The Benefits of Having More Sources of Financing Available

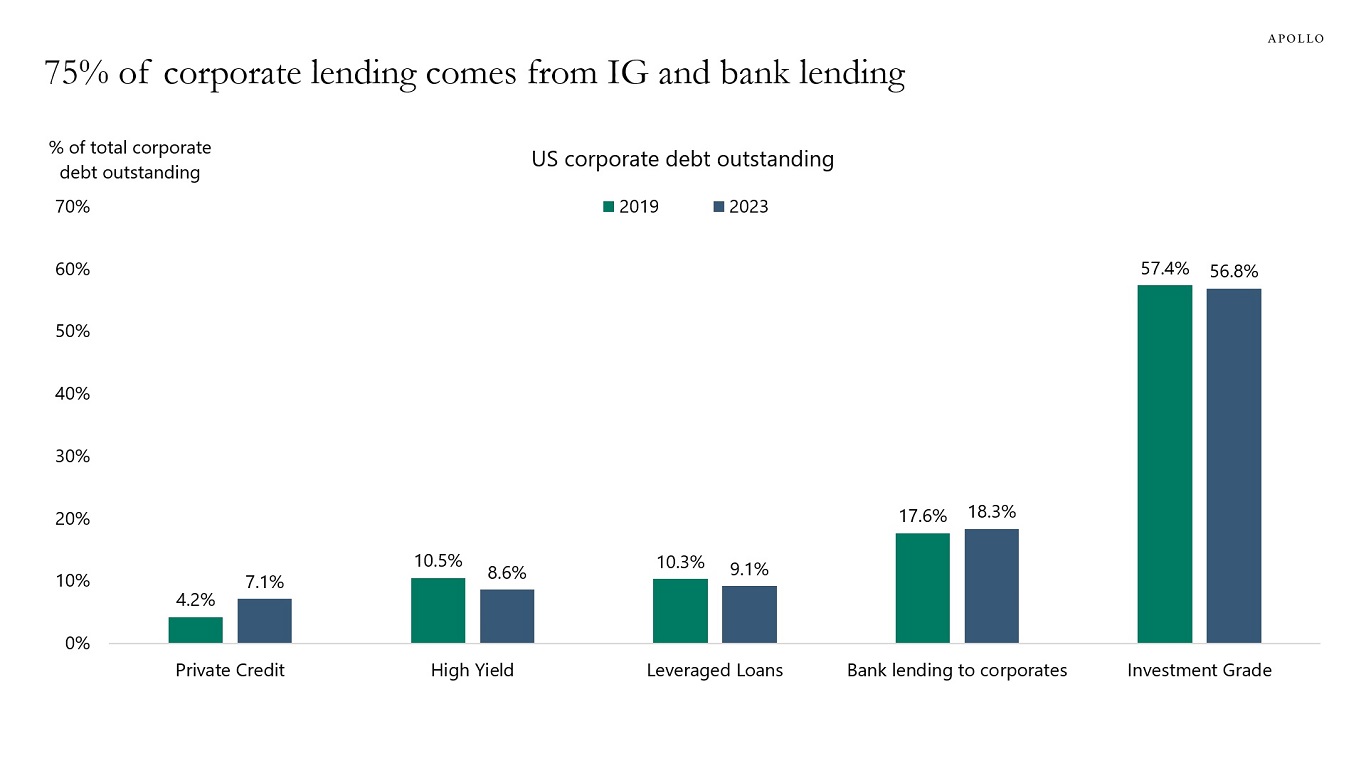

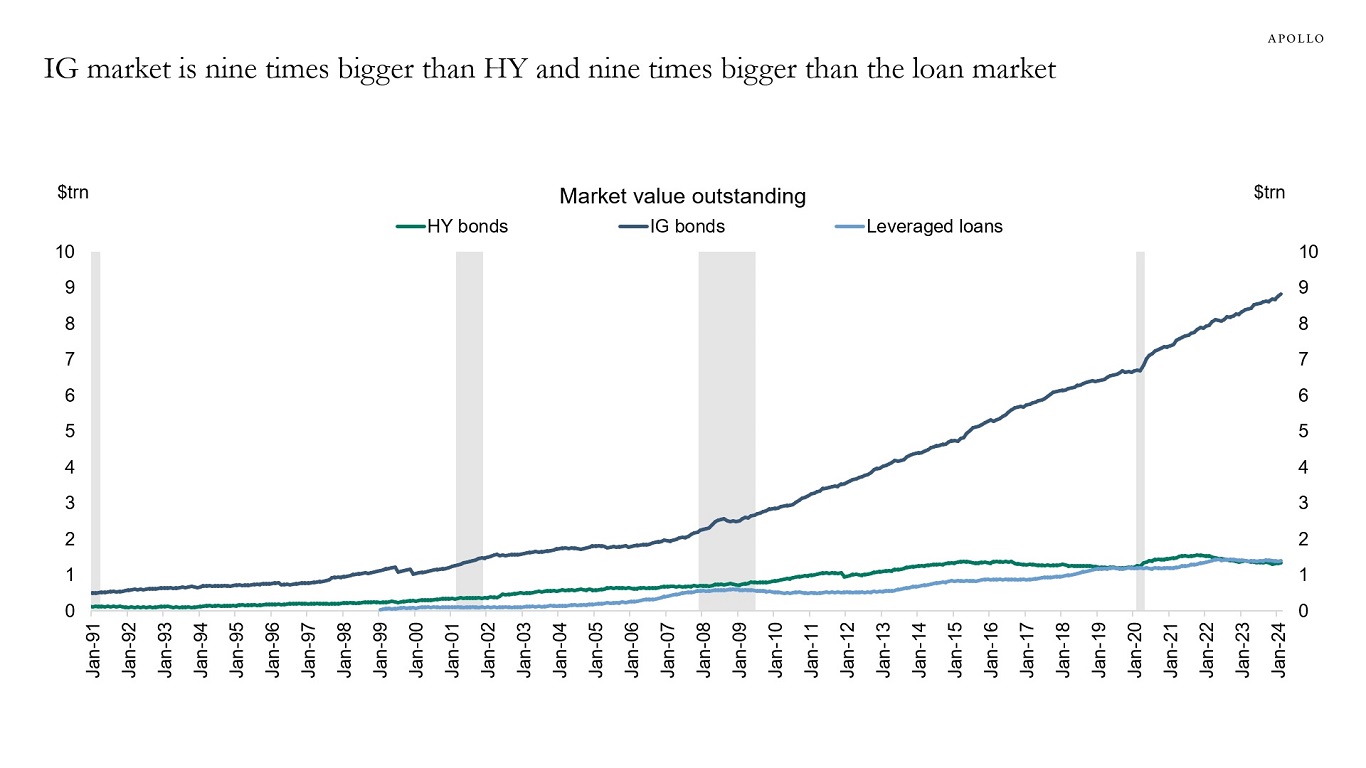

The rising market share of private credit is not coming from banks, it is coming from investment grade markets, high yield markets, and leveraged loan markets, see chart below.

A financial system with more sources of financing for firms has two macroeconomic benefits.

First, the more choices firms have when they need financing, the better. A more diversified financial system with competition between credit providers is better for economic growth, particularly when some players, such as banks, have high leverage and uncertainty about deposits as their source of financing.

Second, having different types of financing available creates more financial stability as more participants can stabilize the financial system and provide credit or buy equity in case of a sudden change in sentiment in financial markets or the economy.

The bottom line is that:

1) The growth in private credit is giving firms in need of financing more choice and thereby boosting long-run growth, and

2) The growth in private markets is improving financial stability with more capital willing to step in when there is distress.

For more discussion see also this OECD working paper and this IMF working paper.

