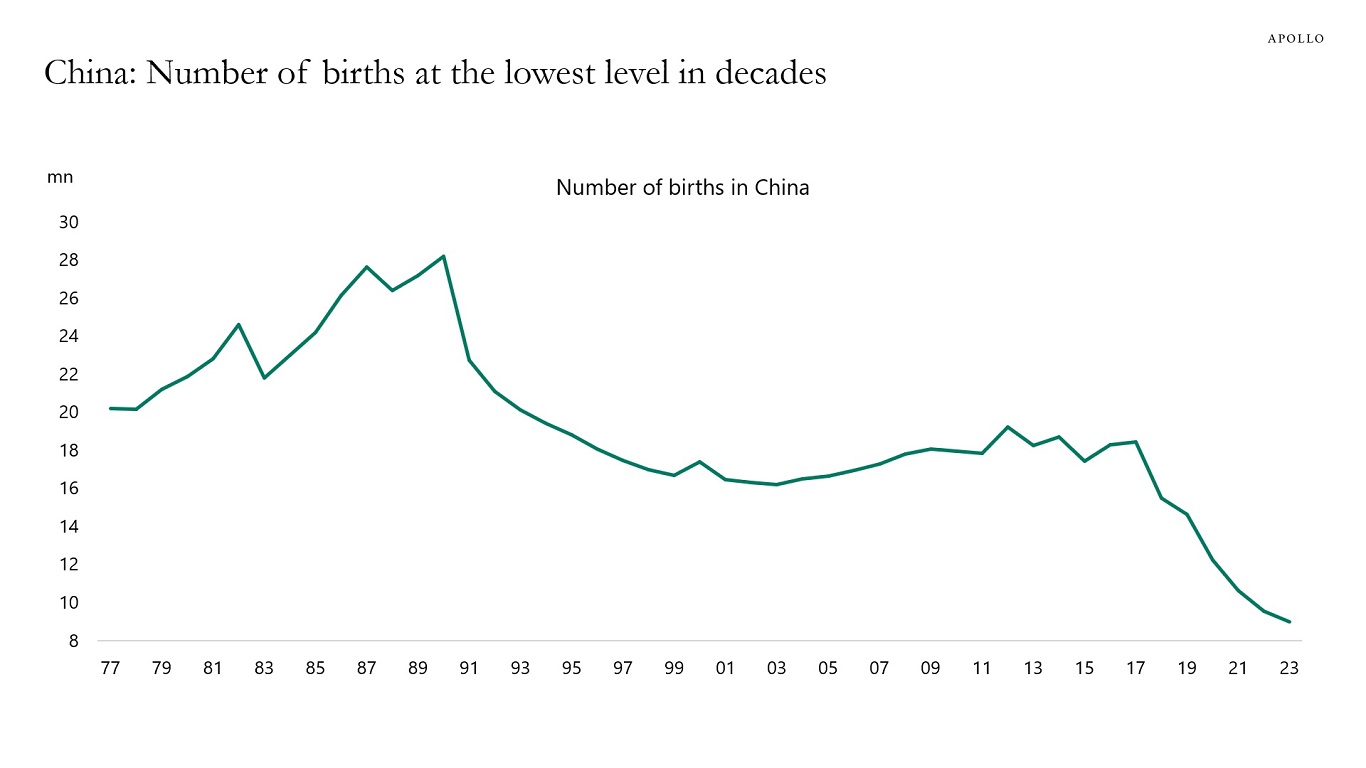

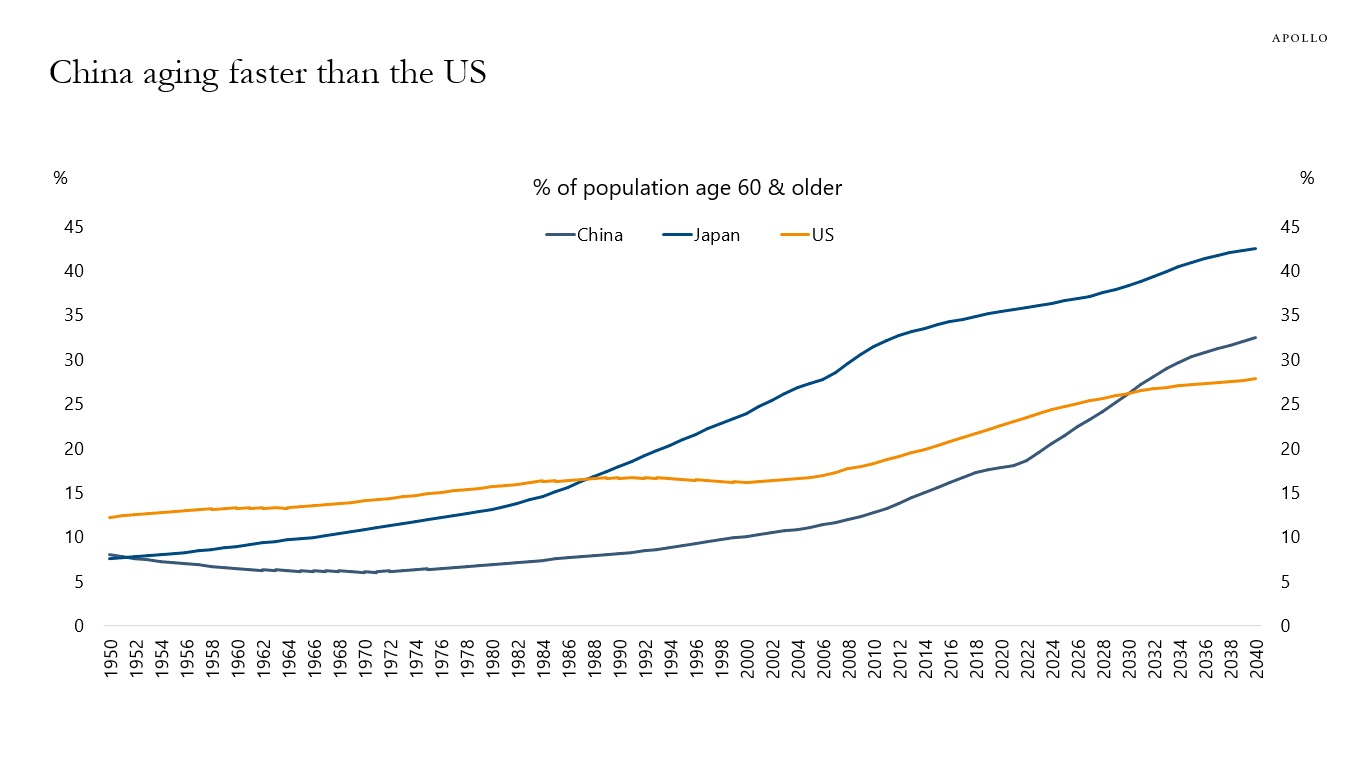

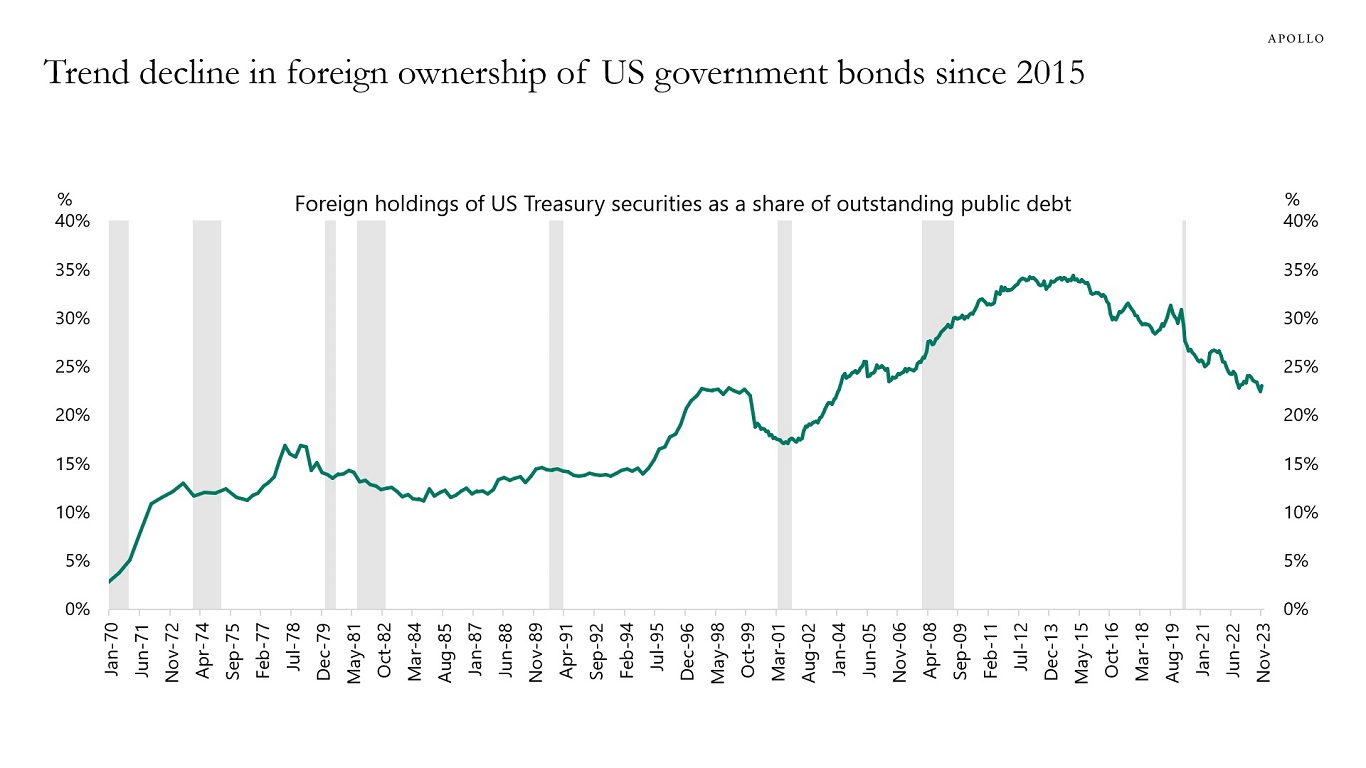

China began its one-child policy in 1980 and ended it in 2016. In 2021, it started its three-child policy, encouraging couples to have three children. The UN projects that China’s population will decline from 1.4 billion today to 800 million by the end of this century. China’s demographic headwinds have significant implications for growth, savings, and FX reserve accumulation and, therefore, Chinese appetite for buying US Treasuries.