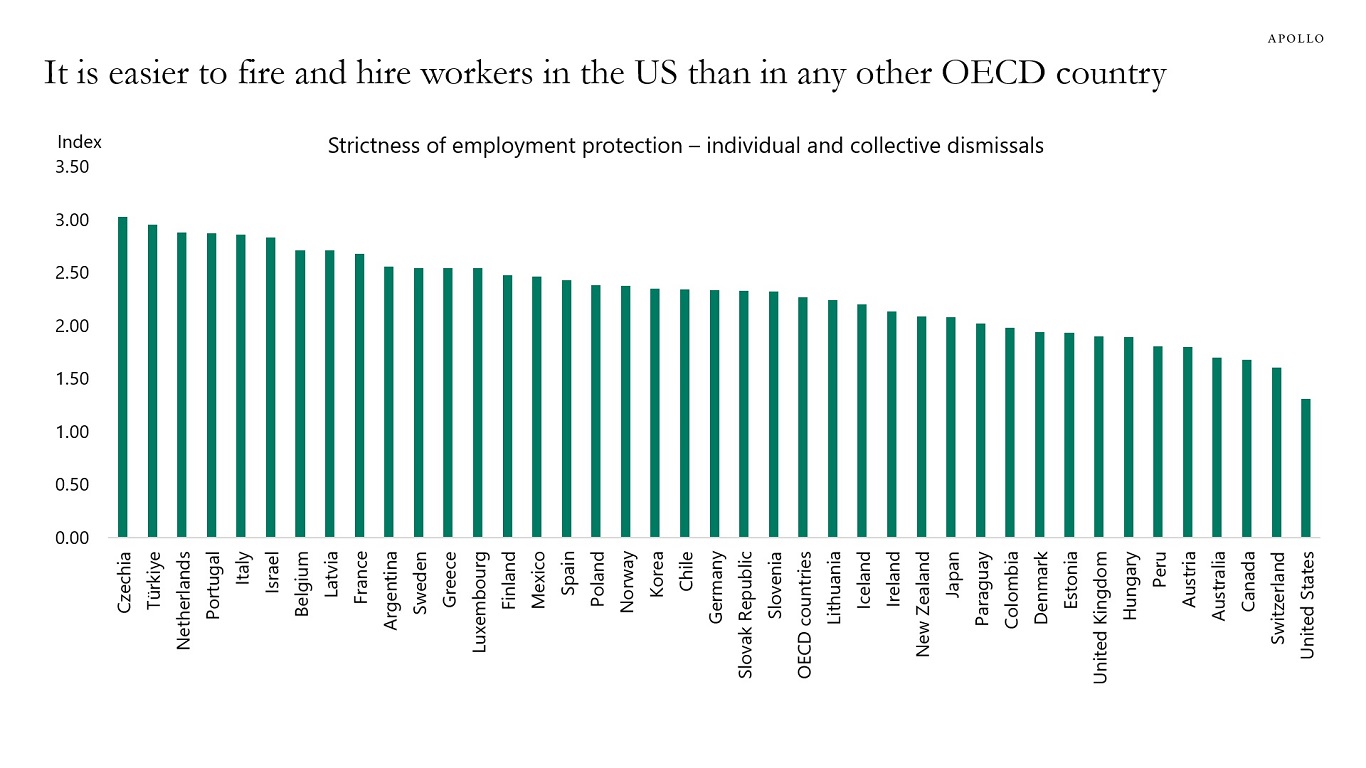

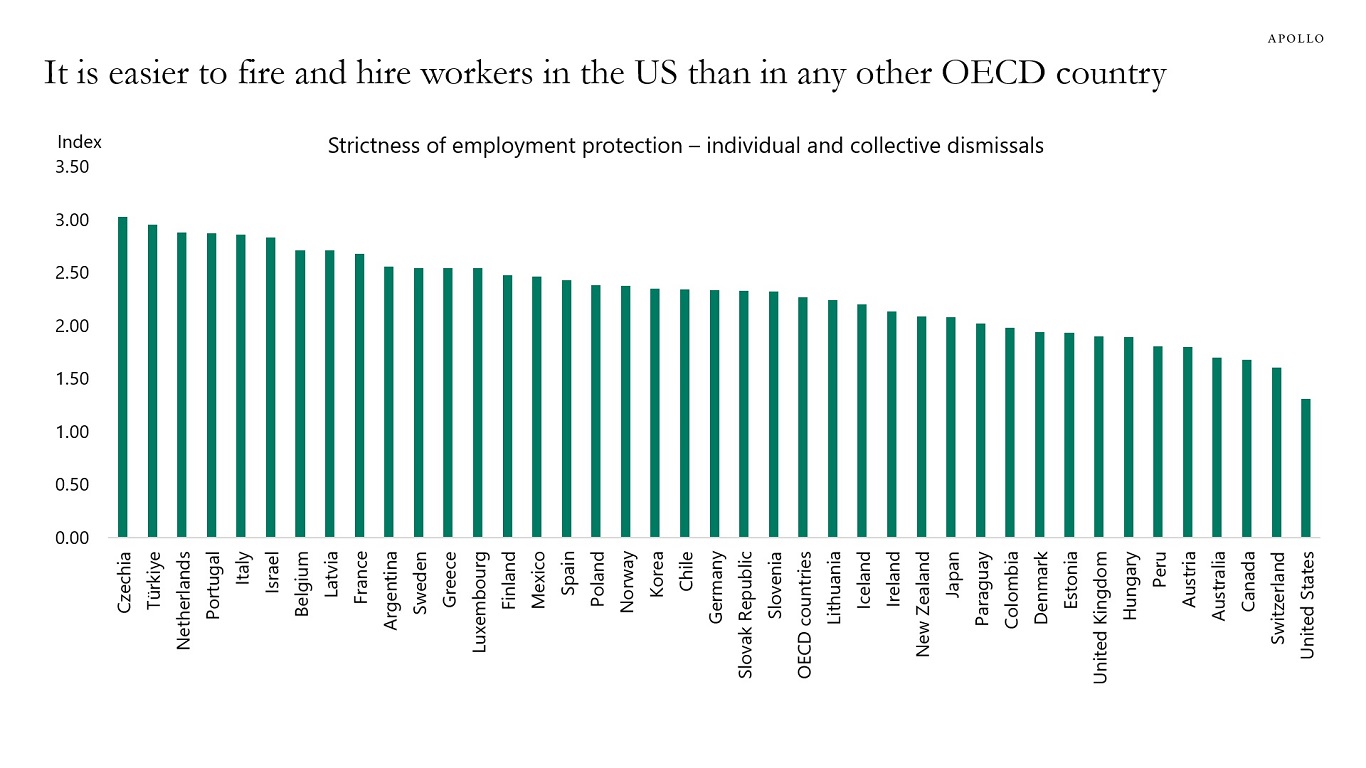

Having a flexible labor market where it is easy to hire and fire workers increases potential growth and resilience to shocks. The US has the most flexible labor market among all OECD countries, see the chart below.

Having a flexible labor market where it is easy to hire and fire workers increases potential growth and resilience to shocks. The US has the most flexible labor market among all OECD countries, see the chart below.

