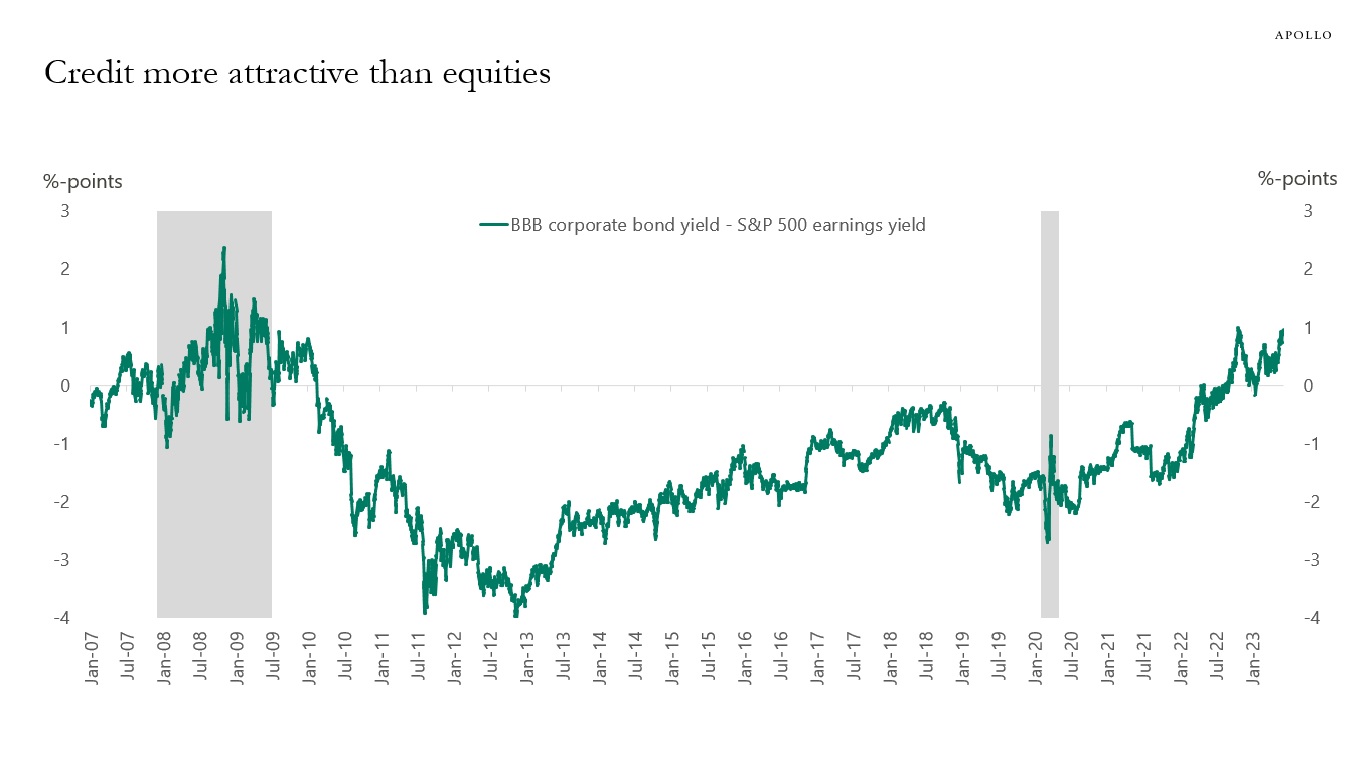

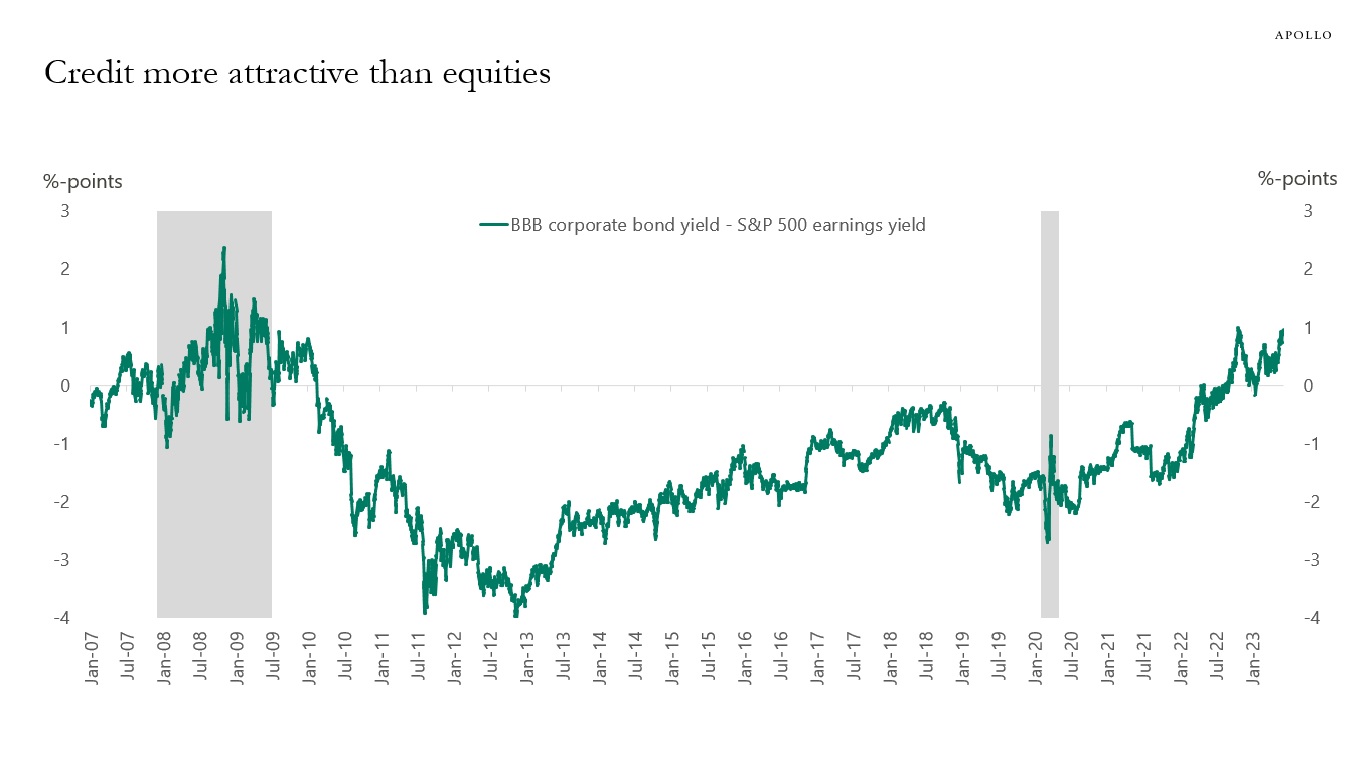

The yield on BBB credit is at the highest levels in 15 years relative to the earnings yield on the S&P500, see chart below.

The yield on BBB credit is at the highest levels in 15 years relative to the earnings yield on the S&P500, see chart below.

