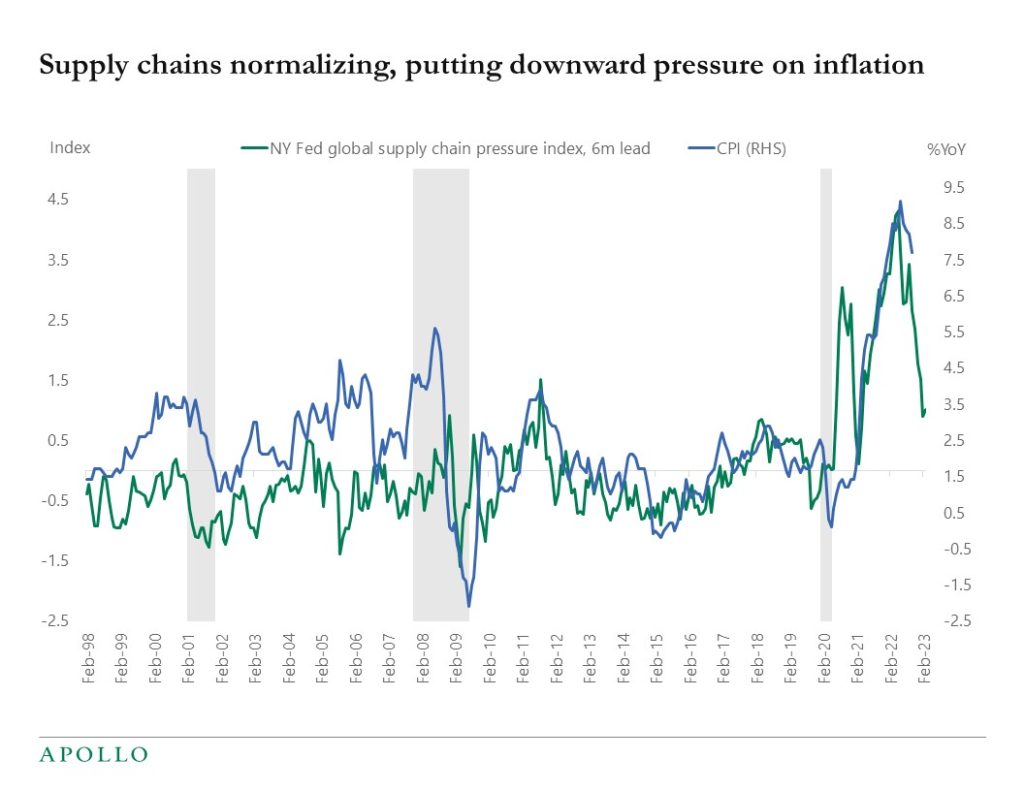

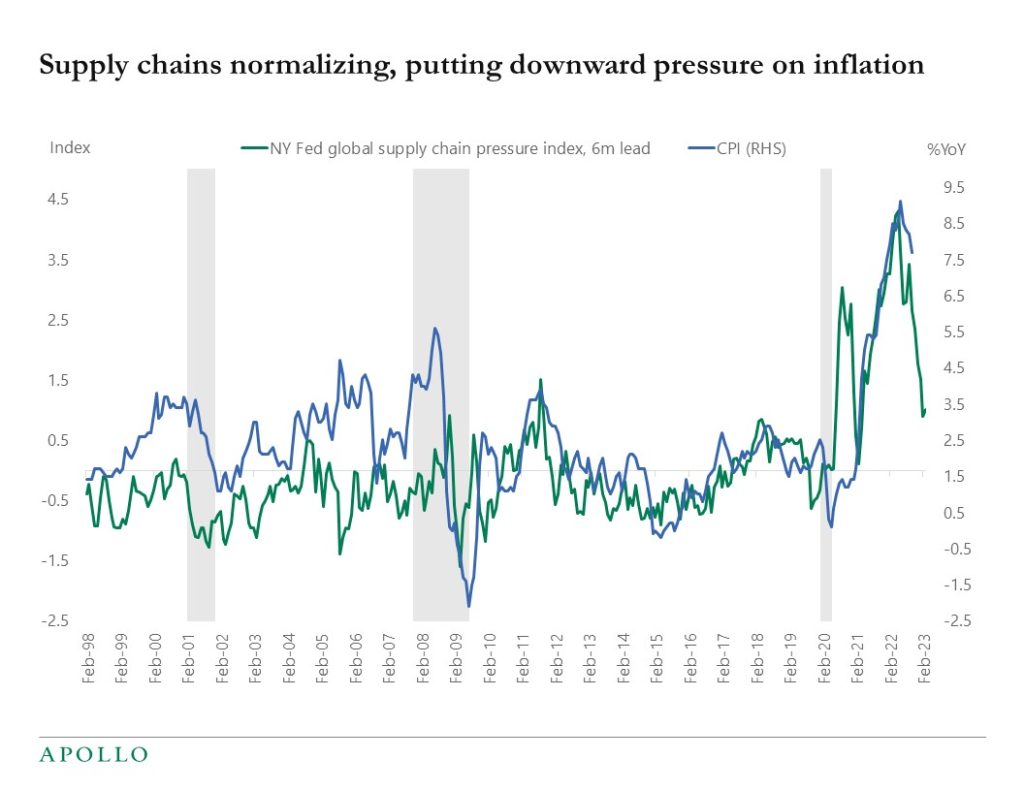

The New York Fed’s measure of supply chain pressures suggests that inflation could be close to the Fed’s 2% target within the next six months, see chart below.

