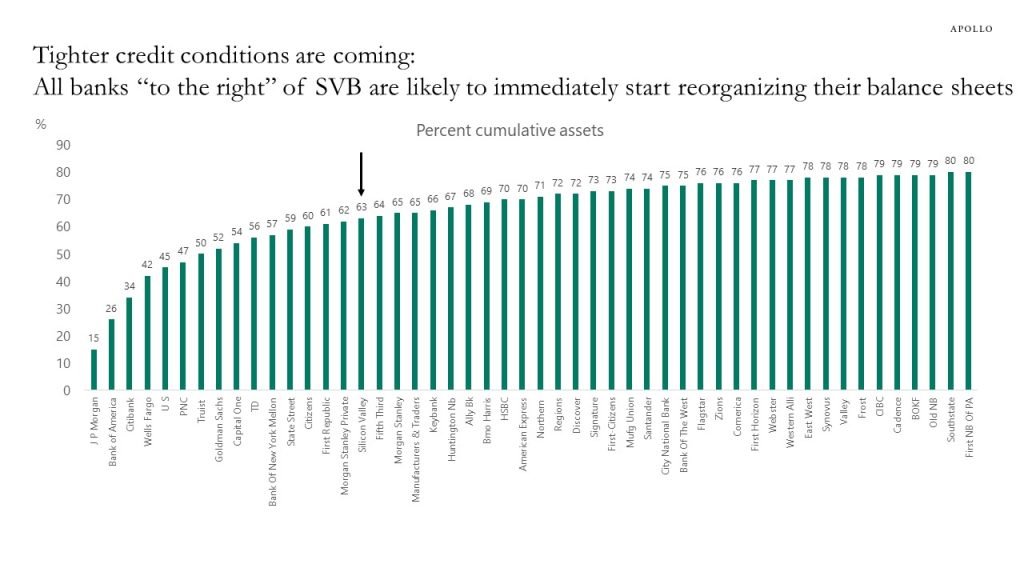

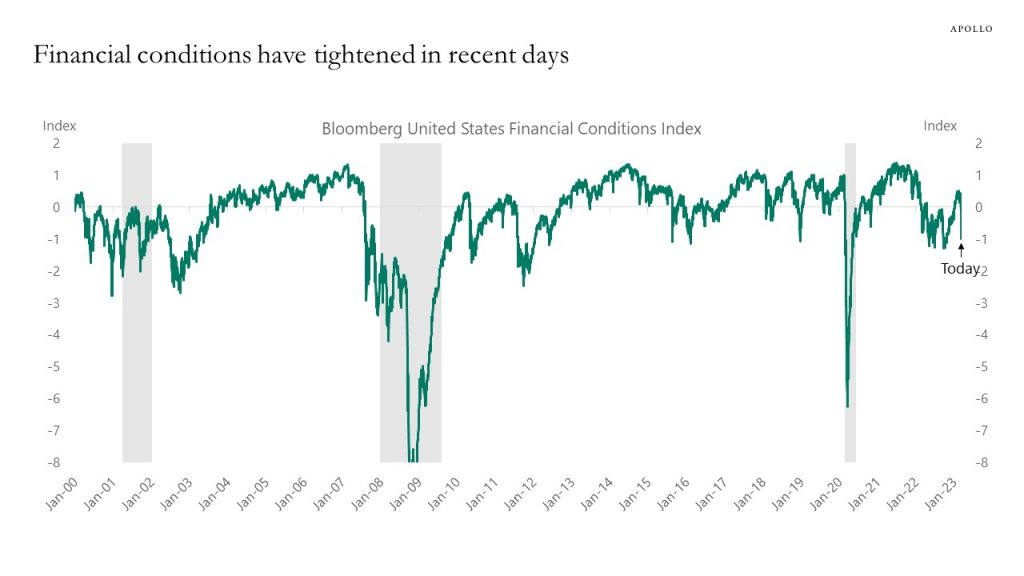

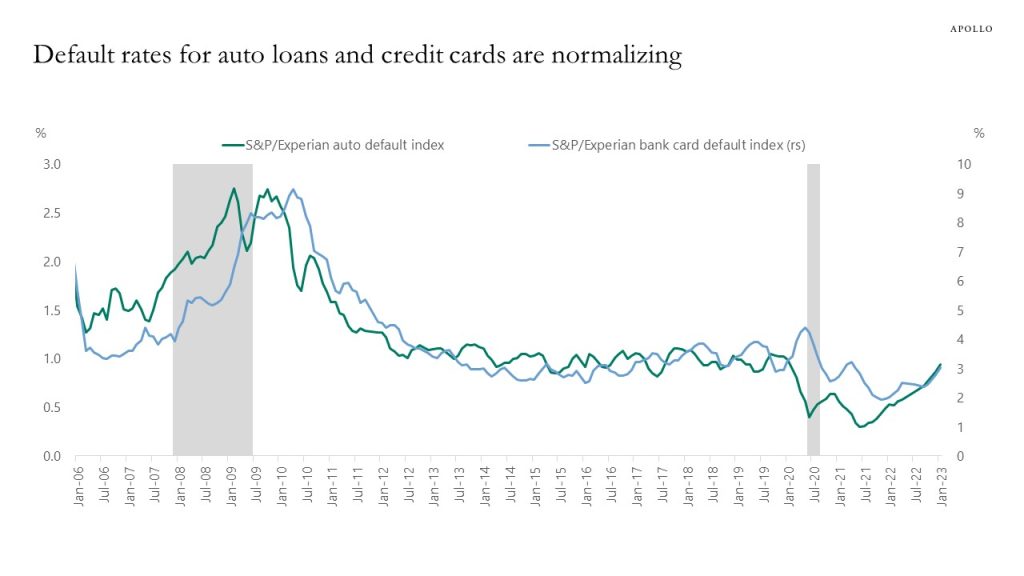

When the facts change, my view changes. A financial accident has happened, and we are going from no landing to a hard landing driven by tighter credit conditions, see chart below. Small banks account for 30% of all loans in the US economy, and regional and community banks are likely to now spend several quarters repairing their balance sheets. This likely means much tighter lending standards for firms and households even if the Fed would start cutting rates later this year. With the regional banks playing a key role in US credit extension, the Fed will not raise interest rates next week, and we have likely seen the peak in both short and long rates during this cycle.