Middle-Market Firms Hit Harder by Fed Hikes

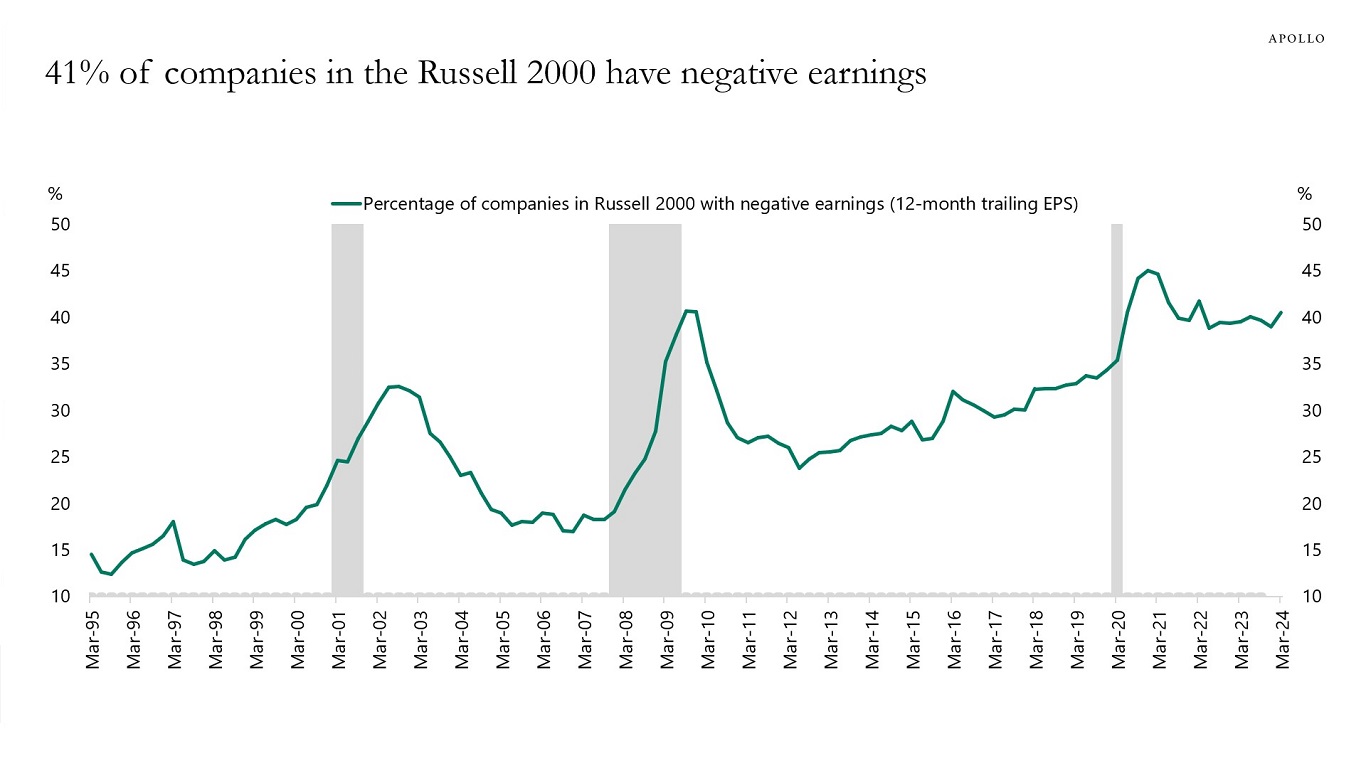

Forty-one percent of companies in the Russell 2000 have negative earnings, see the first chart.

