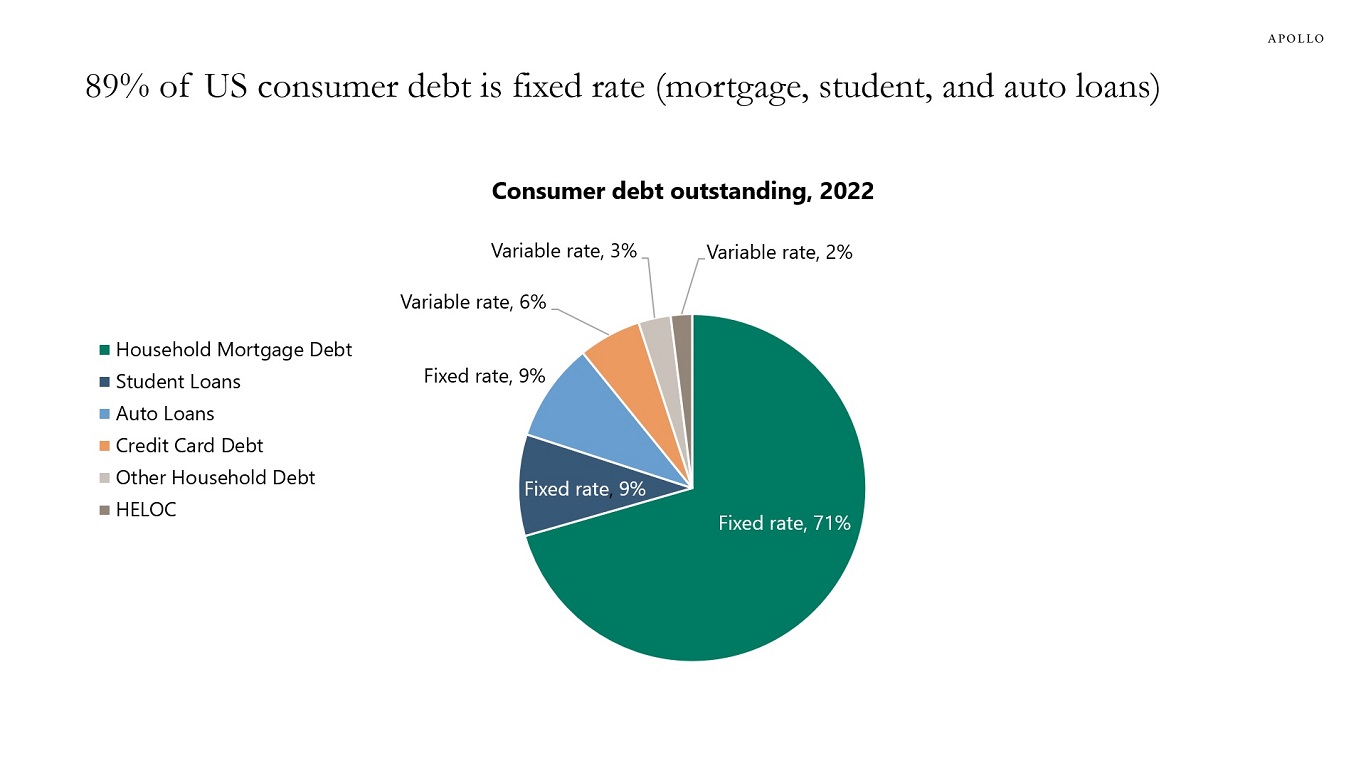

Eighty-nine percent of US household debt is fixed rate (mortgage, student, and auto loans) and 11% is floating rate (credit cards, HELOC, and other types of debt).

As a result, the transmission mechanism of monetary policy has been weak. Combined with significant excess savings during the pandemic, Fed hikes have had a limited impact on the consumer.