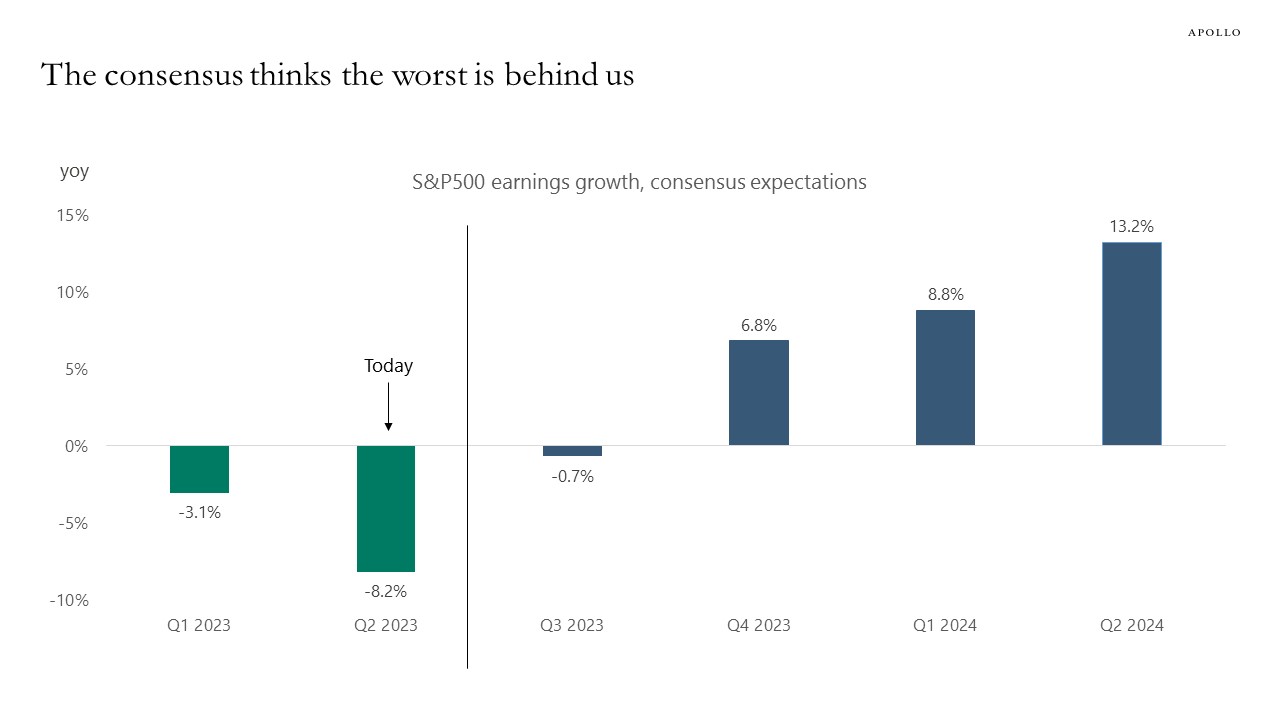

The stock market thinks we have the worst behind us, see chart below, which shows that earnings growth is expected to bottom this quarter and then improve quite rapidly over the coming four quarters.

This forecast will only be correct if core inflation moves quickly down towards 2%. If core inflation remains around 5%, then the Fed will have to put additional downward pressure on demand in the economy and ultimately earnings.

If core inflation remains sticky around 5%, we will likely remain longer in a period with high capital costs and low earnings growth.

Why is the economy still so strong, and why are Fed hikes not having a bigger negative effect on the economy?

There are three reasons:

1. High savings in the household sector.

2. During the pandemic, IG and HY corporates extended the maturity of their loans, making them less vulnerable to higher rates.

3. The service sector is less sensitive to interest rates and continues to experience a structural tailwind after Covid with strong demand for air travel, hotels, restaurants, etc.

The bottom line is that the weaker transmission mechanism of monetary policy will keep the costs of capital higher for longer because that is what is needed for the Fed to get inflation down from currently 5% to the Fed’s 2% inflation target.

