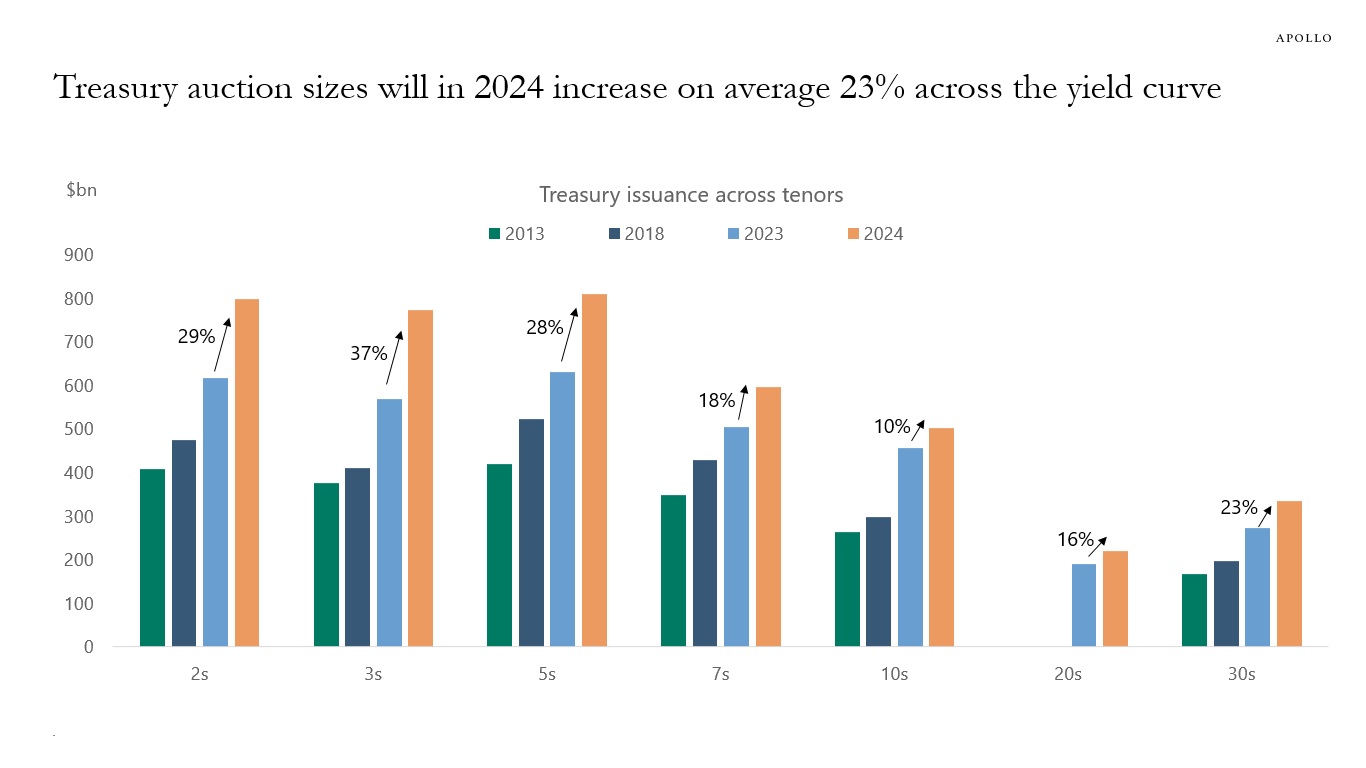

Treasury auction sizes will increase on average 23% in 2024 across the yield curve, see chart below. This forecast comes from the Treasury Borrowing Advisory Committee’s neutral issuance scenario.

The 37% increase in issuance of 3-year notes and the 28% increase in issuance of 5-year notes will in 2024 stress-test demand for Treasuries in the belly of the curve. In particular, if the Fed next year will start cutting rates and wants to soften financial conditions.