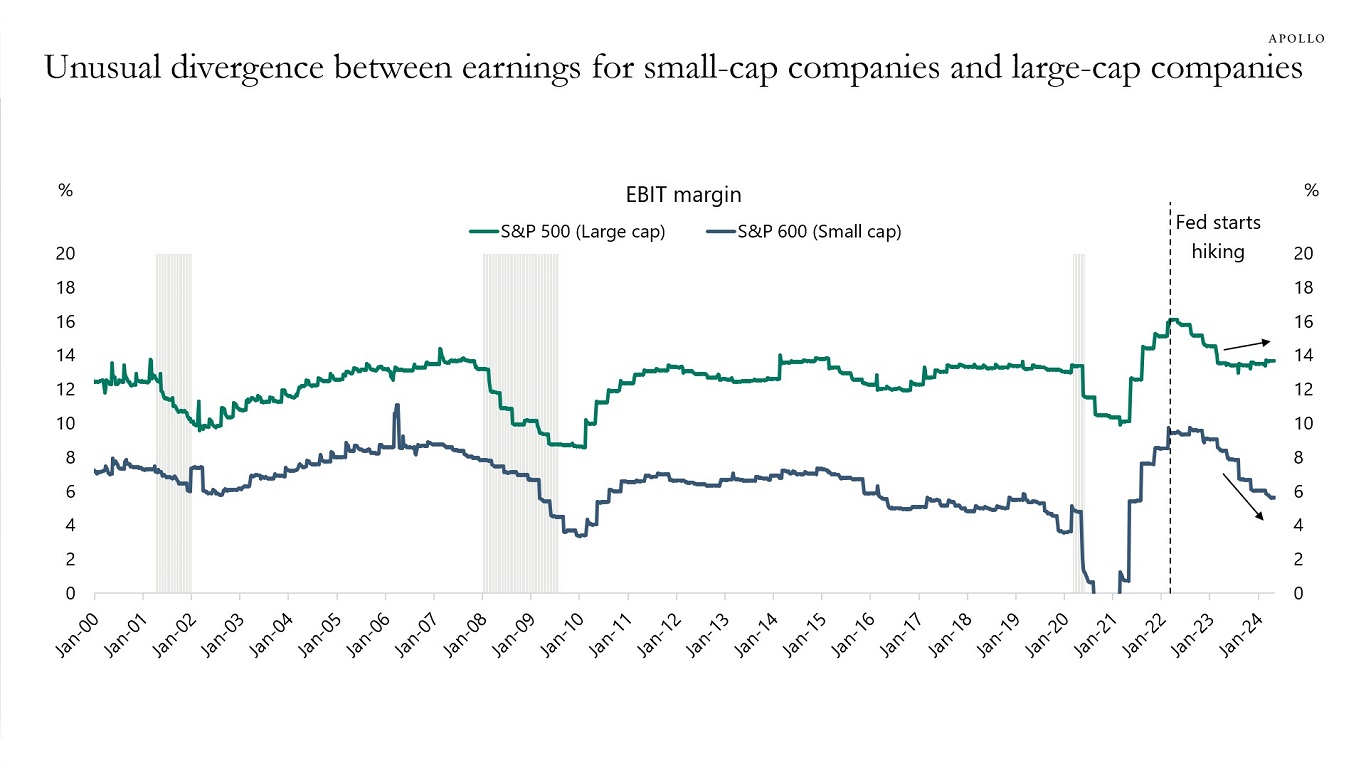

With this backdrop, it is unsurprising that Fed hikes have a more negative impact on small-cap and middle-market companies than on large-cap companies, see the second chart.

The negative impact can be felt in particular in tech, enterprise software, venture capital, and similar firms with no earnings and no revenue.

Tech Jobs Leaving California

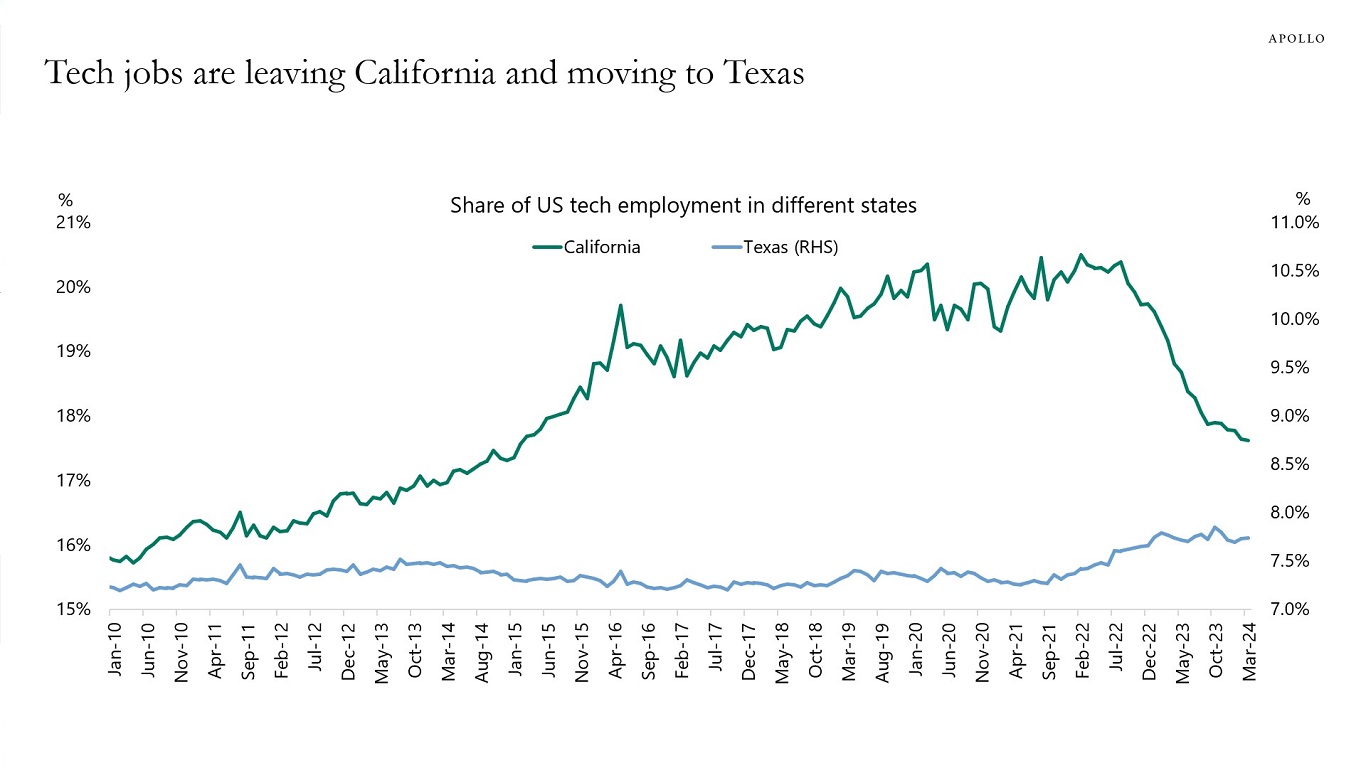

The share of tech jobs in California has been declining and the share of tech jobs in Texas has been rising, see chart below.

