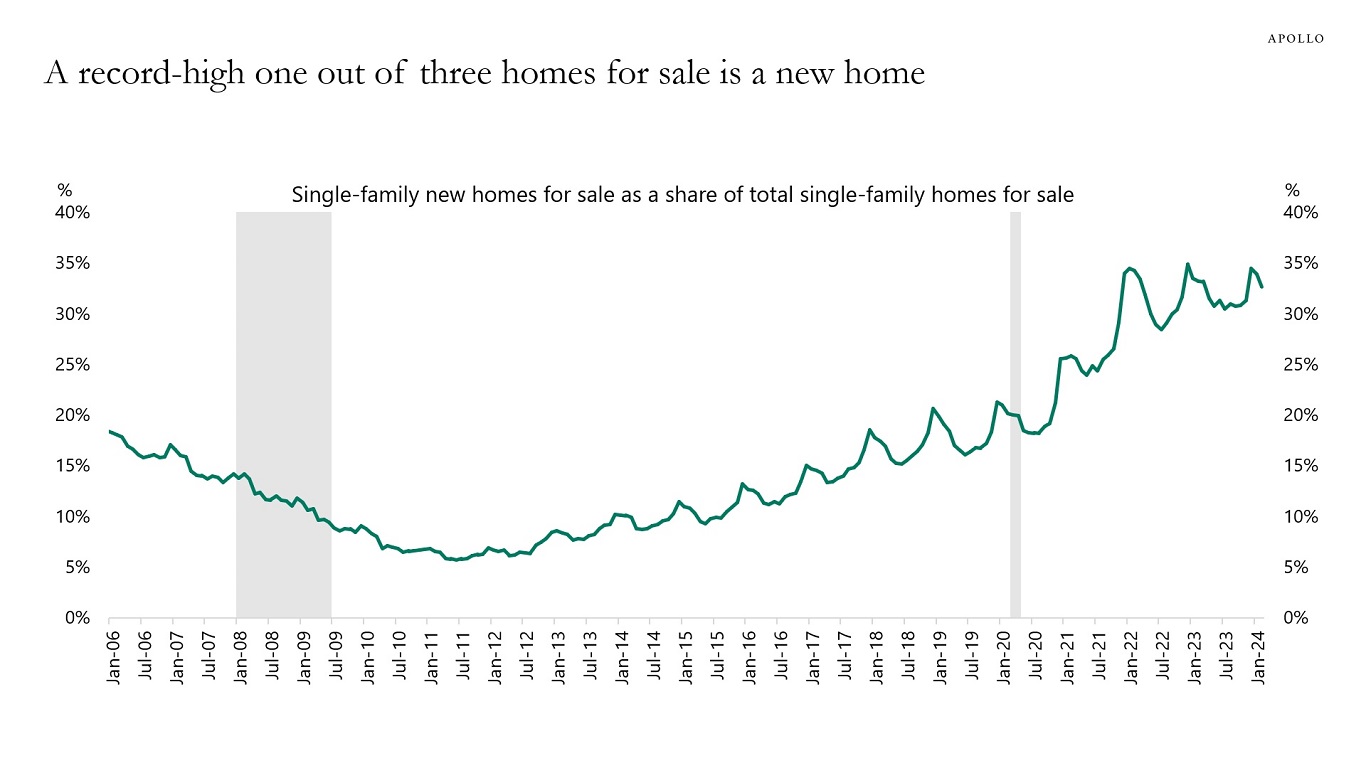

Very Few Existing Homes for Sale

After the 2008 financial crisis, one out of 20 homes for sale was a new home. Today, one out of three homes for sale is a new home, see chart below.

The source of the current low inventory of existing homes for sale is the lock-in effect, as homeowners with low mortgage rates are unwilling to sell their homes and buy a new one at a much higher mortgage rate.

