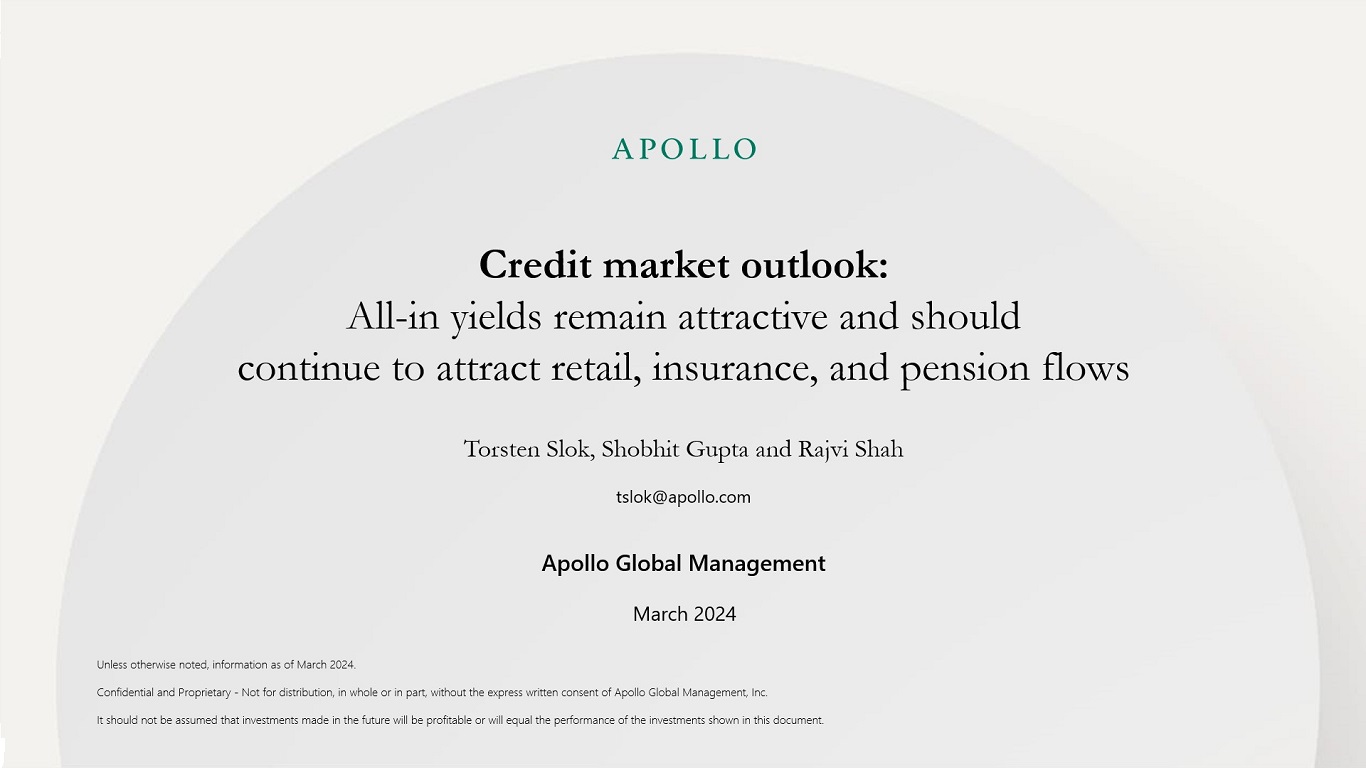

The Sources of Population Growth Are Shifting

Immigration continues to be the key source of population growth in the United States, and the CBO estimates that net births will be negative in a few decades, see chart below.

For more discussion, see also this new paper.

Fed Hikes Weighing on Coverage Ratios

Fed hikes are increasingly impacting coverage ratios for highly leveraged companies, but the composition of coverage ratios remains similar to what we saw from 2012 to 2020, see chart below.