The New York Fed’s measure of supply chain pressures suggests that inflation could be close to the Fed’s 2% target within the next six months, see chart below.

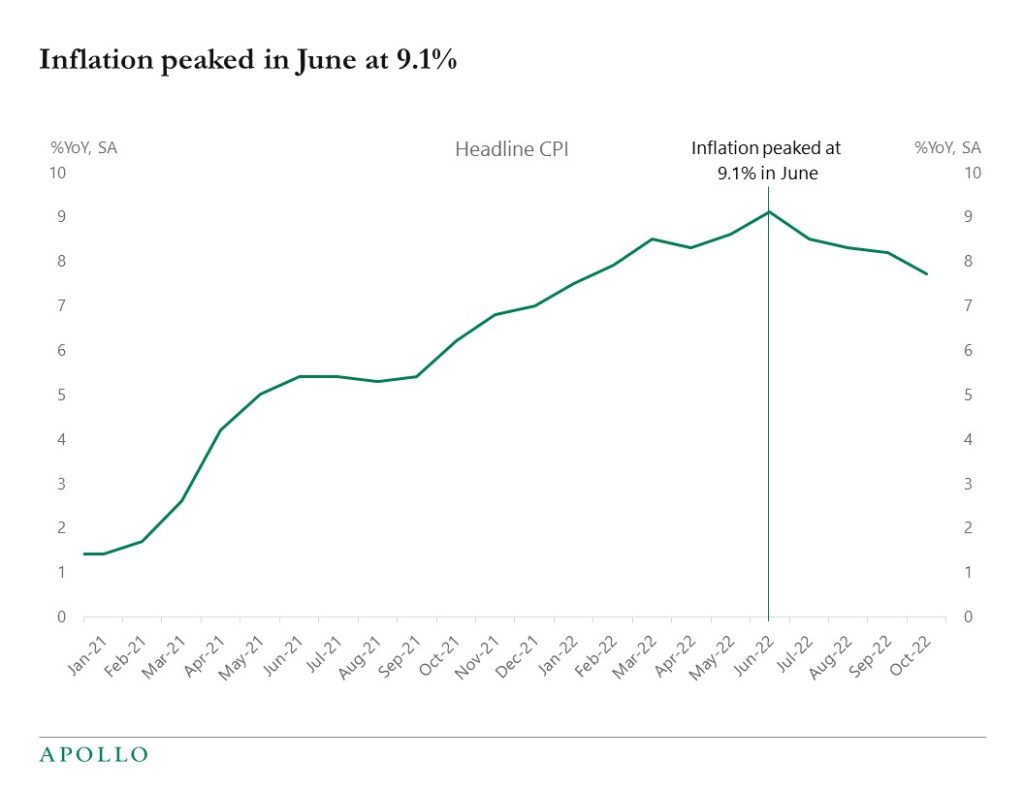

Inflation is 7.7%, and there is an important debate in Fed working papers about how much demand destruction is needed to get inflation down to the FOMC’s 2% target.

Specifically, these Fed studies quantify the size of the sacrifice ratio, defined as the foregone output accruing from a one percentage point decline in inflation, and the two transmission channels investigated are intrinsic adjustment costs and expectational adjustment costs, with expectations playing by far the most important role.

Unfortunately, the sacrifice ratio is not a particularly useful concept when a significant source of the rise in inflation is not demand but supply chain problems driven by covid.

But a critical insight from these papers is that the sacrifice ratio has increased in recent decades, telling the Fed today that even if inflation quickly falls to, say, 4%, because of supply chain problems getting resolved, the demand destruction required to get inflation down to 2% is likely going to be significant, and therefore the ongoing slowdown could be deeper and longer than the market is currently pricing.