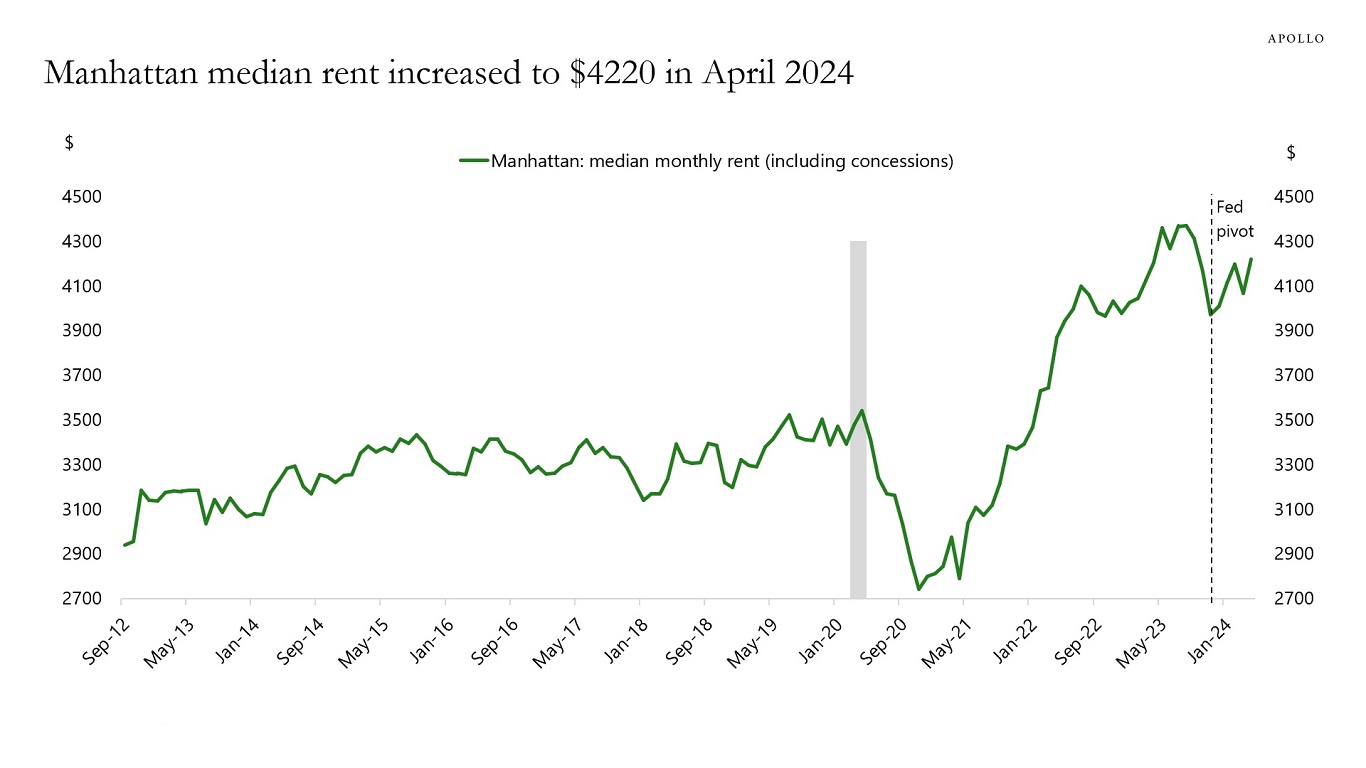

After the Fed pivot in November 2023, lower mortgage rates, rising stock prices, and increased activity in capital markets have put upward pressure on rents in Manhattan, see the first chart below.

Over the same period, easy financial conditions have boosted the housing market, with home prices currently up 7.3% over the past 12 months.