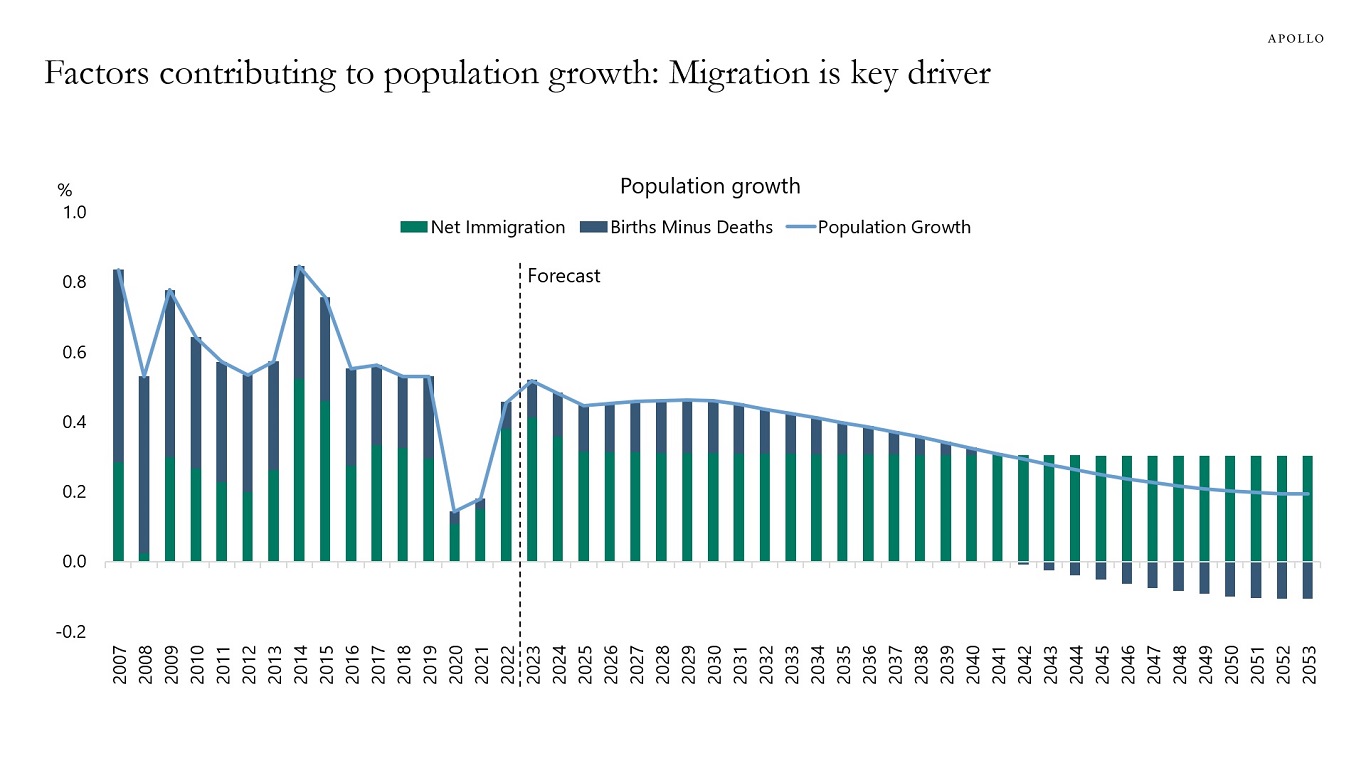

Inflation Is Sticky at 3%

The Fed’s inflation target is 2%, and the bottom line of the inflation discussion is that inflation has started to move sideways at 3%, and this is a problem for the Fed, see chart below.