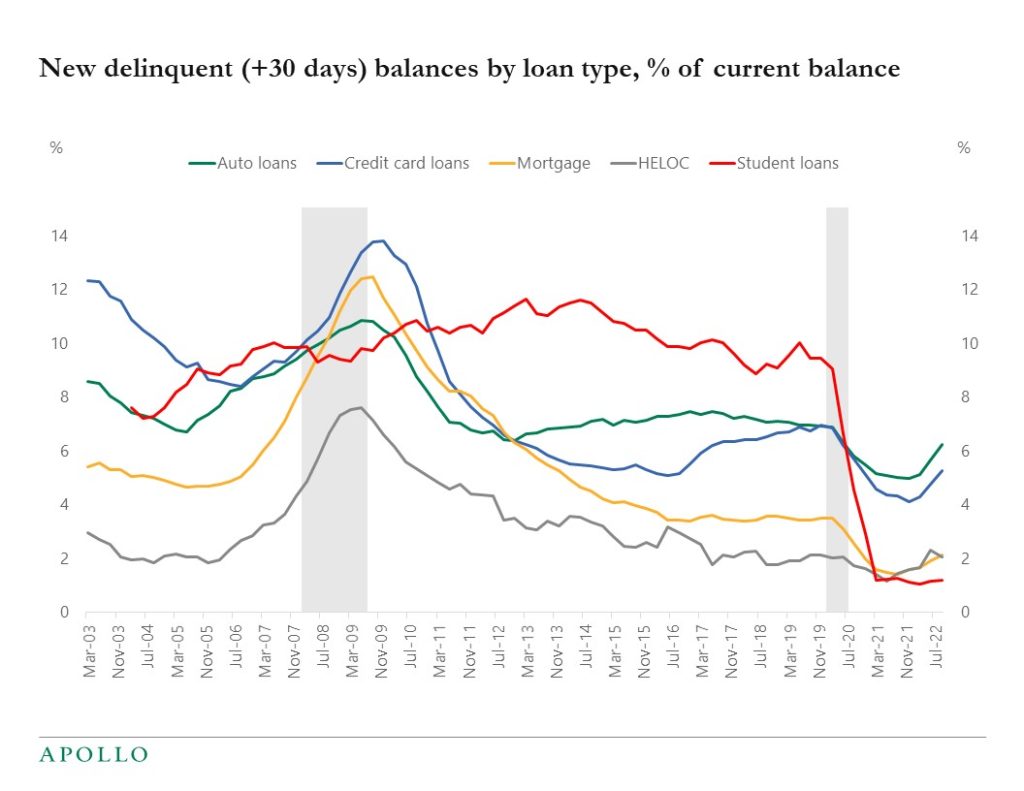

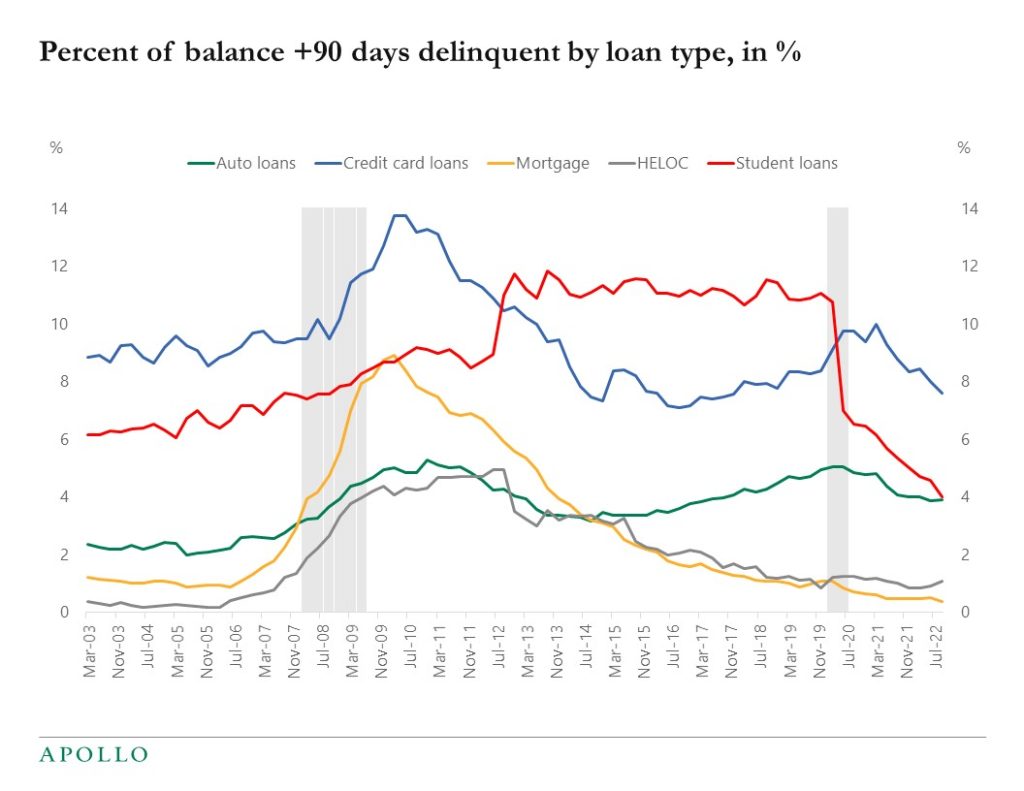

90-day delinquency rates for consumer loans are still very low, but +30-day delinquency rates are starting to rise for credit cards and auto loans, pointing to emerging signs of deterioration in consumer credit quality. This tells the Fed that a slowdown in consumer spending is underway. Combined with falling inflation, the case for a Fed pause is intensifying.

Inventories are very high in general merchandise stores, and plenty of goods on the shelves is putting downward pressure on inflation, see chart below.

