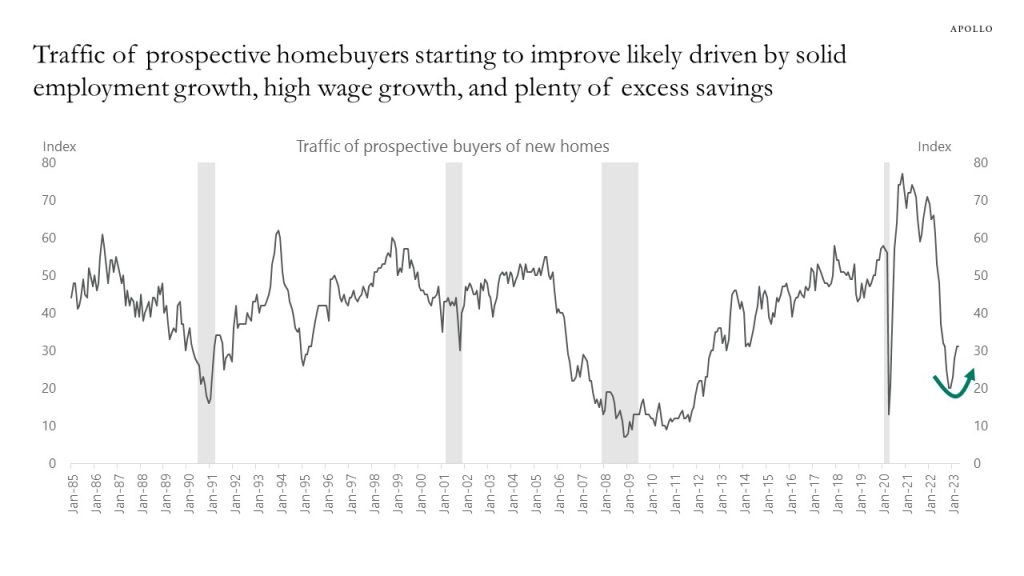

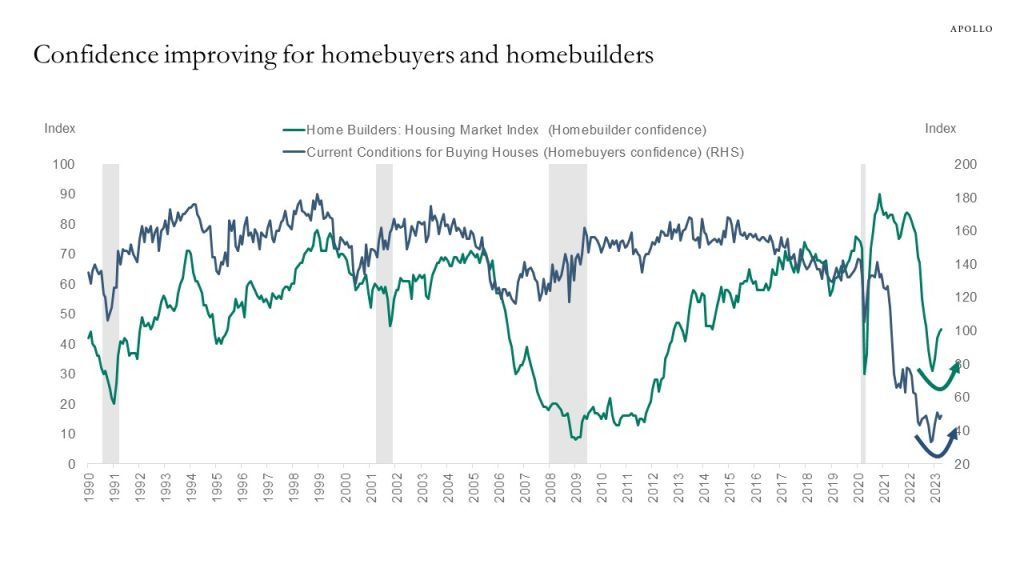

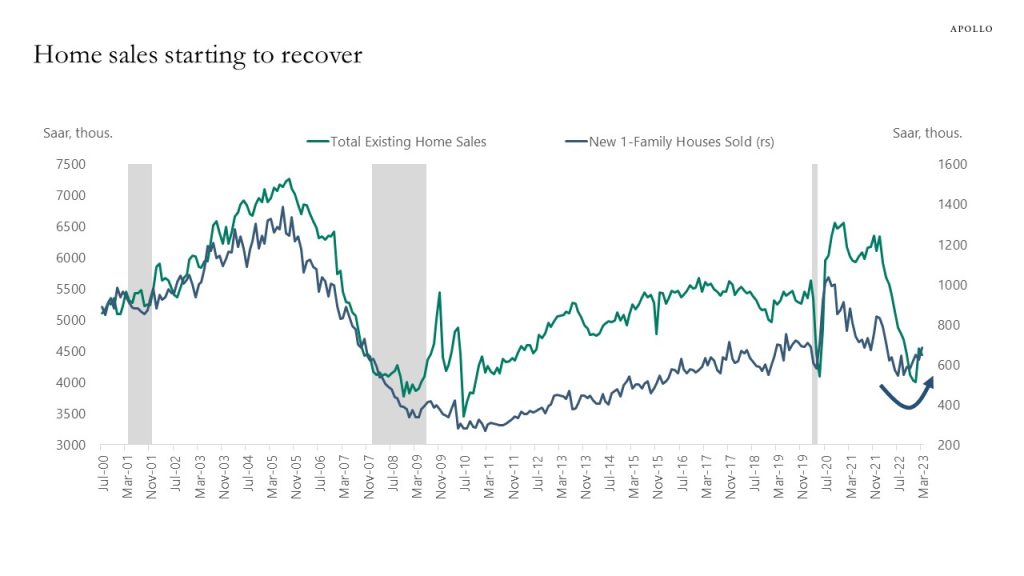

