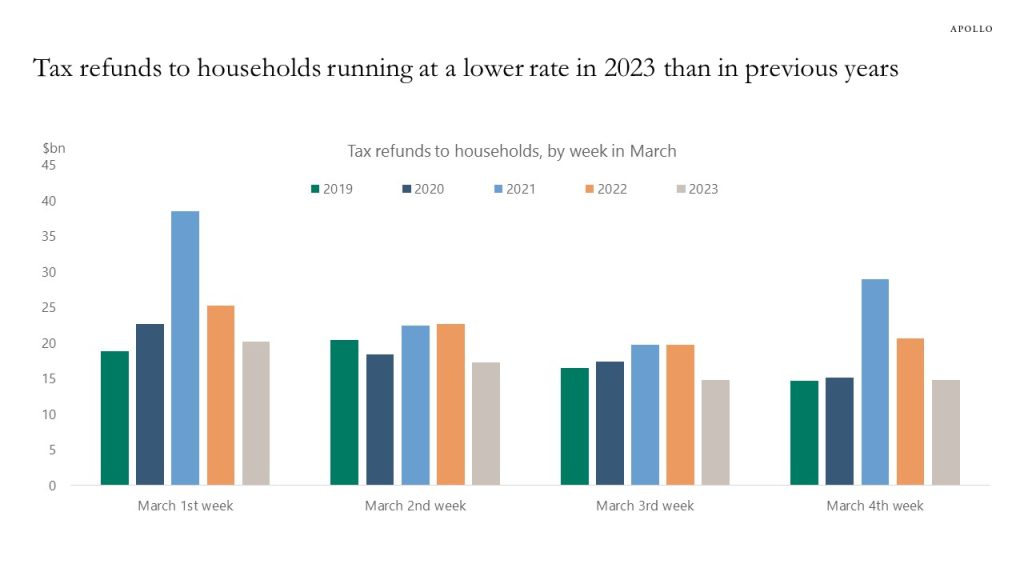

The US Treasury publishes daily data for tax refunds, and the level of tax refunds to households tells us something about how much support there is to consumer spending, and the chart below shows that tax refunds in recent weeks have been running at a lower rate in 2023 than in previous years. Adjusting for inflation would lower the 2023 numbers even further.