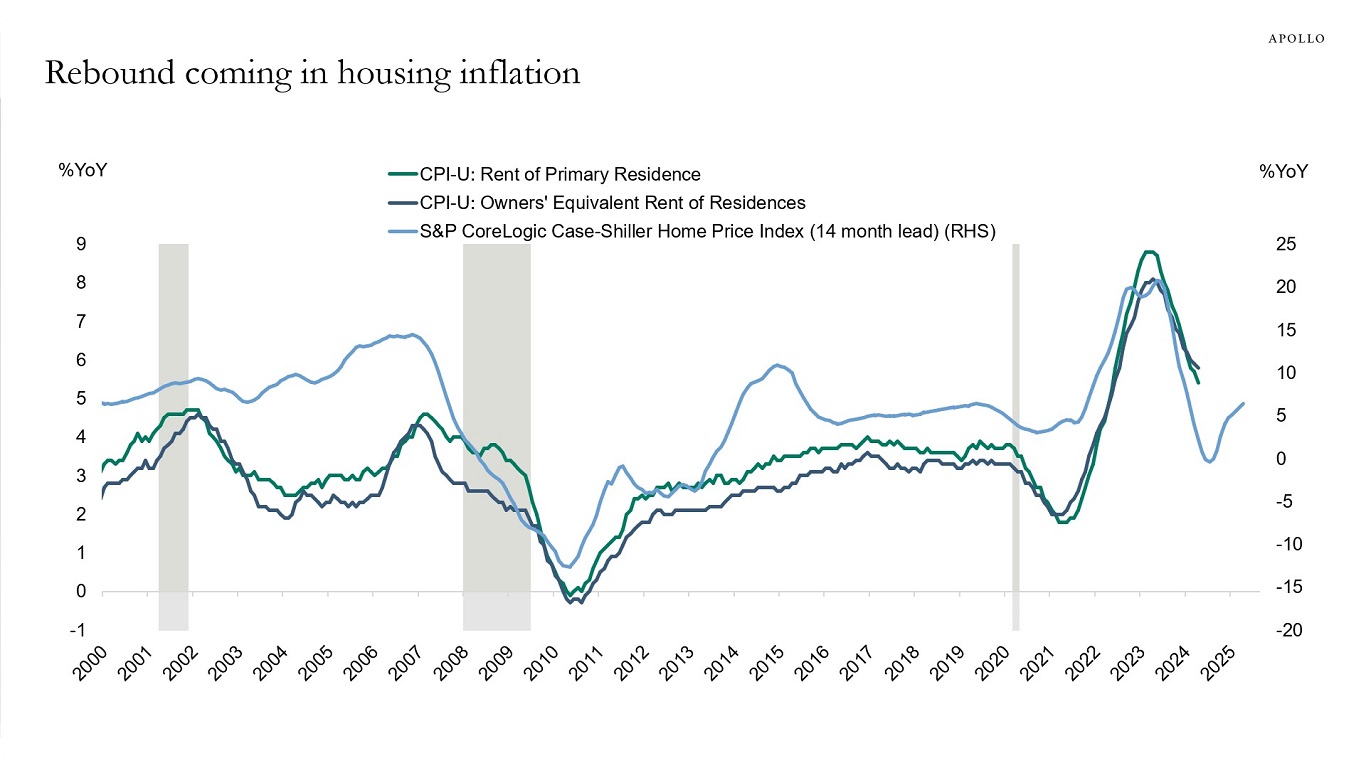

With this backdrop, the risks are rising that shelter inflation may begin to flatten out over the coming months and maybe even rise later this year, see the second chart.

The Fed will have to keep interest rates higher for longer to prevent housing inflation from becoming a problem again.

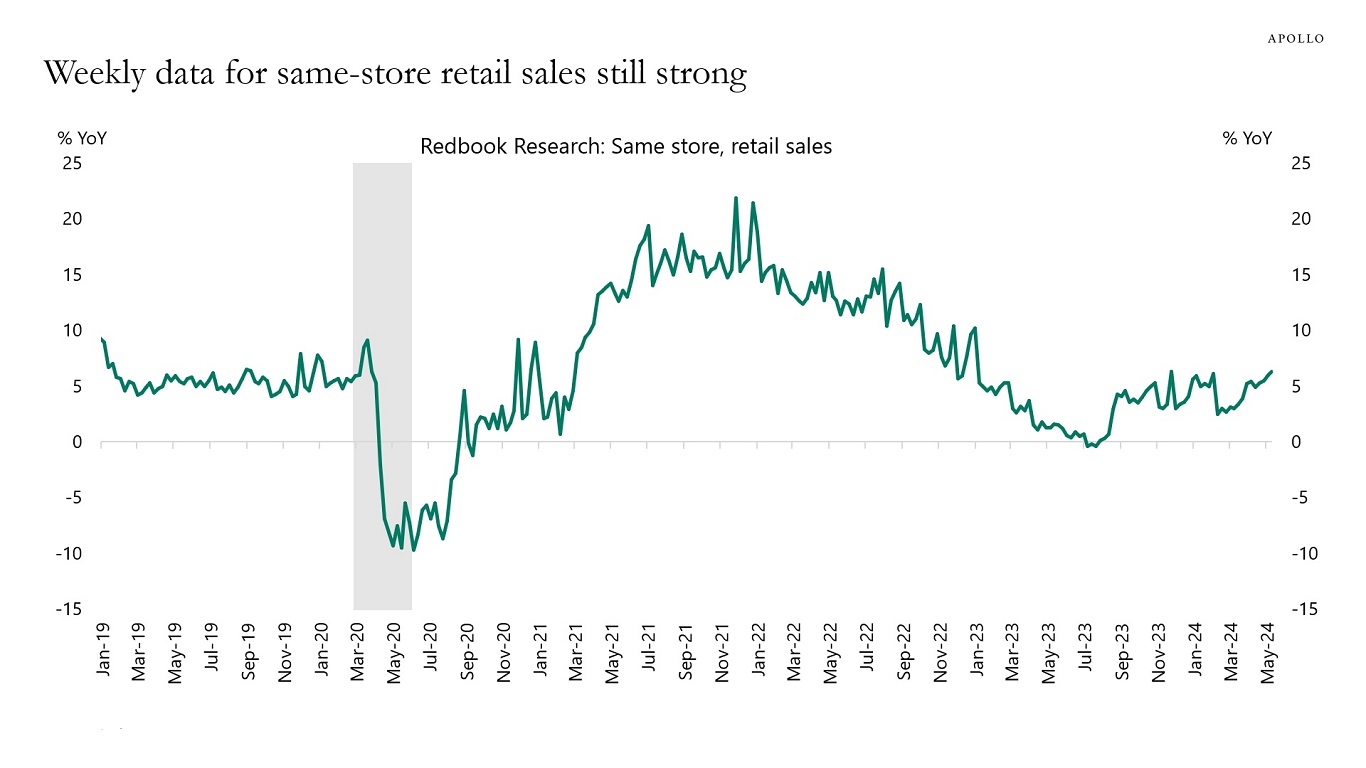

Weekly data for consumer spending continues to show no signs of a slowdown in private consumption, see chart below.