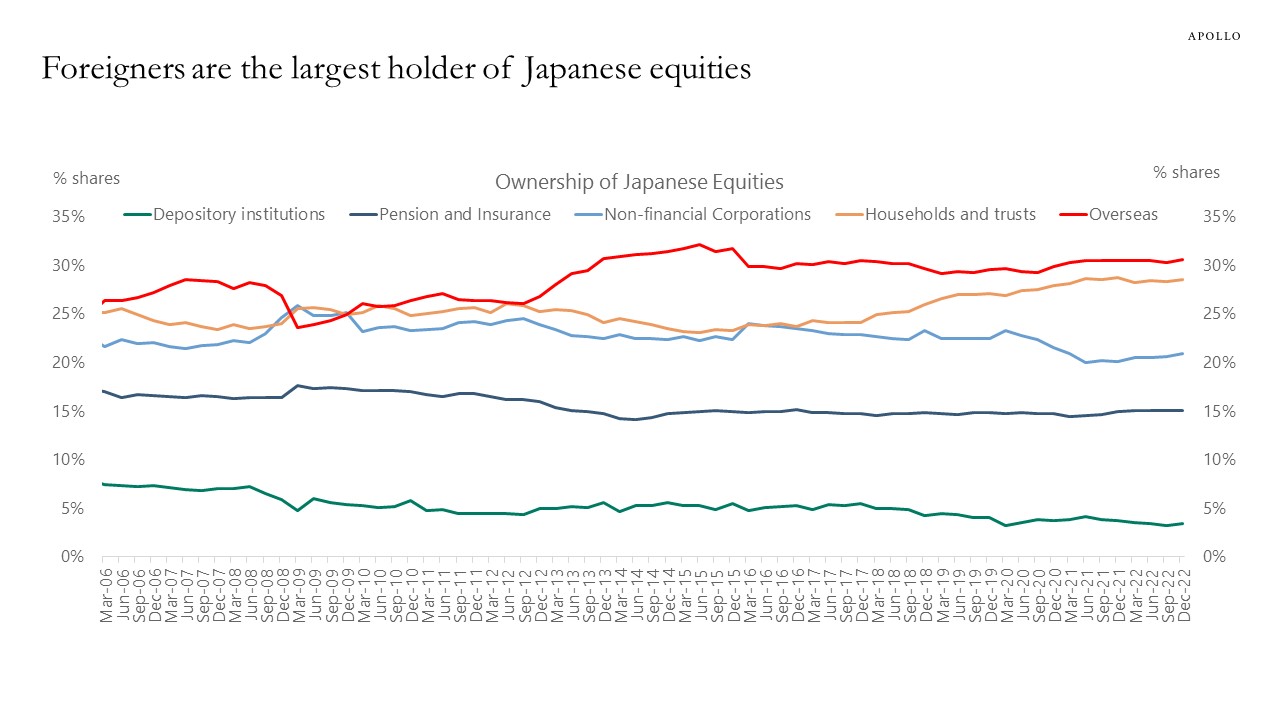

Foreigners own about 30% of Japanese equities outstanding, see chart below. Japanese households also hold around 30%, and Japanese pension and insurance only hold 15%.

Last week we saw a notable increase in the number of individuals applying for unemployment benefits. This caused markets watchers to wonder if we’re at the point where the labor market might be starting to meaningfully weaken in the wake of the Federal Reserve’s rate hikes. That brings us to the major event this week: The FOMC meeting taking place Tuesday through Wednesday. The market is currently pricing that the Fed will not hike rates, but it’s a tough call for the central bank with inflation remaining too elevated. However, signs of a softening labor market may help bolster the case for keeping interest rate increases on hold.

This presentation may not be distributed, transmitted or otherwise communicated to others in whole or in part without the express consent of Apollo Global Management, Inc. (together with its subsidiaries, “Apollo”).

Apollo makes no representation or warranty, expressed or implied, with respect to the accuracy, reasonableness, or completeness of any of the statements made during this presentation, including, but not limited to, statements obtained from third parties. Opinions, estimates and projections constitute the current judgment of the speaker as of the date indicated. They do not necessarily reflect the views and opinions of Apollo and are subject to change at any time without notice. Apollo does not have any responsibility to update this presentation to account for such changes. There can be no assurance that any trends discussed during this presentation will continue.

Statements made throughout this presentation are not intended to provide, and should not be relied upon for, accounting, legal or tax advice and do not constitute an investment recommendation or investment advice. Investors should make an independent investigation of the information discussed during this presentation, including consulting their tax, legal, accounting or other advisors about such information. Apollo does not act for you and is not responsible for providing you with the protections afforded to its clients. This presentation does not constitute an offer to sell, or the solicitation of an offer to buy, any security, product or service, including interest in any investment product or fund or account managed or advised by Apollo.

