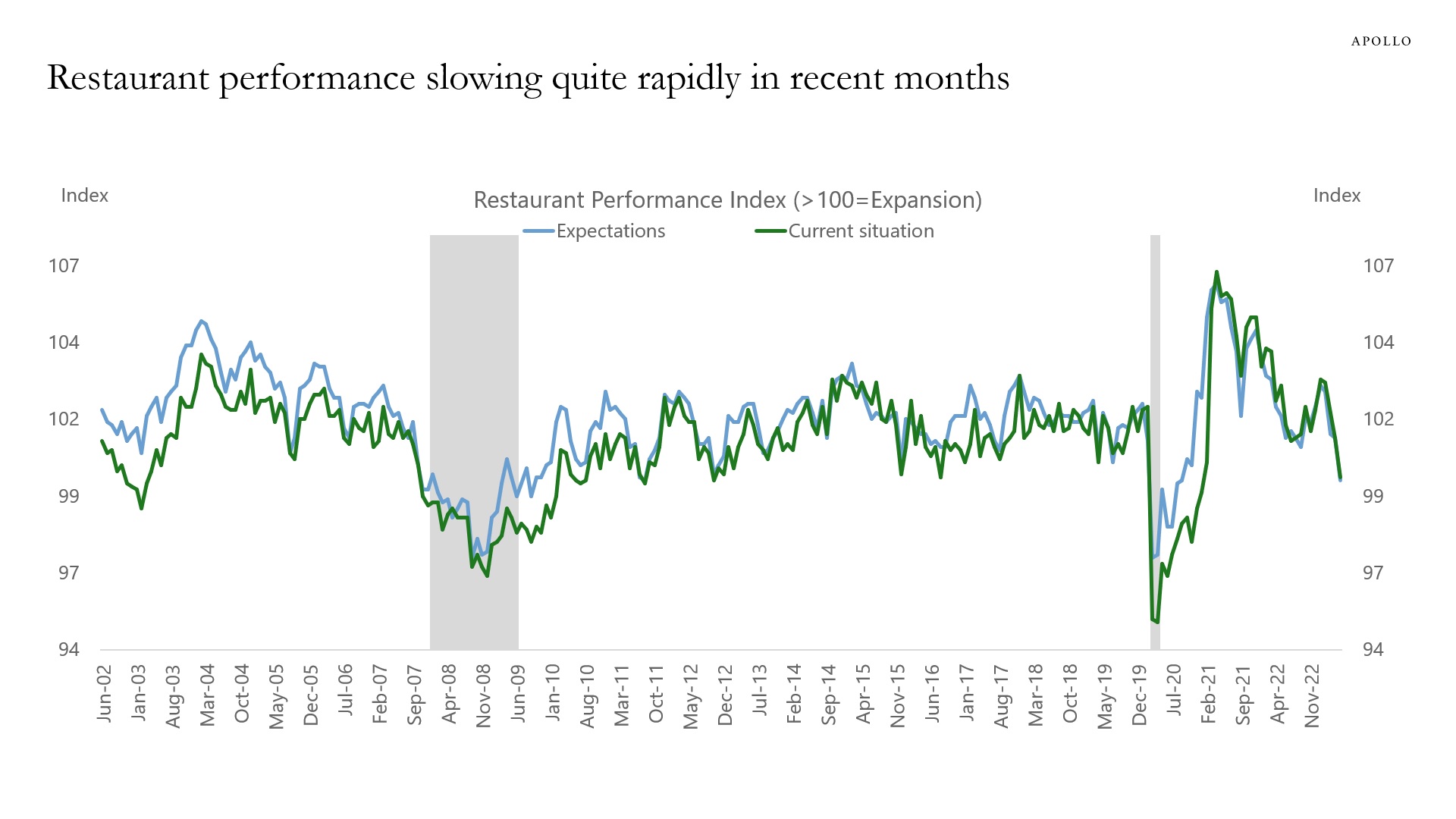

Just when everyone is abandoning the recession call, the data starts to slow down.

1) The Restaurant Performance Index has sharply declined in recent months, see the first chart below.

