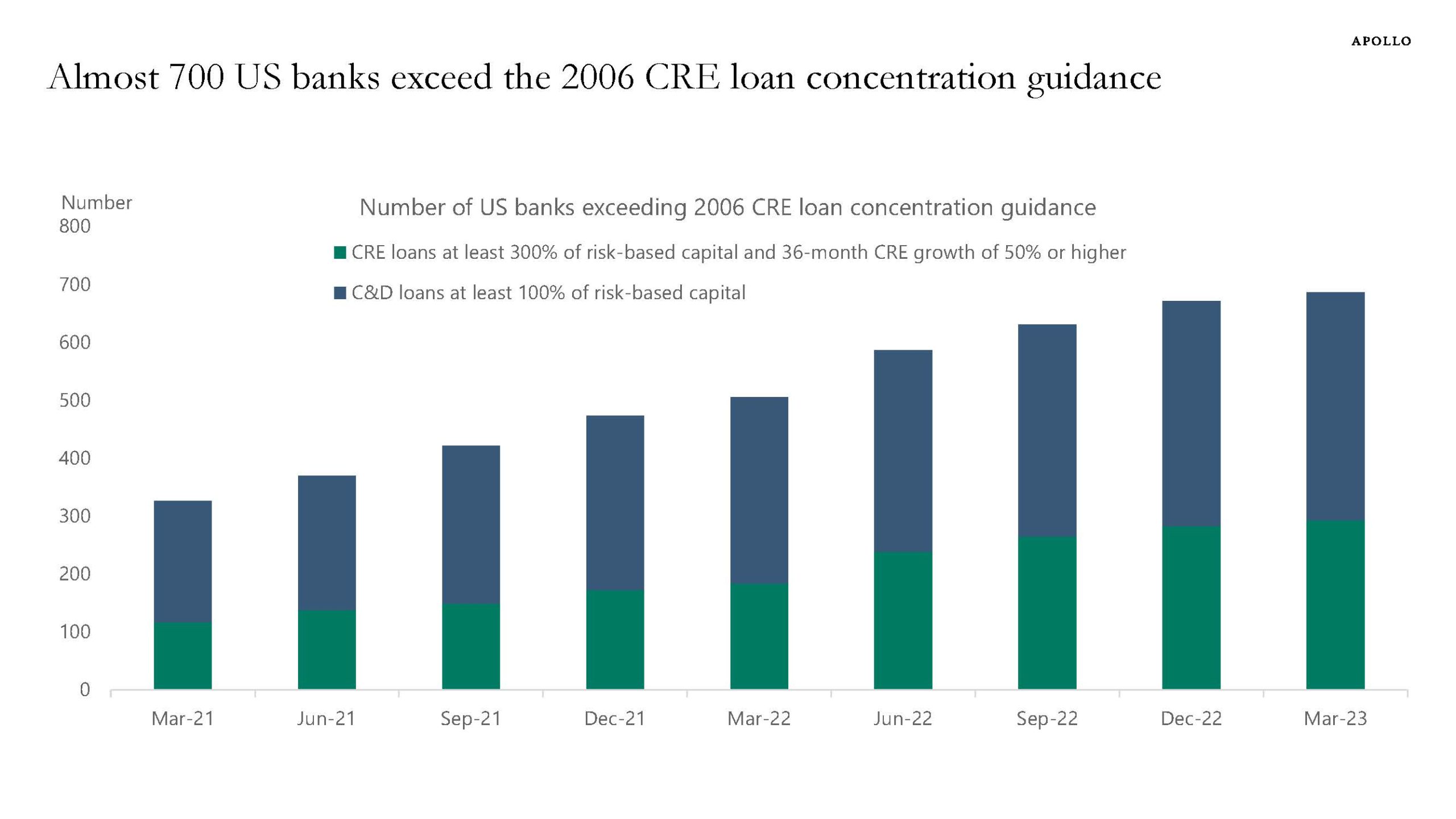

Two years ago, the number of banks exceeding the FDIC’s CRE loan concentration guidelines was about 300. Today there are almost 700, see chart below.

In other words, US banks have become much more vulnerable to a decline in commercial real estate prices.

Our latest credit market outlook is available here.