Certain statements made throughout this presentation may be “forward-looking” in nature. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking information. As such, undue reliance should not be placed on such statements. Forward-looking statements may be identified by the use of terminology including, but not limited to, “may”, “will”, “should”, “expect”, “anticipate”, “target”, “project”, “estimate”, “intend”, “continue” or “believe” or the negatives thereof or other variations thereon or comparable terminology.

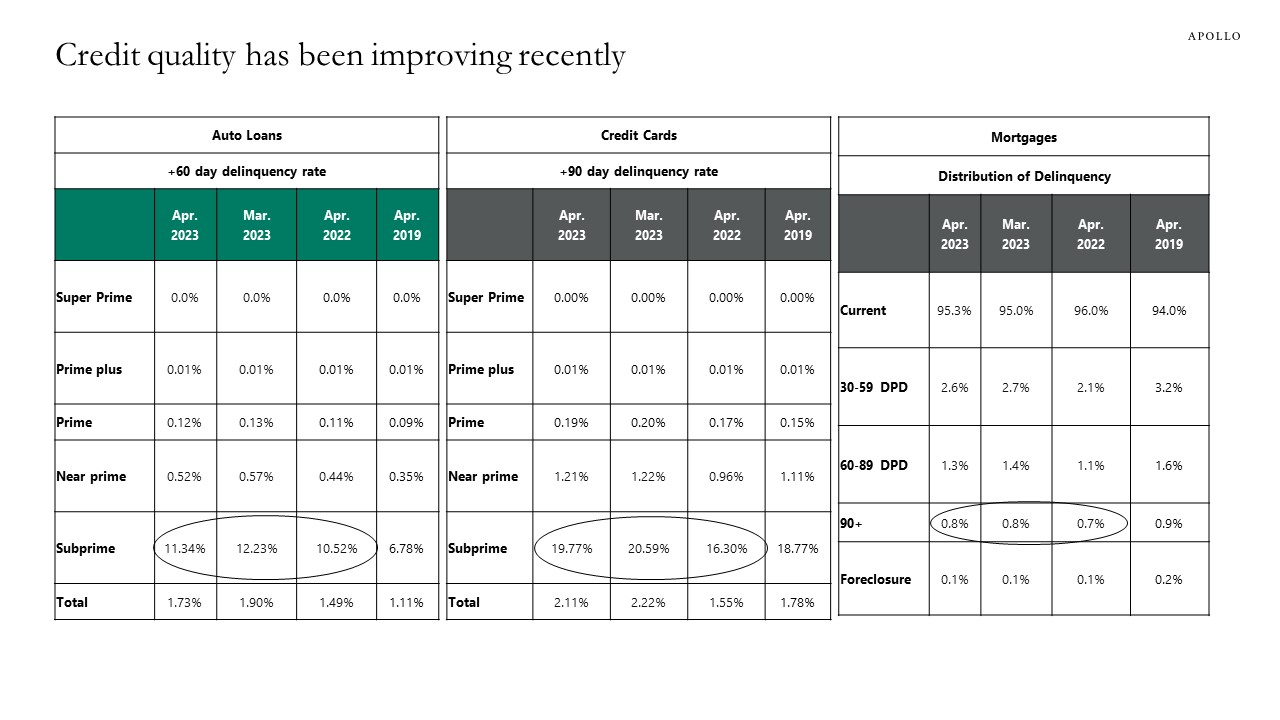

The latest data shows a modest improvement in credit card delinquency rates and auto loan delinquency rates for subprime, near prime, and prime borrowers, see chart below. This is the opposite of what would be expected with the Fed trying to tighten financial conditions.

