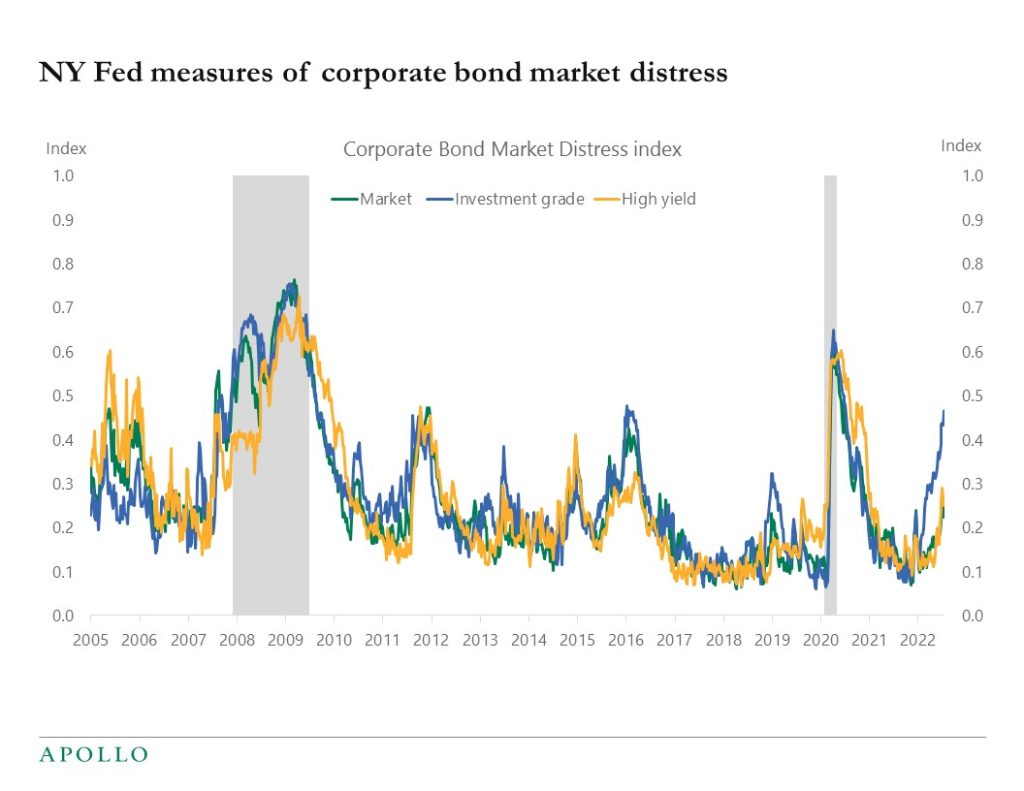

The New York Fed measure of corporate bond market distress is starting to flash red for IG, see chart below. Specifically, the New York Fed corporate bond market distress index is calculated using FISD data on issuance volumes and primary market pricing as well as issuer characteristics.

For the secondary market, the index uses trading data available through TRACE and includes measures that reflect both the central tendencies, and other aspects of the distributions, of volume, liquidity, nontraded bonds, spreads, and default-adjusted spreads. Finally, the index also uses quoted prices from ICE BoA to capture the differential secondary market conditions for traded and non-traded bonds. For more see also here.