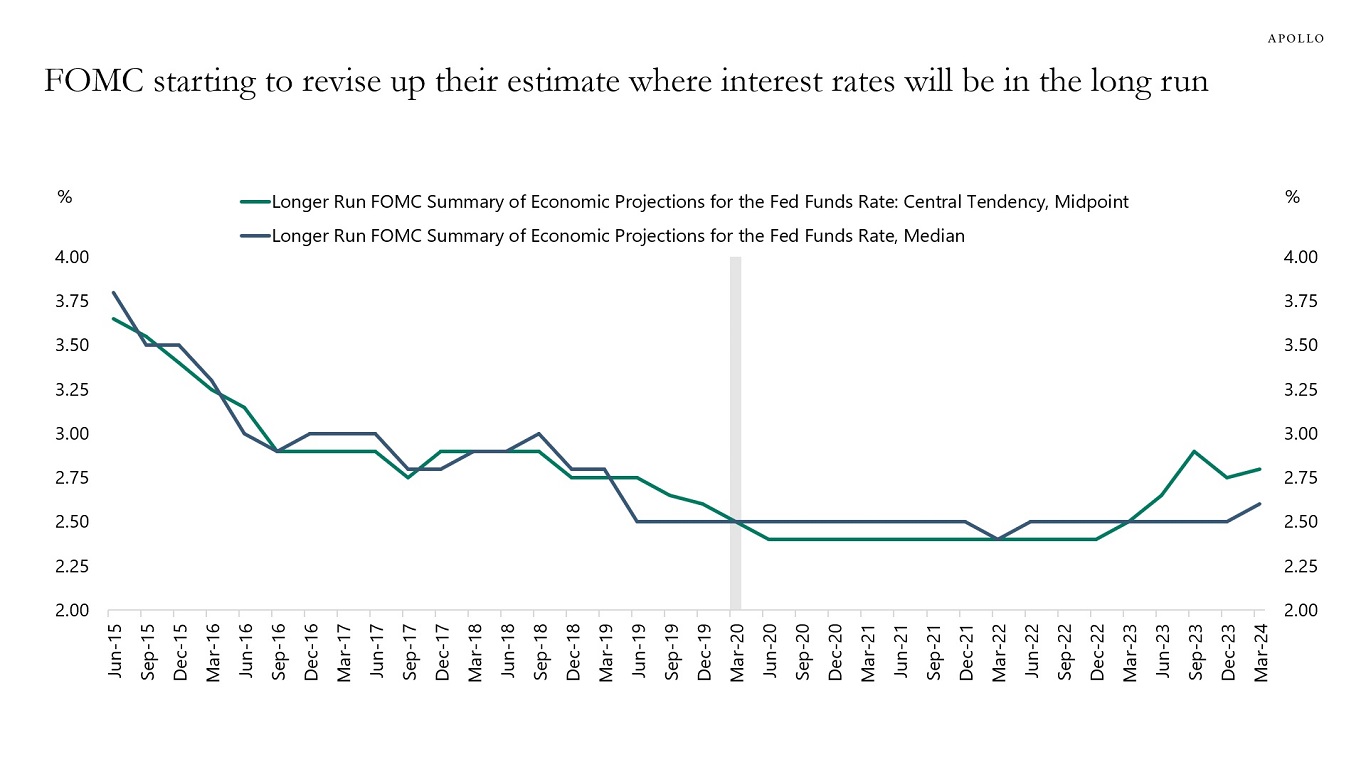

Fed Estimates of Long-Term Interest Rates

The Fed’s estimate of where interest rates will be in the long run has started to move higher, likely driven by the muted response of the economy so far to Fed hikes and by structural changes in deglobalization, energy transition, and defense spending.