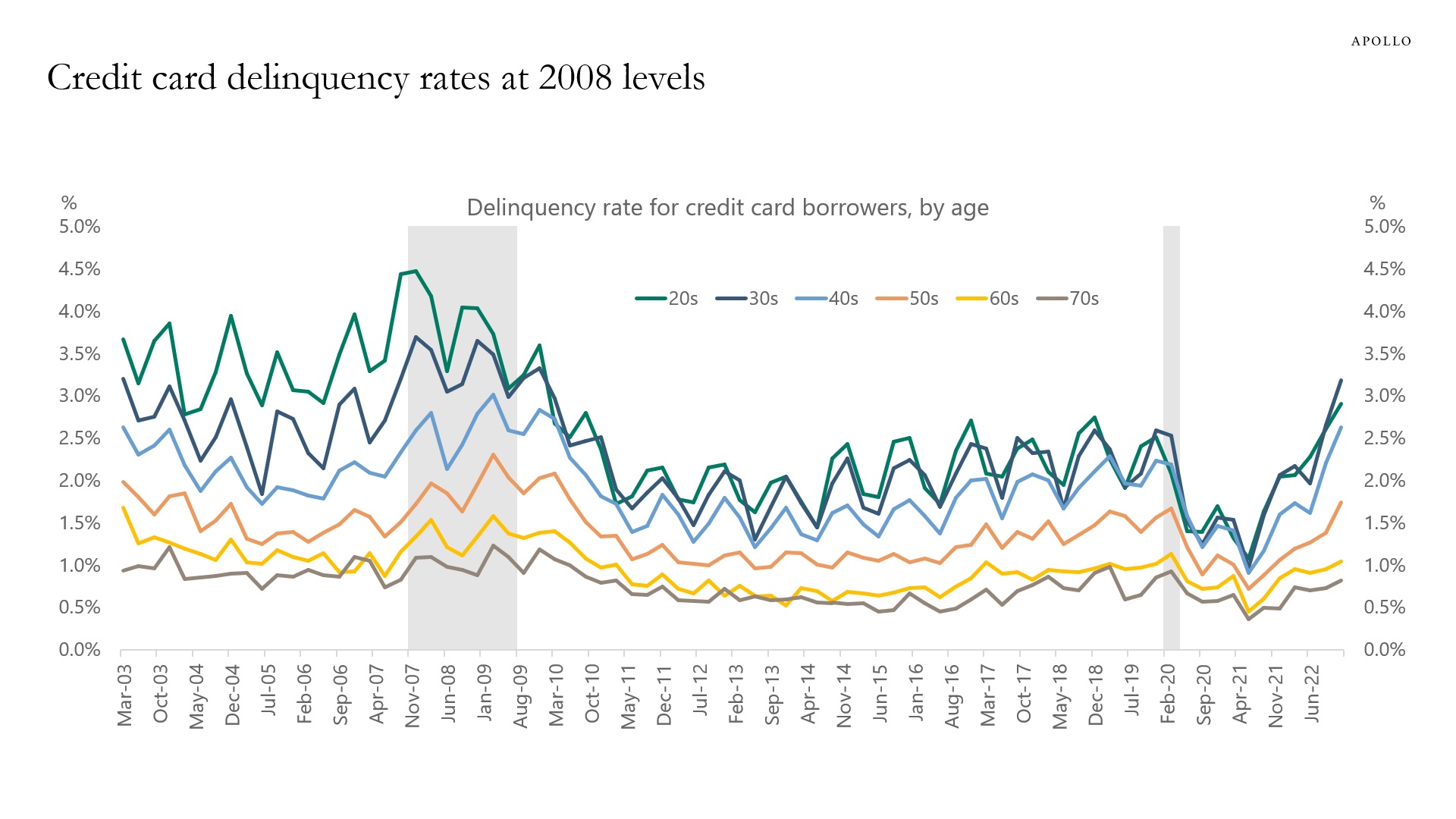

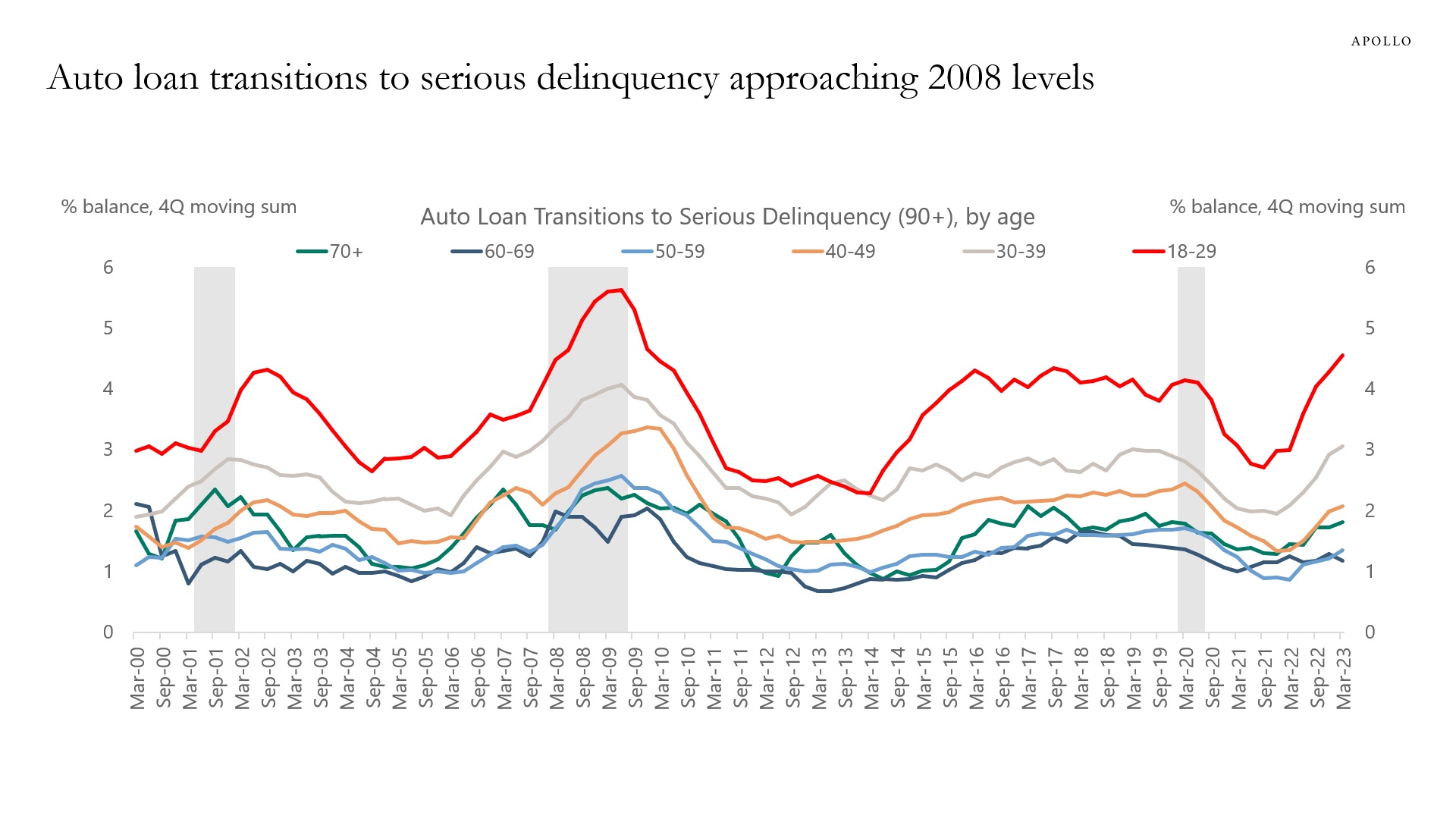

2) Credit card and auto loan delinquencies continue to rise, and these trends will continue with the Fed on hold well into next year; see the second and third charts.

