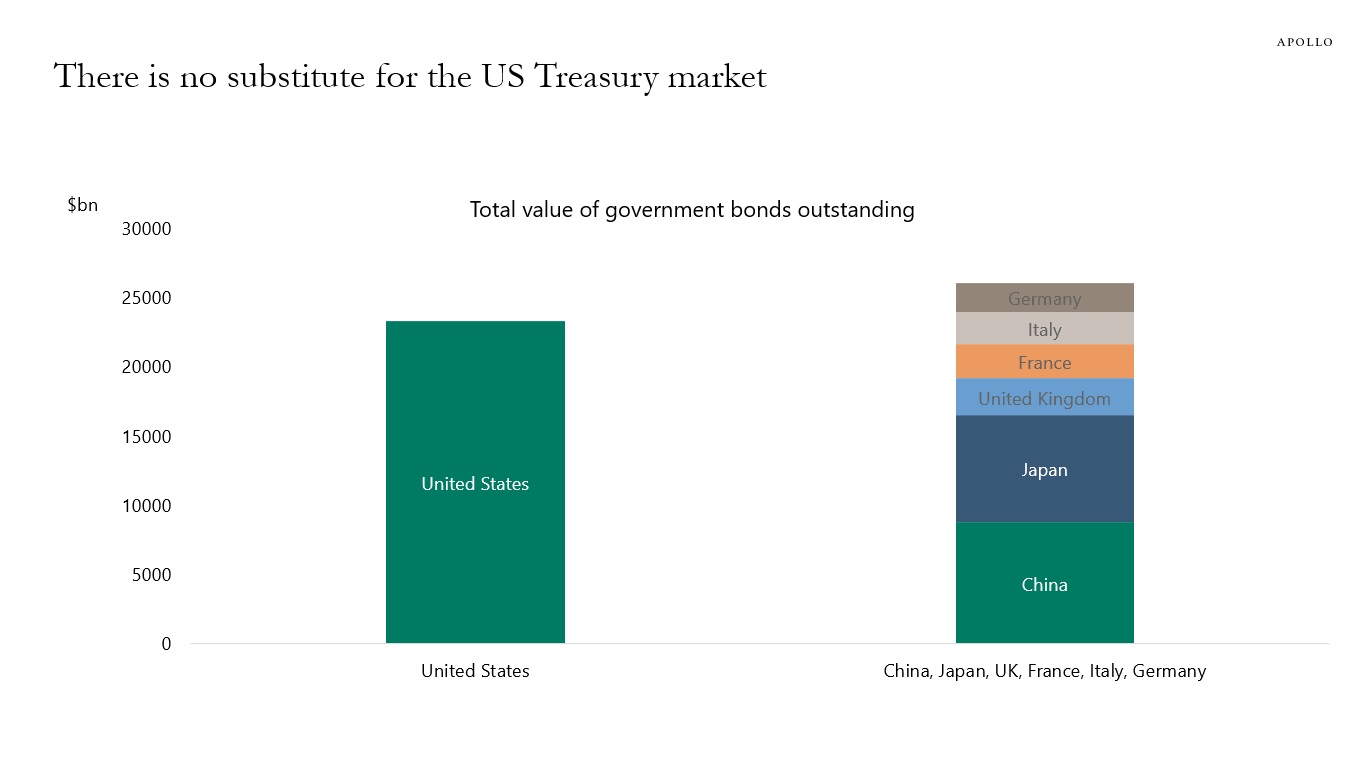

The US Treasury market is the same size as the combined government bond markets of China, Japan, UK, France, Italy, and Germany, see chart below.

The bottom line is that there is no substitute for the US Treasury market.

Looking into 2024, the list of upside risks to yields in the long end is long, with a big budget deficit, increasing Treasury issuance, the risk of a sovereign downgrade, the Fed doing QT, falling foreign demand for Treasuries, and a shift in issuance away from bills to coupons.

These forces are pushing long rates higher. But a dovish Fed pulls in the other direction.

Even if the Fed starts cutting rates, a steepener in the first half of 2024 seems most likely, with upside risks to long-term interest rates coming from factors unrelated to what the Fed will do.

In particular, if we get a soft landing in 2024, then both economic and non-economic forces could, by the end of 2024, push long-term interest rates higher than where they are today.