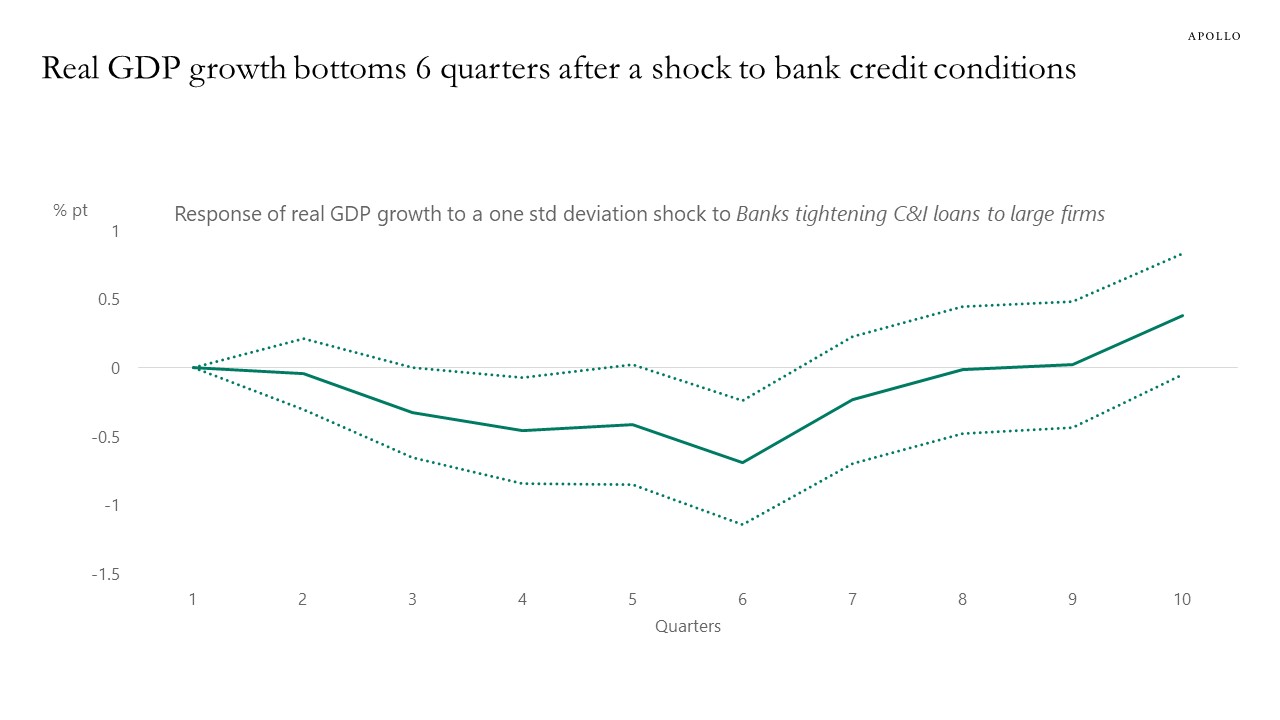

We built a small vector autoregressive model with GDP growth, loan growth, and bank lending standards, and giving a one standard deviation shock to bank lending standards using a standard Cholesky decomposition shows that it takes six quarters before tighter credit conditions have a maximum negative impact on GDP, see chart below. In other words, the negative impact of the SVB collapse on tighter lending standards will continue to accumulate until the second half of 2024 because it takes time for banks to repair their balance sheets.