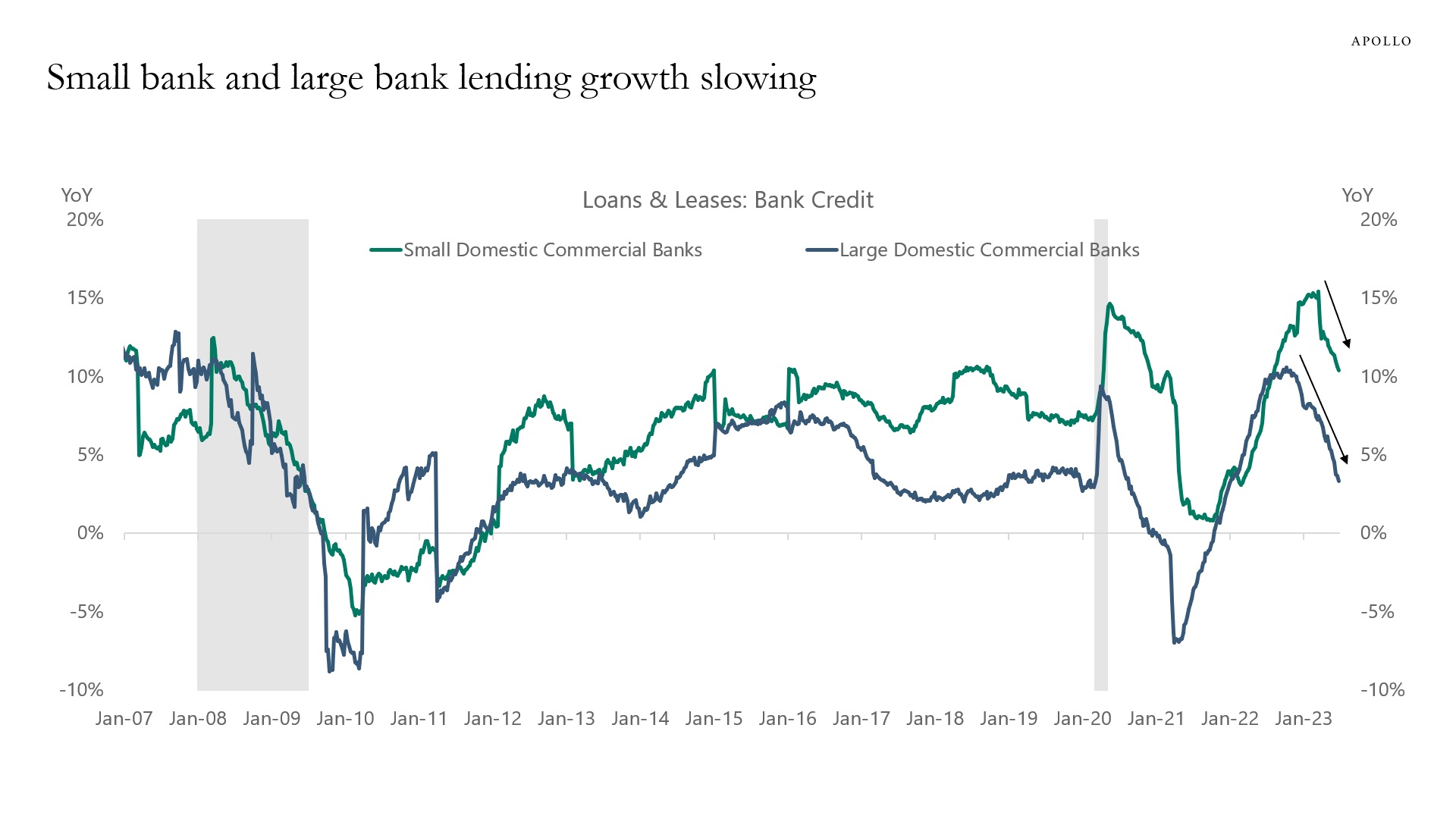

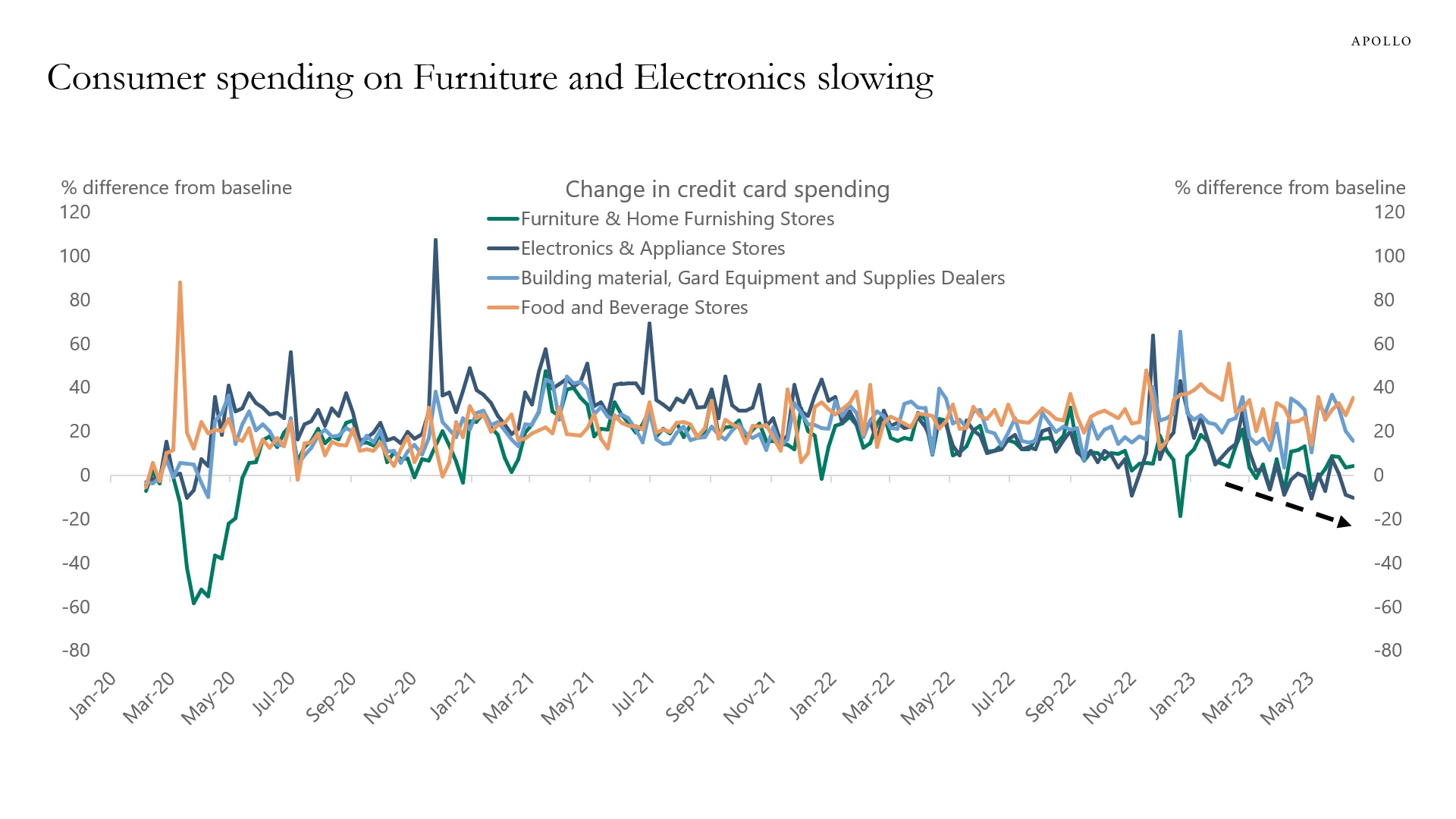

3) Weekly data for bank lending is slowing rapidly, and weekly credit card data shows that consumer spending on durables that require financing, such as furniture and electronics, is slowing, see the fourth and fifth charts.

