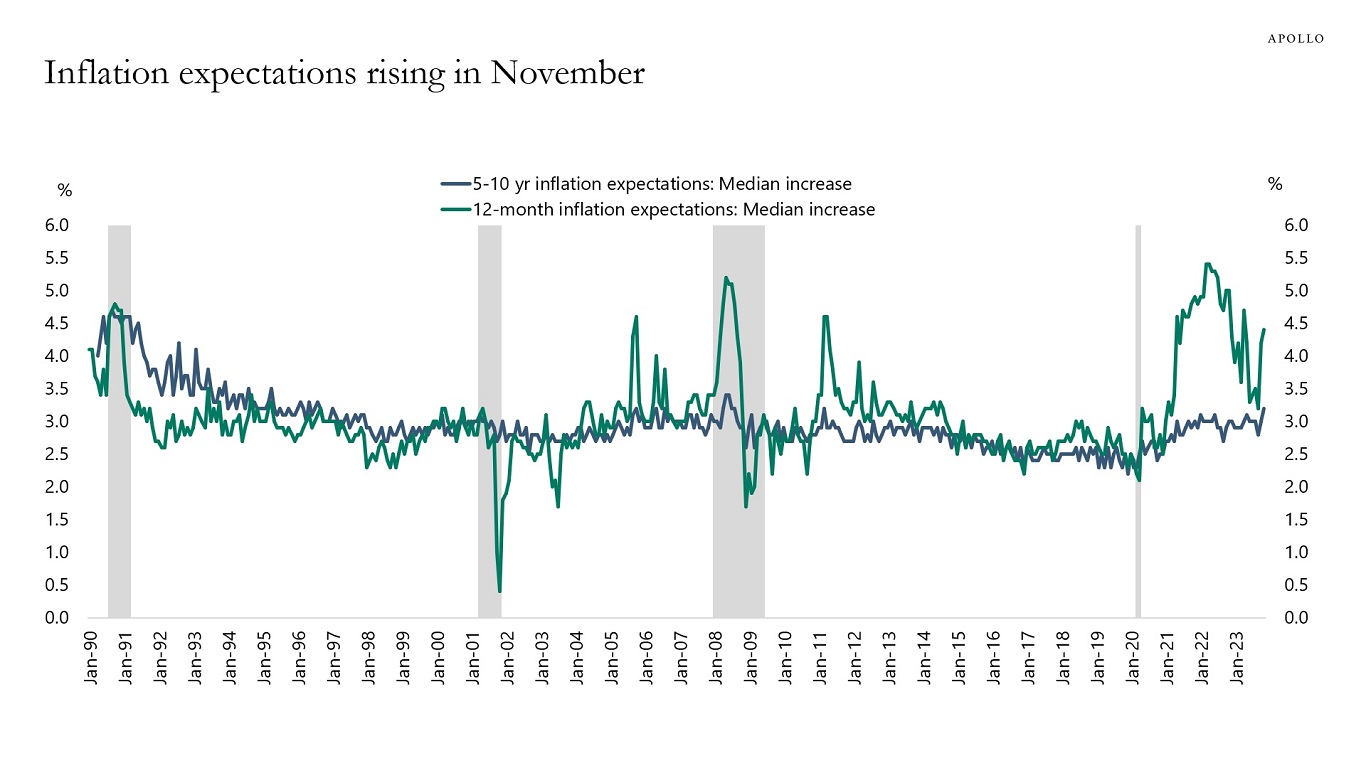

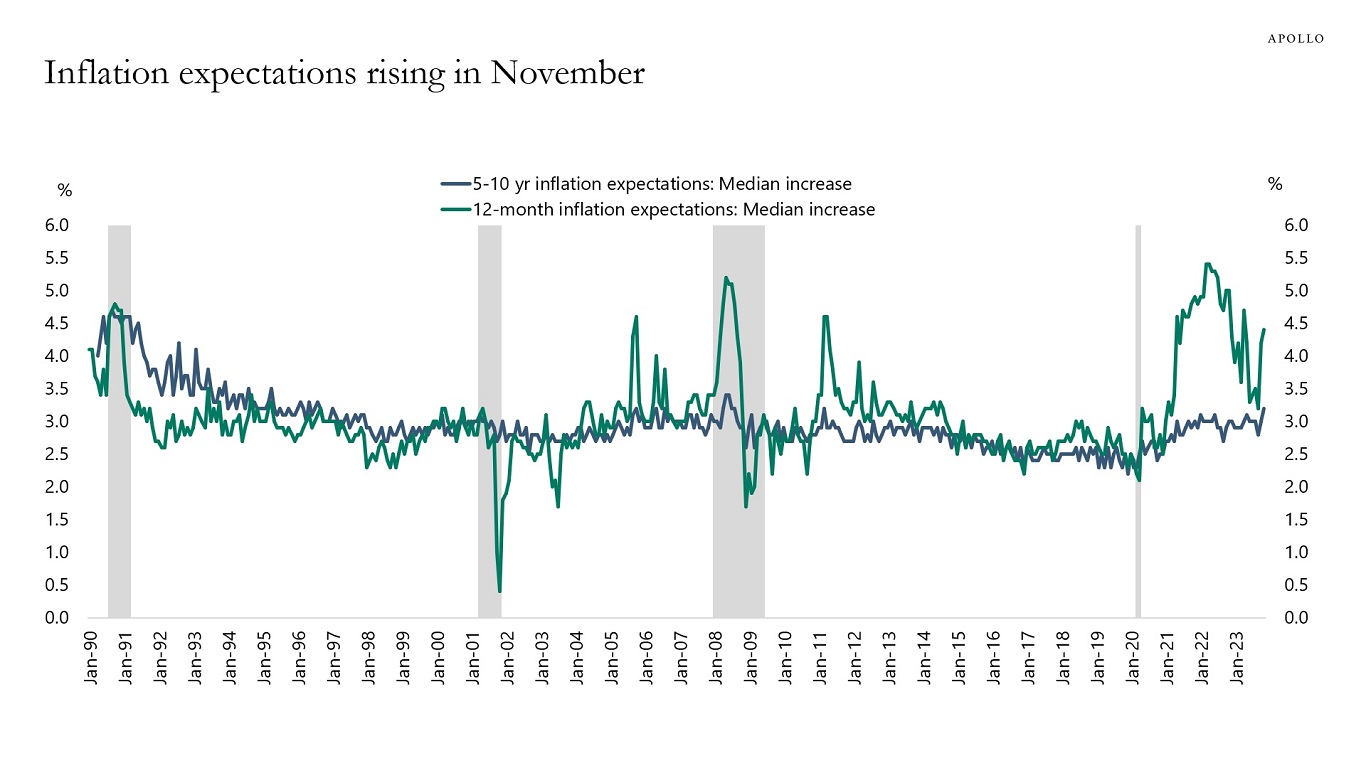

The Fed cannot begin to send dovish signals when inflation expectations jump higher the way they have done recently, see chart below.