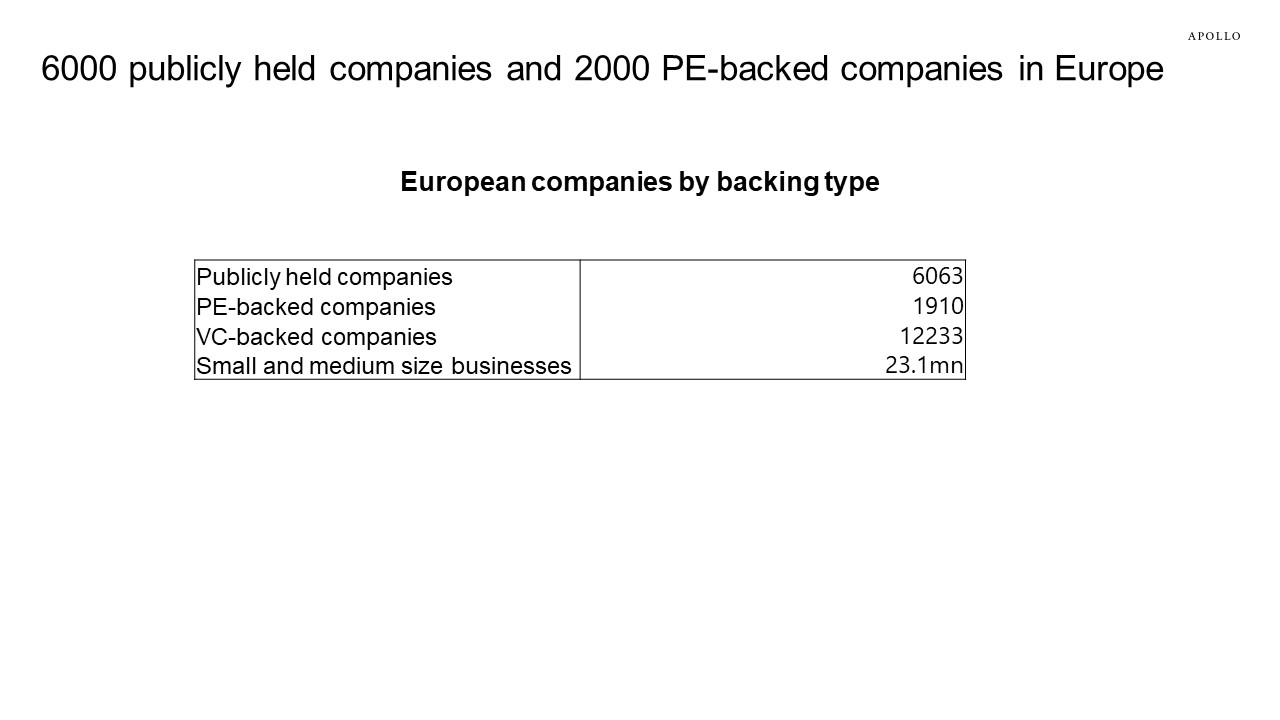

In Europe, there are three times as many publicly held companies as there are PE-backed companies, see chart below.

