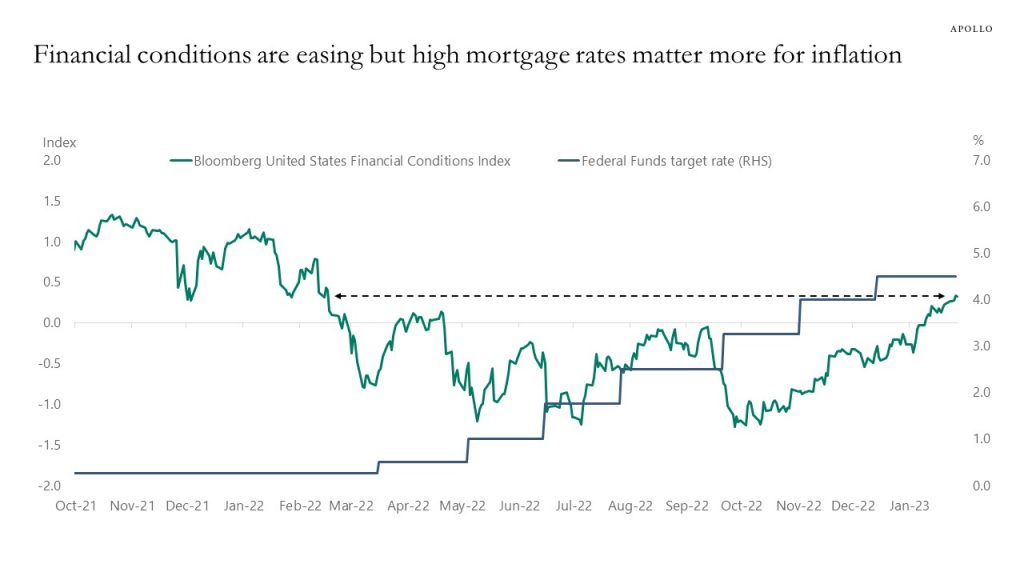

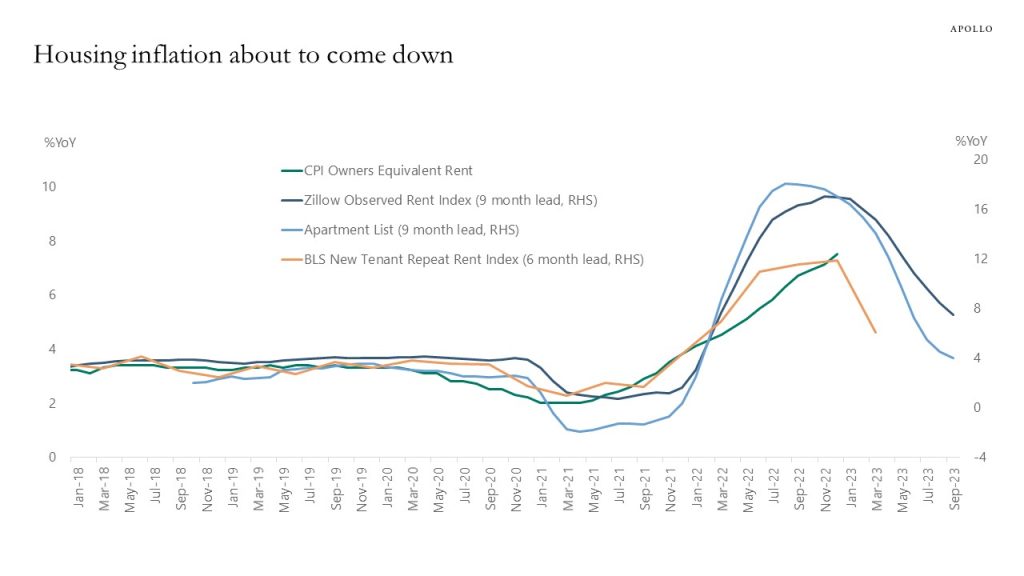

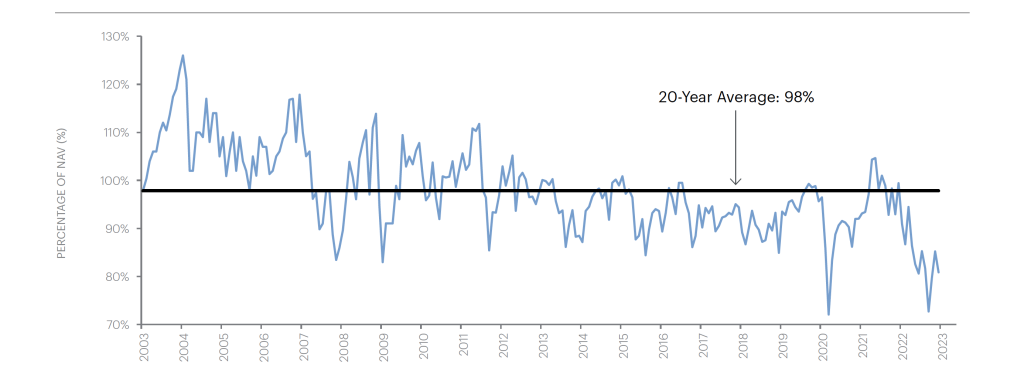

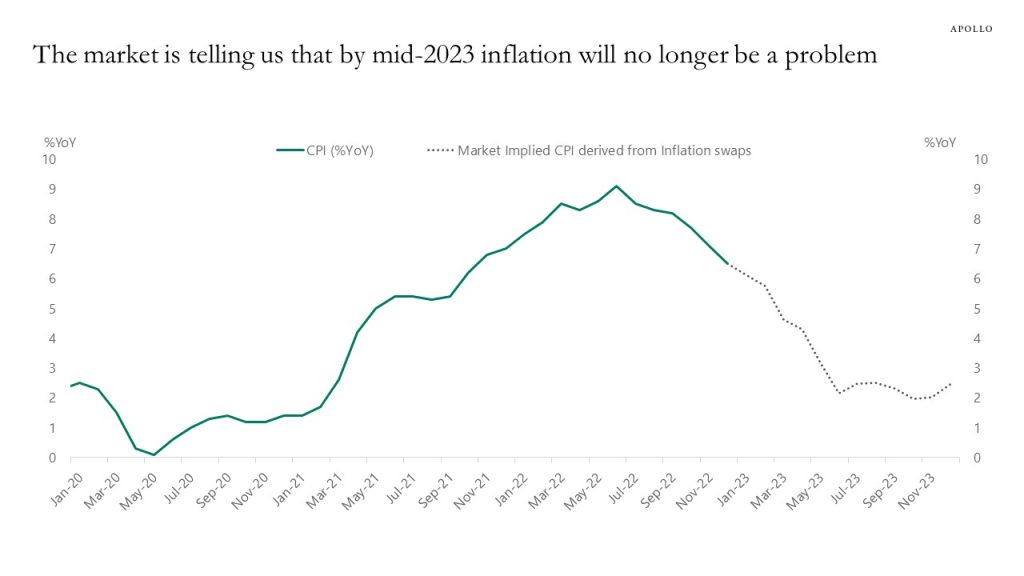

Financial conditions have eased to levels seen before the Fed started raising rates, but the Fed is not going to worry much about the ongoing rise in the S&P500 and tightening of credit spreads because what matters for the inflation outlook is the mortgage rate, which continues to put downward pressure on housing inflation, see charts below.