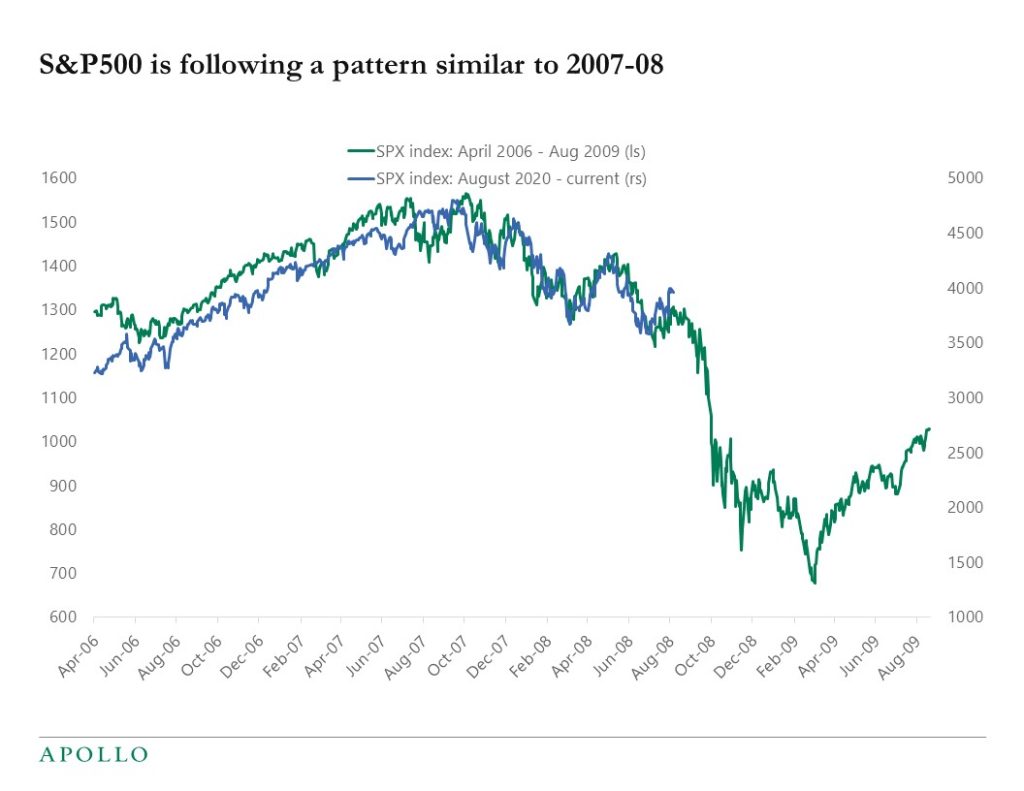

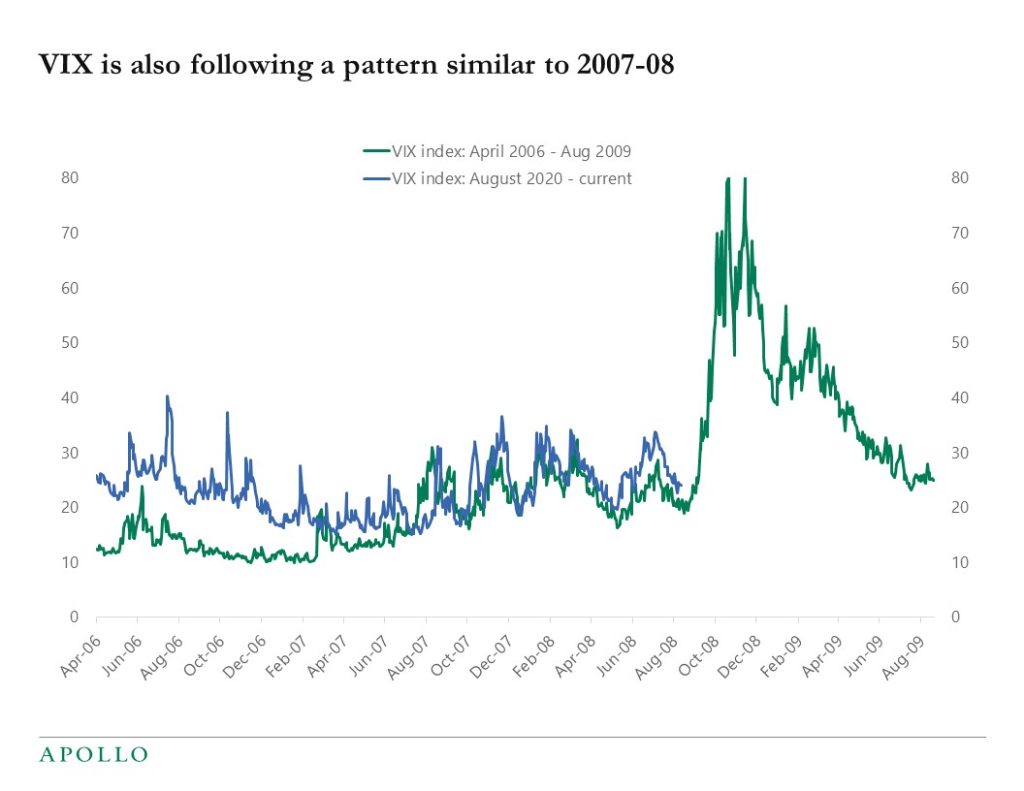

There are no reasons to expect a financial accident in the next month, but it is noteworthy how similar the pattern for the S&P500 and VIX is today to the pattern seen before the Lehman bankruptcy in September 2008, see chart below.

