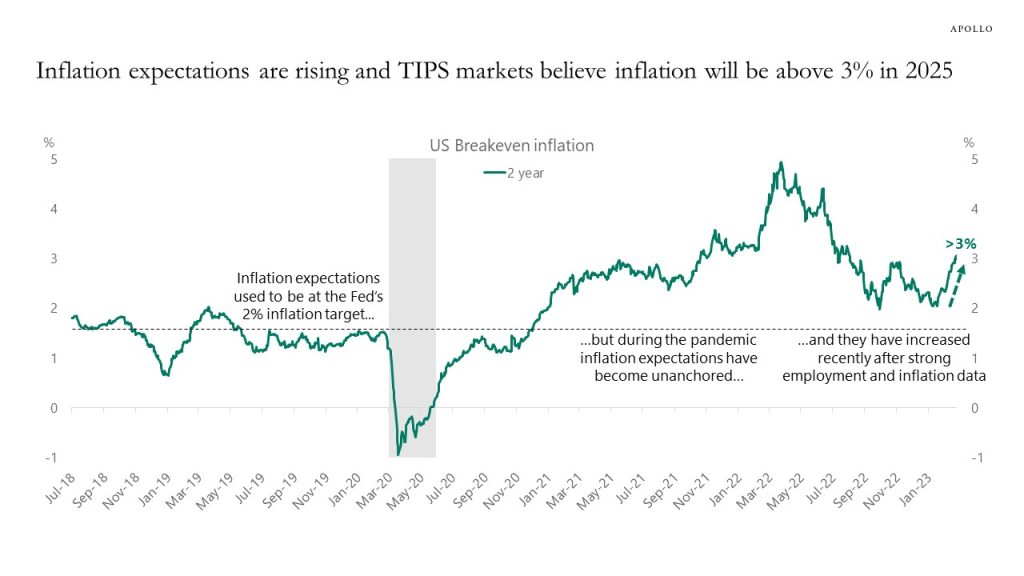

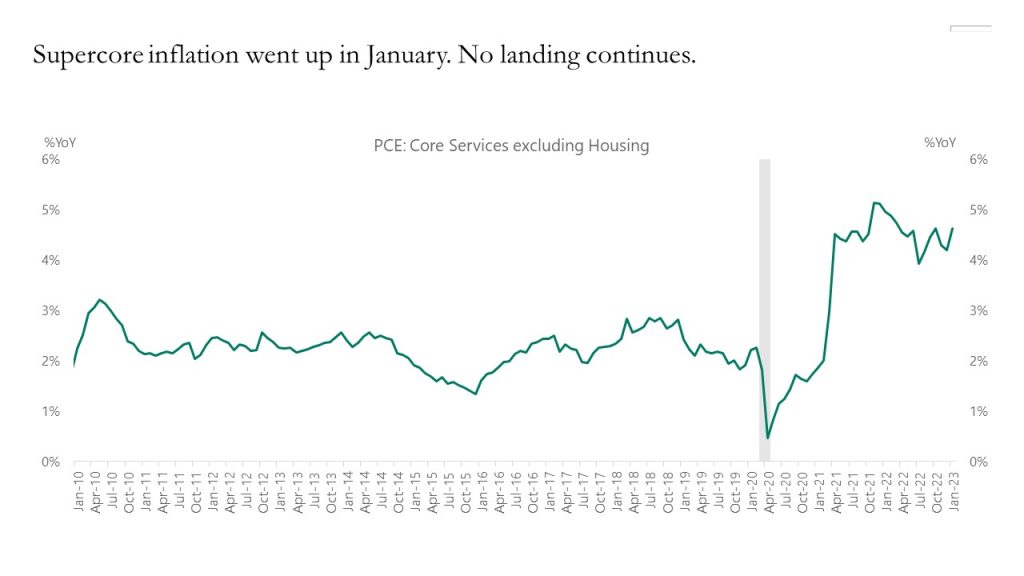

The ongoing no landing is not just about waiting for the lagged effects of Fed hikes, it is also about the level of the Fed funds rate not being high enough to cool the economy down.

