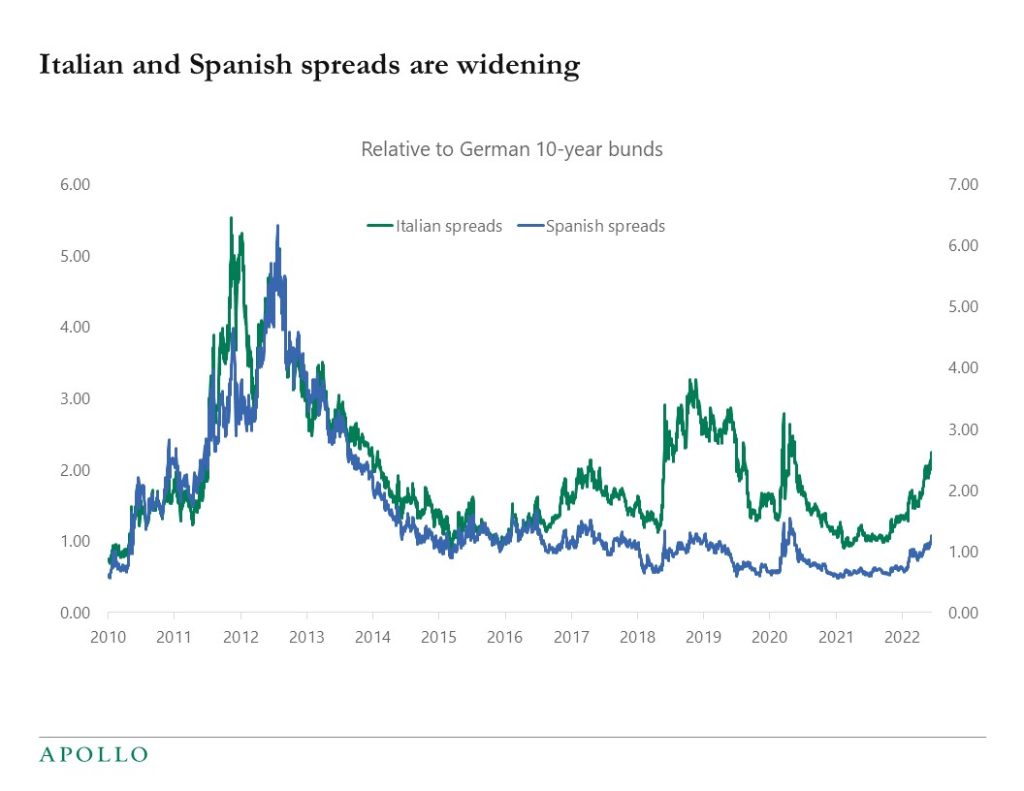

Since the ECB last week announced that from July 1, they will no longer be doing QE, i.e. the ECB will no longer be buying European government bonds, spreads between periphery government bonds and German bunds have widened, see chart below. This is increasing the risk of more distress in European assets.