The Fed cannot begin to send dovish signals when inflation expectations jump higher the way they have done recently, see chart below.

Last week, we got two important data points: CPI inflation and retail sales. Both core and headline inflation came in under expectations, the latest indication that inflation is trending in the right direction. But there’s still more work to do to get inflation down to the Federal Reserve’s 2% target. Retail sales were weaker than expected in October, likely impacted by the restart of student loan payments on October 1. In taking a closer look at what’s happening with consumer services, we’re seeing a notable decline in demand in areas like restaurant spending. This softening is likely the combined impact of interest rate hikes, student loan payments restarting, and households running low on excess savings. Taken together, we’re seeing more pressure on consumer spending as we head into the holiday season.

This presentation may not be distributed, transmitted or otherwise communicated to others in whole or in part without the express consent of Apollo Global Management, Inc. (together with its subsidiaries, “Apollo”).

Apollo makes no representation or warranty, expressed or implied, with respect to the accuracy, reasonableness, or completeness of any of the statements made during this presentation, including, but not limited to, statements obtained from third parties. Opinions, estimates and projections constitute the current judgment of the speaker as of the date indicated. They do not necessarily reflect the views and opinions of Apollo and are subject to change at any time without notice. Apollo does not have any responsibility to update this presentation to account for such changes. There can be no assurance that any trends discussed during this presentation will continue.

Statements made throughout this presentation are not intended to provide, and should not be relied upon for, accounting, legal or tax advice and do not constitute an investment recommendation or investment advice. Investors should make an independent investigation of the information discussed during this presentation, including consulting their tax, legal, accounting or other advisors about such information. Apollo does not act for you and is not responsible for providing you with the protections afforded to its clients. This presentation does not constitute an offer to sell, or the solicitation of an offer to buy, any security, product or service, including interest in any investment product or fund or account managed or advised by Apollo.

Certain statements made throughout this presentation may be “forward-looking” in nature. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking information. As such, undue reliance should not be placed on such statements. Forward-looking statements may be identified by the use of terminology including, but not limited to, “may”, “will”, “should”, “expect”, “anticipate”, “target”, “project”, “estimate”, “intend”, “continue” or “believe” or the negatives thereof or other variations thereon or comparable terminology.

There is a lot of discussion in markets about the implications of the US fiscal situation.

Three areas to watch for investors are 1) debt ceiling and shutdown risk, 2) Treasury auctions, and 3) US downgrade risk. The complication for markets is that the debt ceiling and shutdown come and go with months between, but Treasury auctions happen every week, and a notice from a rating agency about the US fiscal situation can come with no warning.

In other words, for investors, the fiscal situation is not like watching quarterly earnings but instead a topic constantly lingering in the background that can impact markets with little or no warning—if, for example, a Treasury auction tails or rating agencies issue a statement.

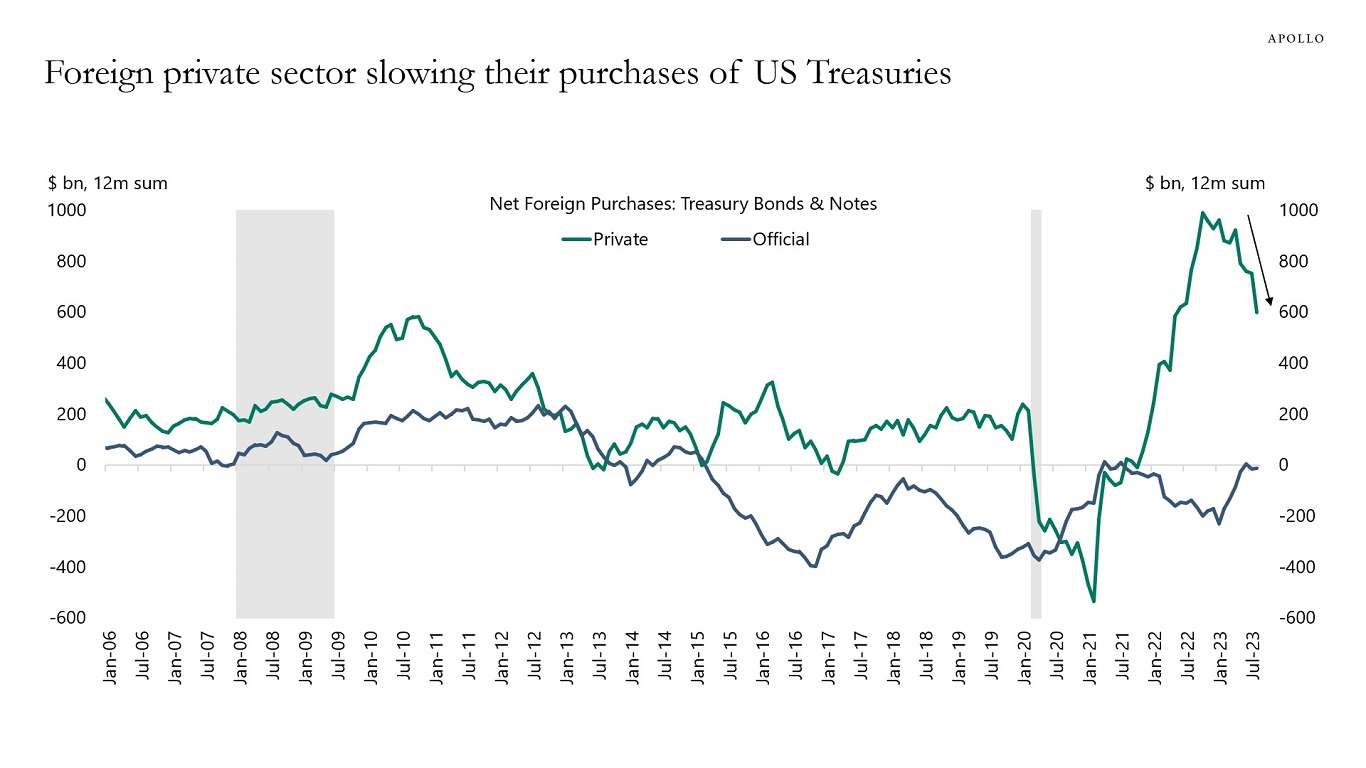

The fundamental question remains: Who is going to buy the growing supply of Treasuries, and at what price?

