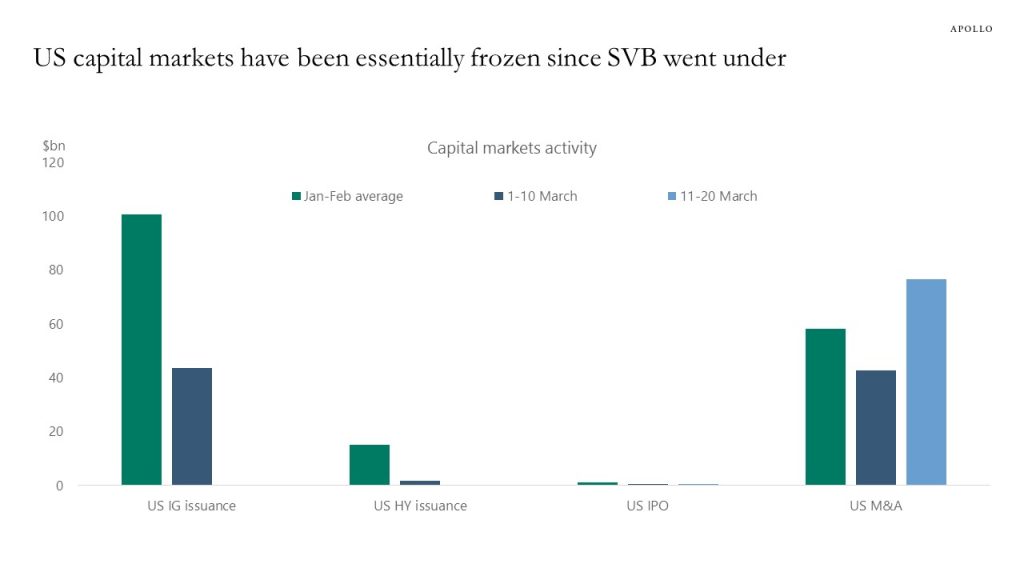

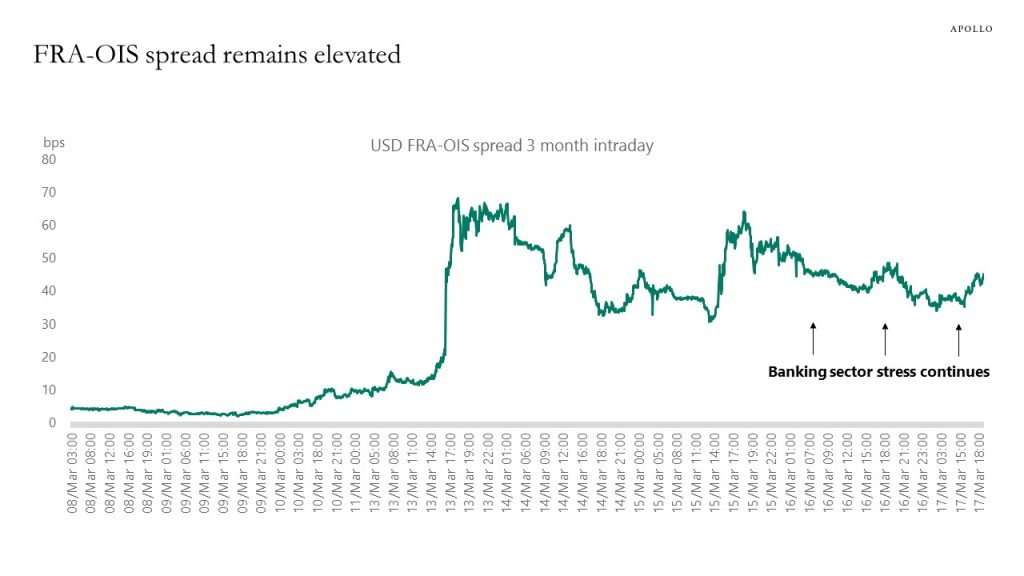

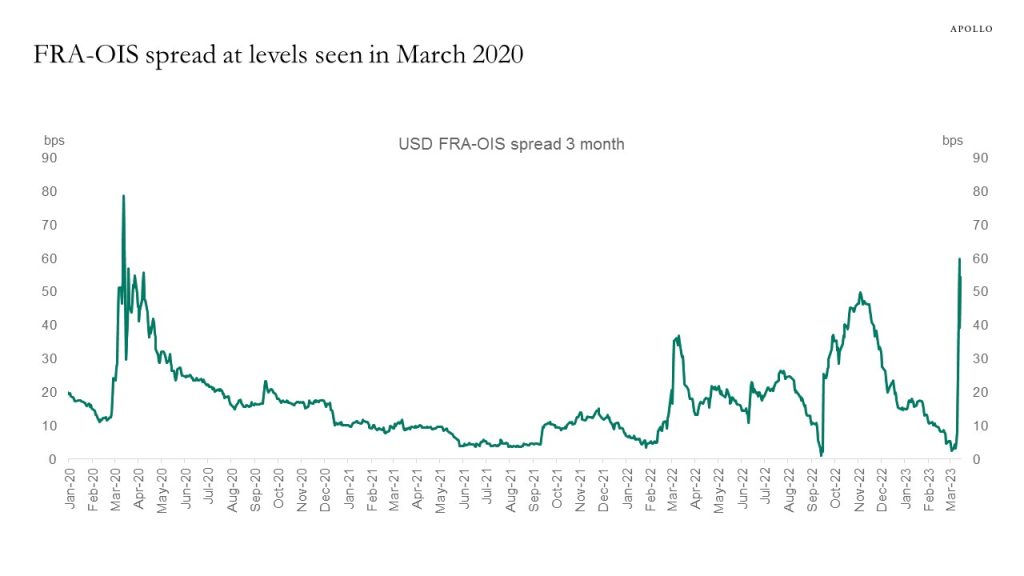

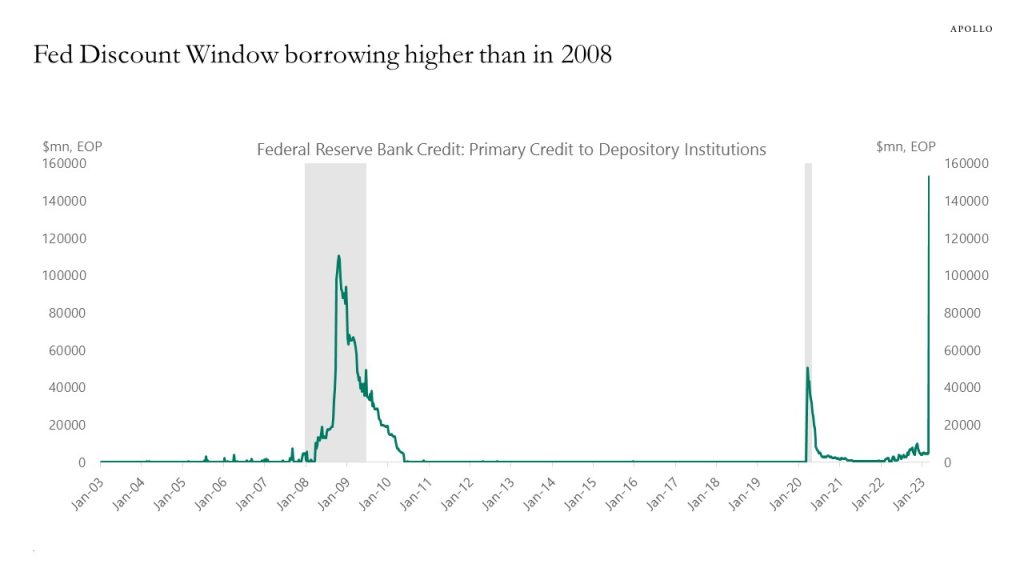

Since SVB went under, there has been basically no HY issuance, IG issuance, or IPO activity, see chart below. And completed M&A activity since Friday, March 10 reflects long-time planned M&A rather than new risk-taking. The longer capital markets are closed, and the longer funding spreads for banks remain elevated, the more negative the impact will be on the broader economy.