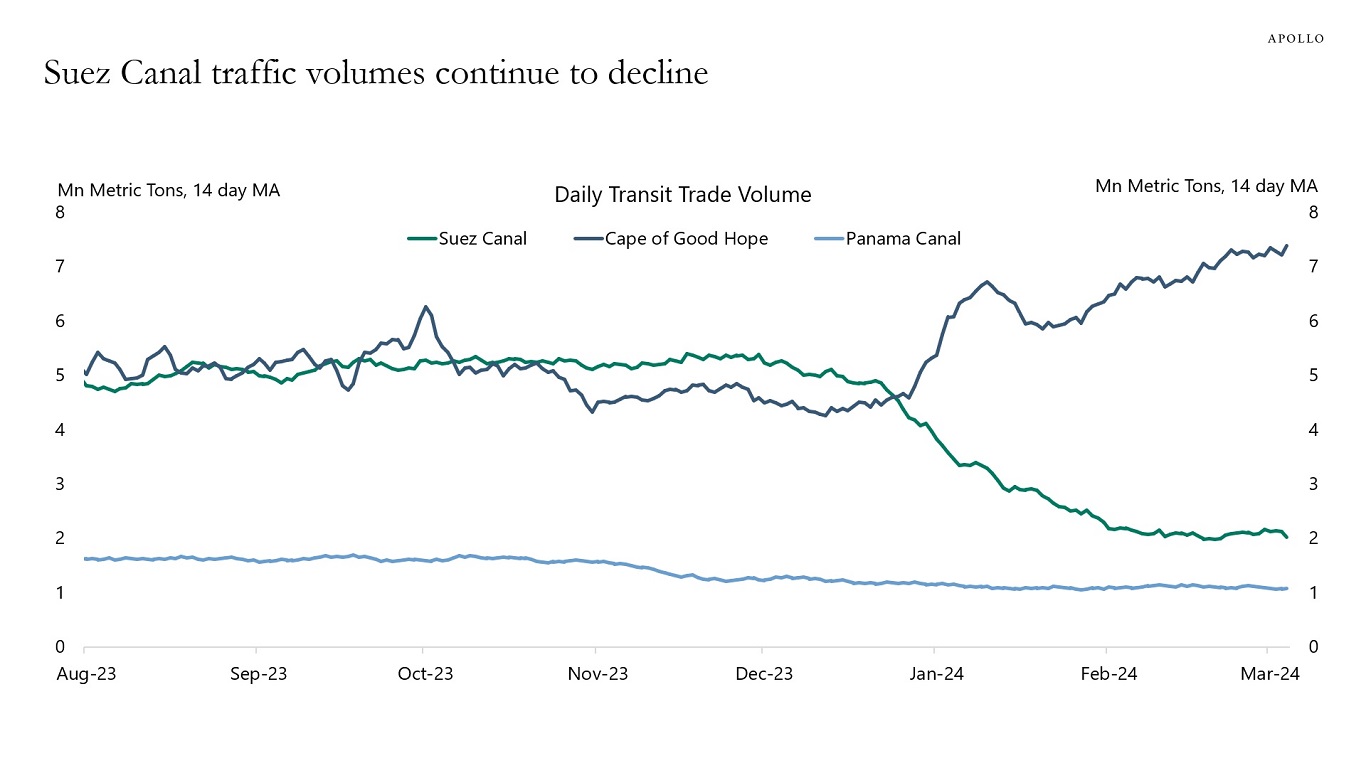

Supply Chain Problems Continue

Container transportation prices are slowly coming down from their peaks, but IMF data shows that traffic volumes through the Suez Canal continue to deteriorate, see chart below.