This dramatic growth in the supply of the risk-free asset is “pulling dollars away” from other fixed-income assets, including investment grade credit, as investors substitute away from spread products toward Treasuries.

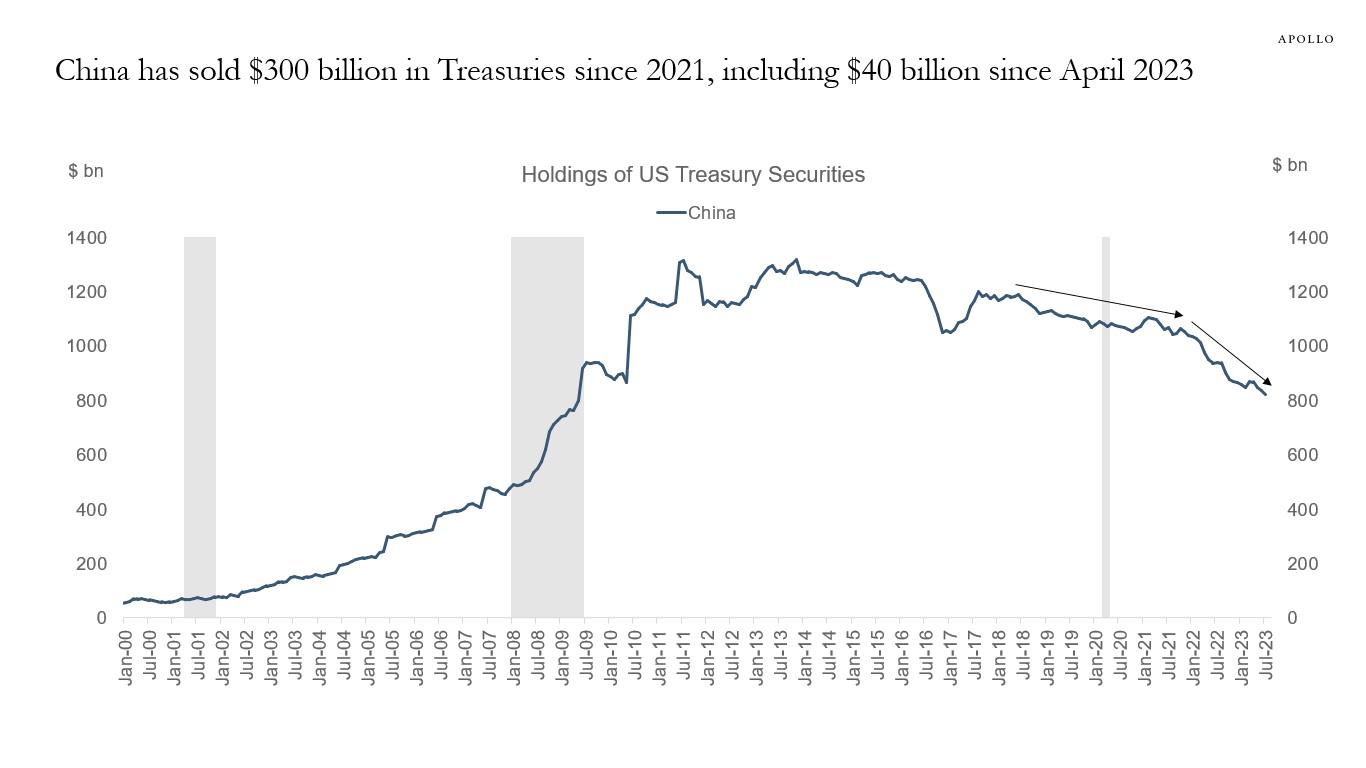

With the ongoing significant increase in the supply of Treasuries, investors in credit markets need to spend some time on signs of demand and supply imbalances in the Treasury market.

The bottom line is that the world only saves a limited amount of dollars every year, and the significant growth in the size of the Treasury market is at risk in 2024 of crowding out demand for other types of fixed income.