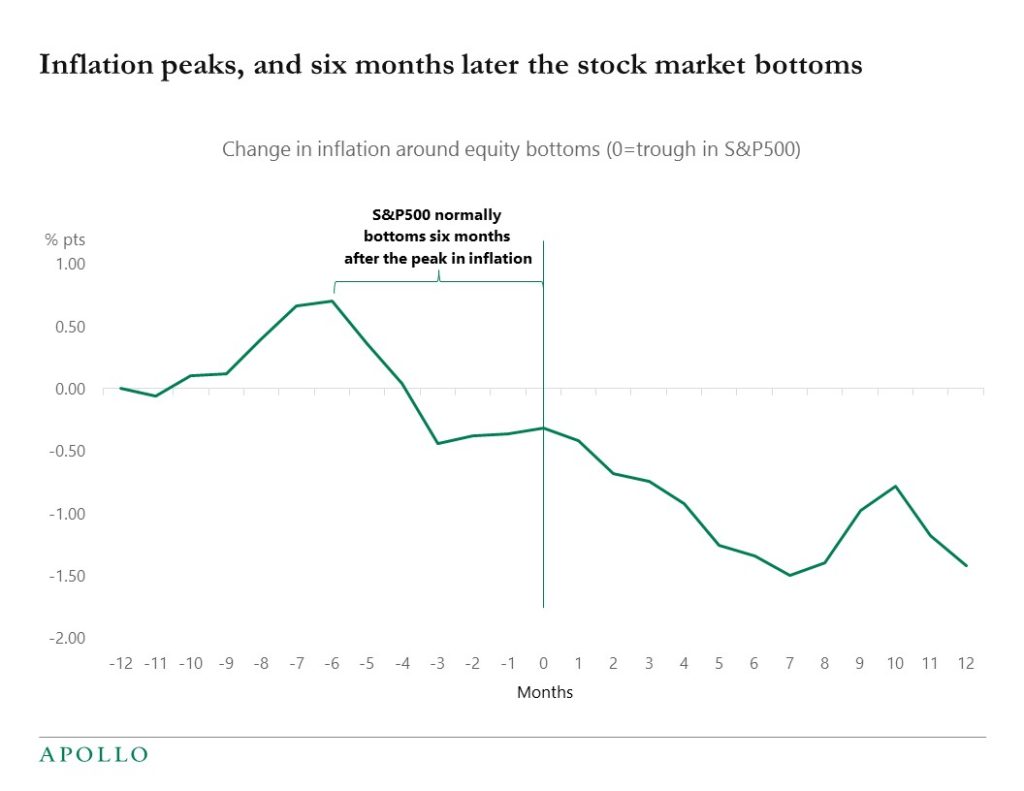

Inflation peaked in June at 9.1%, and the stock market typically bottoms six months after the peak in inflation, see charts below.

