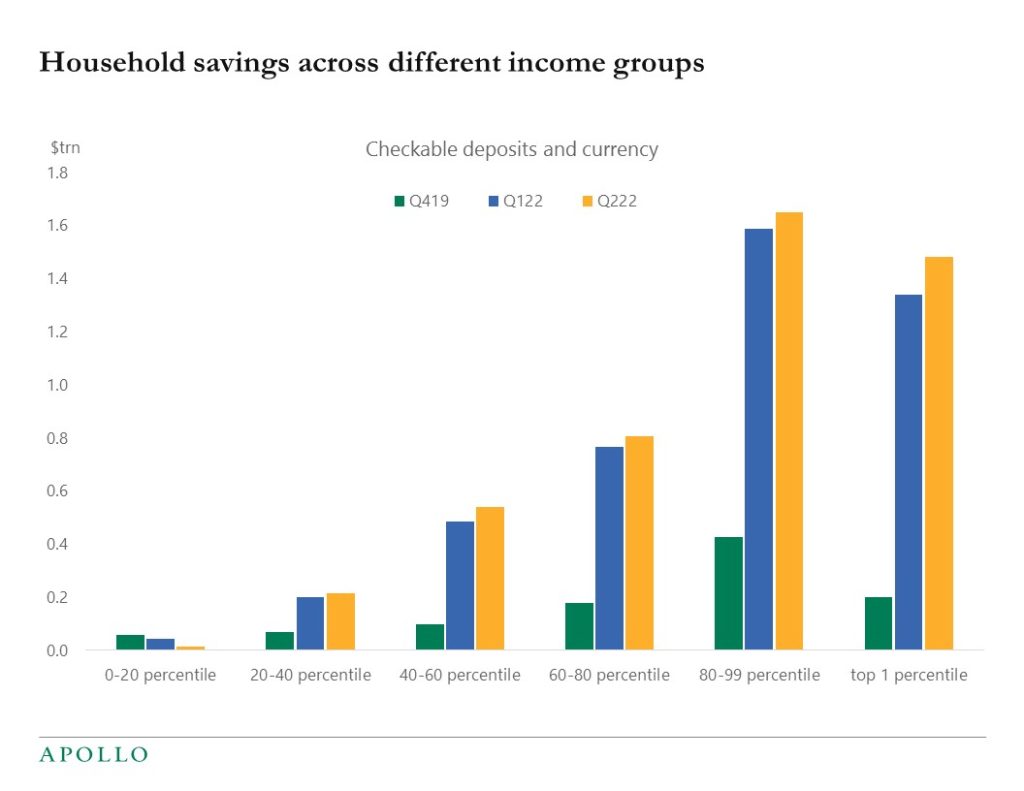

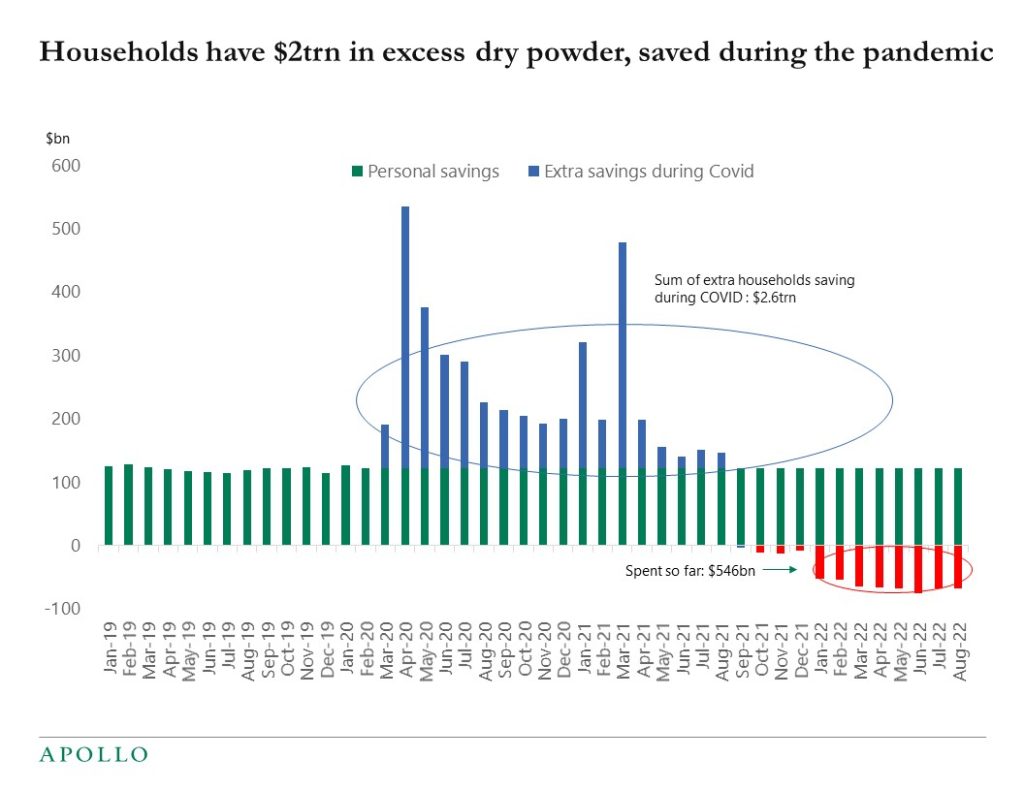

A key reason inflation remains so high is that households still have significant savings left, and the market underappreciates this strong tailwind for consumer spending, see charts below. Combined with solid job and wage growth, it will take many quarters before the level of household savings is back at pre-pandemic levels.