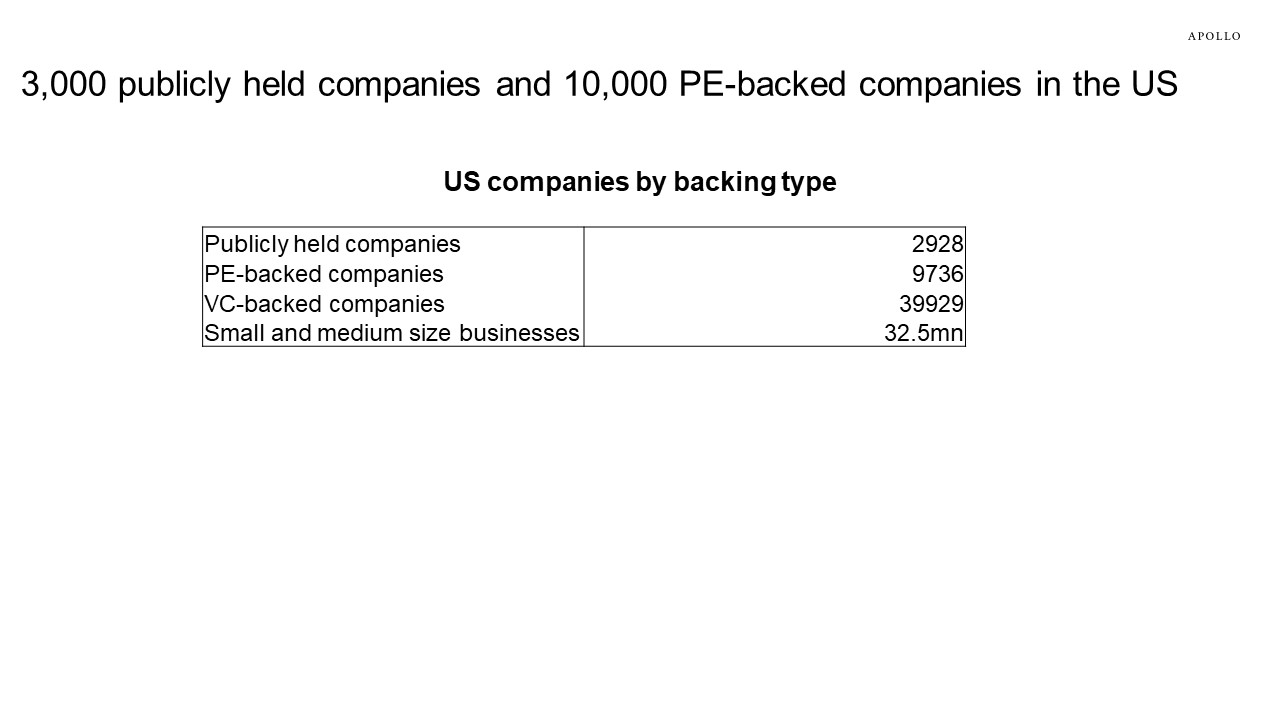

The number of publicly held companies is shrinking, and there are about three times as many PE-backed firms in the US as there are publicly held companies, see chart below.

With inflation remaining elevated, the costs of capital will also remain elevated, which will continue to put downward pressure on tech, growth, and venture capital.

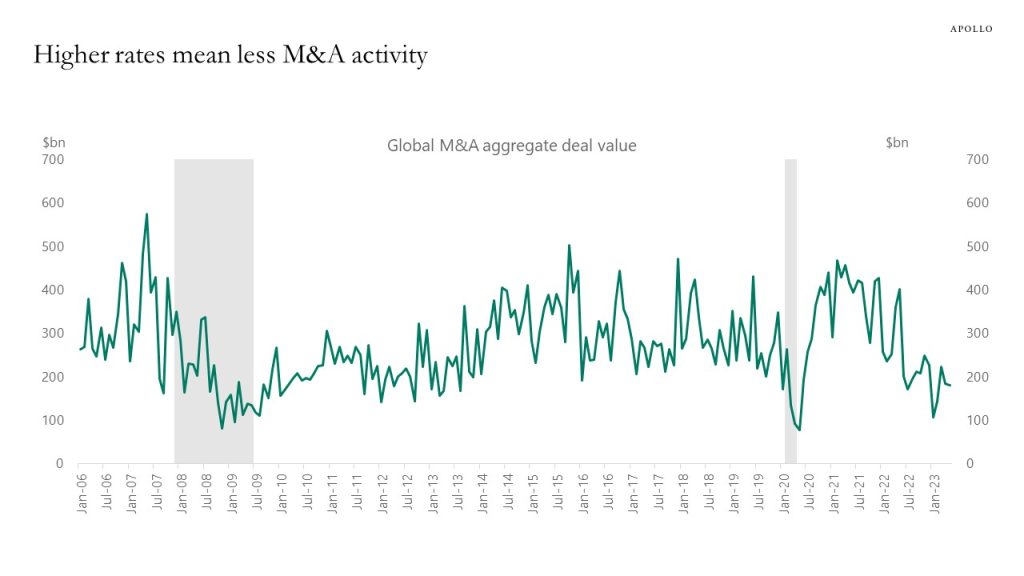

M&A activity has declined over the past two years, and this trend will continue, driven lower by central banks increasing the costs of capital as they continue to fight inflation.