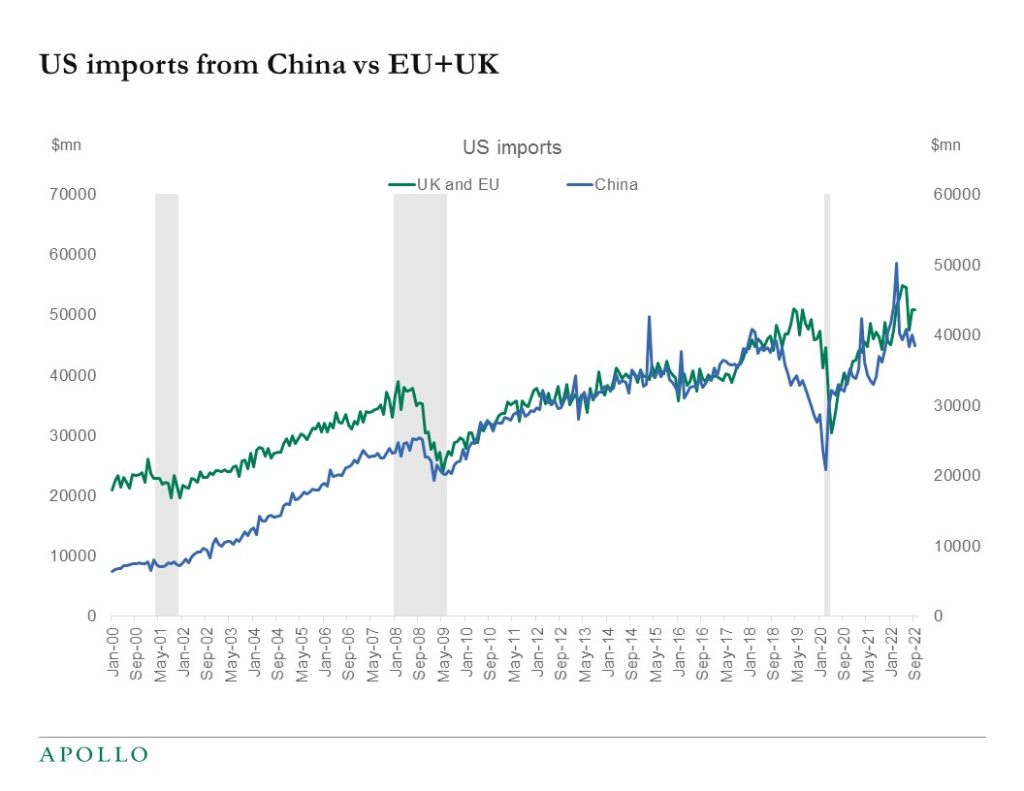

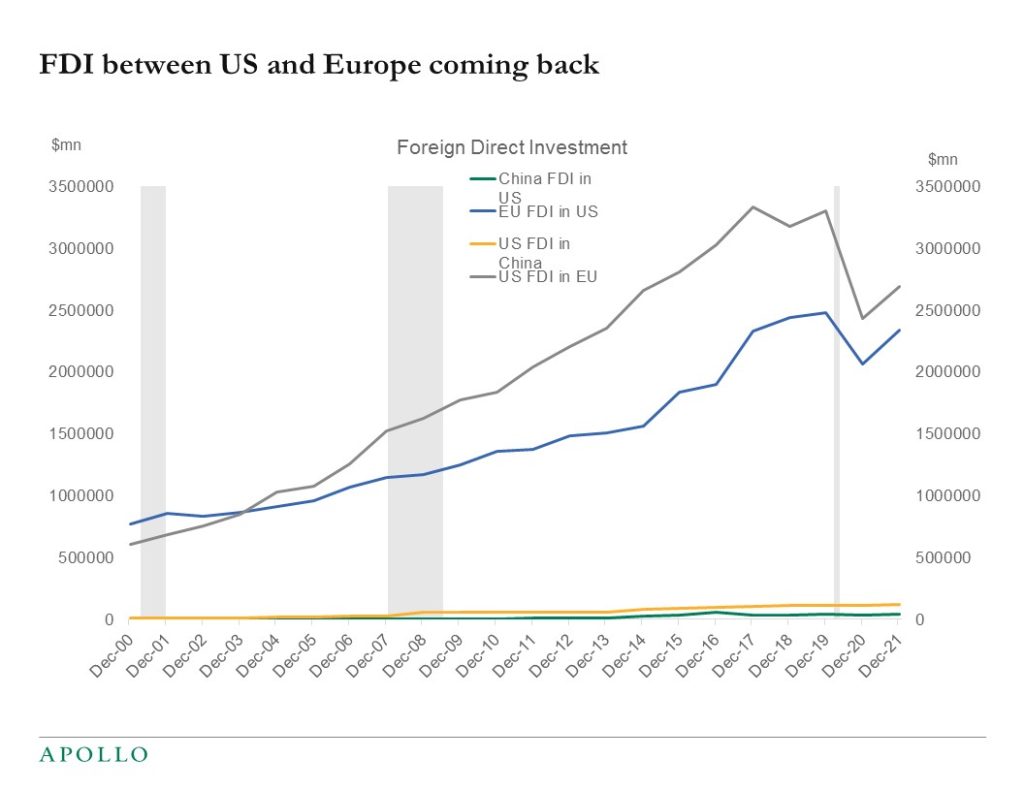

US imports from Europe and UK have been rising, and US imports from China have been declining. And foreign direct investment between the US and Europe is increasing. These trends reflect the ongoing segmentation of global trade with more onshoring and friendshoring, in particular among OECD countries. The market implication of deglobalization is more structural upward pressure on inflation, complicating the Fed’s job of getting inflation back to the 2% target.

Fed hikes are starting to cool down the economy via three transmission channels:

