We have updated our US consumer outlook chart book, see the attached PDF.

Weekend Reading

Fed: How Did It Happen?: The Great Inflation of the 1970s and Lessons for Today

https://www.federalreserve.gov/econres/feds/files/2022037pap.pdf

The Rest of the World’s Dollar-Weighted Return on U.S. Treasurys

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3928006

IMF: Sovereign Eurobond Liquidity and Yields

https://www.imf.org/-/media/Files/Publications/WP/2022/English/wpiea2022098-print-pdf.ashx

Fed: Neighborhood Types and Demographics

https://files.stlouisfed.org/files/htdocs/publications/economic-synopses/2022/06/01/neighborhood-types-and-demographics.pdf

Slowdown Watch

We have updated our attached daily and weekly indicators for the US economy, and the daily data for airline travel, consumer mobility, and restaurant bookings are still not showing signs of a slowdown.

The weekly data for hotel occupancy rates is also solid, and weekly jobless claims continue to decline, suggesting that the labor market is still strong. Weekly data for cinema visits is also strong, and so is the weekly data for bank lending and the weekly data for credit and debit card usage.

There are some early signs of weakness in the housing market, with the weekly data for listings starting to trend higher in recent weeks. Traffic of prospective home buyers is also starting to come down.

At the anecdotal level, there are more sound bites about layoffs in tech and startups, but these anecdotes are not yet visible in the macro data.

The bottom line is that the economy is still strong, and the Fed needs to tighten financial conditions further to slow growth and inflation.

US Consumer Still Strong

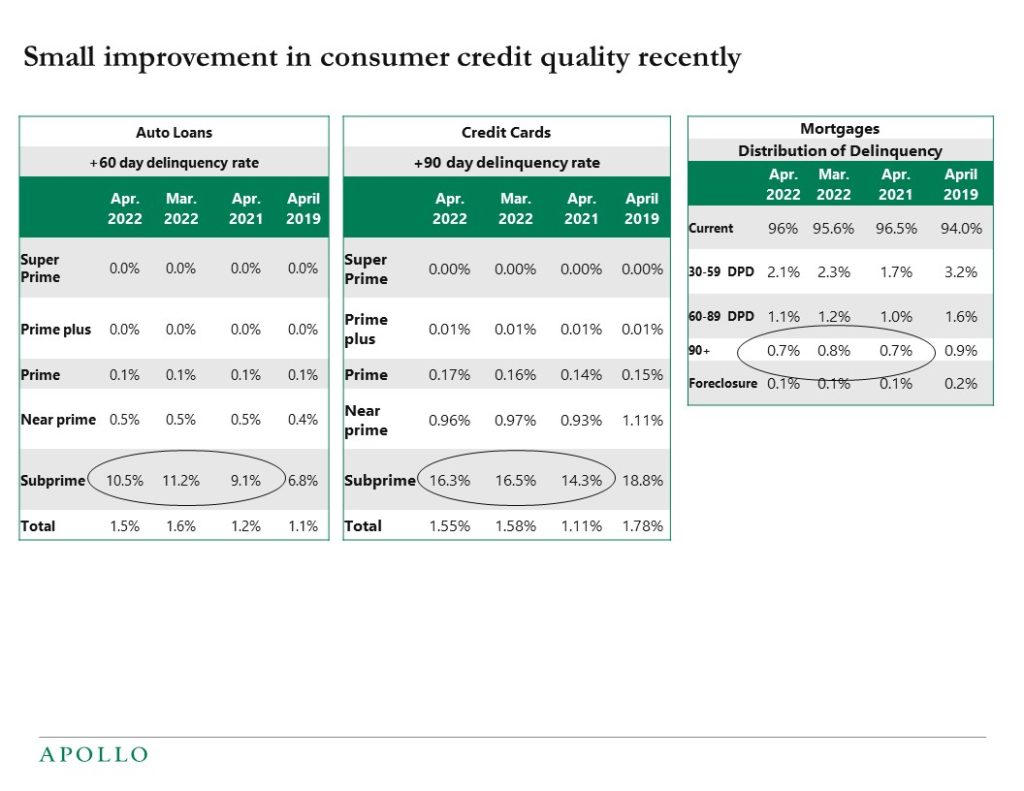

After a brief period of rising delinquency rates on credit cards and auto loans for subprime borrowers, the latest data shows a modest improvement in consumer credit quality with delinquency rates falling, see table below. This is consistent with a strong labor market, high wage growth, and a high level of household savings. US consumer spending will eventually grow at a slower pace because this is what the Fed wants to see, but the bottom line is that there are no signs yet in the macro data of the US consumer slowing down.

Employment Report for May

The employment report confirms the Fed narrative that the economy is still strong and more rate hikes are needed. But the report also shows that wage inflation has peaked, allowing the Fed to turn less hawkish as we enter the third quarter. For more, download the PDF.