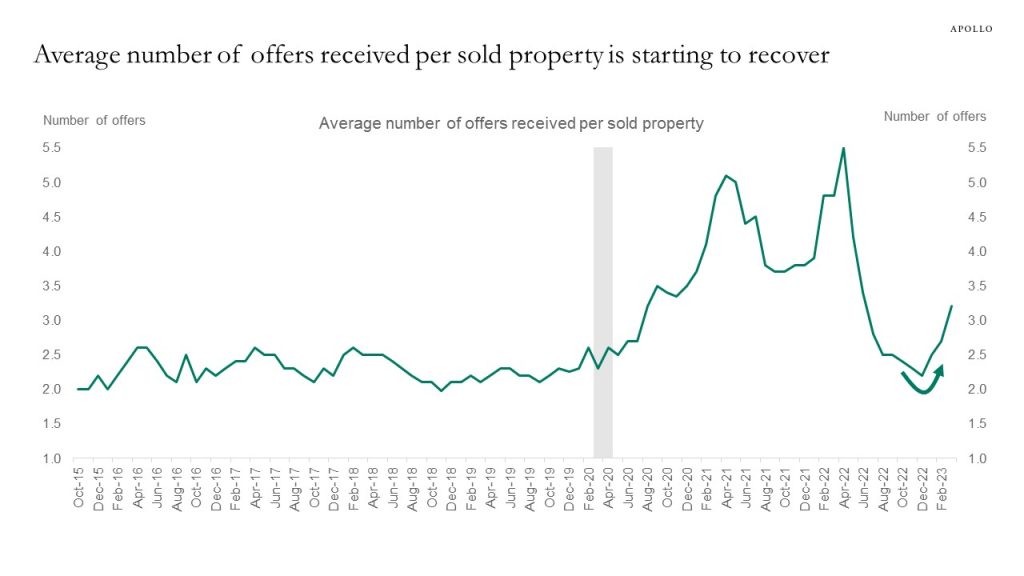

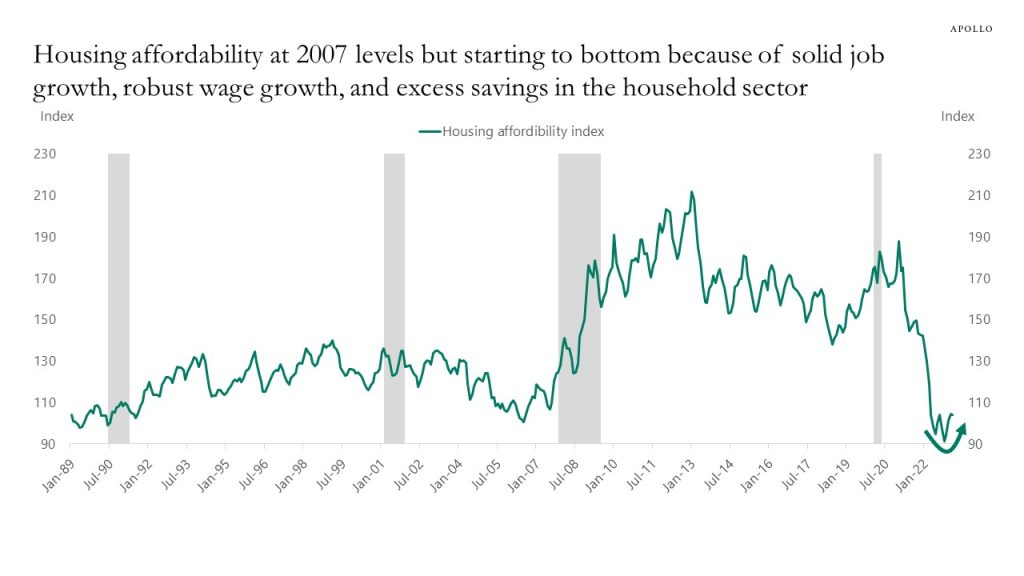

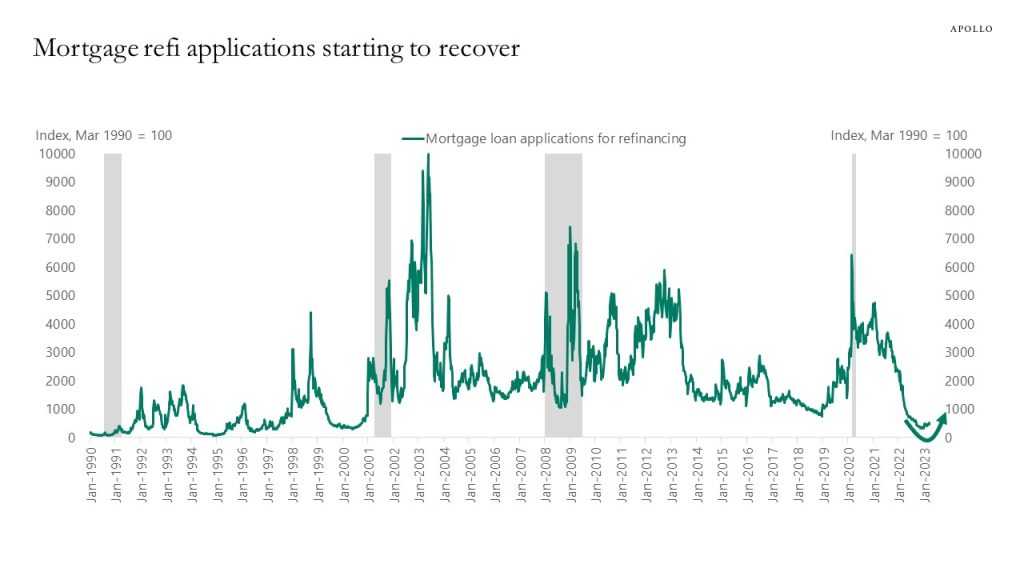

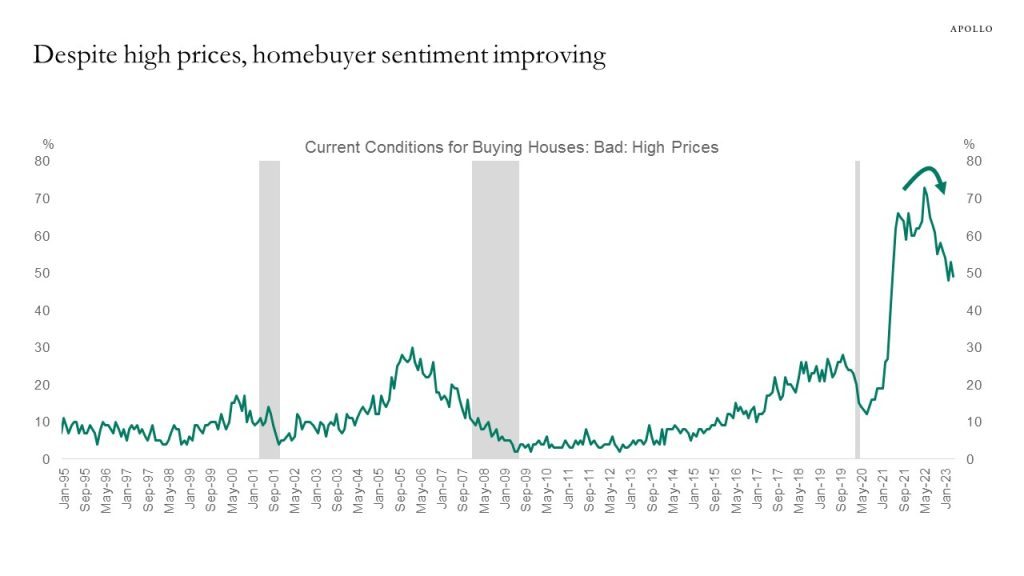