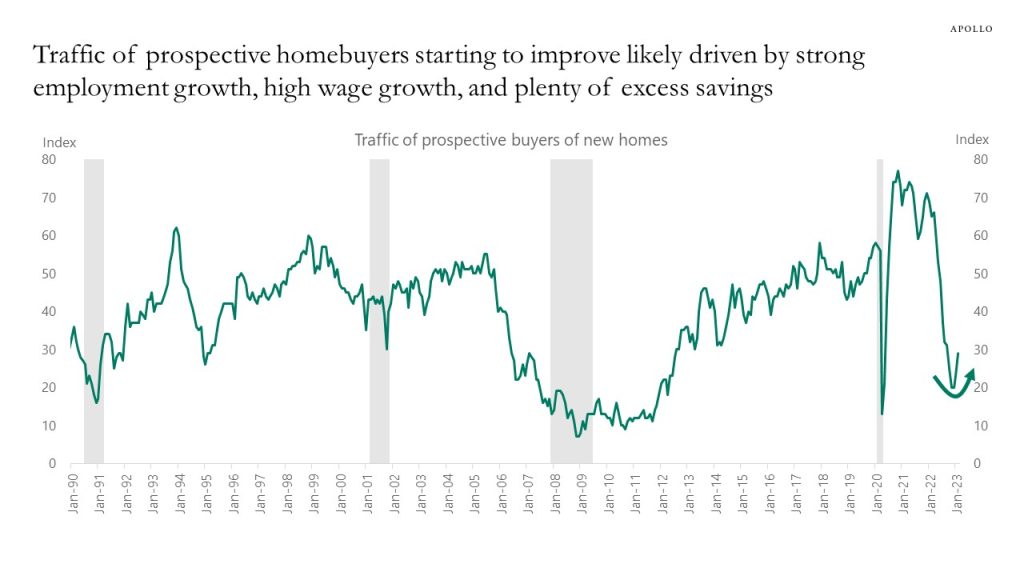

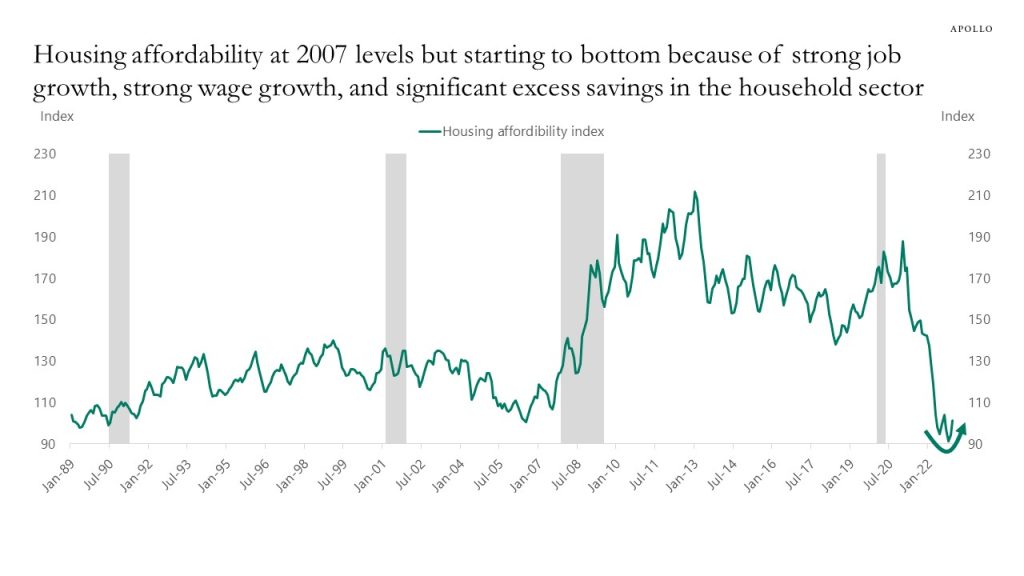

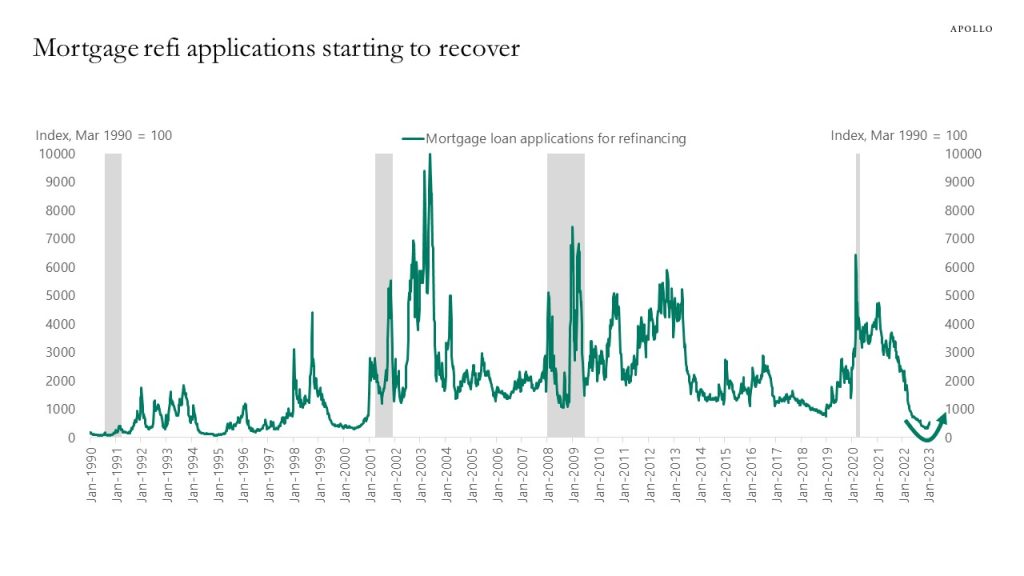

The no landing scenario is playing out because the Fed has not raised interest rates enough, and as a result, even the interest rate-sensitive components of GDP are now starting to recover because of continued strong job growth, high wage growth, and high excess savings across the income distribution. As time goes by, the economy begins to adjust to a new higher level of inflation and a new higher level of interest rates.

