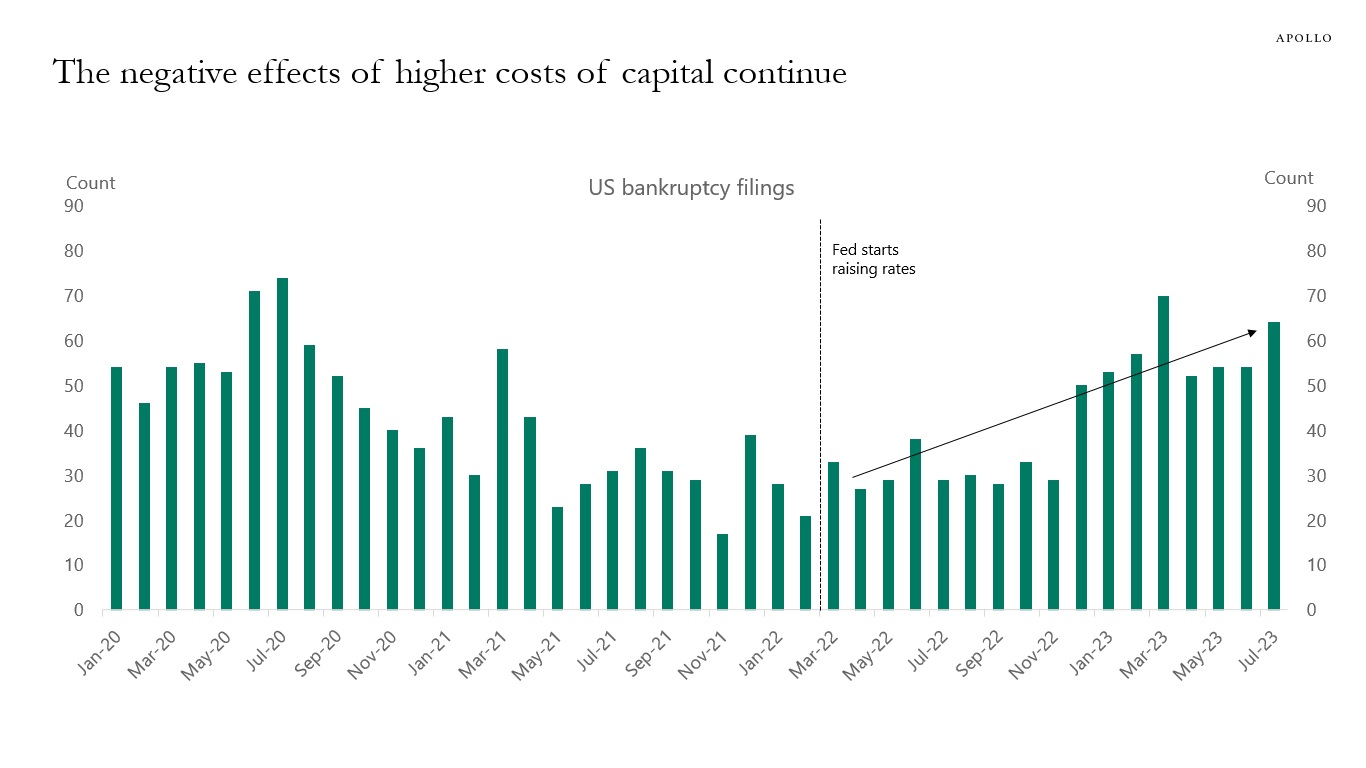

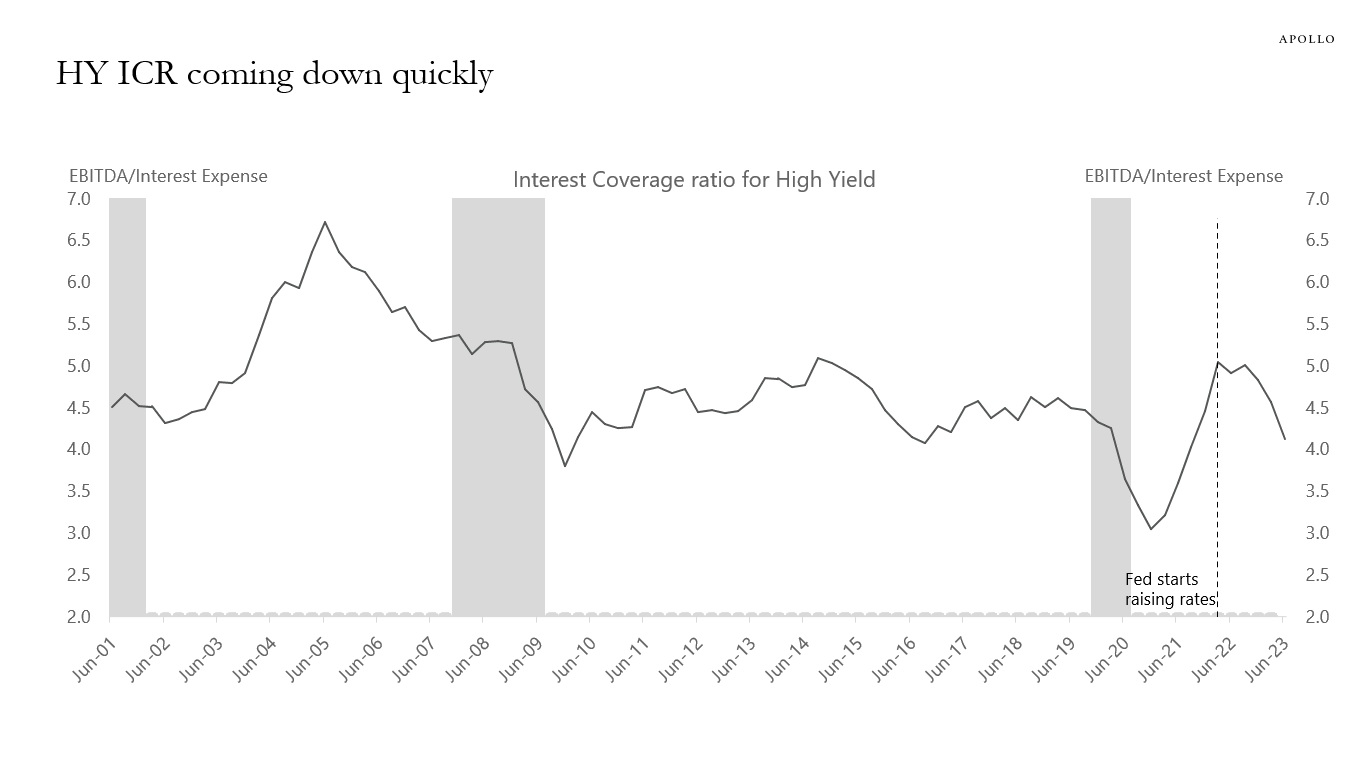

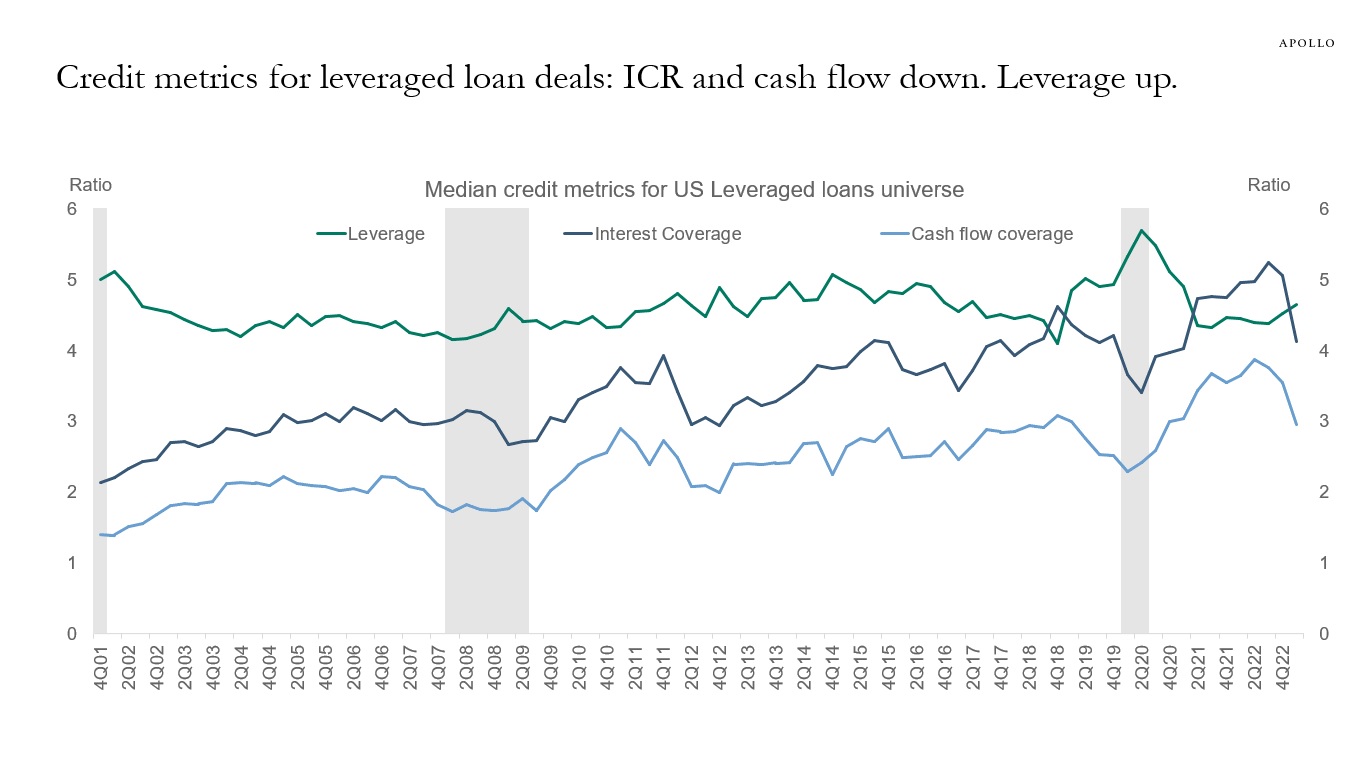

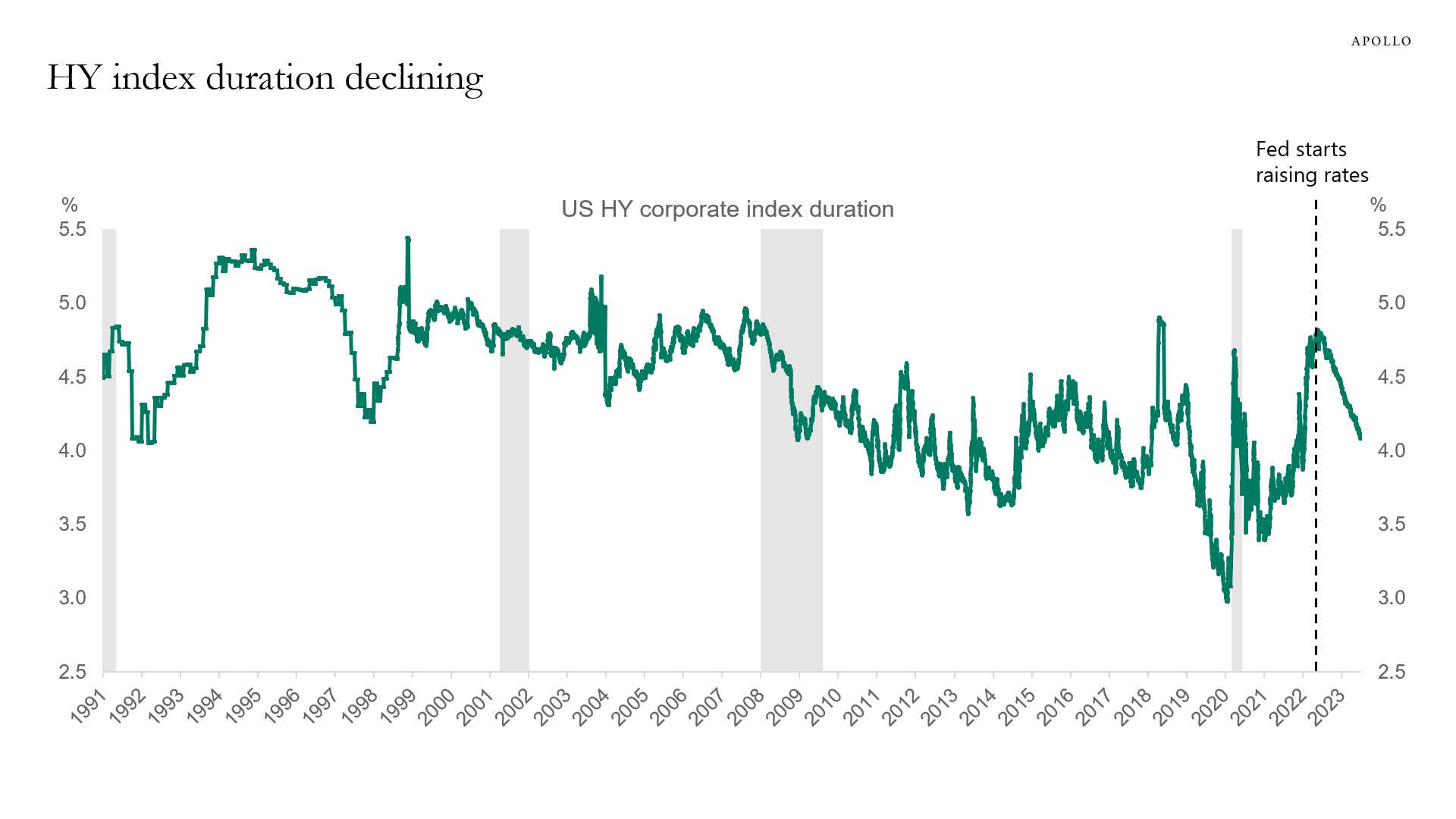