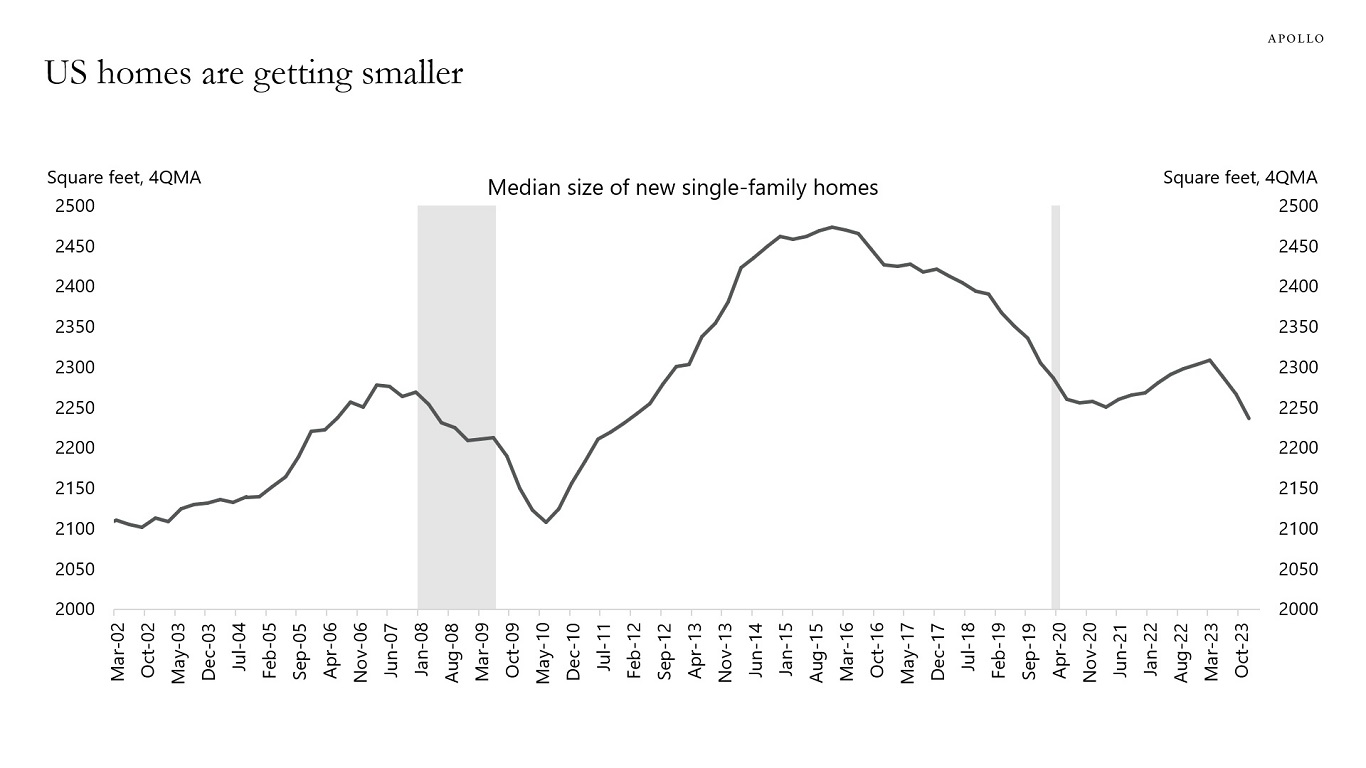

Homebuilders Building Smaller Homes

The median size of new single-family homes peaked at 2,473 square feet in 2016.

Today, the size of new homes being built is 2,237 square feet, see chart below.