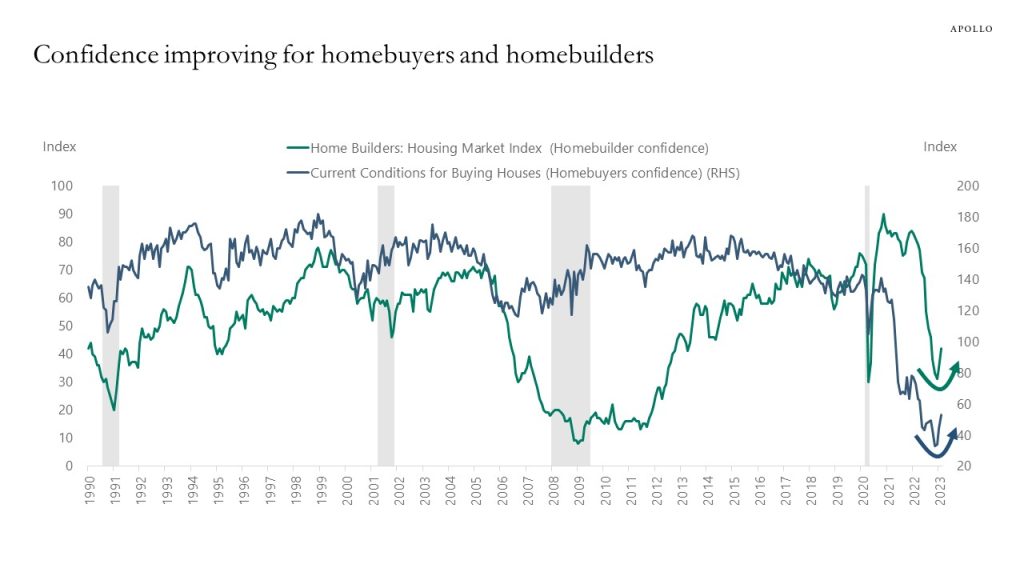

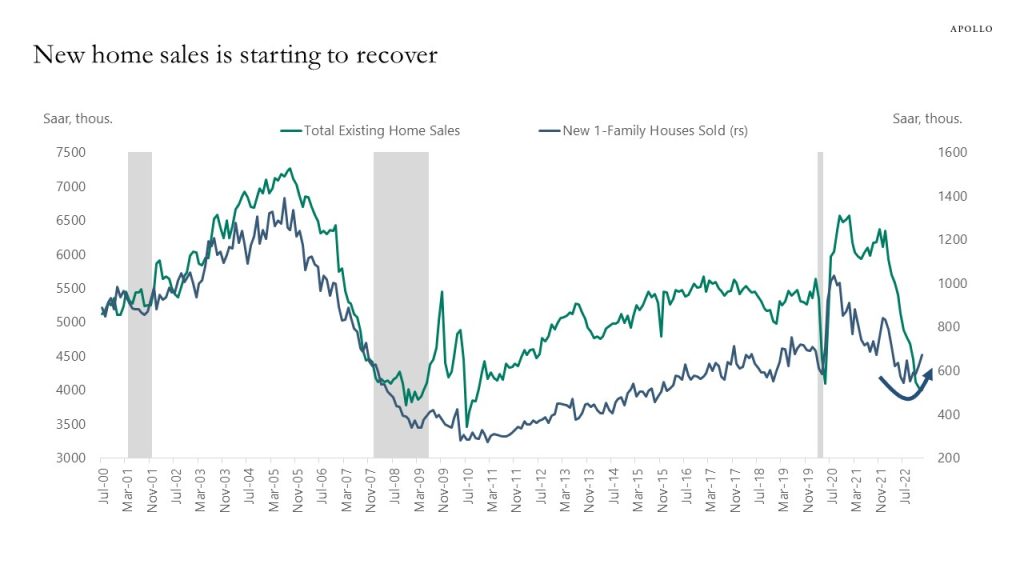

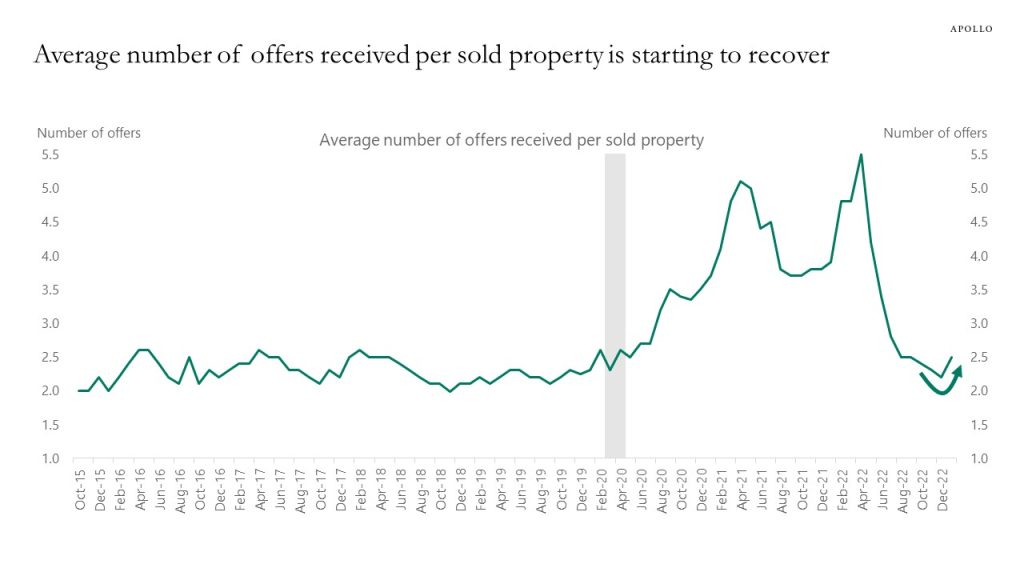

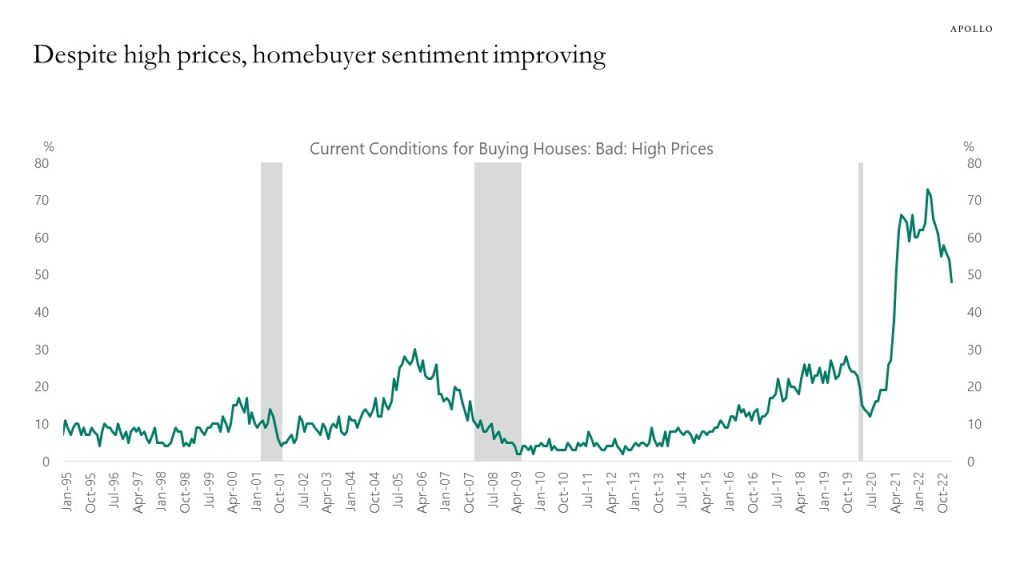

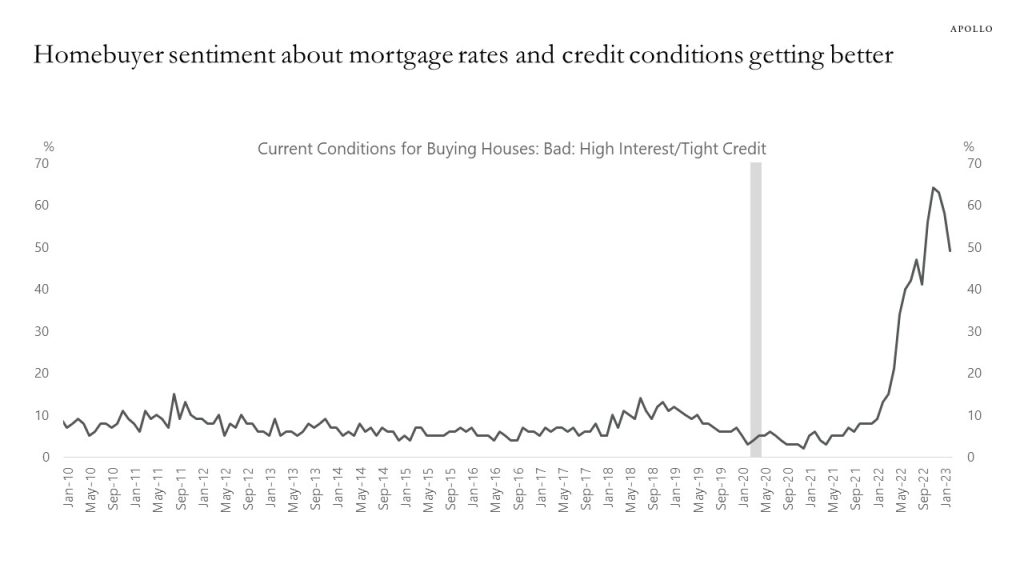

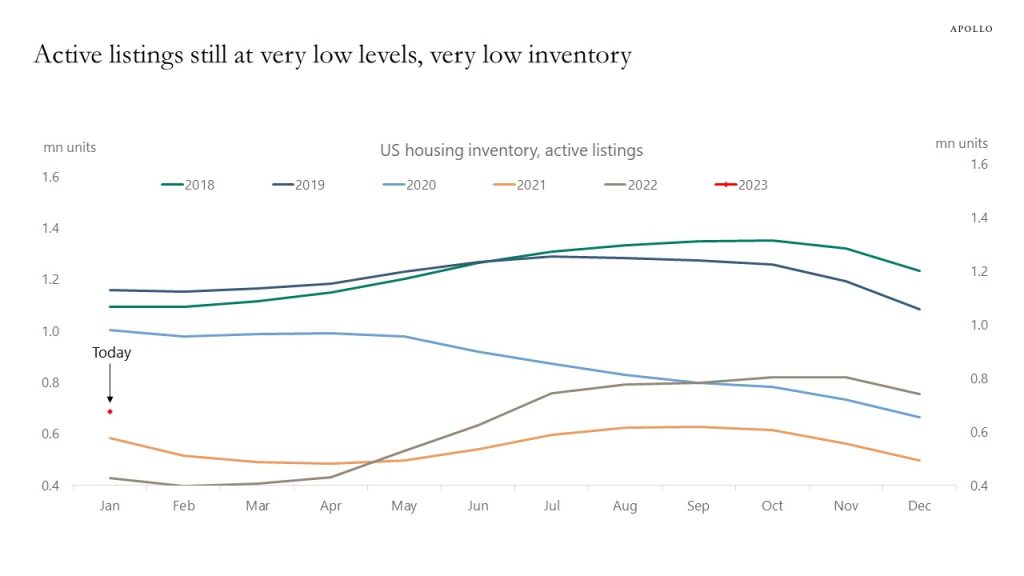