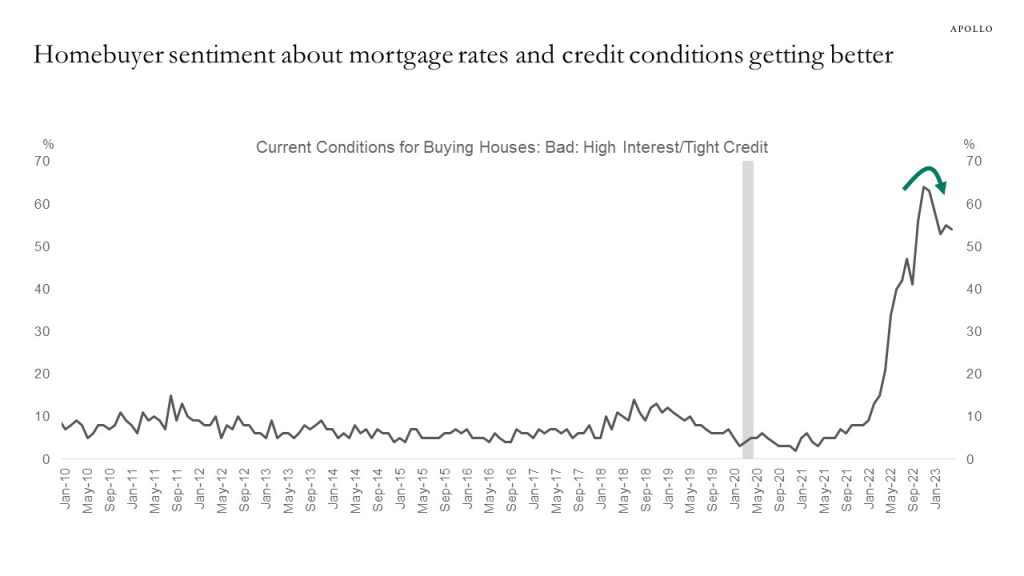

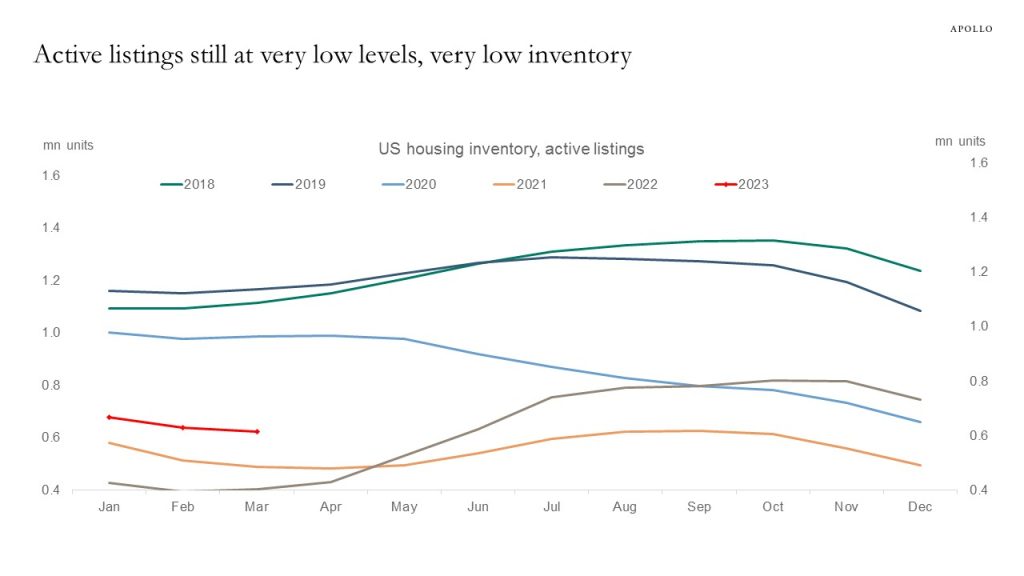

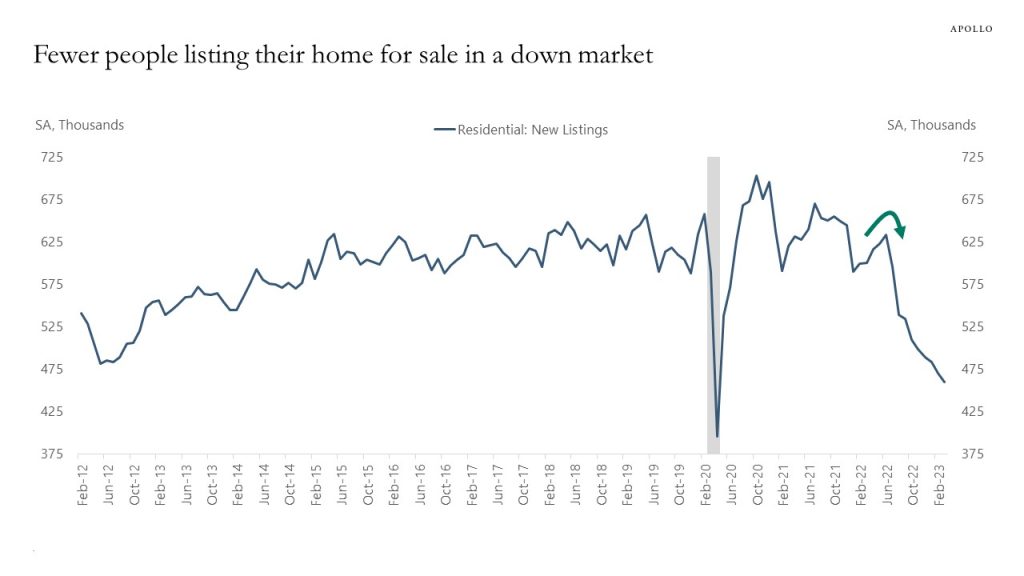