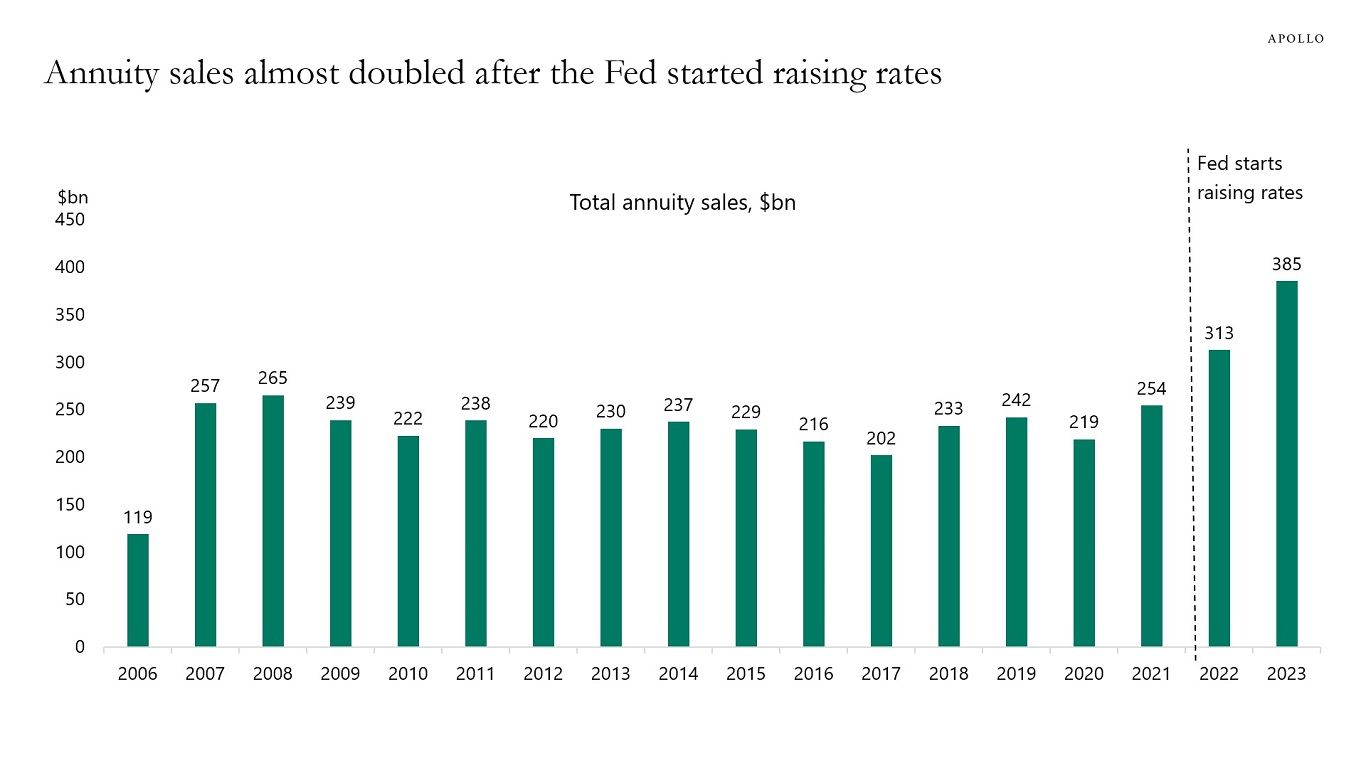

Record-High Annuity Sales Supporting Credit

Annuity sales are almost double their pre-pandemic levels because of higher interest rates. And strong annuity sales create strong demand for credit, see chart below.