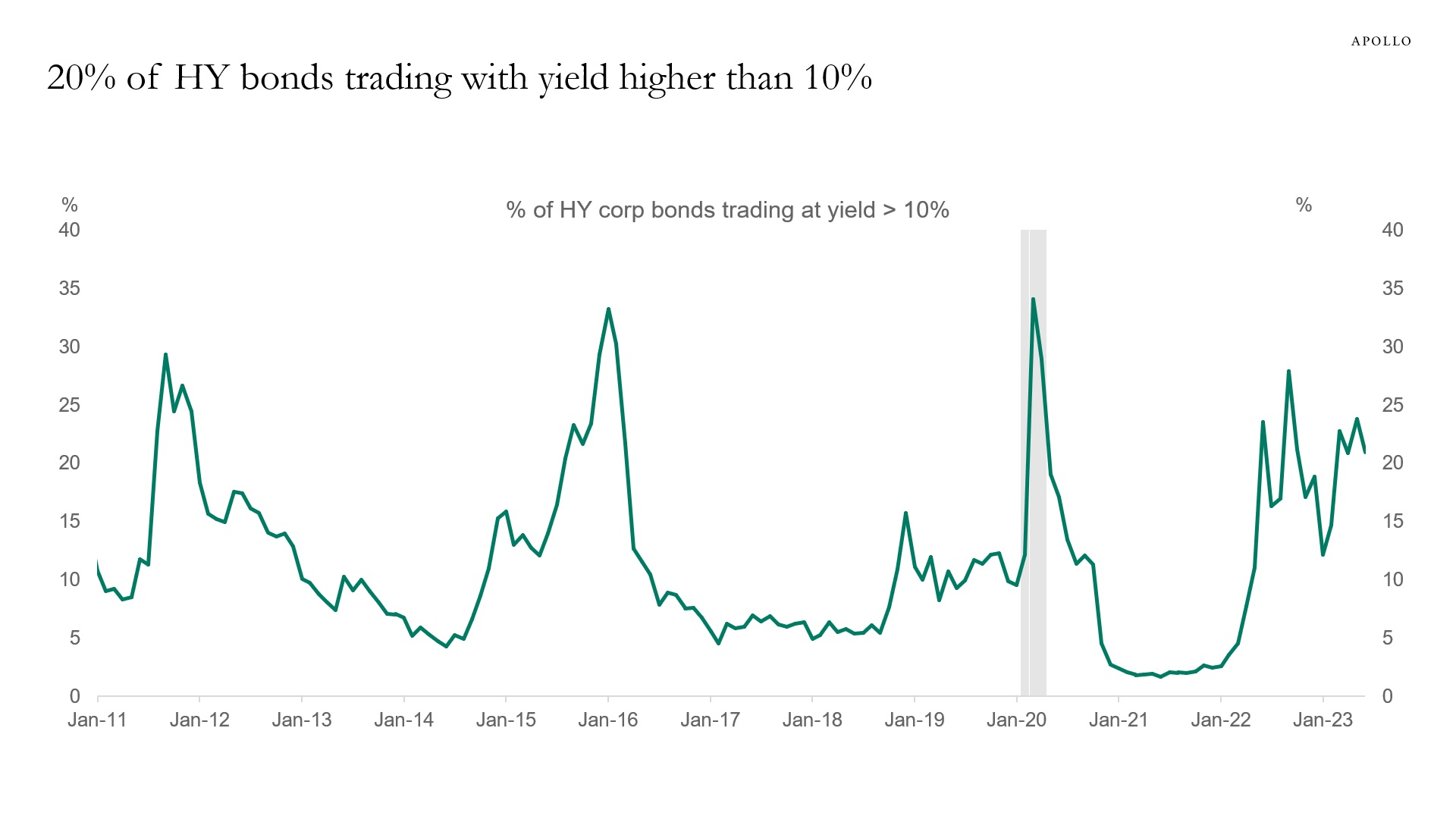

The Fed started raising rates in March 2022, and the effects are clear. Higher costs of capital have pushed more and more companies into bankruptcy. This is the idea behind raising rates: to slow the economy down with the ultimate goal of getting inflation back to 2%. Every day there are companies that cannot get new loans or refinance, and this trend higher in bankruptcies will continue as long as interest rates stay high.