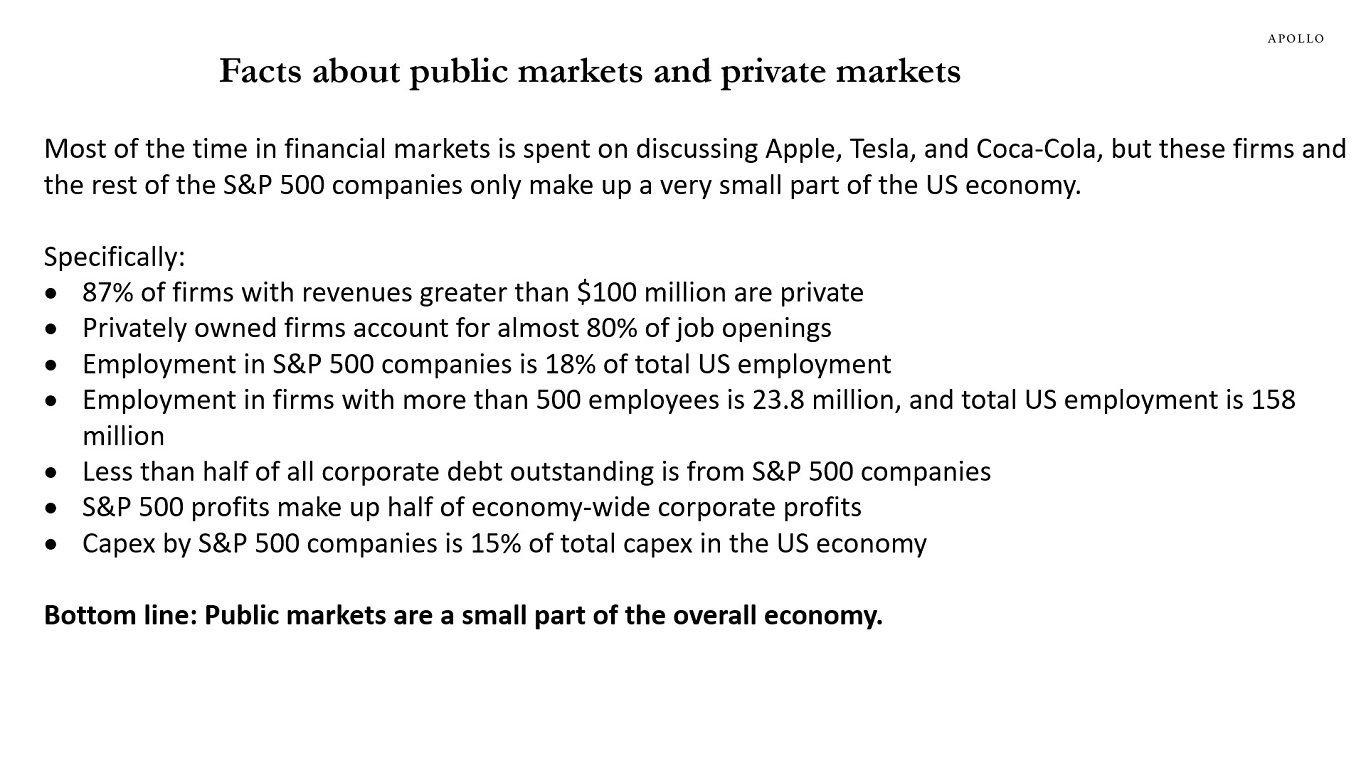

Most of the time in financial markets is spent on discussing Apple, Tesla, and Coca-Cola, but these firms and the rest of the S&P 500 companies only make up a very small part of the US economy, see our chart book available here.