Looking at net foreign purchases of Treasuries shows that foreign official institutions, i.e., central banks and sovereign wealth funds, have been net sellers of Treasuries since 2015, see chart below.

Foreign private buyers, on the other hand, stepped up purchases when the Fed raised interest rates in 2022. But in 2023 with rates peaking, they have been slowing their purchases, see again the chart below.

The bottom line is that investors across all asset classes need to spend some time not only on who is buying Treasuries—including whether it is yield-sensitive or yield-insensitive buyers—but also on Treasury auction metrics and what the rating agencies are saying and doing.

Stocks are driven by stories. Stories such as AI, weight-loss medication, or CRE being a headwind for regional banks.

The bond market, on the other hand, is different. Bonds and credit are contracts. Contracts are formal and legally binding agreements about delivering future cash flows to investors.

The most remarkable difference between stocks and bonds is how unquantifiable stories are, how stories come and go, and how stories involve selecting certain facts and ignoring other facts.

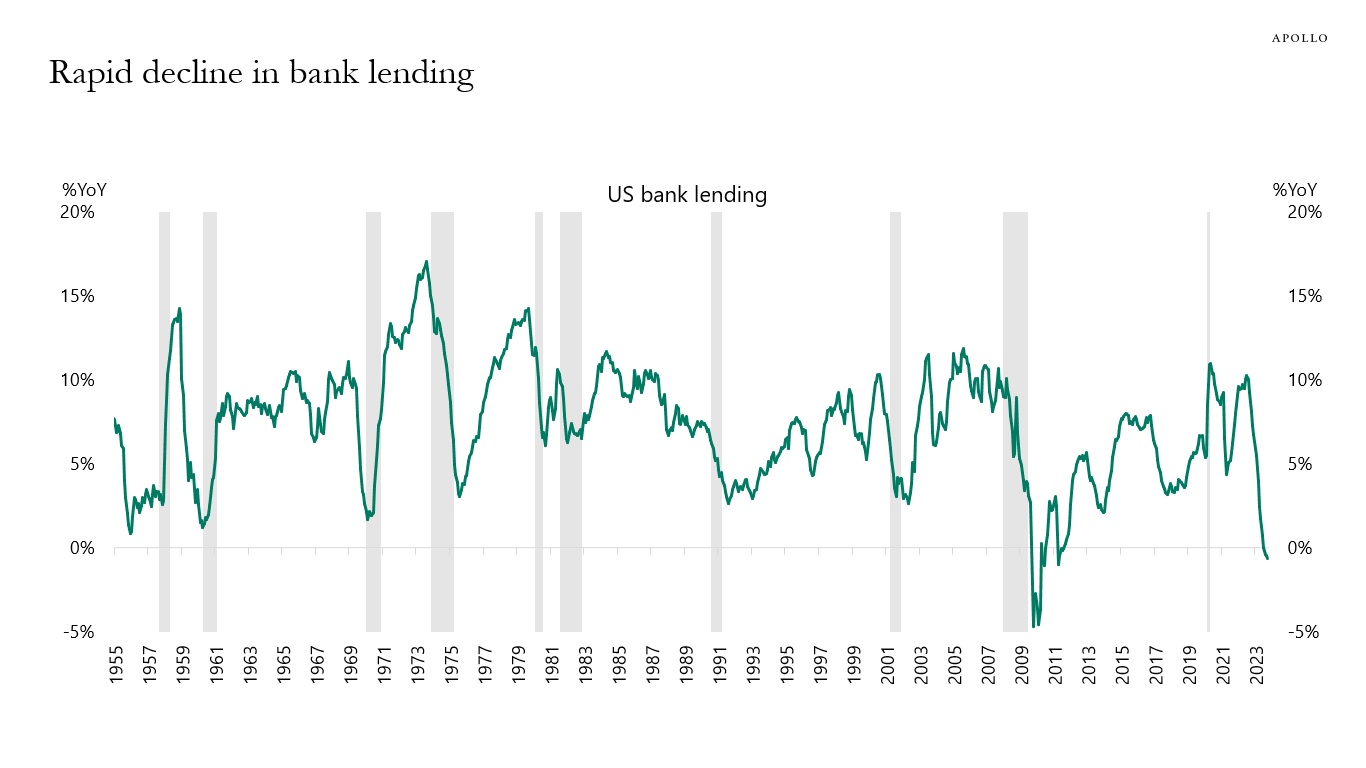

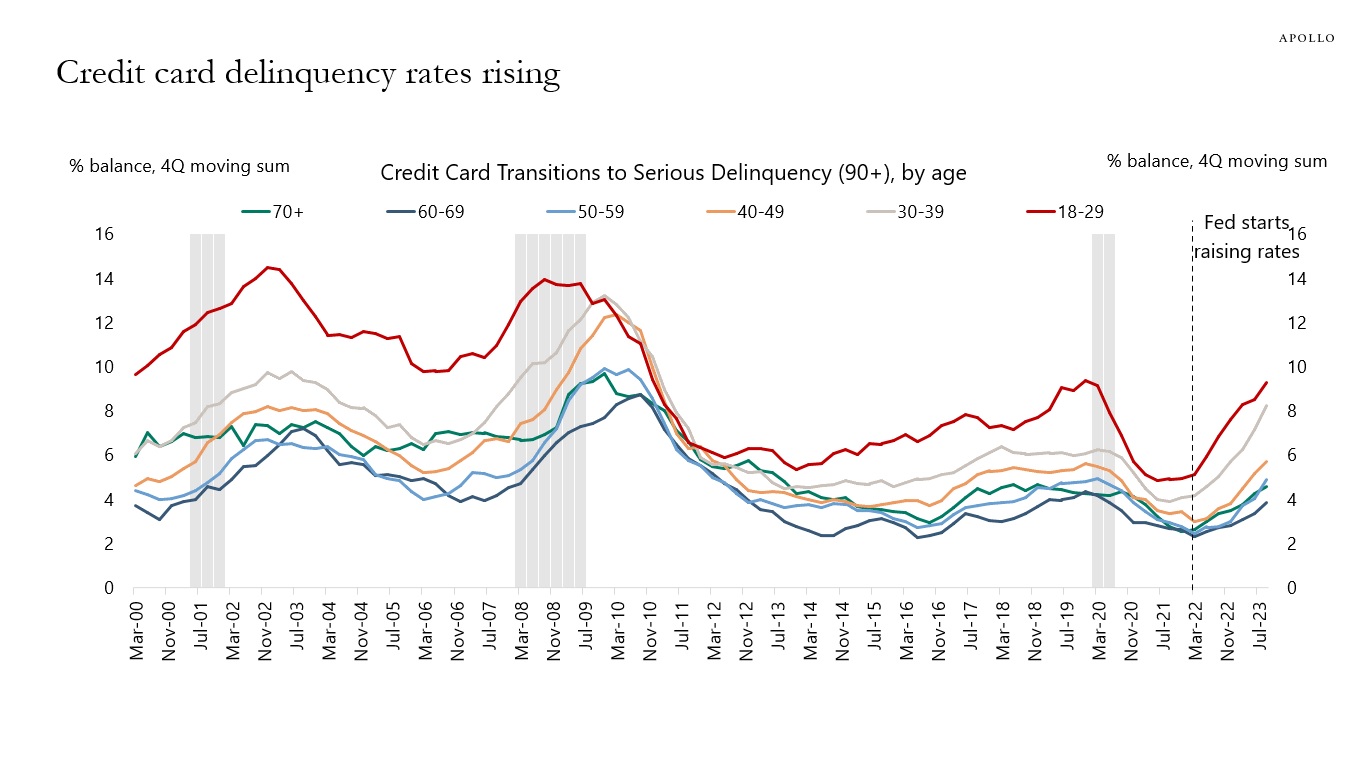

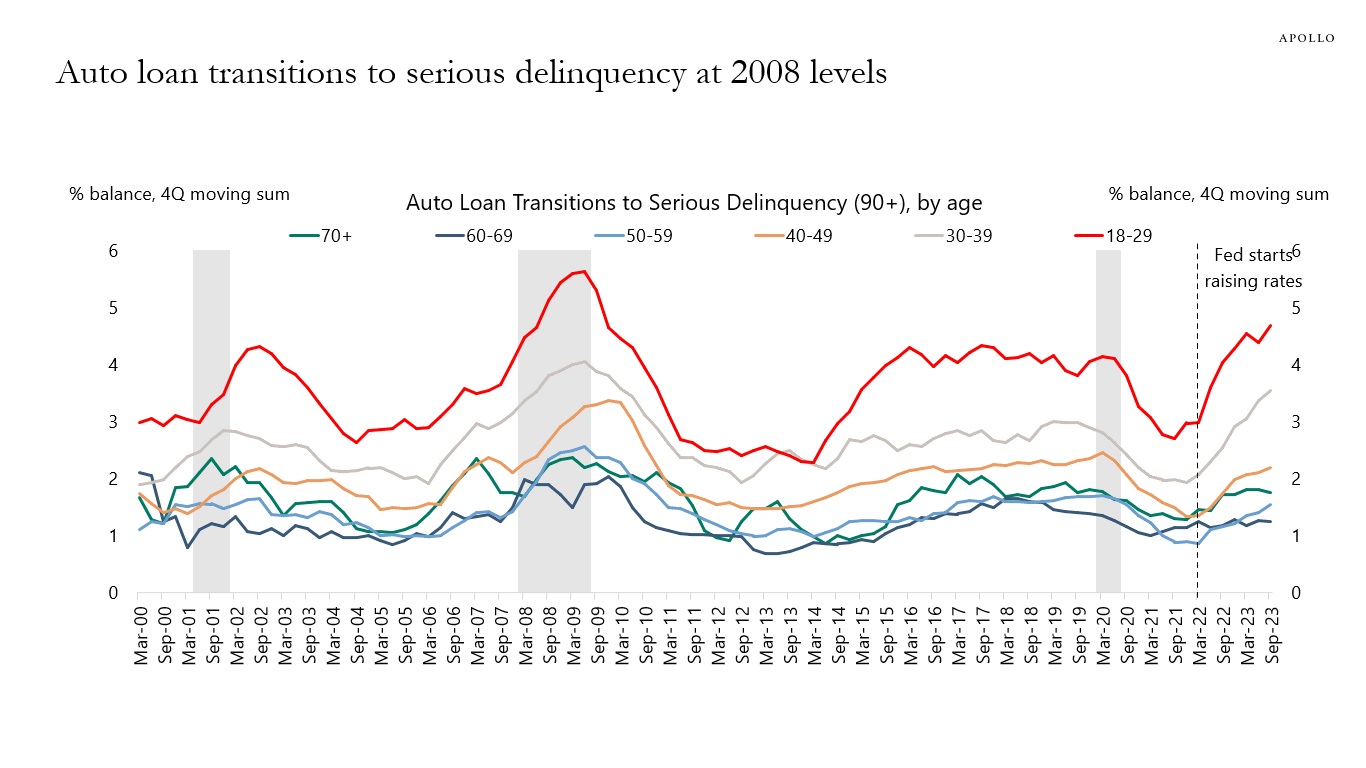

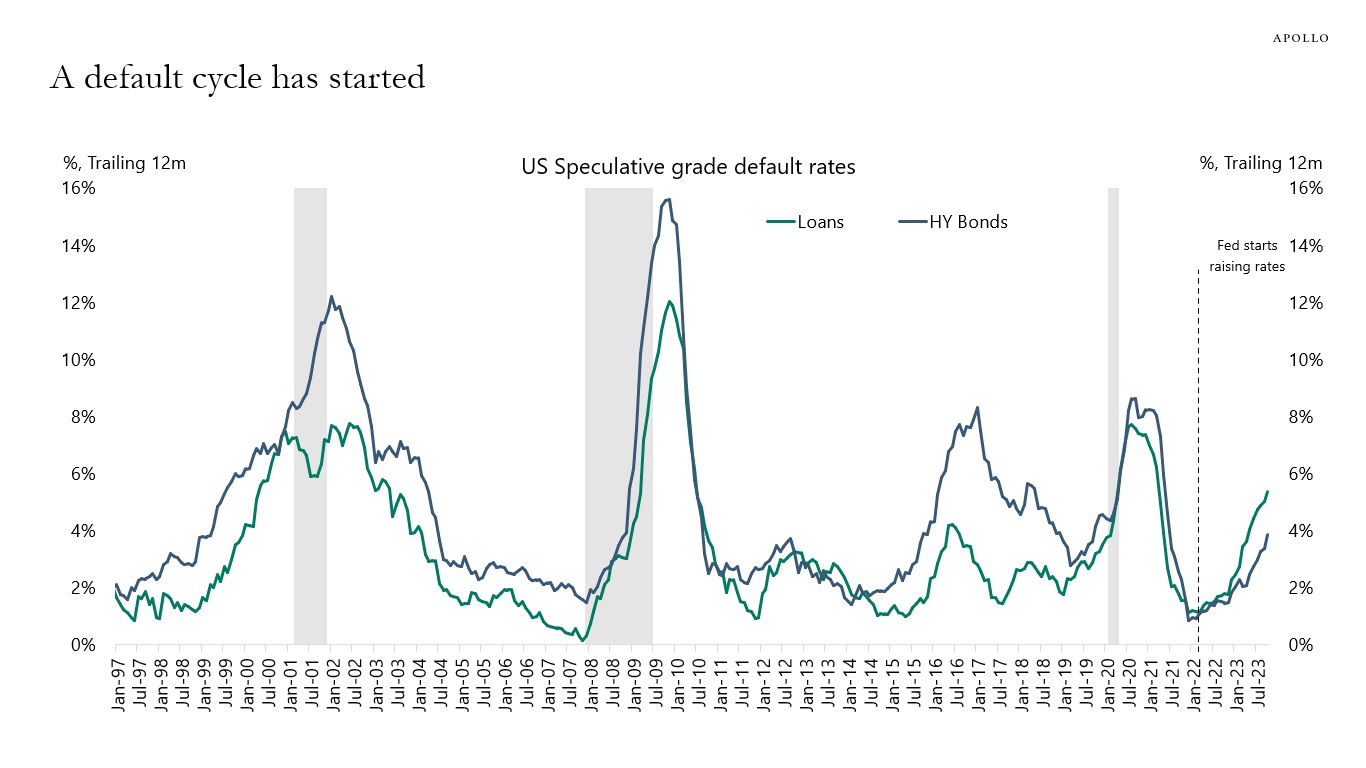

At the moment, stocks are focusing on the rapid decline in inflation. But stocks could also have chosen to focus on rising delinquency rates on