Dividend Recaps Coming Back

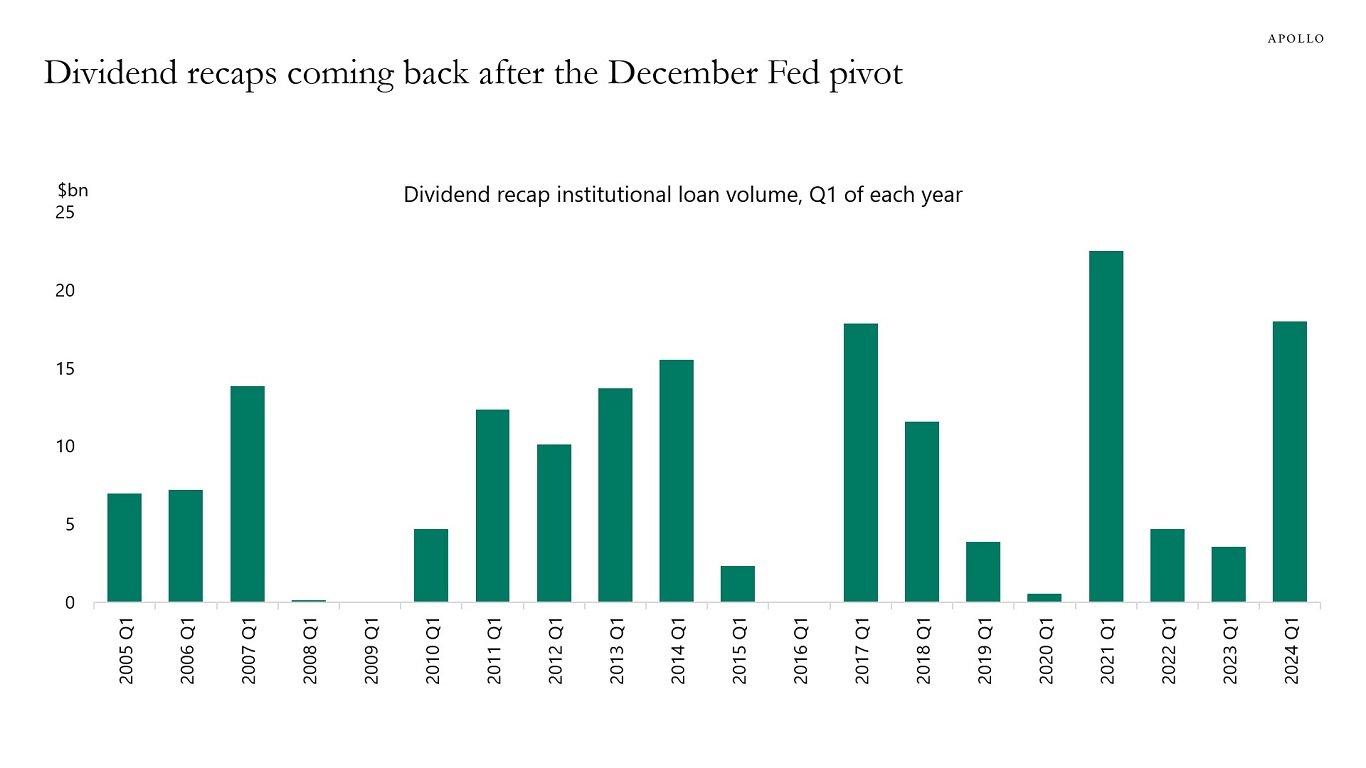

The December Fed pivot triggered a boom in dividend recaps, see chart below.