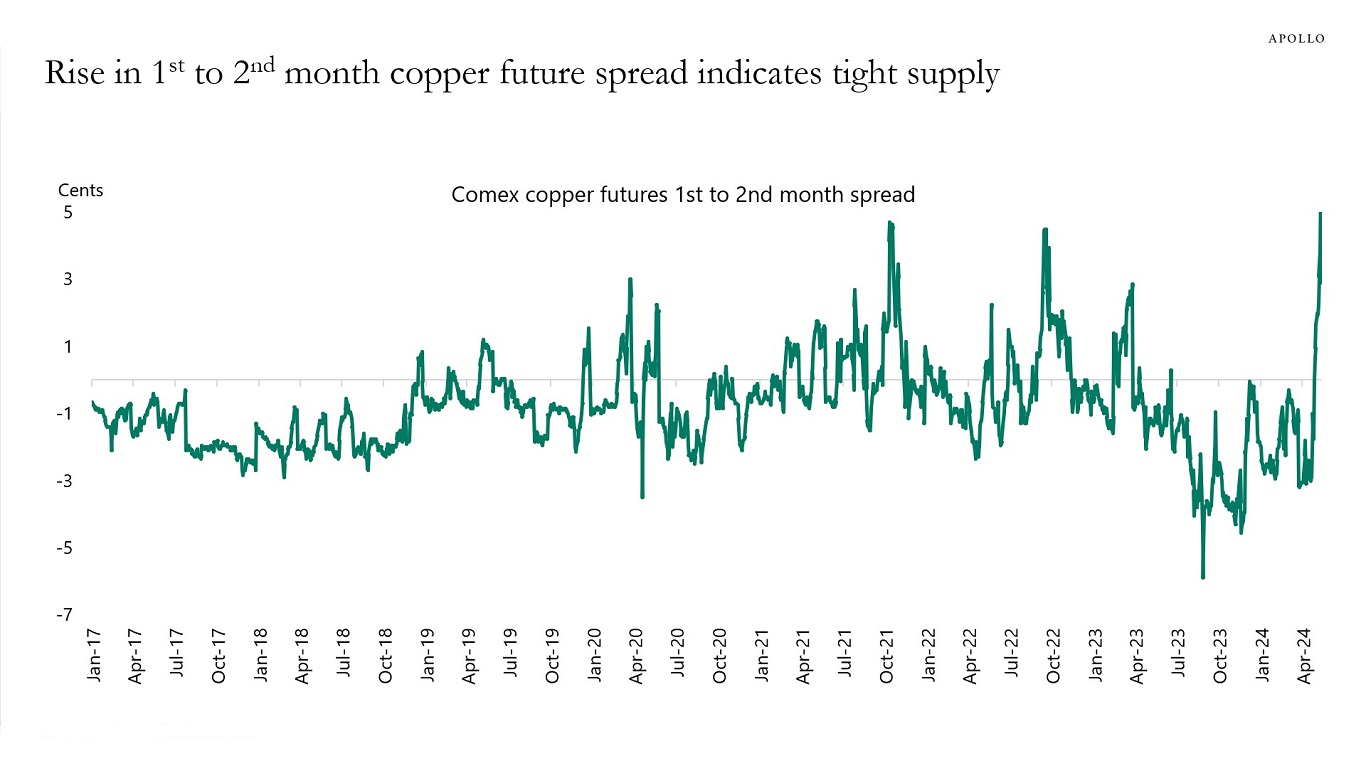

Copper prices are rising due to supply shortages, hedge fund speculation, China demand, AI demand, and green energy demand. For more, see our chart book available here.

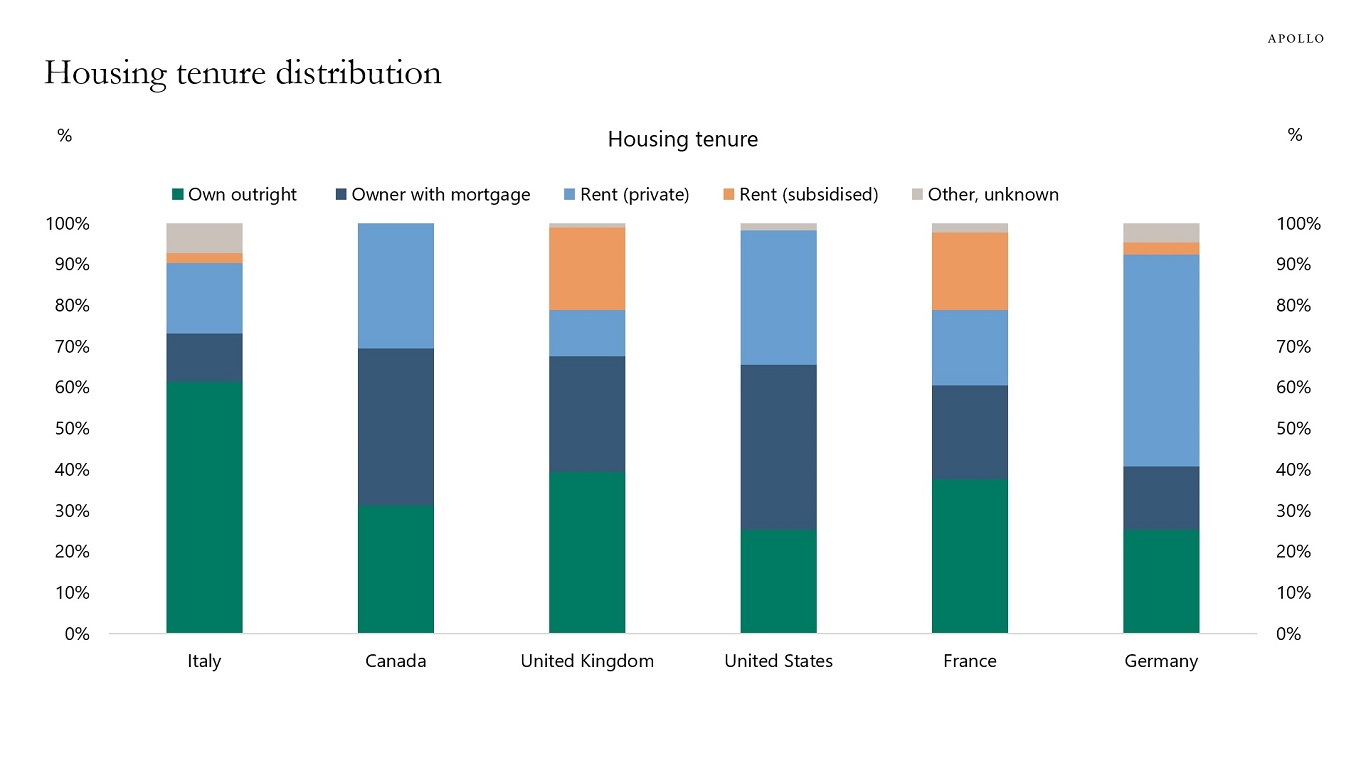

The share of the population that owns their home varies across the G7 countries, with a homeownership rate in Germany at 41%, in the US at 65%, and in Italy 73%, see chart below.