credit cards and auto loans, the rise in HY default rates, or the rapid decline in bank lending, see charts below. But these facts are complicated. So, for now, the stock market is holding on to the simple story that inflation is falling. Without the nuance that a rapid decline in inflation would often be driven by a rapid decline in the economy.

With Fed hikes every day biting harder and harder on consumers, firms, and banks, and rates staying high at least until the middle of 2024, the risks are rising that we over the next six months will get a soft landing in inflation and a hard landing in the labor market.

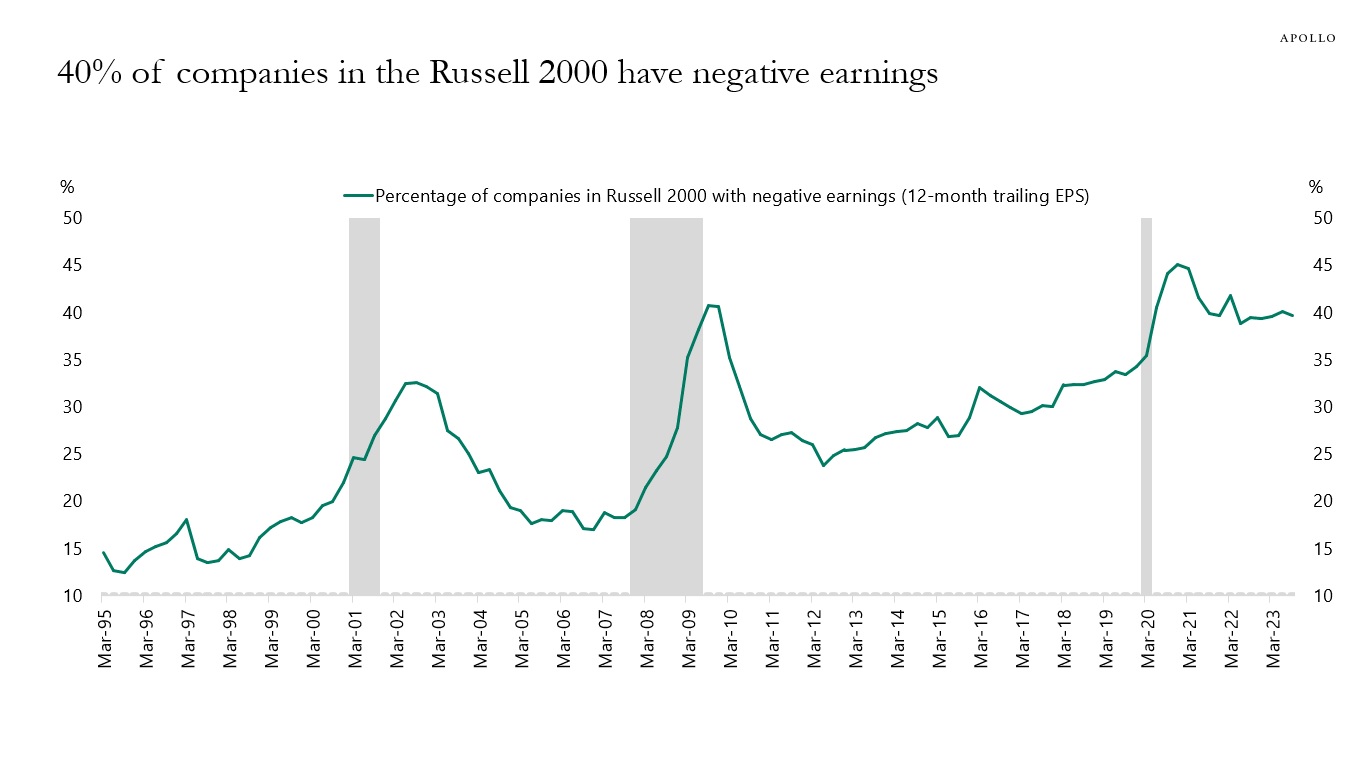

During recessions, the share of unprofitable firms rises. This is not surprising.

