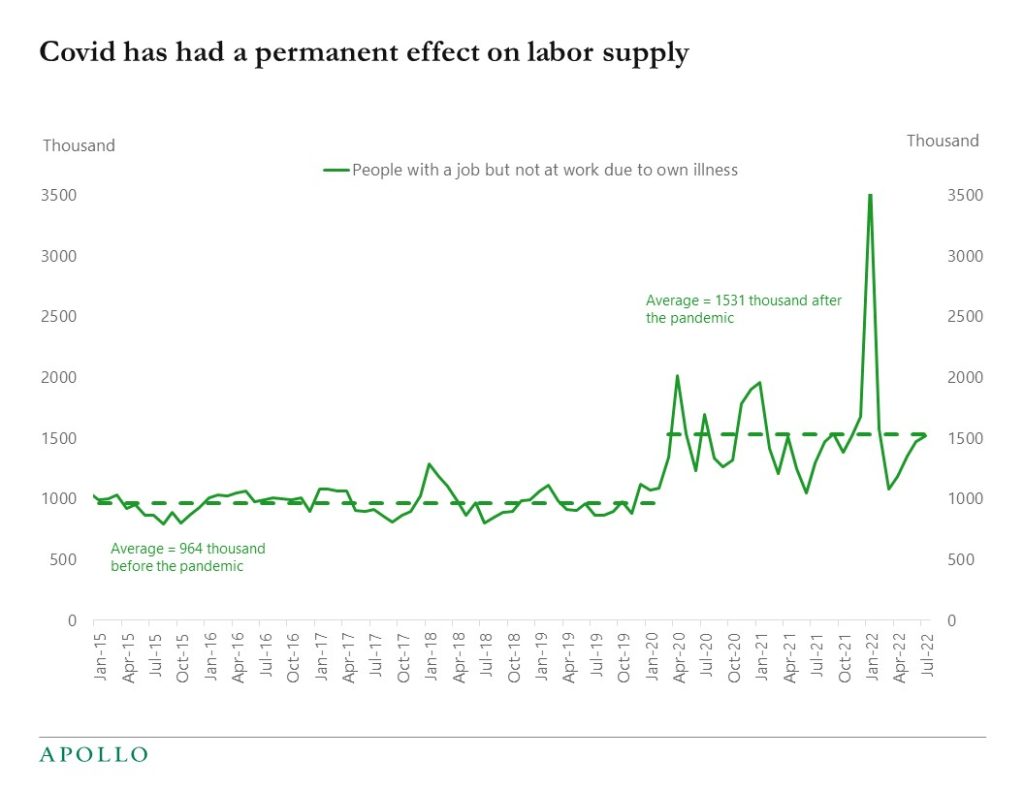

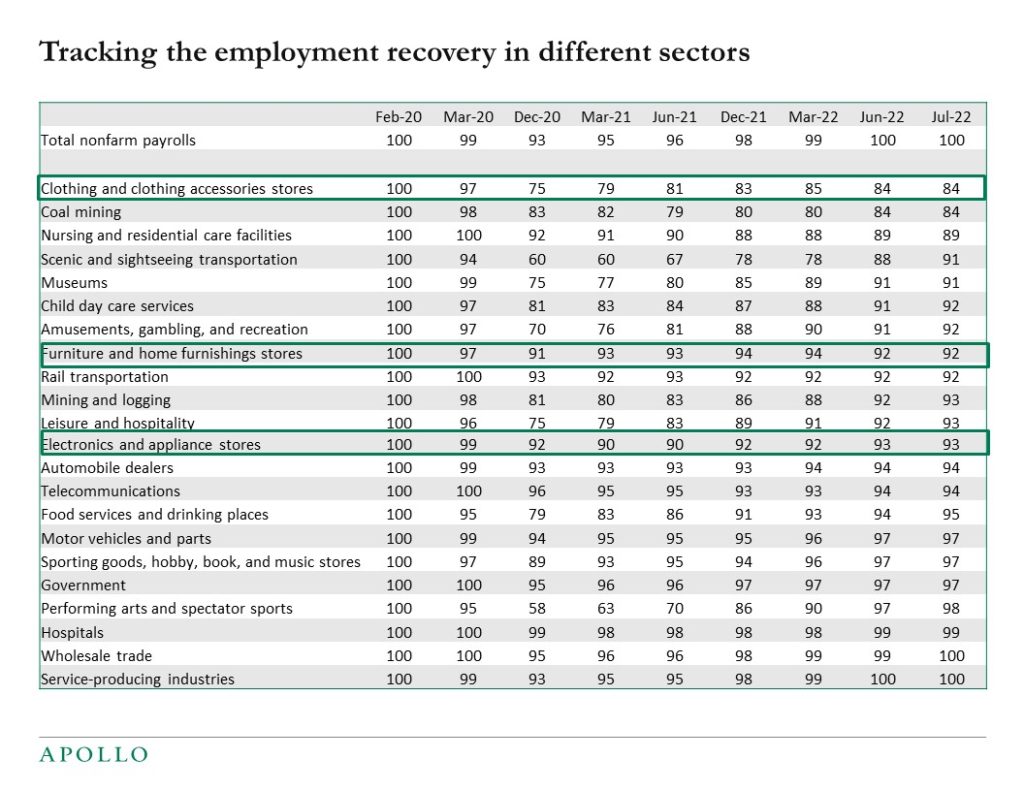

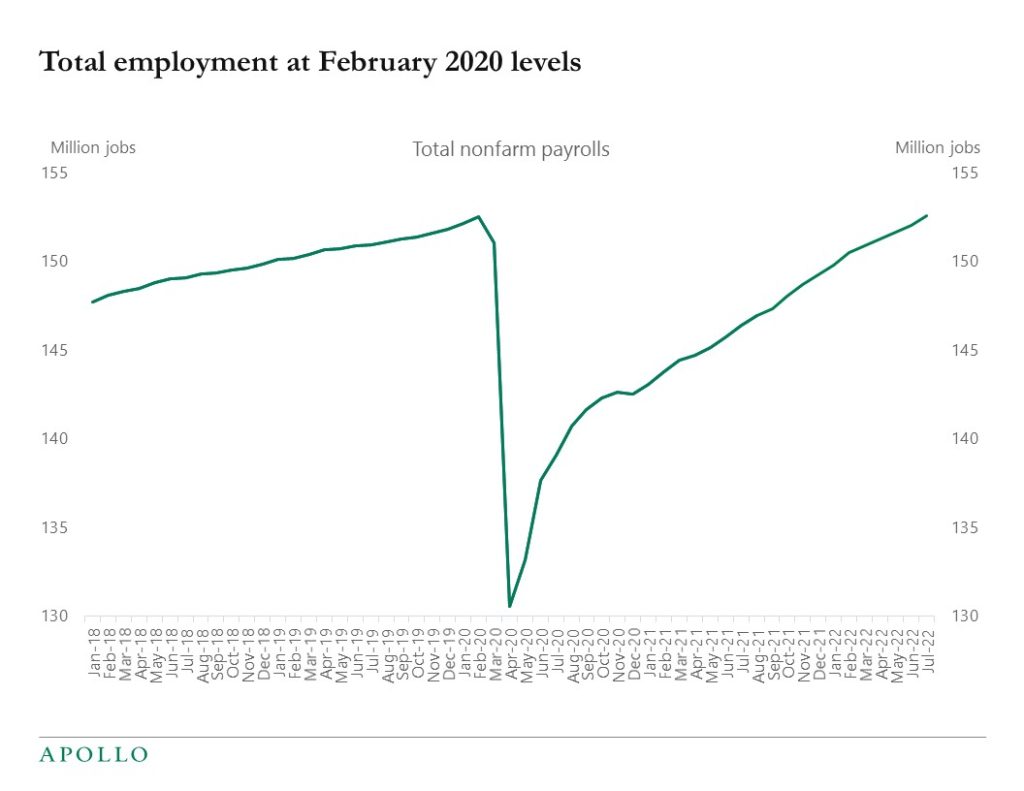

The pandemic has had a permanent negative effect on labor supply, and this is a crucial reason why there are worker shortages and, therefore, why wage pressures are so intense, see charts below. There is little the Fed can do about this other than continue to destroy demand.