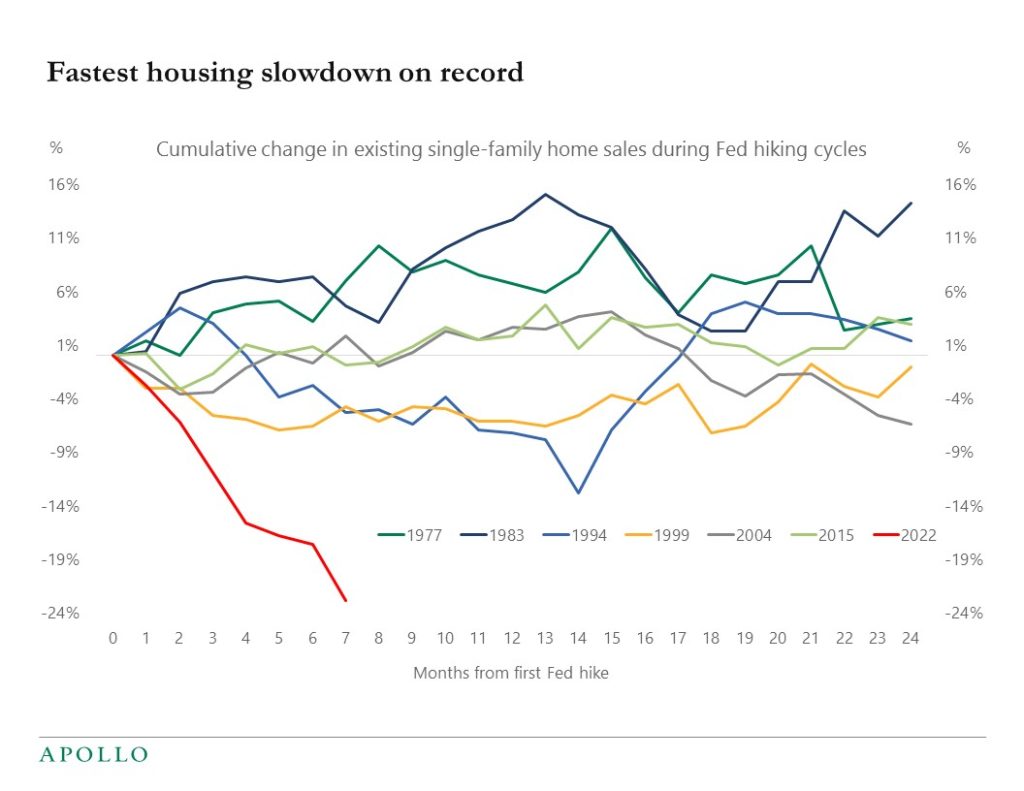

1) The interest rate-sensitive components of GDP are slowing down (housing, autos, and capex spending), see chart below.

2) The tech sector is in turmoil because of higher risk-free rates, and layoff announcements are rising.

3) HY primary markets are essentially closed, and this is having a negative impact on issuing firms in both the goods and service sectors.

The bottom line is that monetary policy is working as intended. The Fed started raising rates in March 2022, and these three transmission channels confirm the conventional wisdom that it takes 12 to 18 months before Fed hikes have their biggest effects on the economy.

From an inflation perspective, higher rates are cooling housing inflation and car price inflation, which will push down headline inflation over the coming quarters. As a result, the Fed will soon have achieved their goal and the FOMC will be done with raising rates.