But even before the economy has entered a recession, the share of companies in the Russell 2000 with no earnings is at 40%, see chart below.

The bottom line is that if the economy enters a recession, a lot of middle-market companies will be vulnerable to the combination of high rates and slowing growth.

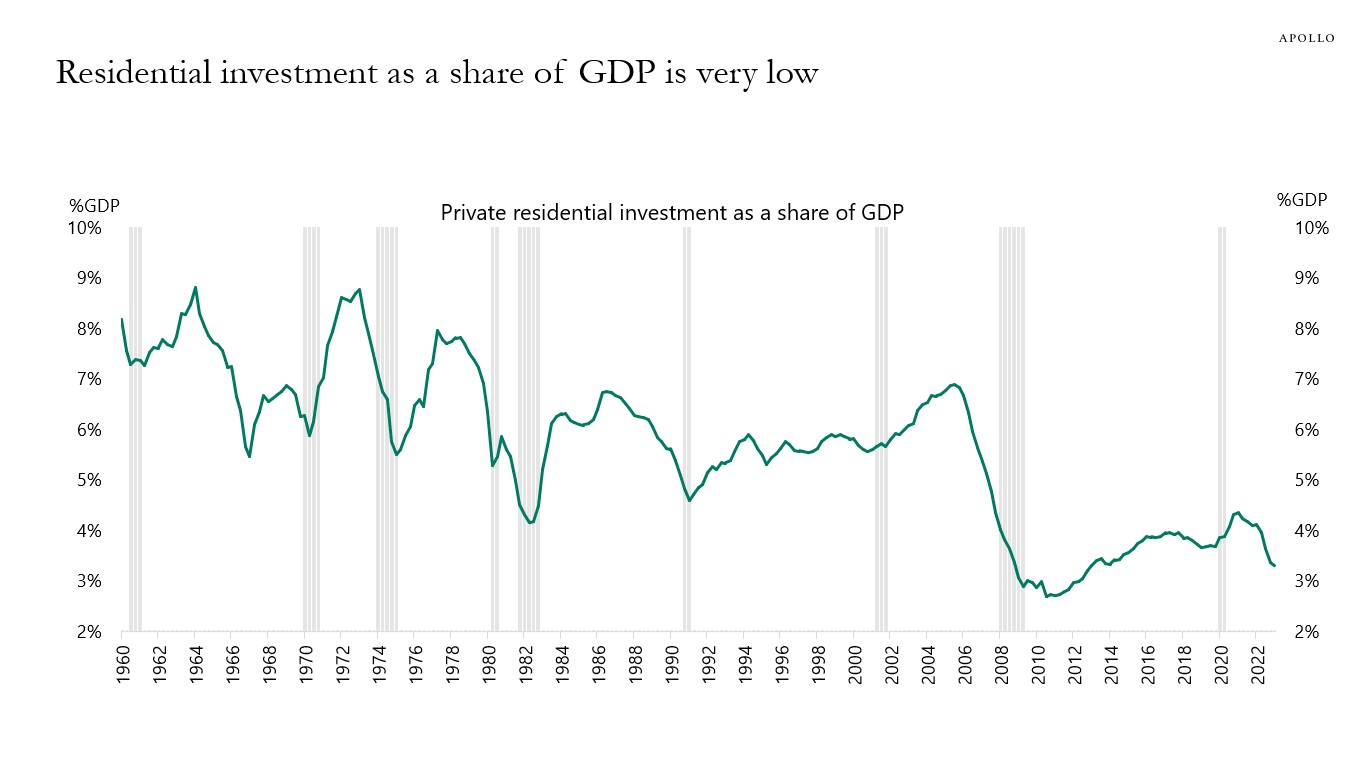

Housing construction as a share of GDP is near all-time low levels, see chart below.

Combined with a very low inventory of homes for sale, the implication for investors is that the downside risks to the economy from housing are limited despite high mortgage rates.

In other words, there is a limit to how much a decline in housing construction can subtract from GDP growth when the level of residential investment is already low.