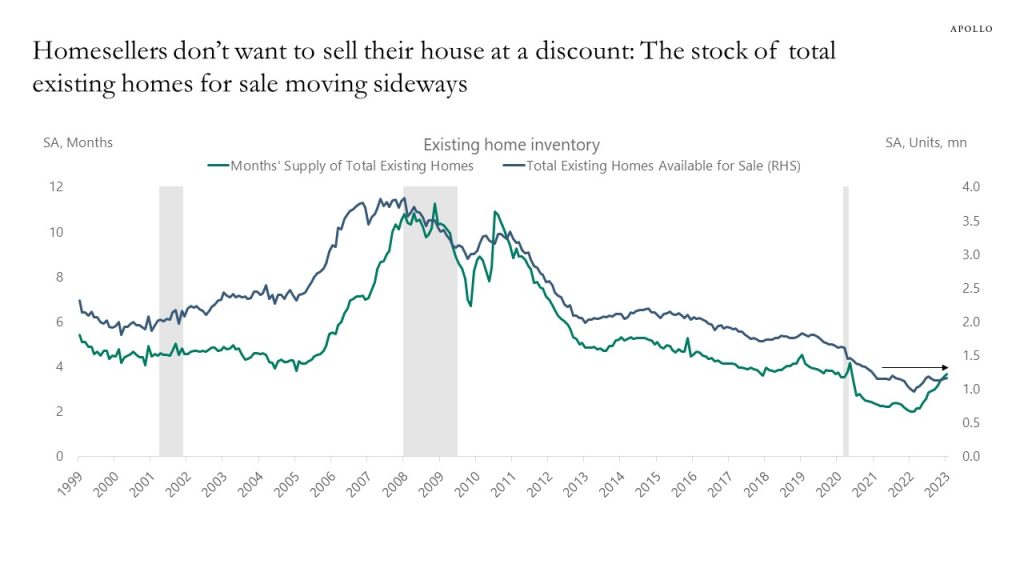

Most notably, the housing market is starting to rebound, see charts below. Traffic of prospective buyers of new homes is rebounding, homebuilder sentiment and homebuyer sentiment are rebounding, new home sales are beginning to recover, the average