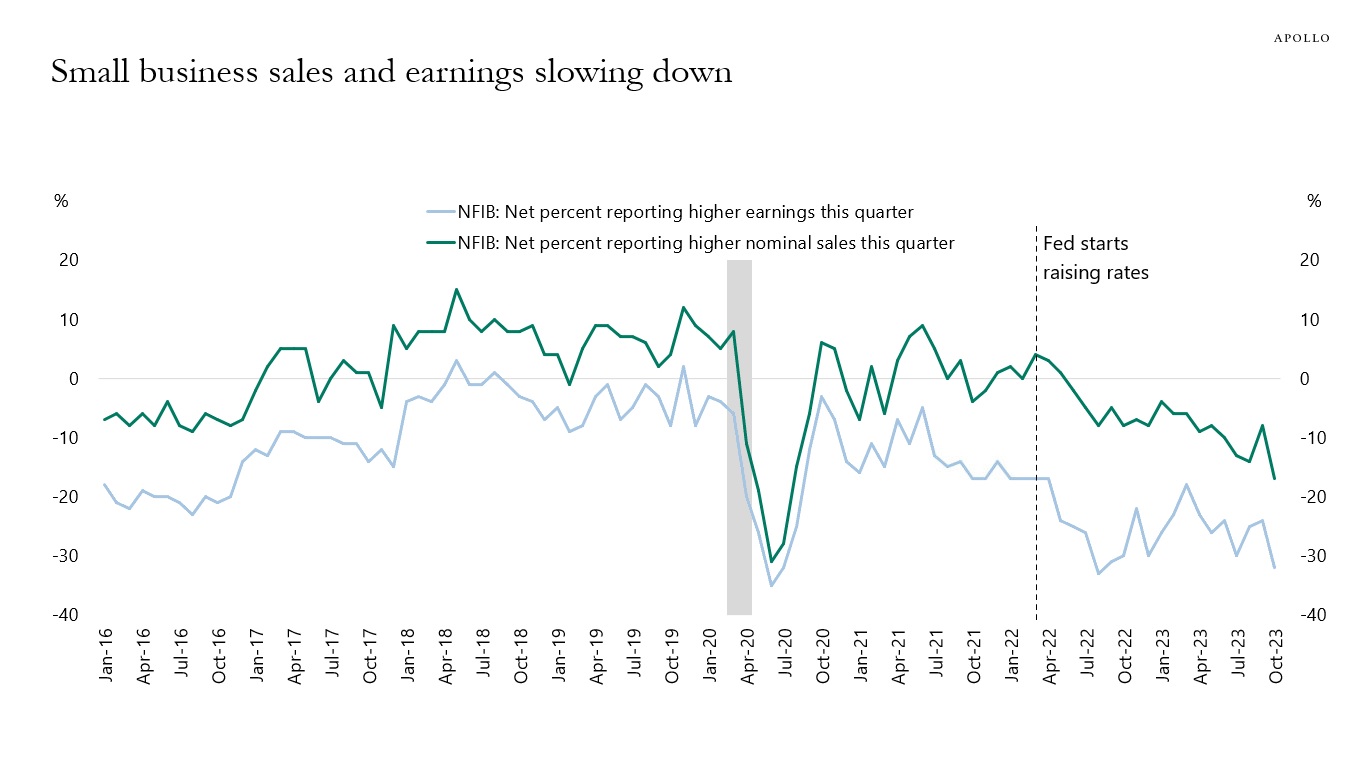

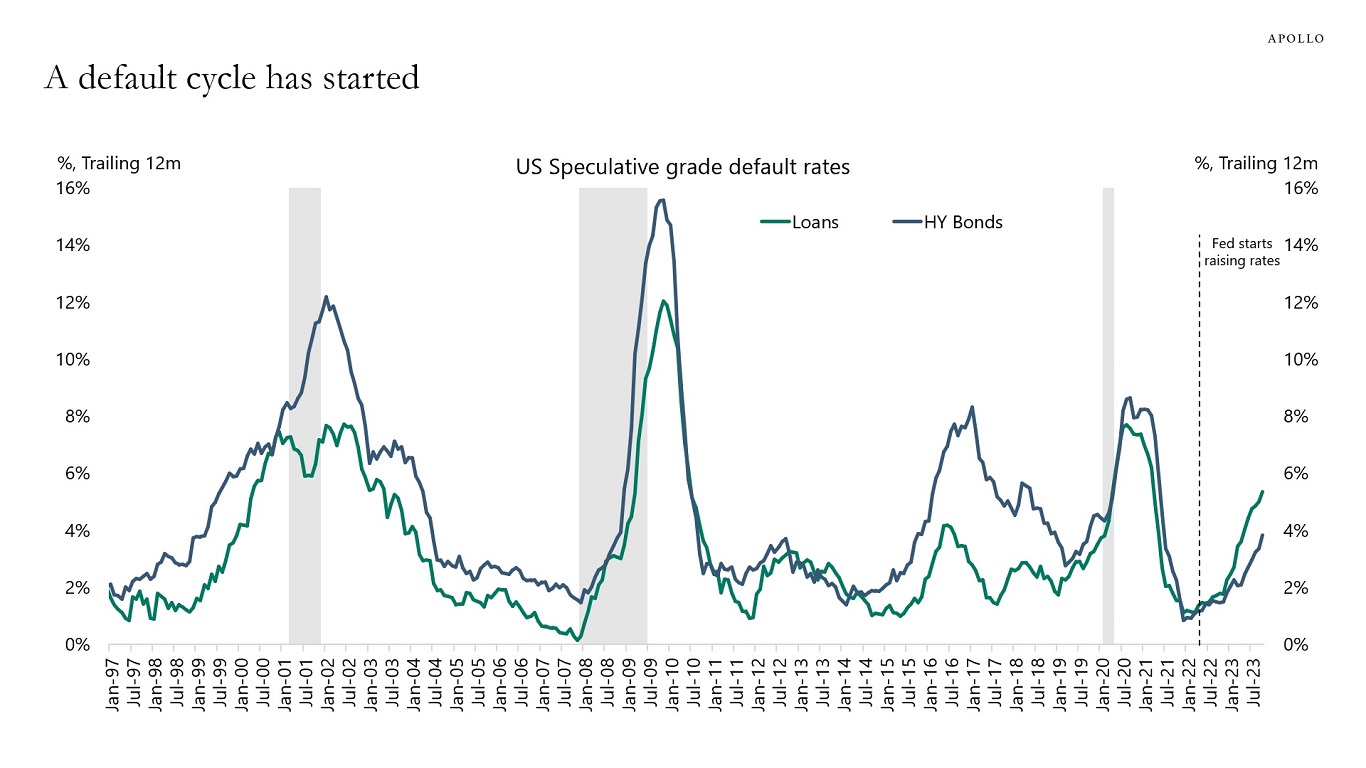

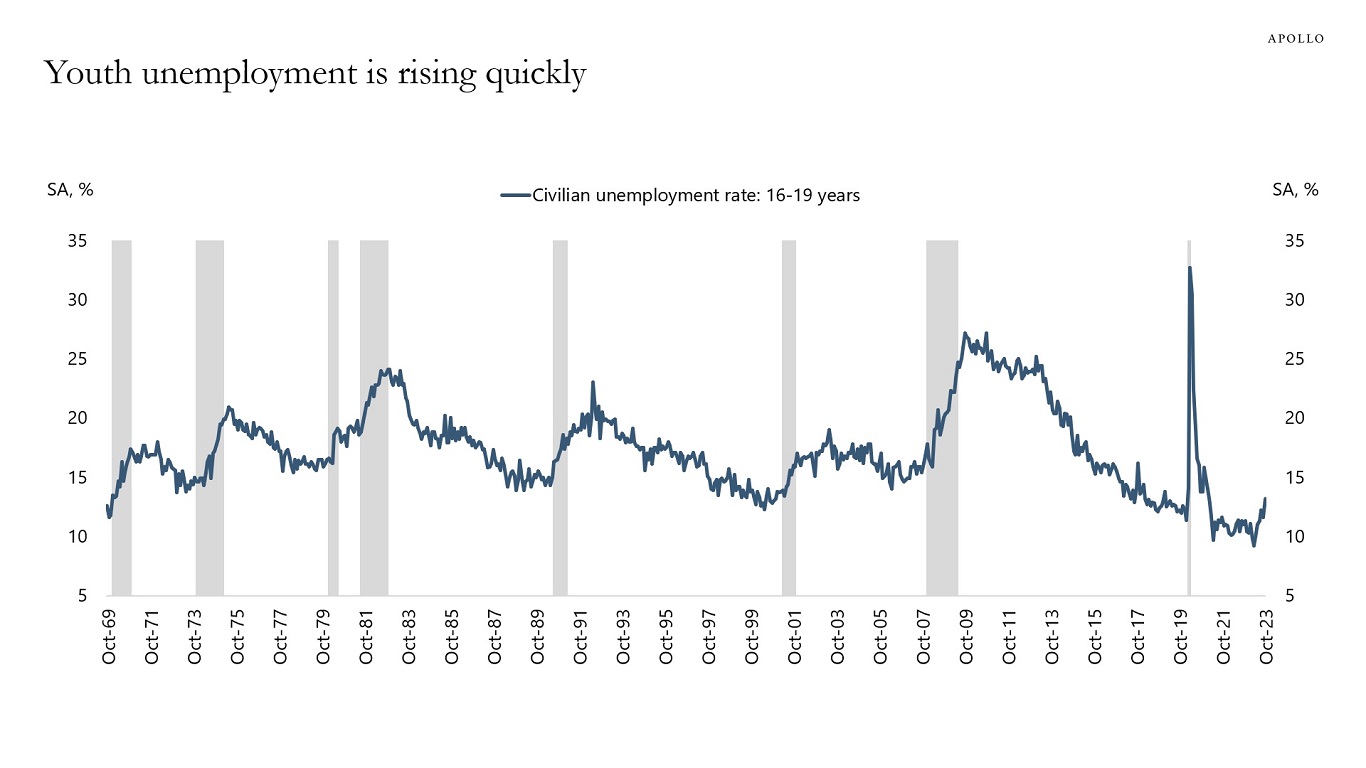

Since the Fed started raising rates, small businesses have seen a trend decline in earnings and sales, see chart below.

This is what the textbook would have predicted. Higher costs of capital weigh on small-cap companies with high leverage, low coverage ratios, and weak or no earnings.

With the Fed keeping rates high at least until the middle of 2024, we should expect these trends to continue.