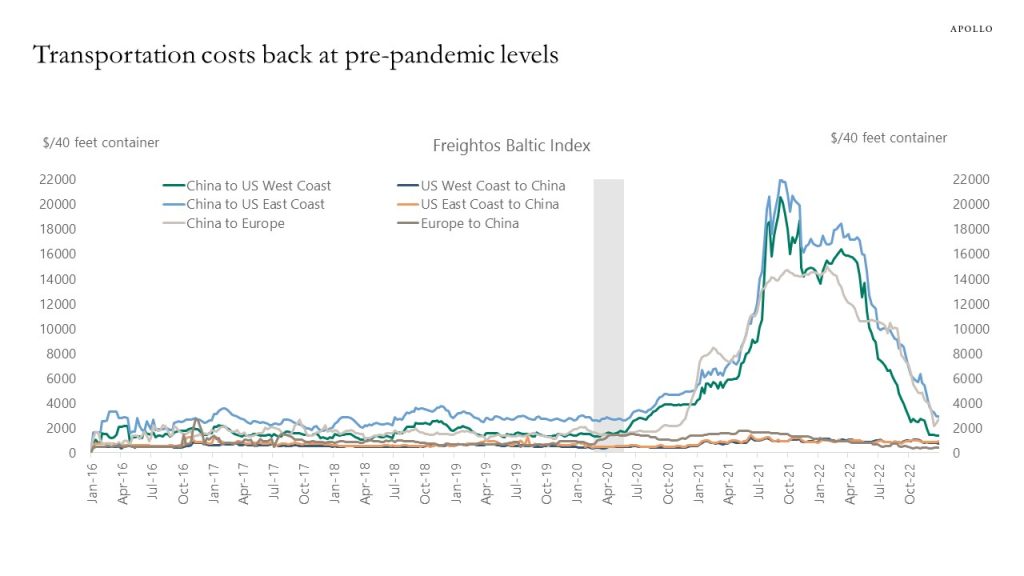

Supply chains are back to normal, and the price of transporting a 40-feet container from China to the US West Coast has declined from $20,000 in September 2021 to $1,382 today, see chart below. This normalization in transportation costs is a significant drag on goods inflation over the coming months. Services inflation will be driven lower by declining rent inflation. Wage inflation remains elevated, but we have just had an extended period where consumer price inflation was higher than wage inflation. So companies and profit margins will also be able to deal with a period where wage inflation is higher than consumer price inflation. The bottom line is that the Fed and the consensus are right to expect a decline in inflation as we go through 2023. And new Fed research here shows that inflation persistence is less of a worry.