number of offers received per sold property is starting to recover, active listings are still very low, and indicators suggest that homesellers are simply not selling their home if they don’t like the price they are being offered. This makes sense with continued strong job growth, strong wage growth, and high household savings.

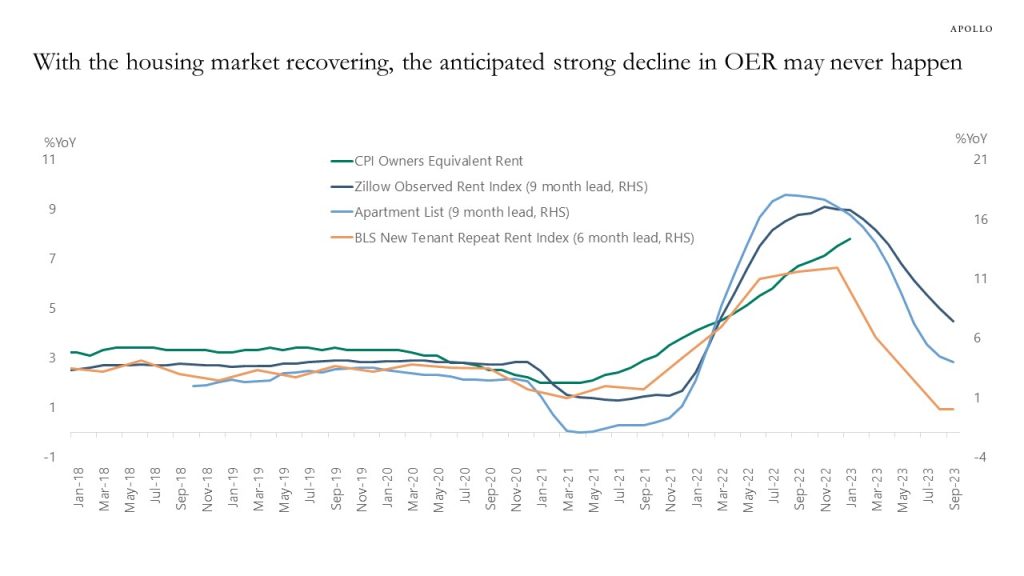

With the housing market recovering, the risks are rising that the expected strong rollover in the shelter component of the CPI index may never happen, see the last chart.