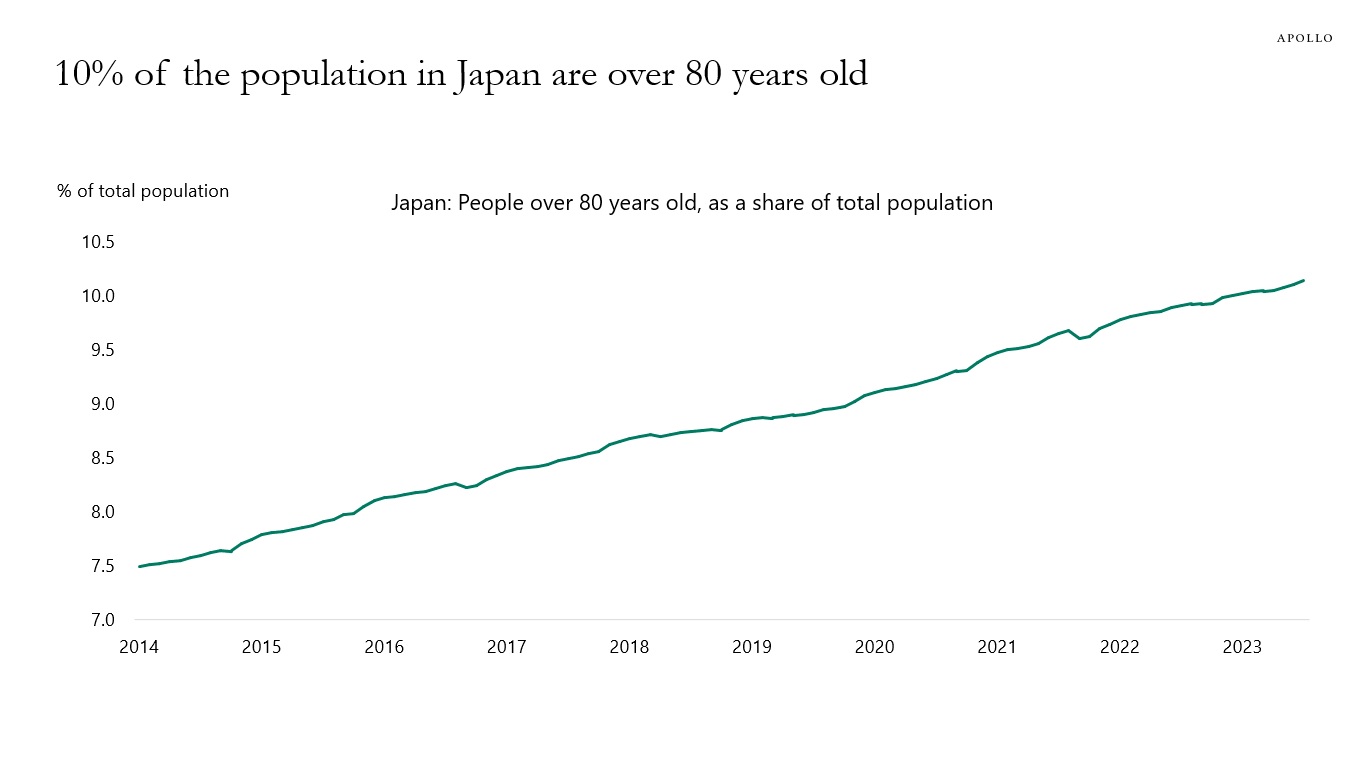

Japan continues to face significant headwinds from demographics, see chart below.

Benchmark constraints can create unintended concentration in fixed-income portfolios, hindering alpha-generation potential. Relaxing these restrictions may enhance diversification and help unlock potential excess returns. In this paper, we illustrate how integrating less-constrained or unconstrained strategies can help enhance long-term risk-adjusted performance.

Key Takeaways

The information herein is provided for educational purposes only and should not be construed as financial or investment advice, nor should any information in this document be relied on when making an investment decision. Opinions and views expressed reflect the current opinions and views of the authors and Apollo Analysts as of the date hereof and are subject to change. Please see the end of this document for important disclosure information.

Important Disclosure Information

This presentation is for educational purposes only and should not be treated as research. This presentation may not be distributed, transmitted or otherwise communicated to others, in whole or in part, without the express written consent of Apollo Global Management, Inc. (together with its subsidiaries, “Apollo”).

The views and opinions expressed in this presentation are the views and opinions of the author(s) of the White Paper. They do not necessarily reflect the views and opinions of Apollo and are subject to change at any time without notice. Further, Apollo and its affiliates may have positions (long or short) or engage in securities transactions that are not consistent with the information and views expressed in this presentation. There can be no assurance that an investment strategy will be successful. Historic market trends are not reliable indicators of actual future market behavior or future performance of any particular investment which may differ materially, and should not be relied upon as such. Target allocations contained herein are subject to change. There is no assurance that the target allocations will be achieved, and actual allocations may be significantly different than that shown here. This presentation does not constitute an offer of any service or product of Apollo. It is not an invitation by or on behalf of Apollo to any person to buy or sell any security or to adopt any investment strategy, and shall not form the basis of, nor may it accompany nor form part of, any right or contract to buy or sell any security or to adopt any investment strategy. Nothing herein should be taken as investment advice or a recommendation to enter into any transaction.

Hyperlinks to third-party websites in this presentation are provided for reader convenience only. There can be no assurance that any trends discussed herein will continue. Unless otherwise noted, information included herein is presented as of the dates indicated. This presentation is not complete and the information contained herein may change at any time without notice. Apollo does not have any responsibility to update the presentation to account for such changes. Apollo has not made any representation or warranty, expressed or implied, with respect to fairness, correctness, accuracy, reasonableness, or completeness of any of the information contained herein, and expressly disclaims any responsibility or liability therefore. The information contained herein is not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. Investors should make an independent investigation of the information contained herein, including consulting their tax, legal, accounting or other advisors about such information. Apollo does not act for you and is not responsible for providing you with the protections afforded to its clients.

Certain information contained herein may be “forward-looking” in nature. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking information. As such, undue reliance should not be placed on such information. Forward-looking statements may be identified by the use of terminology including, but not limited to, “may”, “will”, “should”, “expect”, “anticipate”, “target”, “project”, “estimate”, “intend”, “continue” or “believe” or the negatives thereof or other variations thereon or comparable terminology.

The Standard & Poor’s 500 (“S&P 500”) Index is a market-capitalization-weighted index of the 500 largest U.S. publicly traded companies by market value.

Additional information may be available upon request.