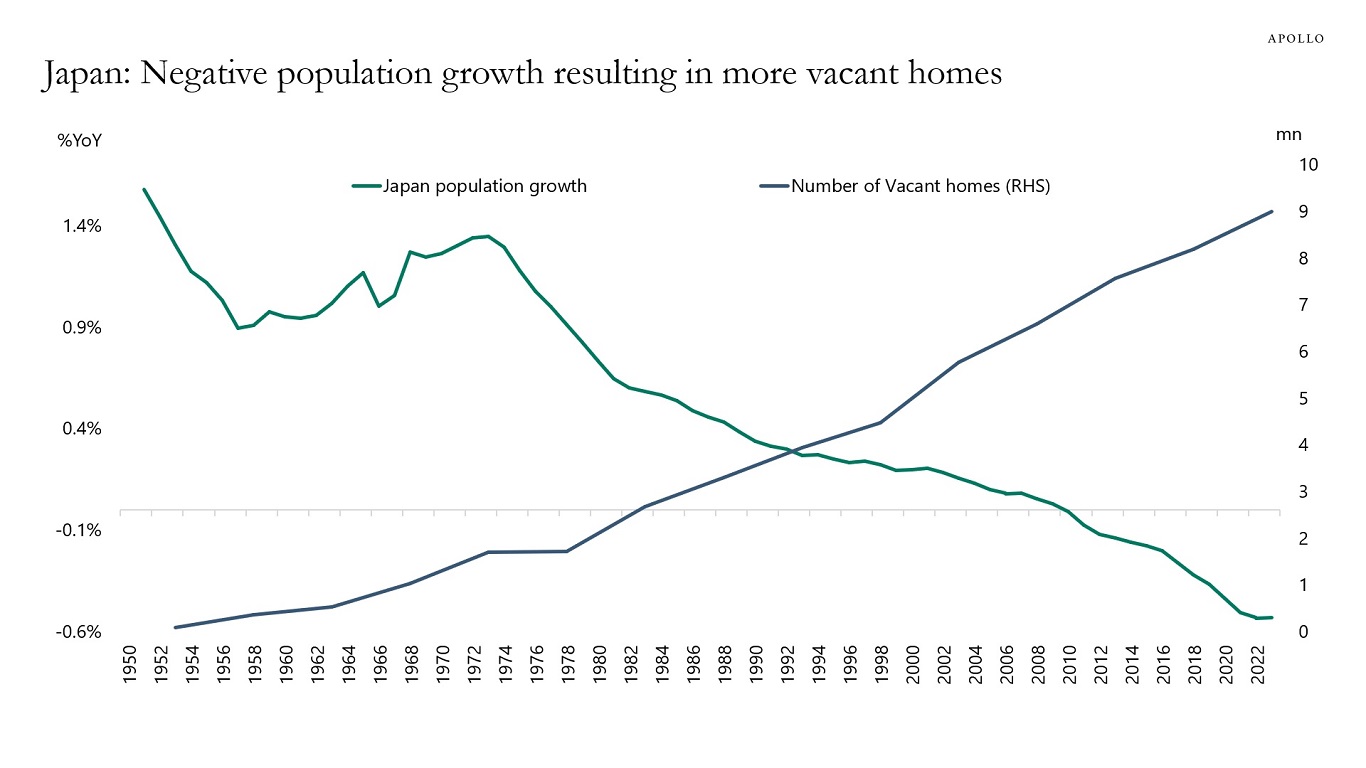

In Japan, the population is shrinking, and, as a result, the number of vacant homes is rising, see chart below.