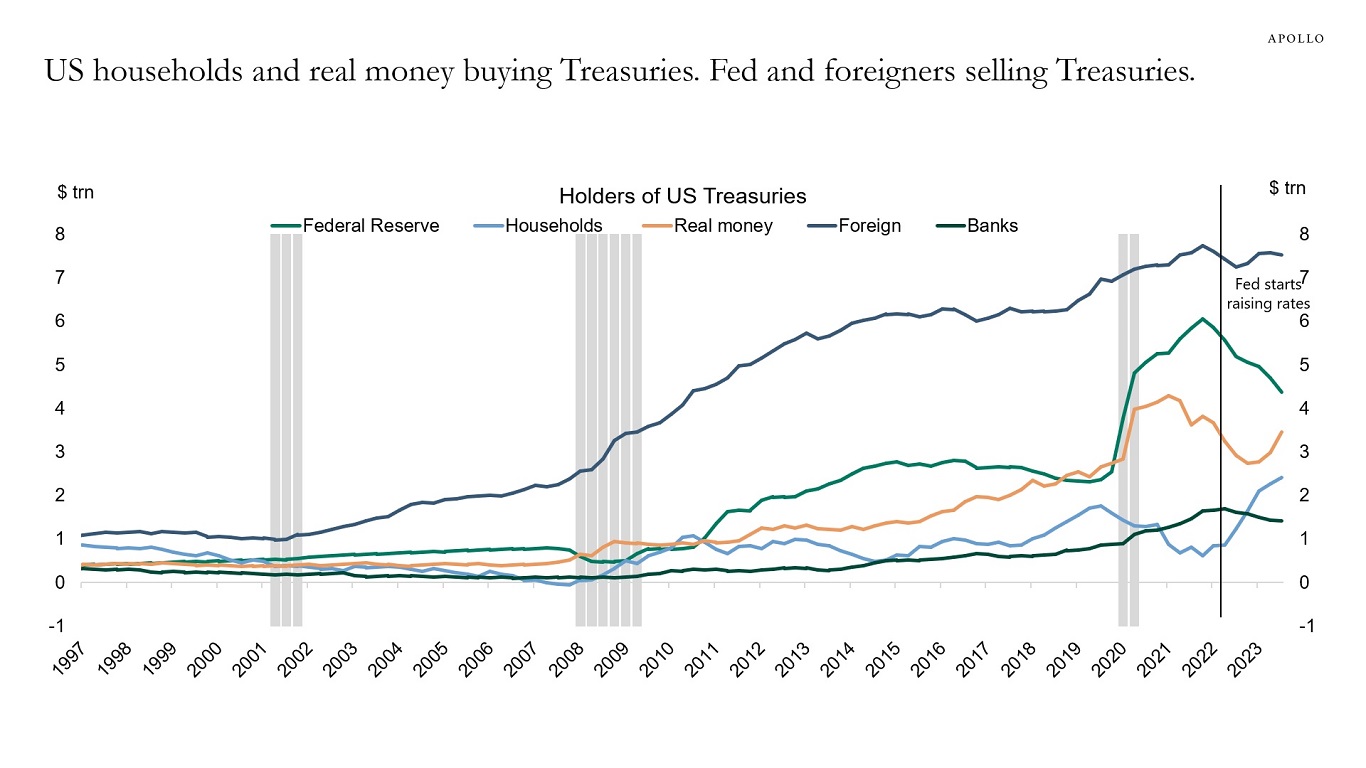

Who Is Buying US Treasuries?

The buyer base for US Treasuries has shifted from yield-insensitive buyers (sovereign wealth funds and central banks, including the Fed) to yield-sensitive buyers (US households, US pensions, US insurance), see chart below.

This may become a problem once the Fed begins to cut rates because that could mean less demand from the yield-sensitive buyers, ultimately resulting in a steeper yield curve.

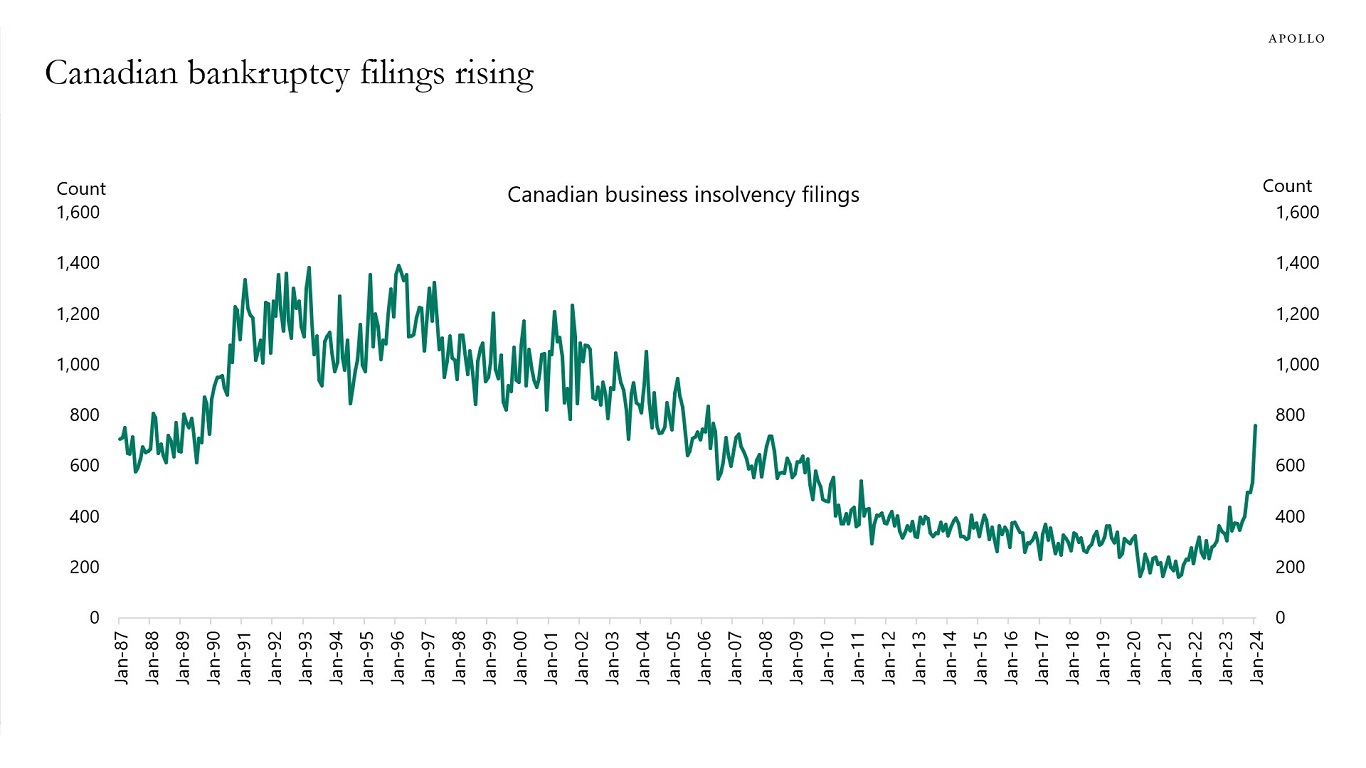

Canadian Bankruptcies Rising

Canadian business insolvency filings have increased dramatically in recent months, see chart below.