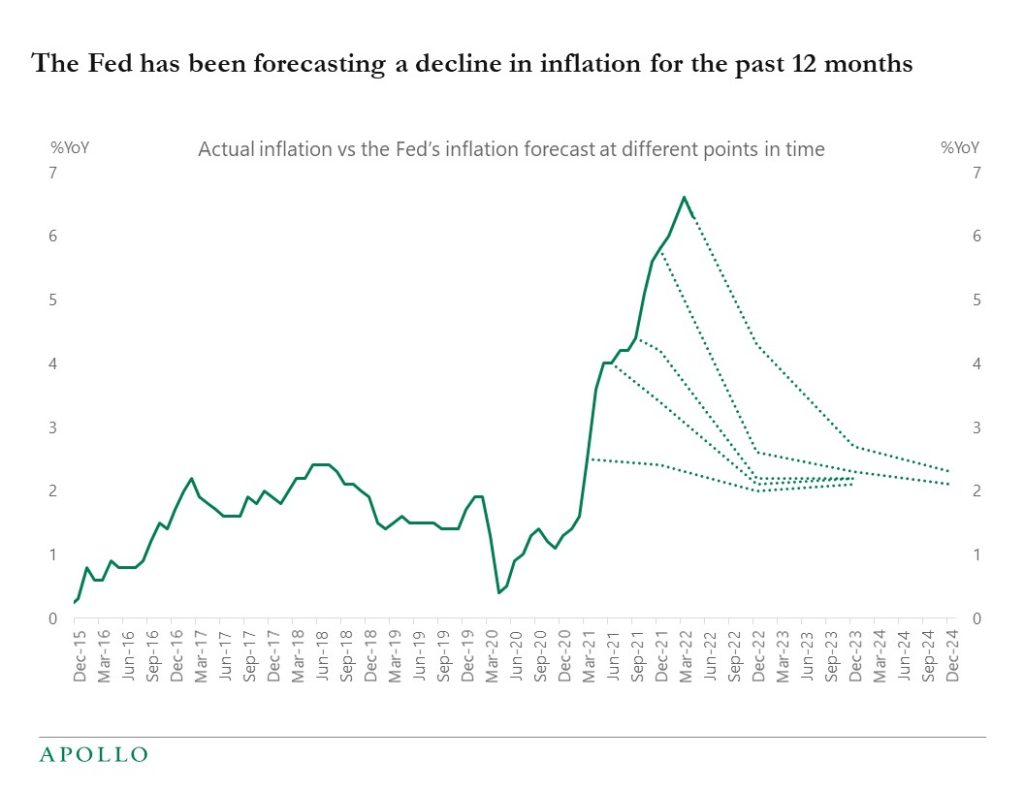

Two Questions for Investors

The Fed and markets continue to expect a quick reversal in inflation back to the Fed’s 2% target, see chart below. This raises two questions for investors: As the Fed destroys demand to cool down inflation, what level of the unemployment rate is required to achieve this path, and can the Fed engineer a soft landing without increasing the unemployment rate too much and thereby triggering a recession?

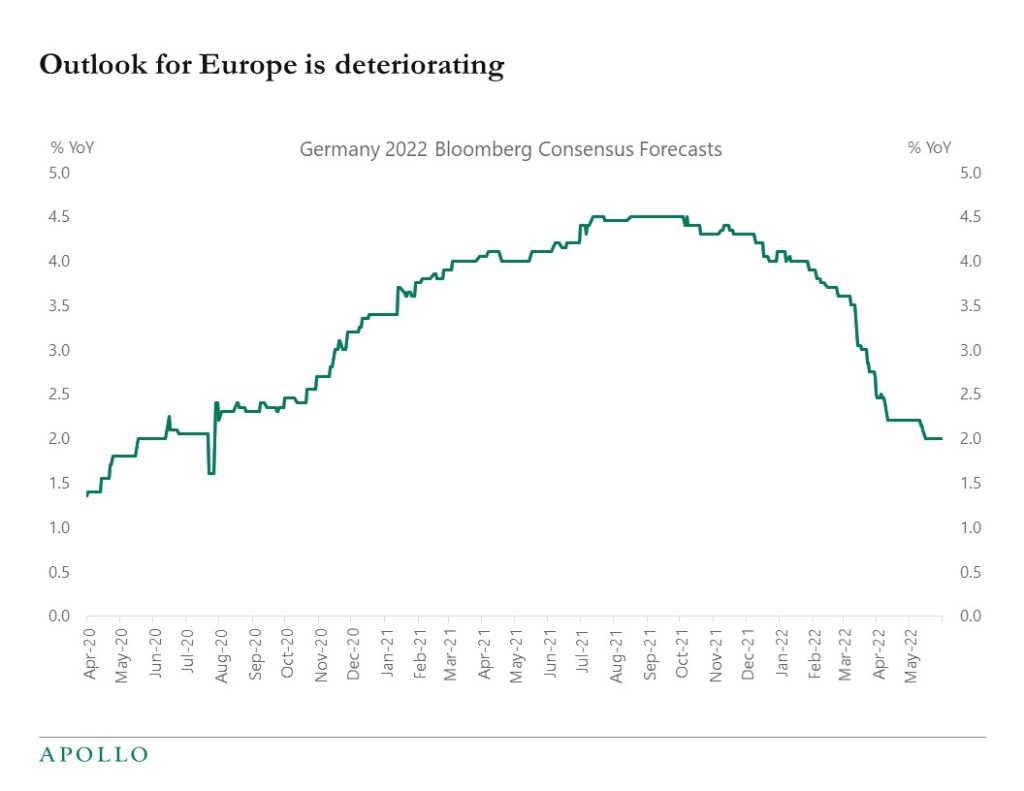

Outlook for Europe Deteriorating

The consensus continues to downgrade growth expectations for Europe, raising questions about ECB rate hikes and the rising risk of loan losses and defaults in Europe, see chart below.