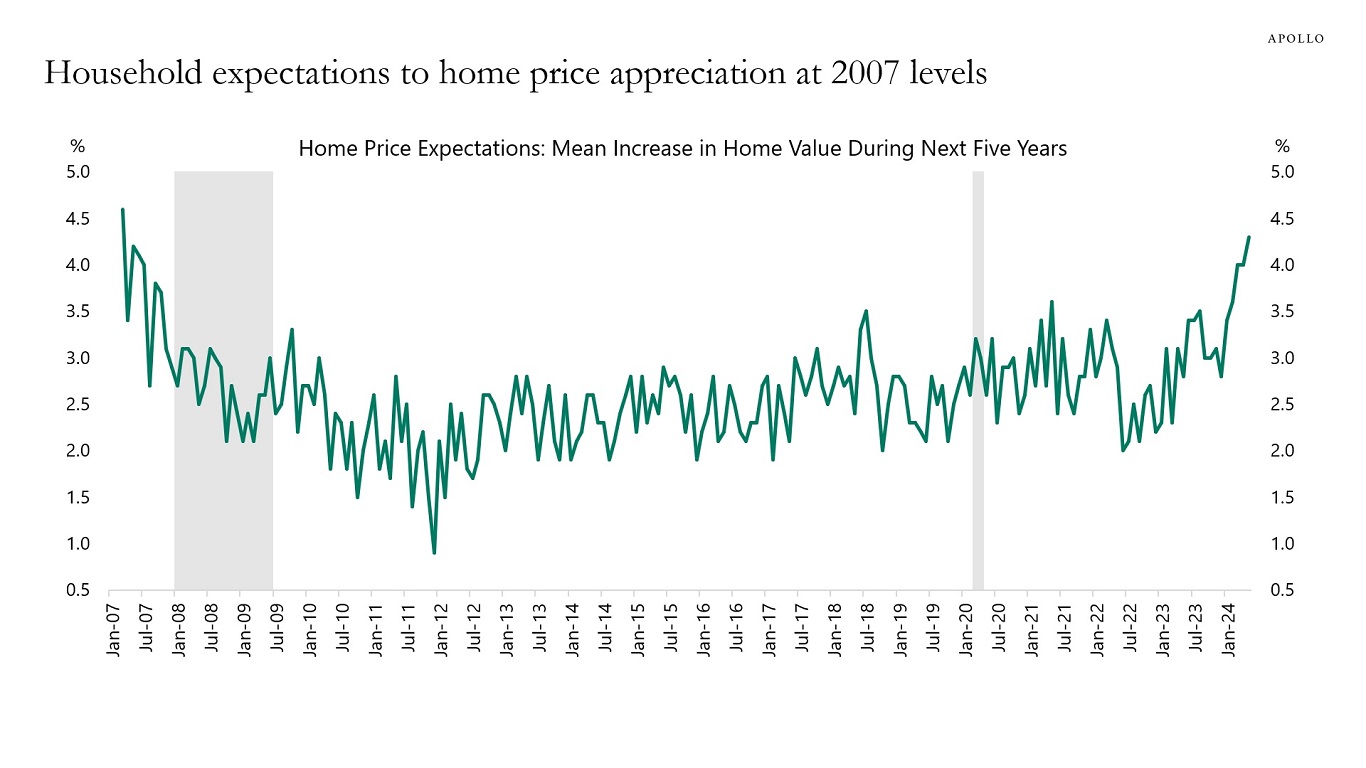

Household expectations to future home price appreciation are currently at the highest level since 2007, see chart below.

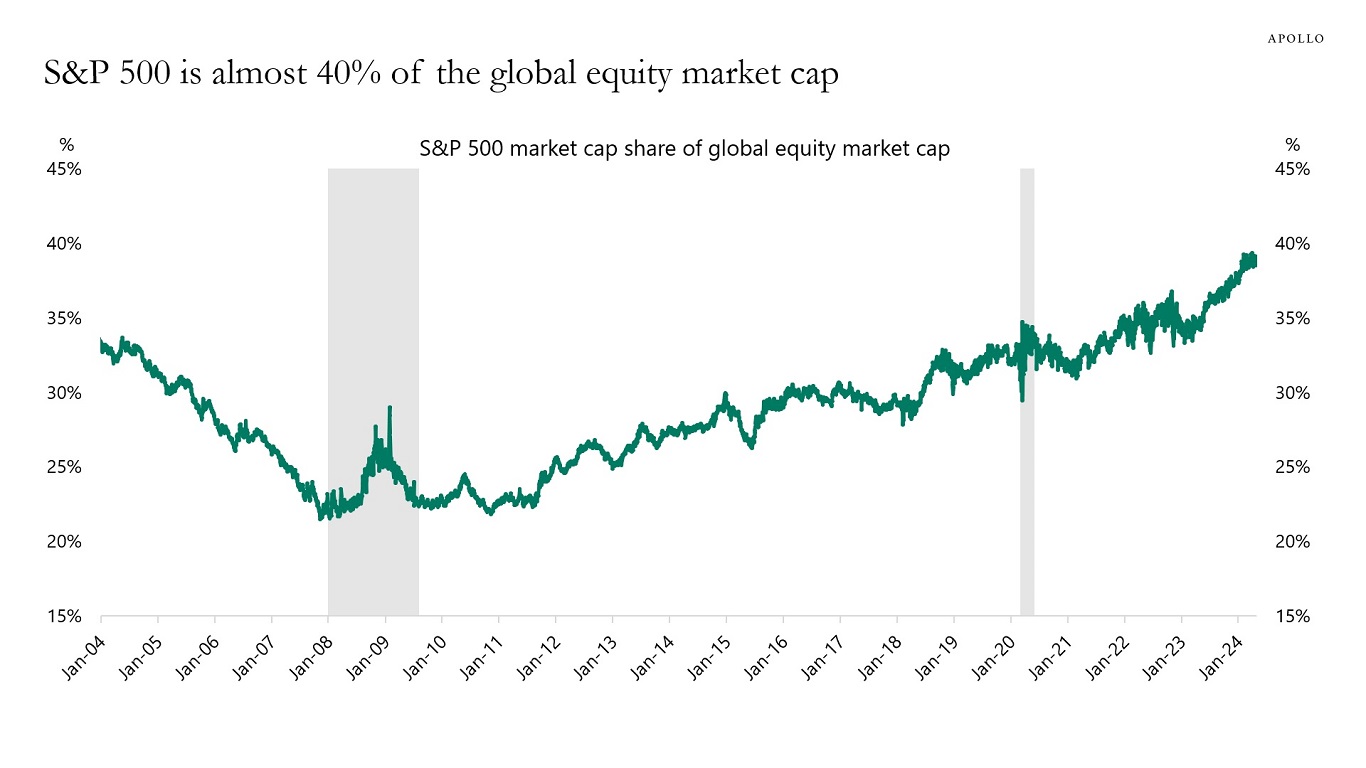

US markets continue to outperform international markets, and the market cap of the S&P 500 is currently the biggest share of the global market cap in decades, see chart below.