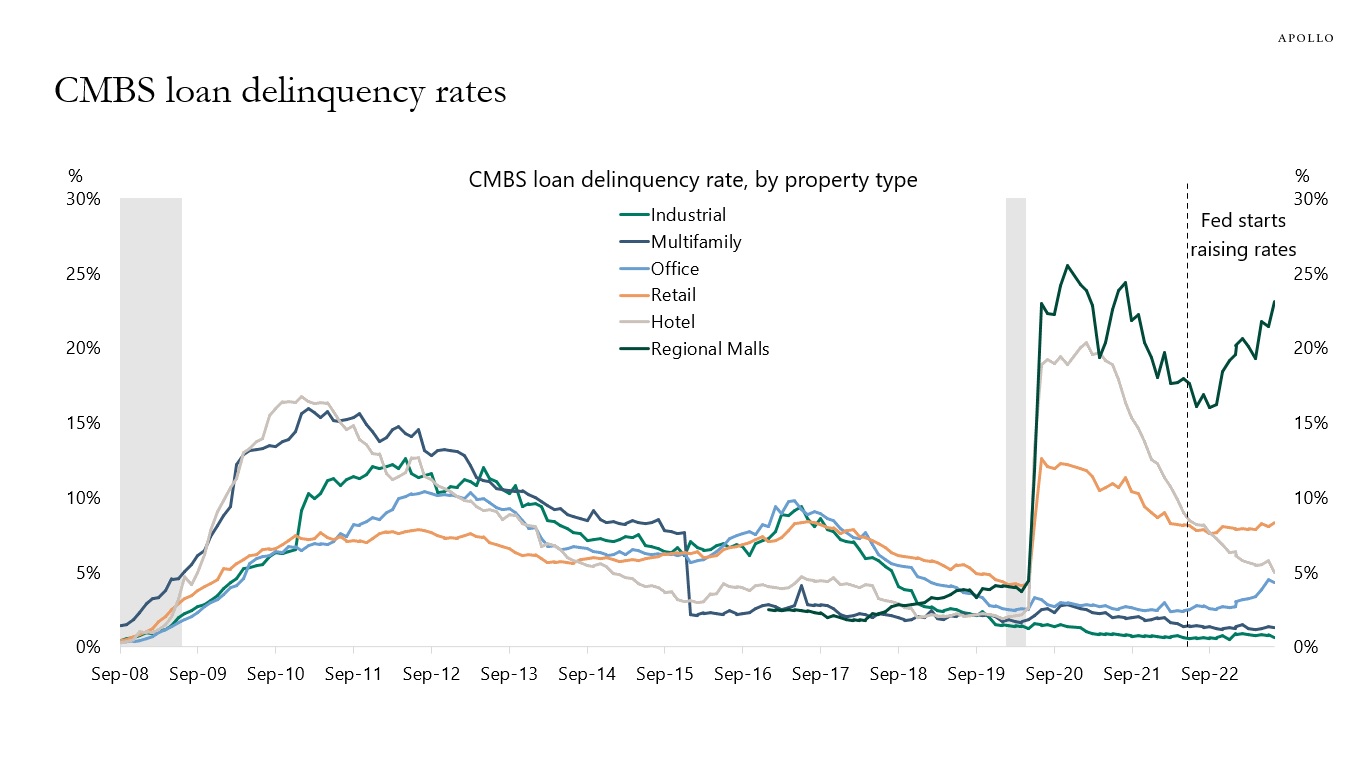

Before the pandemic, the sub-components of CMBS traded as one asset class where delinquency rates would move up and down in sync with the business cycle.

Since the pandemic and after the Fed started raising rates, there has been significant differentiation between different types of commercial real estate, with delinquency rates for office and regional malls rising, delinquency rates for hotels first going up and then down, and the delinquency rate for retail settling at a permanently higher level, see chart below.

The bottom line is that after the pandemic, active credit selection has become key for investors in CMBS and CRE more broadly.

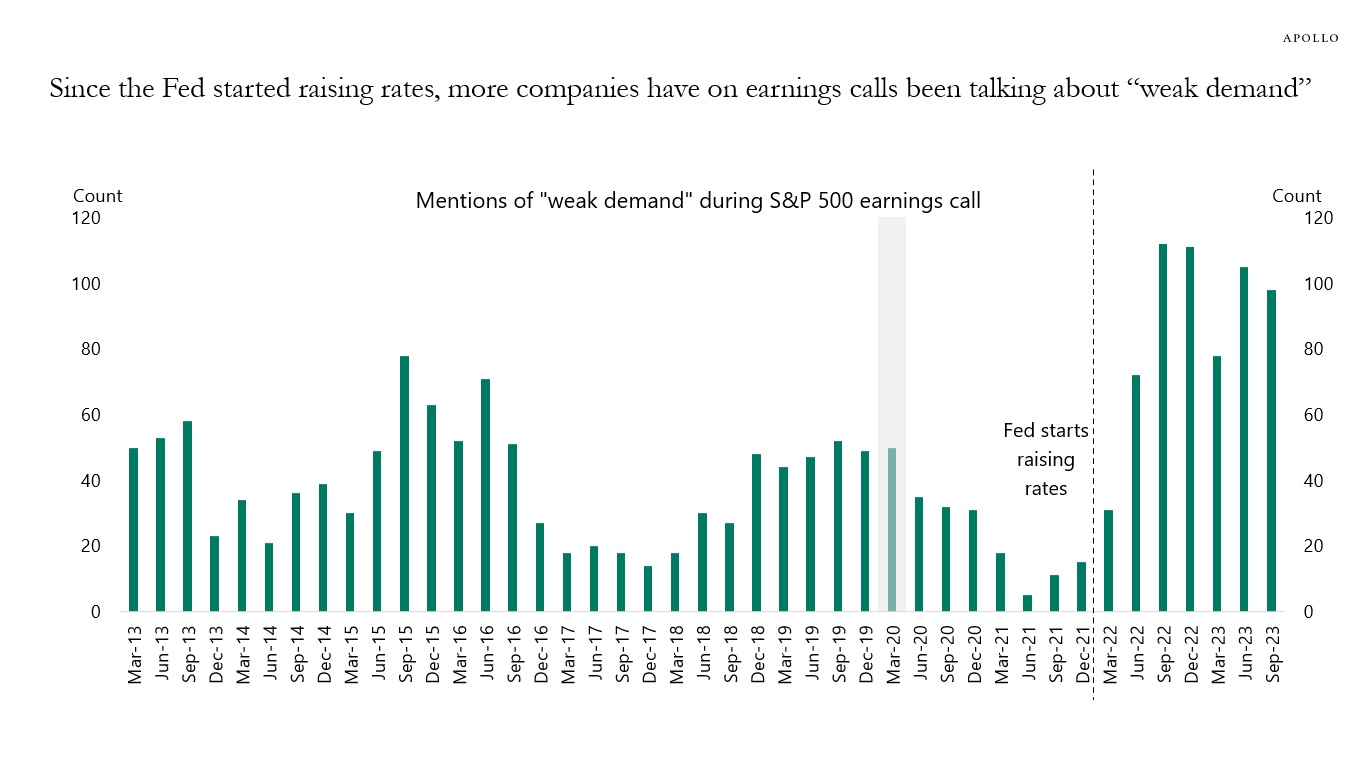

Since the Fed started raising rates in March 2022, S&P500 companies have on earnings calls talked more and more about weak demand, see chart below.

This is what the textbook would have predicted. Higher interest rates increase borrowing costs for consumers and corporates—which slows down demand.