The Forecasting Record of the Fed and the Market

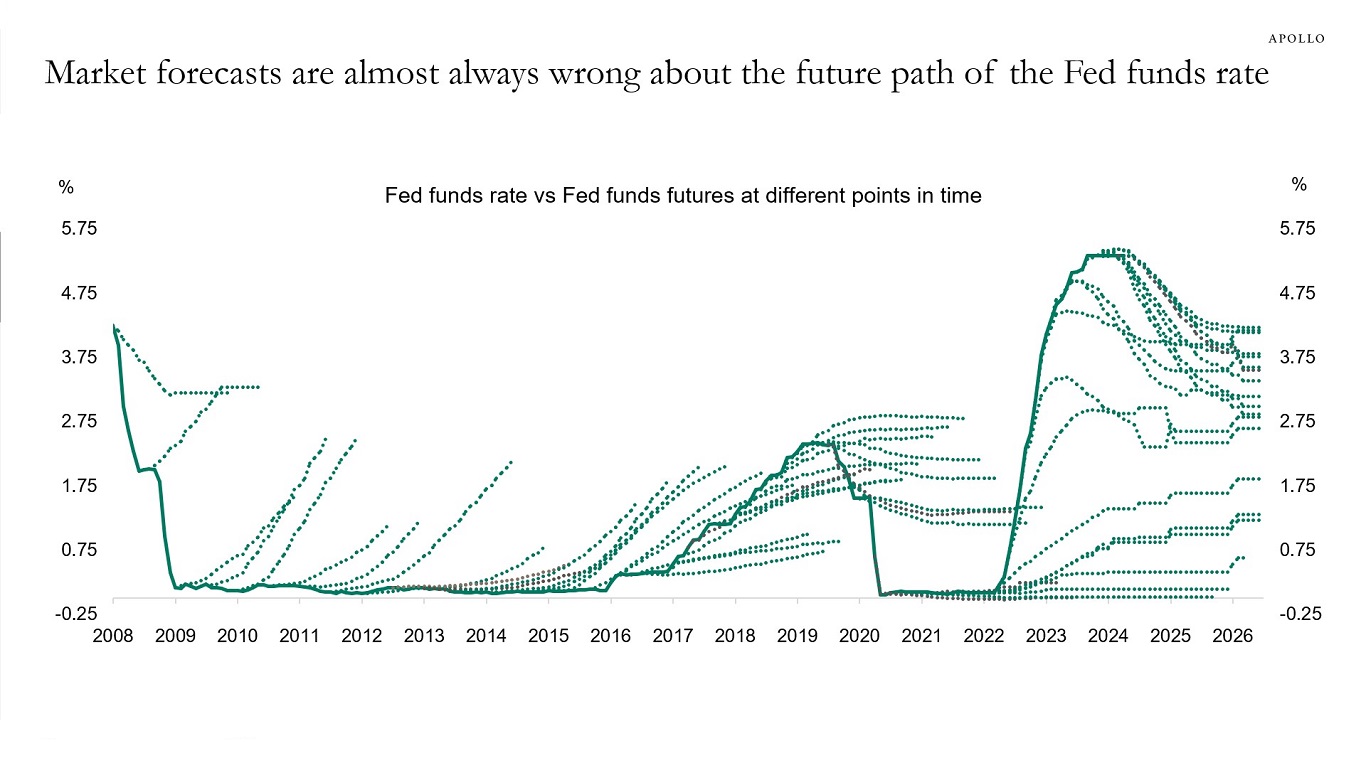

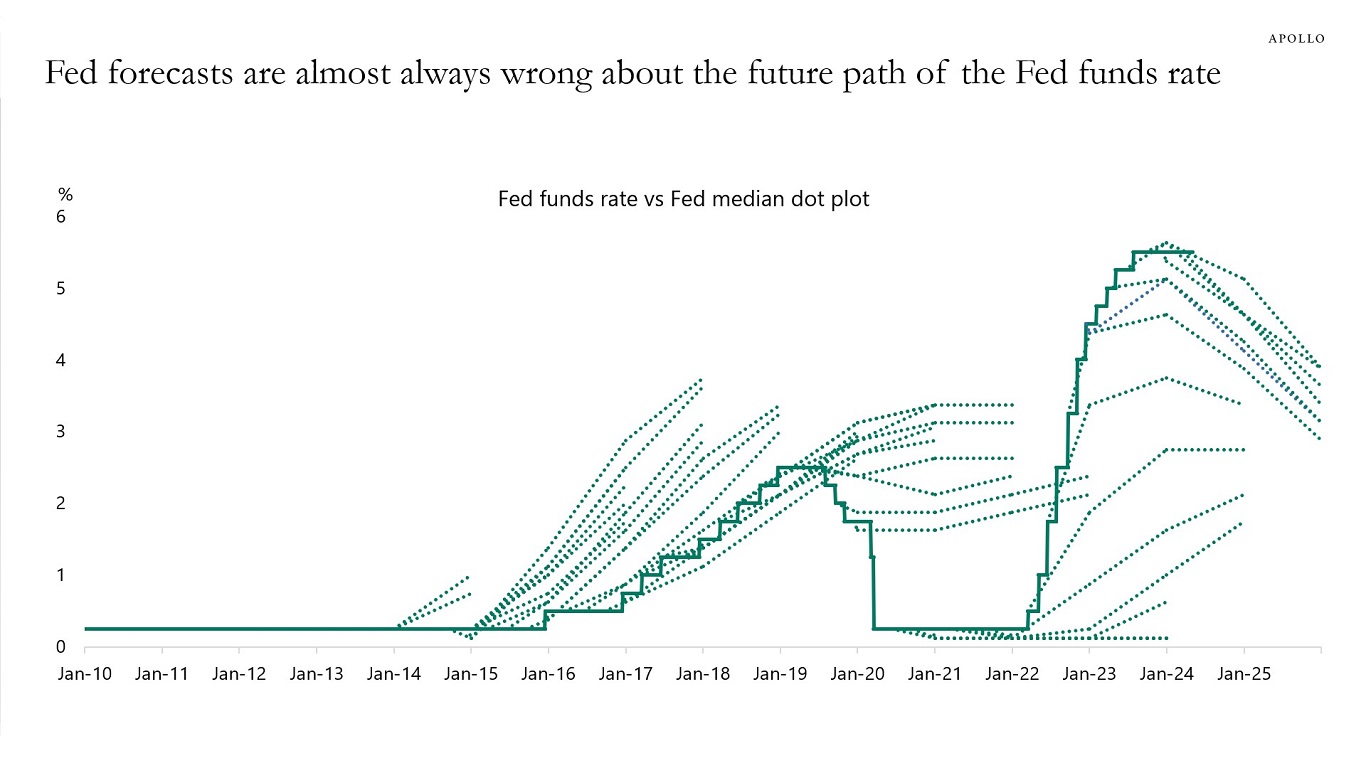

The Fed started publishing the dot plot in 2012, and comparing the Fed’s forecasts with the forecasts from Fed funds futures yields three important conclusions, see charts below:

1) The Fed’s and the market’s forecasts about the future path of the Fed funds rate are almost always wrong.

2) The forecasts are very similar, and the Fed has managed to anchor market expectations about where it thinks the Fed funds rate is going.

3) The direction of the forecasting mistake is always identical, suggesting that the market is taking its cue about the future path of interest rates from the Fed’s dot plot.

The good news is that the Fed is able to anchor market expectations, and thereby reduce volatility in financial markets.

The bad news is that when the Fed’s forecast is wrong and the FOMC has to move from three cuts in 2024 to say, one cut, it will hurt Fed credibility.

The US economy’s lower interest-rate sensitivity, combined with strong structural and cyclical tailwinds to growth, brings us to the conclusion that the Fed will not cut interest rates in 2024.