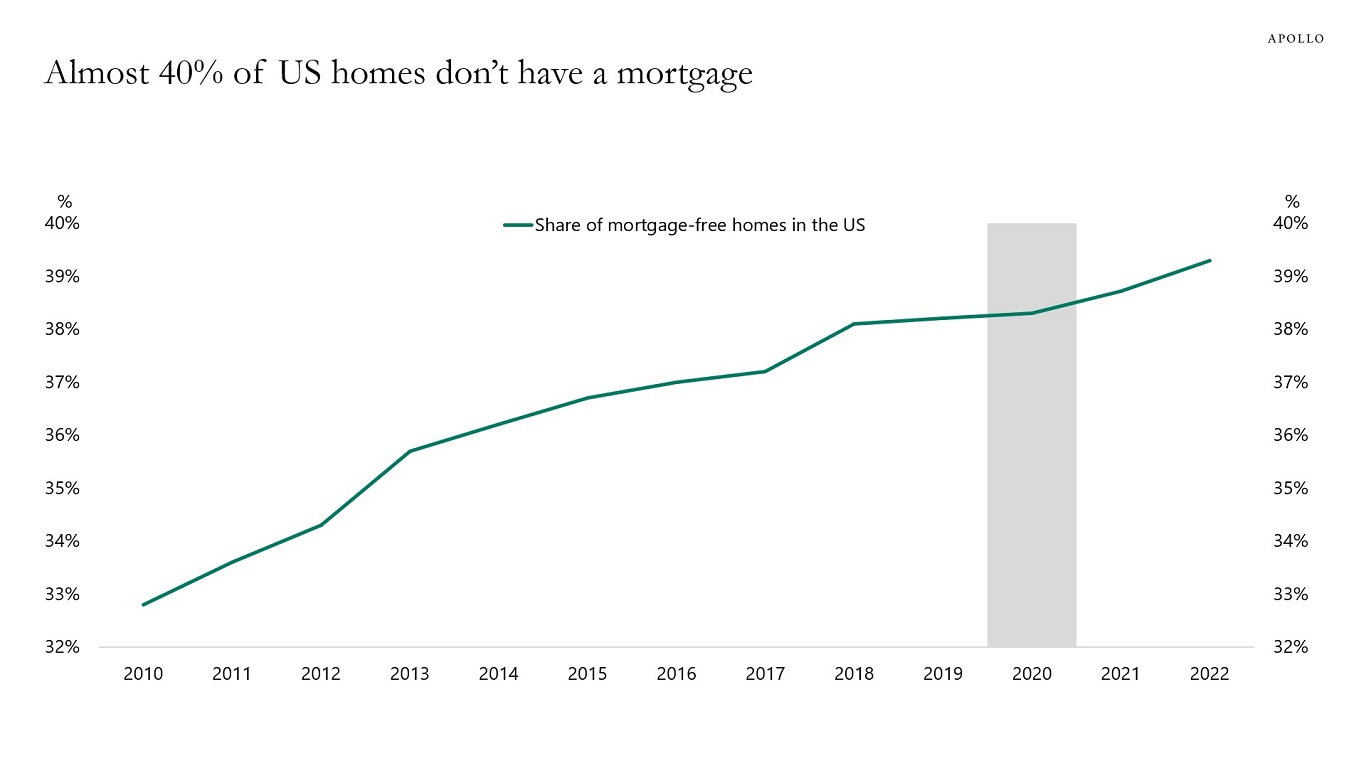

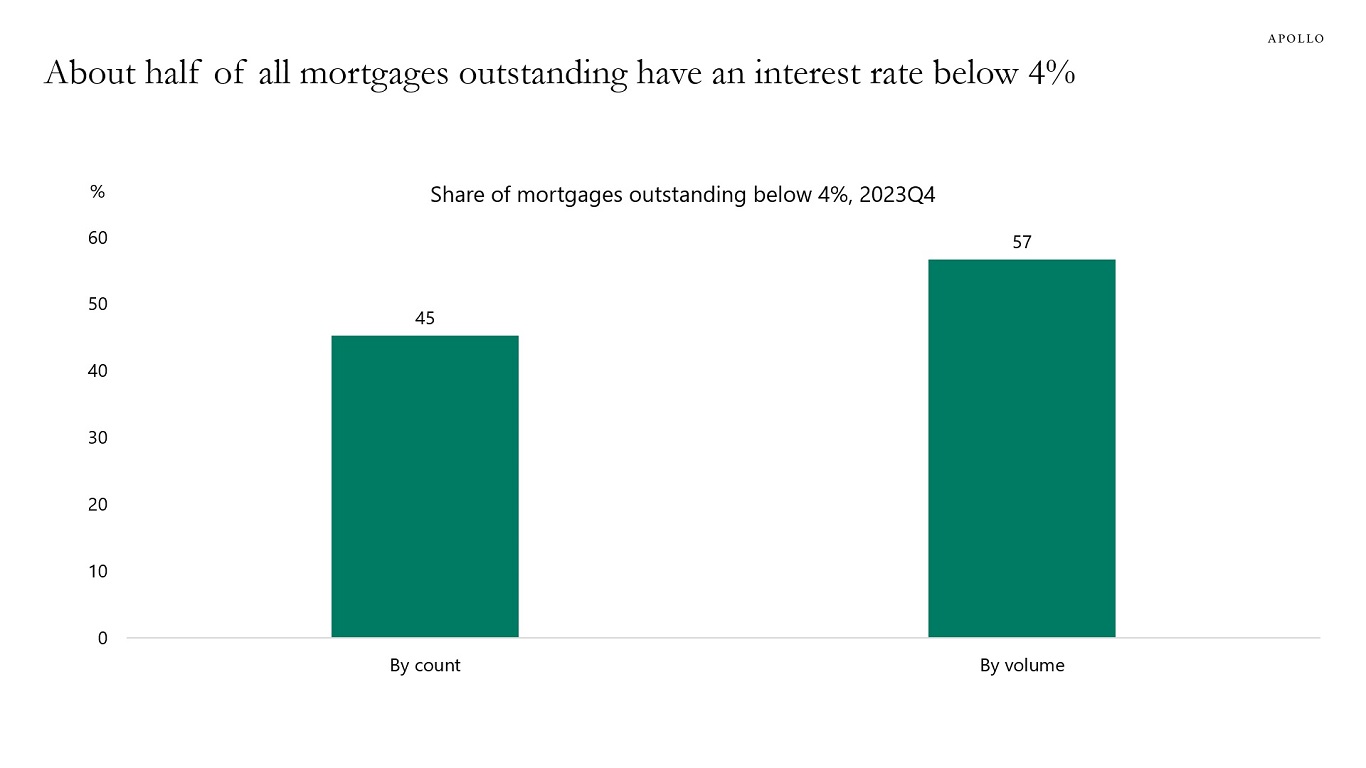

The transmission mechanism of monetary policy is weaker because a rising share of US homes don’t have a mortgage, and about half of all mortgages have an interest rate locked in below 4%, see charts below.