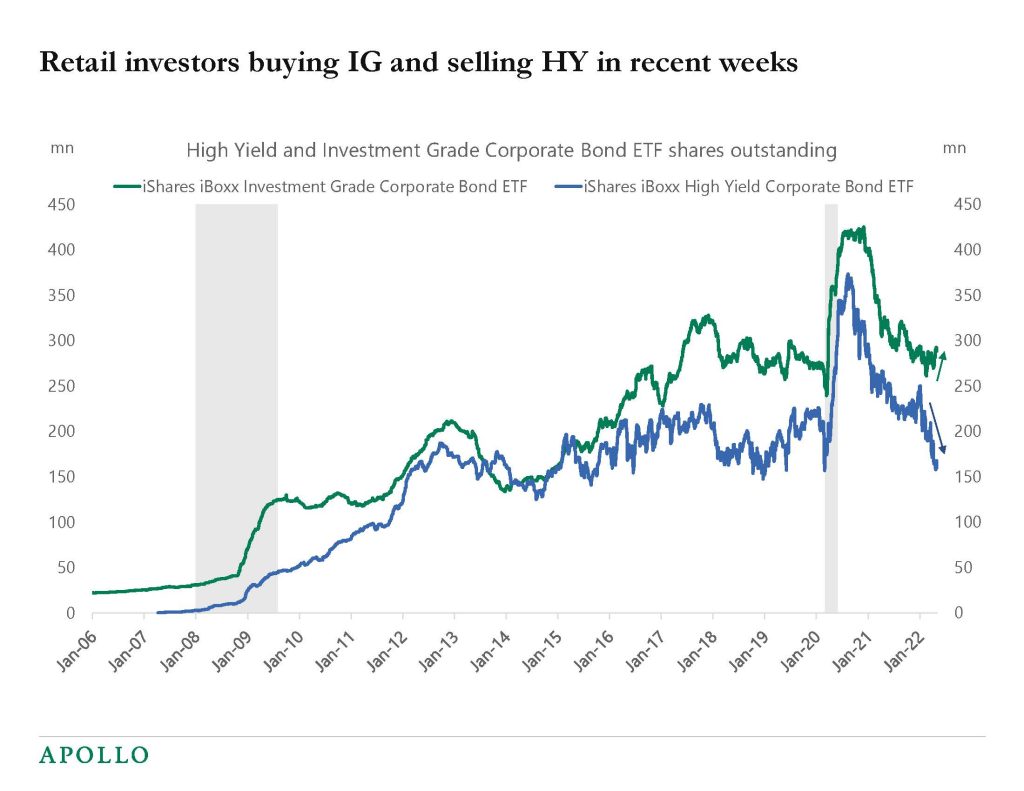

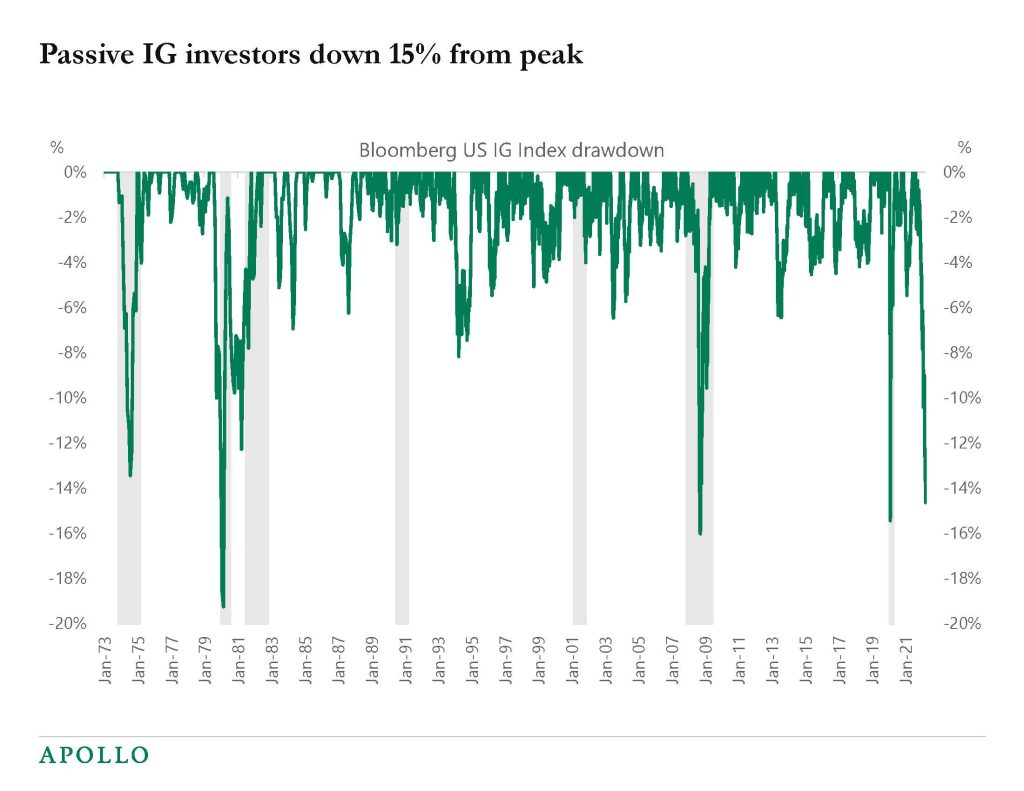

We have updated our credit market chartbook, and the conclusion is that the Fed wants to see wider spreads in both IG and HY to get inflation down. There is also a rising risk that Fed rate hikes will result in a recession, triggering additional spread widening for both IG and HY spreads.

The bottom line is that with inflation currently at 8% and the Fed’s inflation target at 2%, it is too early for markets to declare victory. Credit spreads need to go wider until we have certainty about inflation coming down to 2% and certainty that we will not have a hard landing.