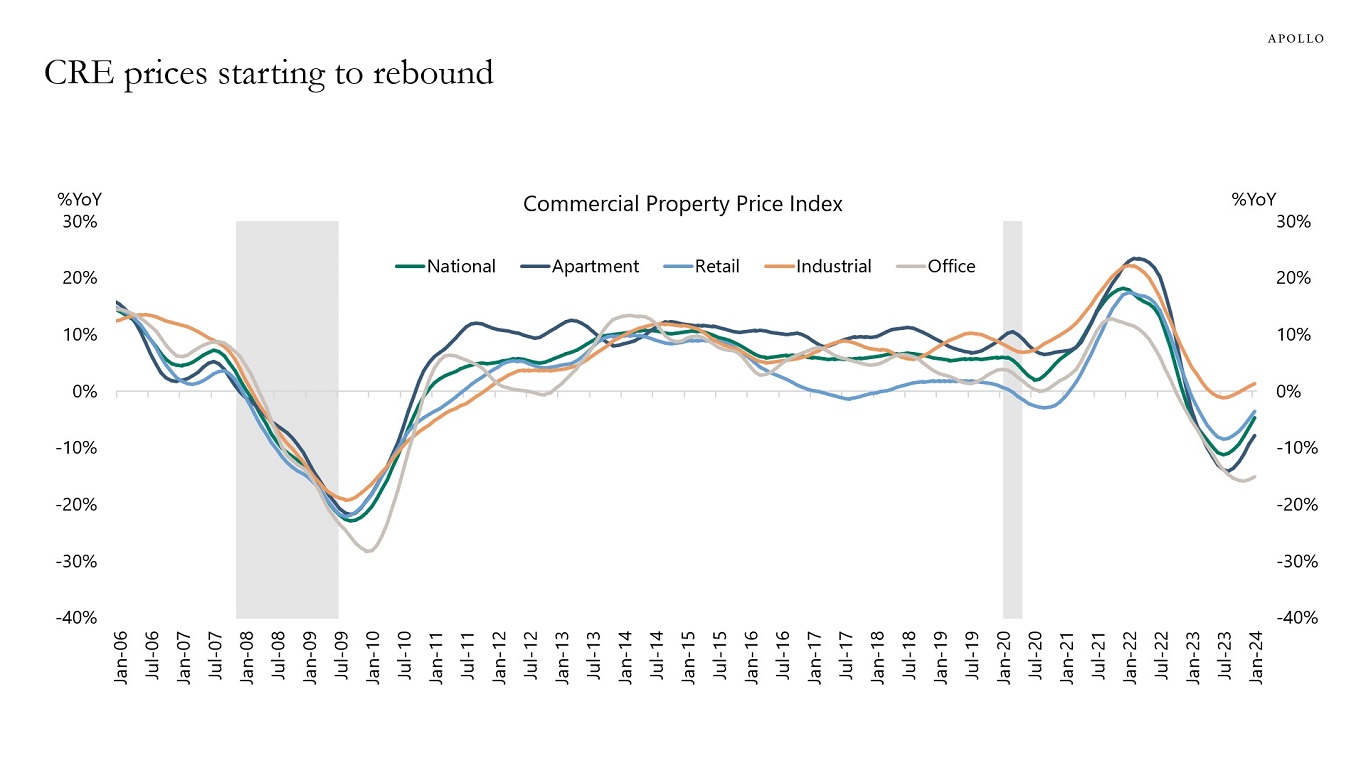

CRE Prices Rebounding

With no signs of a recession, commercial real estate prices are starting to recover, see chart below. This is helpful for the regional banks and for the broader economic recovery.

Credit Market Outlook

The ongoing rally in credit is likely to continue driven by attractive all-in yields with strong demand from retail, insurance, and pensions. Our latest outlook for credit markets is available here.