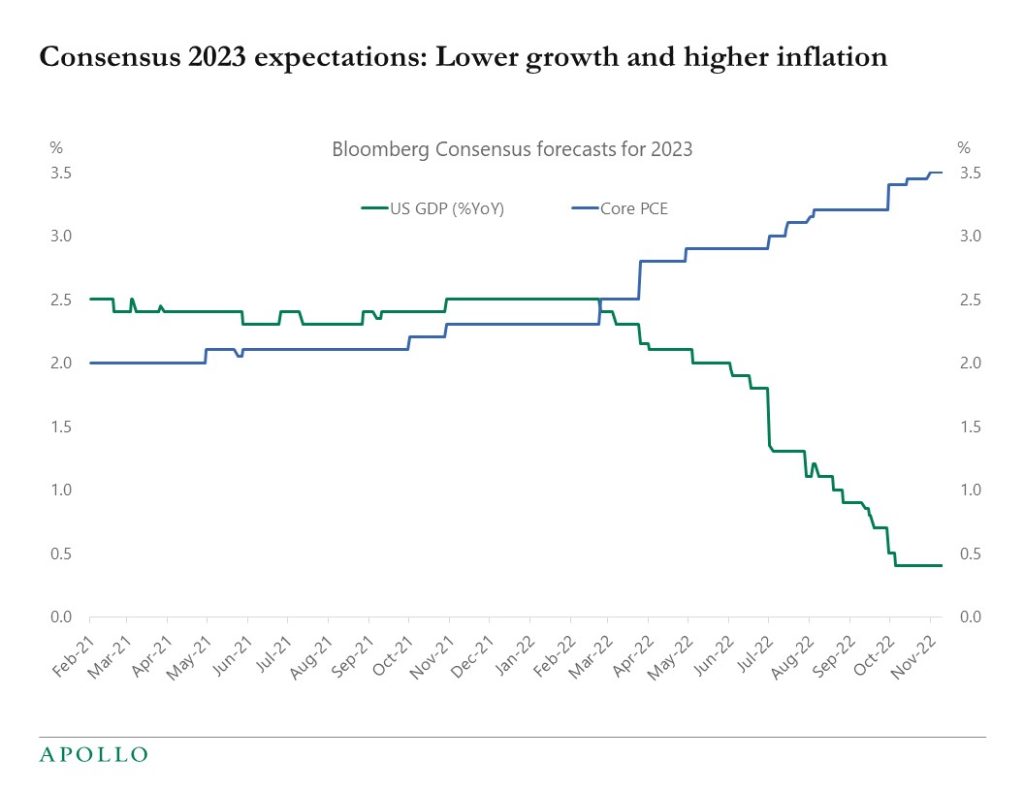

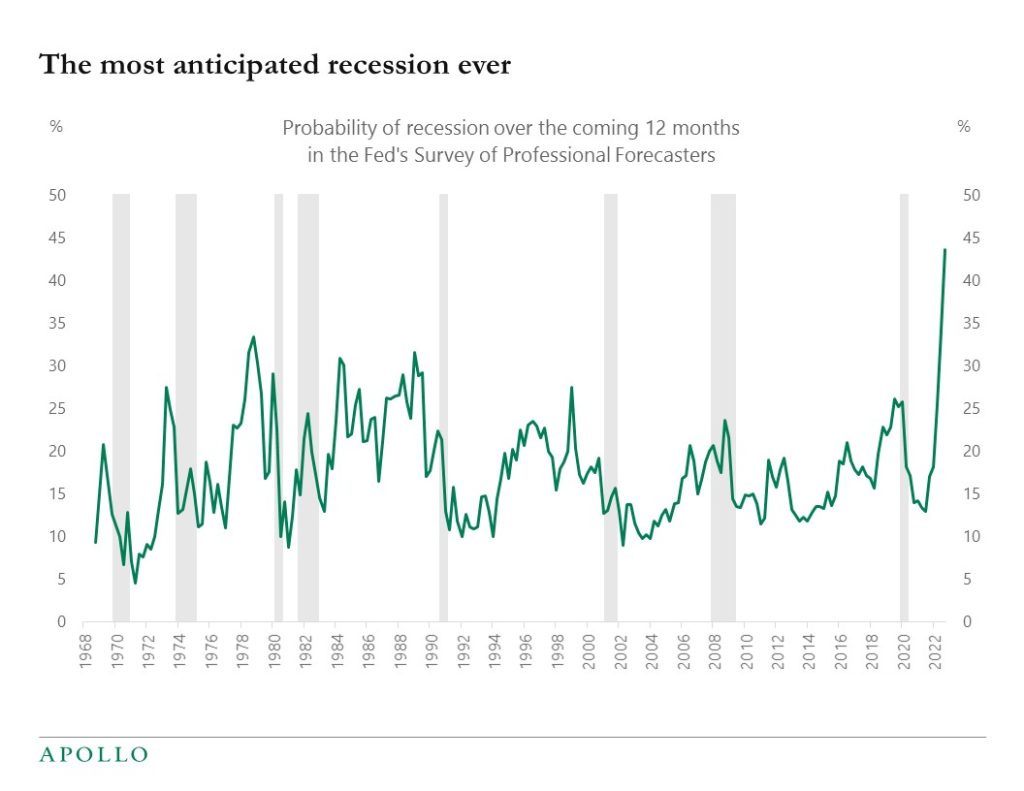

If there is a recession in 2023, it would be the most anticipated recession ever, see chart below. My latest outlook presentation is available here.

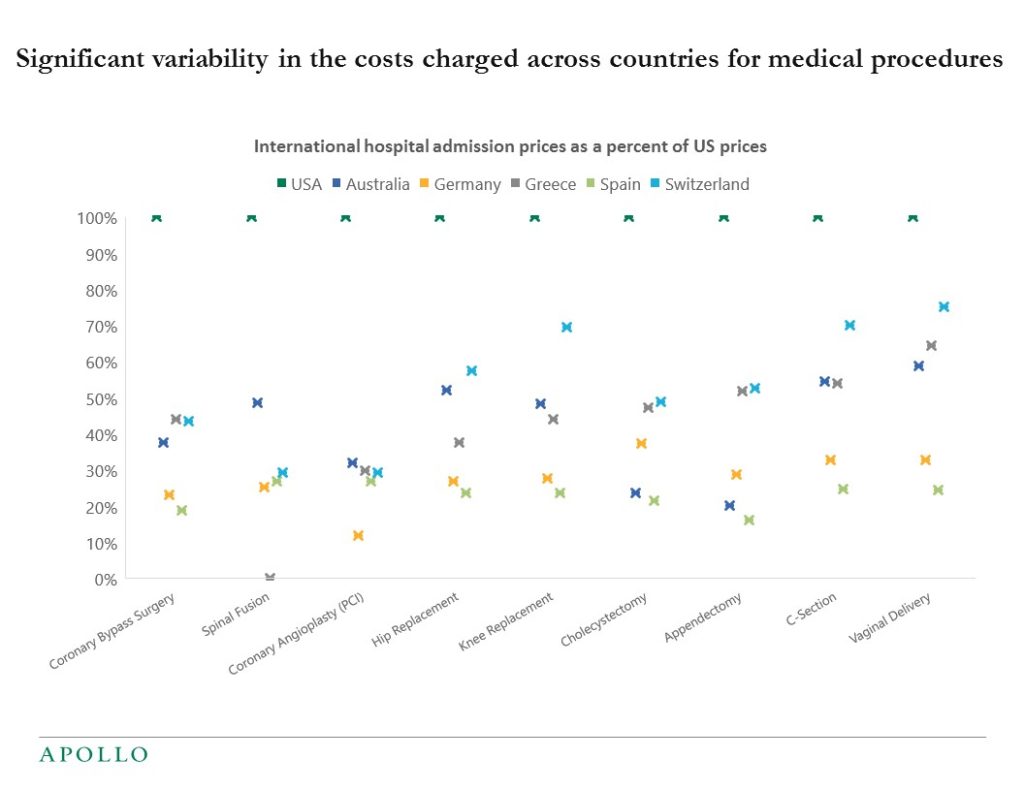

The chart below compares the price of different medical procedures across countries.