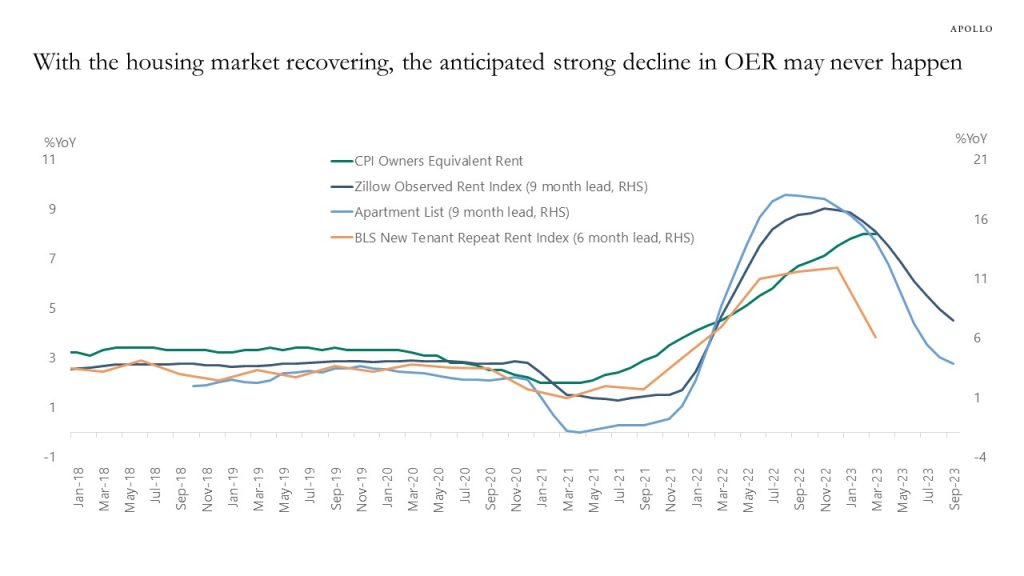

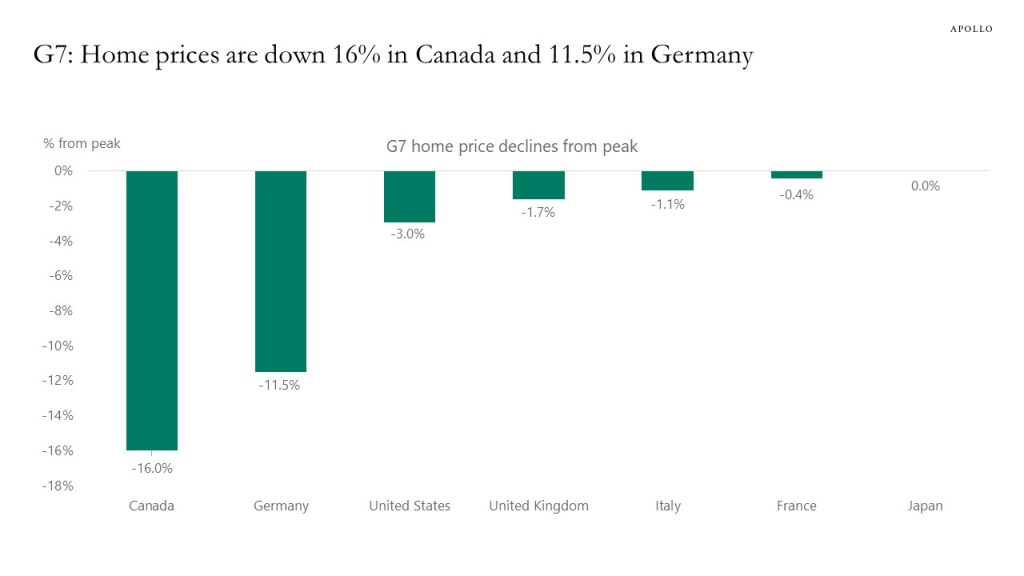

A US housing recovery has started, and this is a problem for the Fed because home prices have a weight of 40% in the CPI basket, and rising house prices will make inflation more sticky and make it more difficult for the Fed to get inflation down from currently 5% to the FOMC’s 2% inflation target. Our US housing outlook is available here.