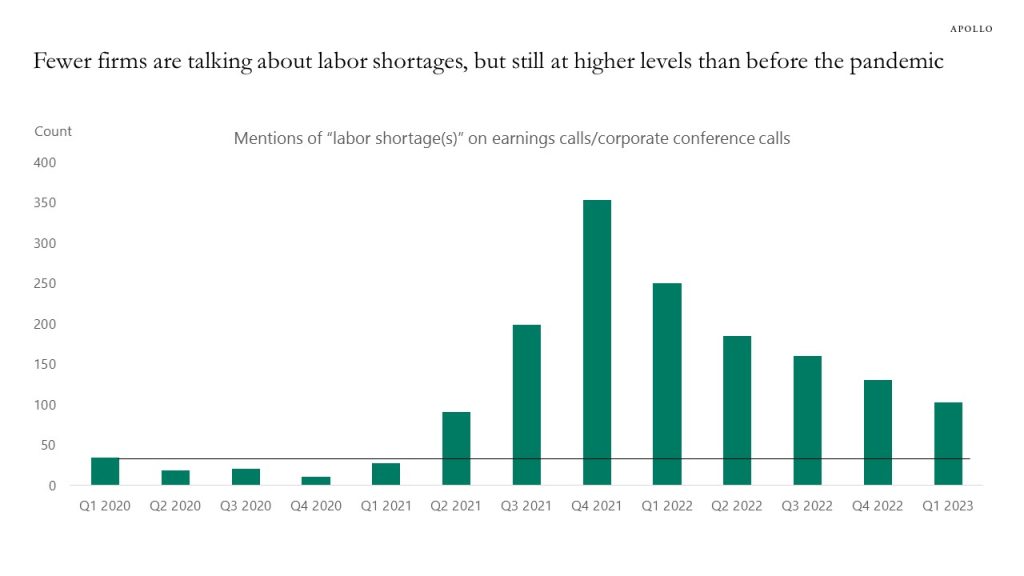

The Fed is trying to slow down hiring to dampen the upward pressure on wage and consumer price inflation, but cooling down the labor market takes time, and while corporate worries about labor shortages have declined, they are still well above pre-pandemic levels, see chart below.