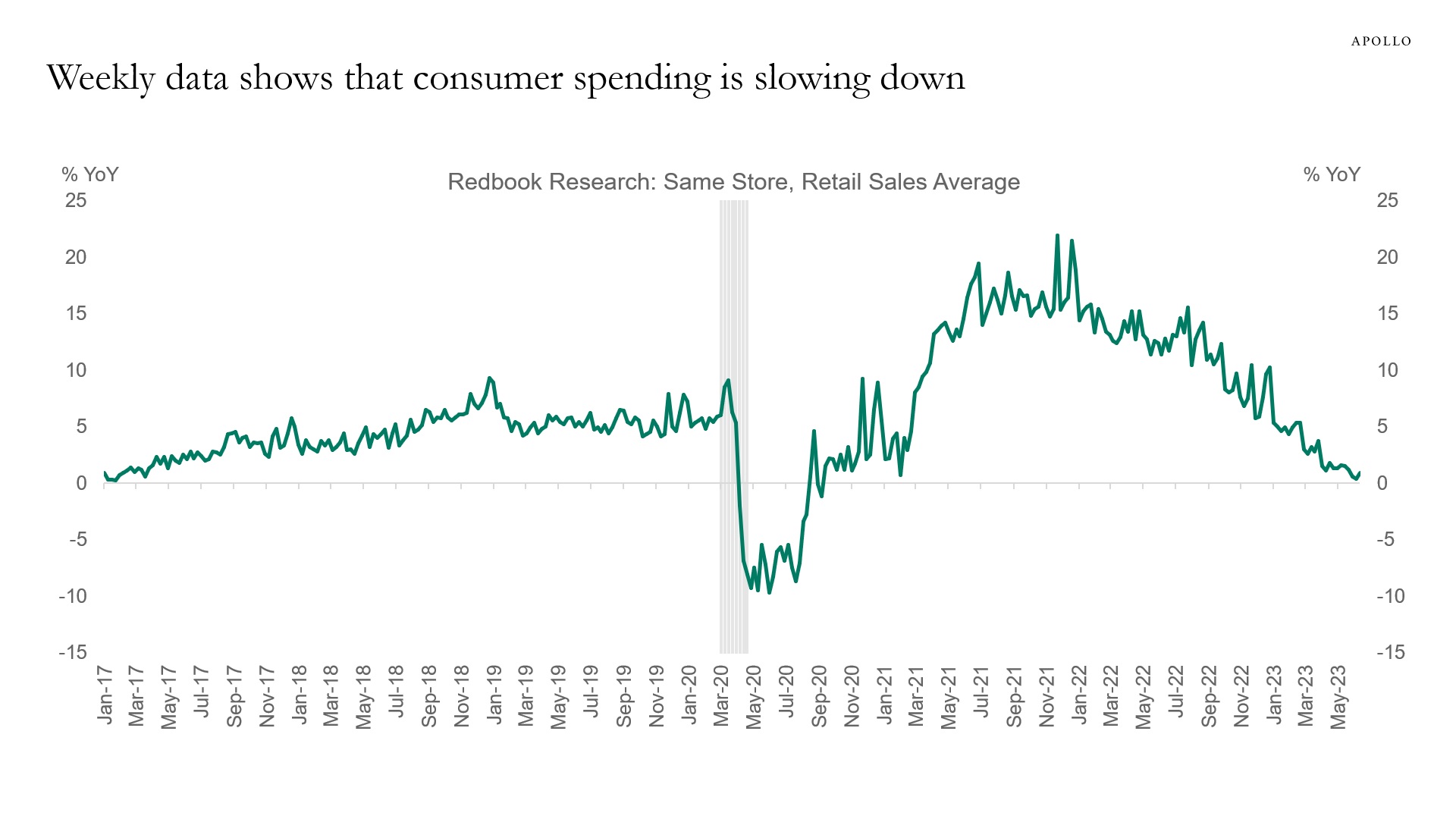

The bottom line is that Fed hikes are starting to negatively impact consumer spending, as also shown in the weekly data in the sixth chart.

Weaker consumer spending is not surprising. The whole idea from the Fed raising interest rates is to slow down growth and ultimately inflation.