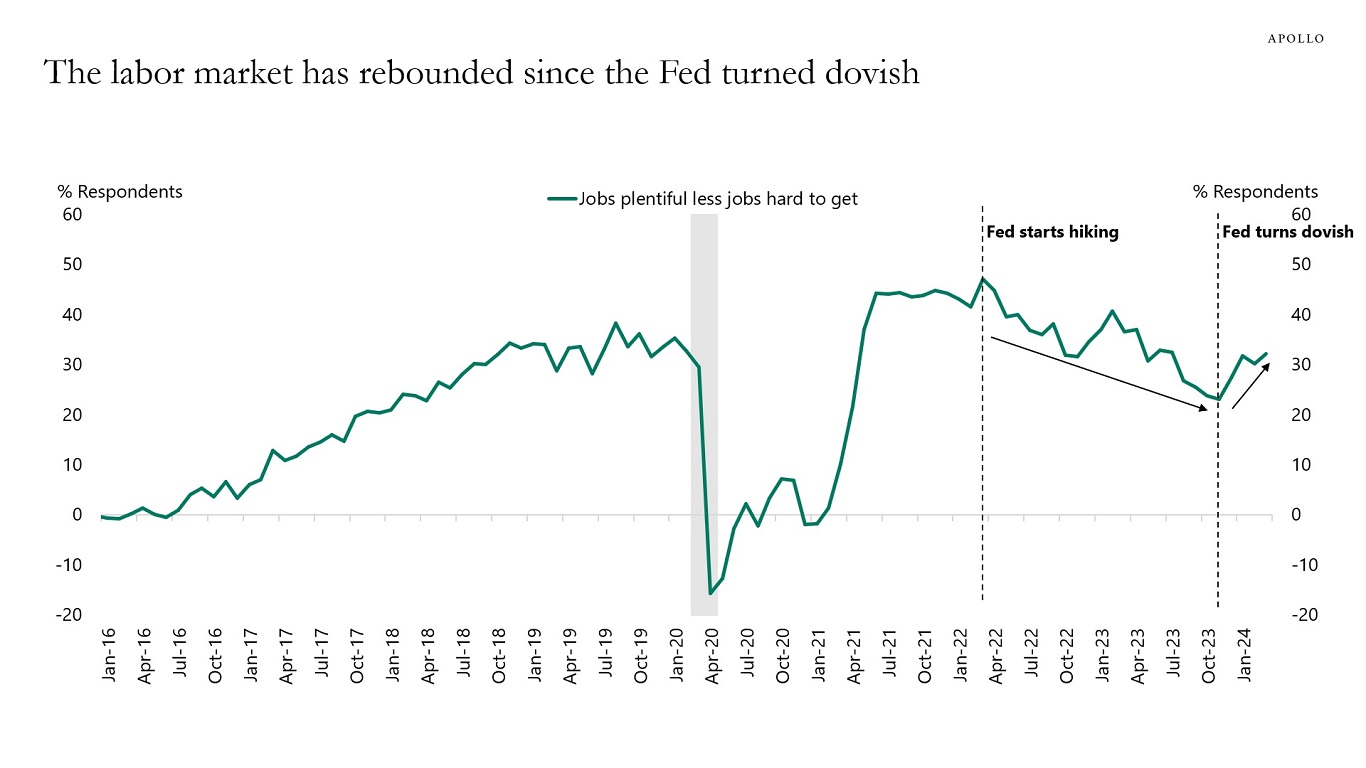

Strong Labor Market Continues

After the Fed started raising rates in March 2022, the labor market started softening, with households saying that it was harder to find a job. This changed after the Fed pivot, see the first chart below.

Since December 2023, households have said that it is easier to find a job, reflecting a rebound in corporate confidence, see the second chart.

The bottom line is that the improvement we have seen in the labor market in January and February is real. Combined with low jobless claims, nonfarm payrolls are likely to surprise to the upside again in March.

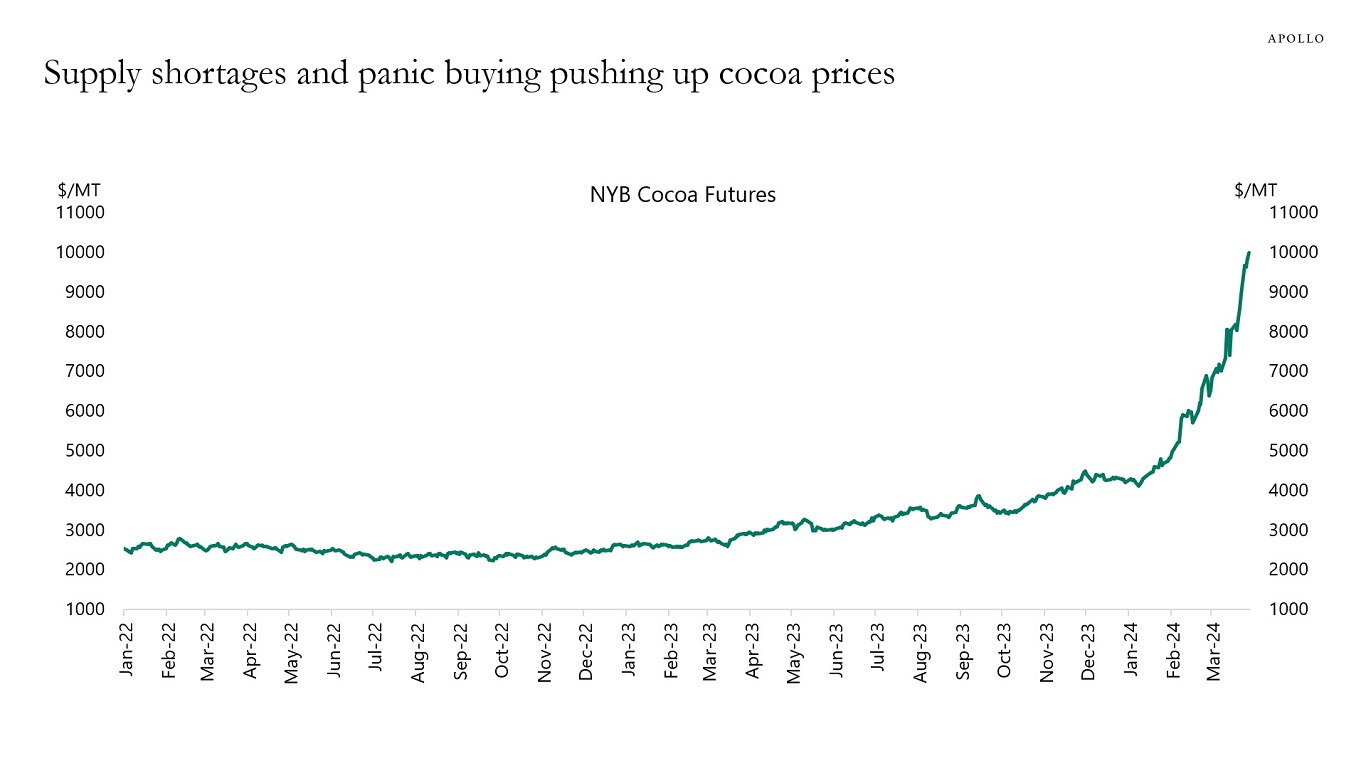

Your Chocolate Is About to Become Much More Expensive

Cocoa prices have tripled over the past six months, driven by extreme weather in West Africa, crop disease, and associated panic buying, see chart below.