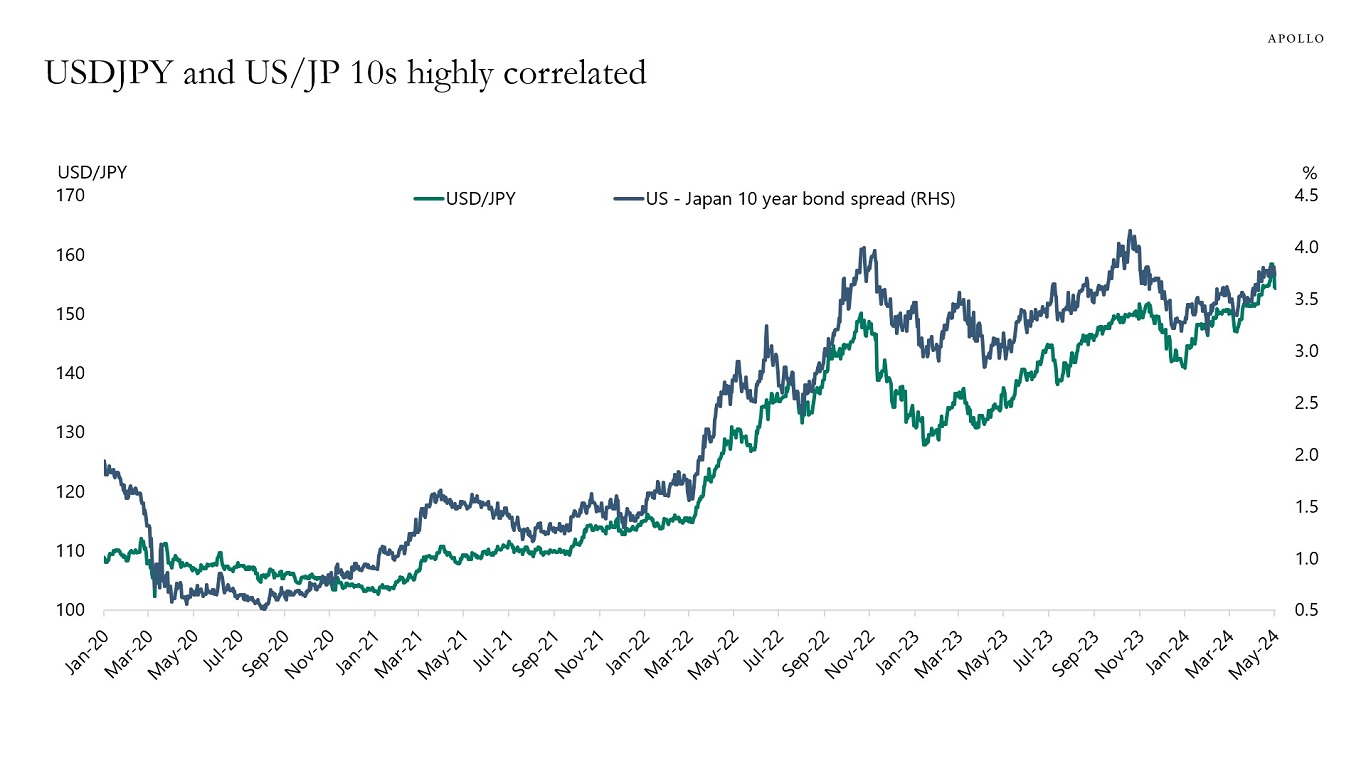

Why Is the Yen Depreciating?

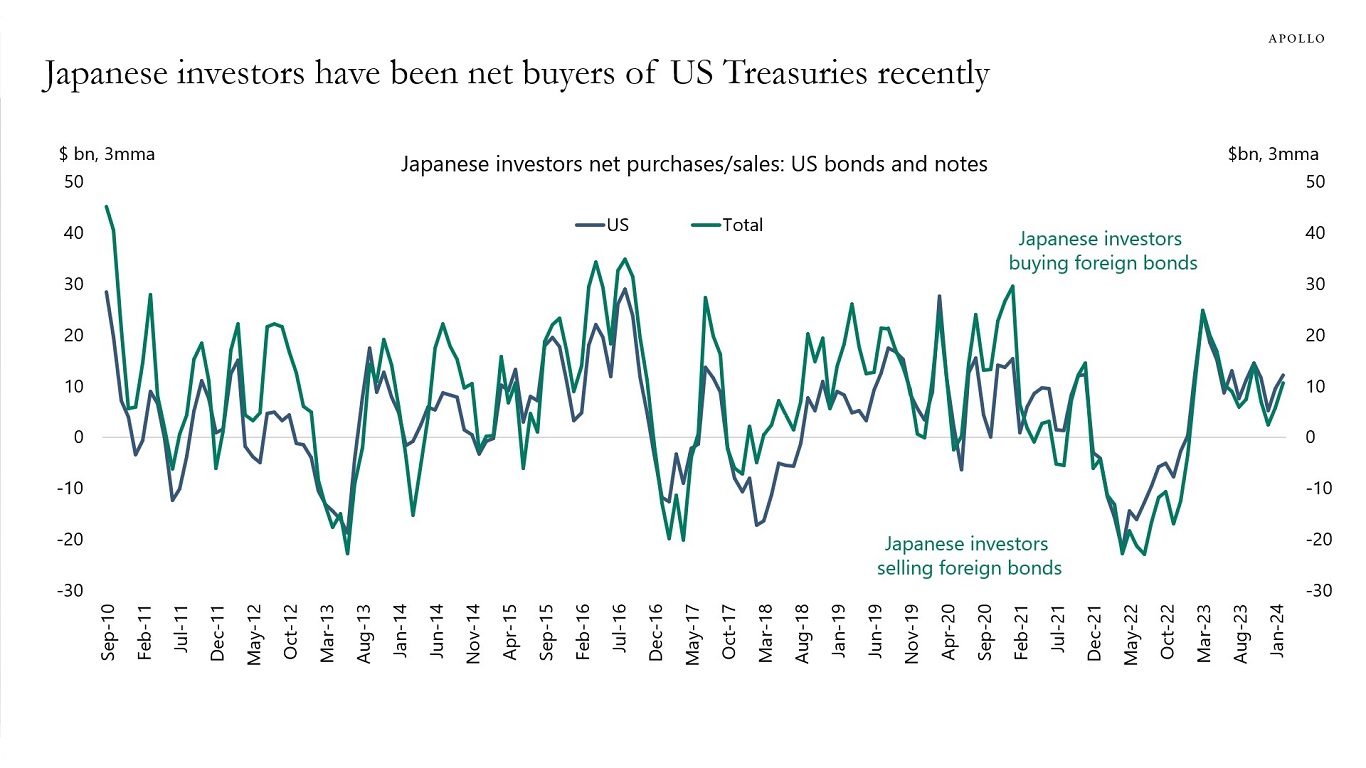

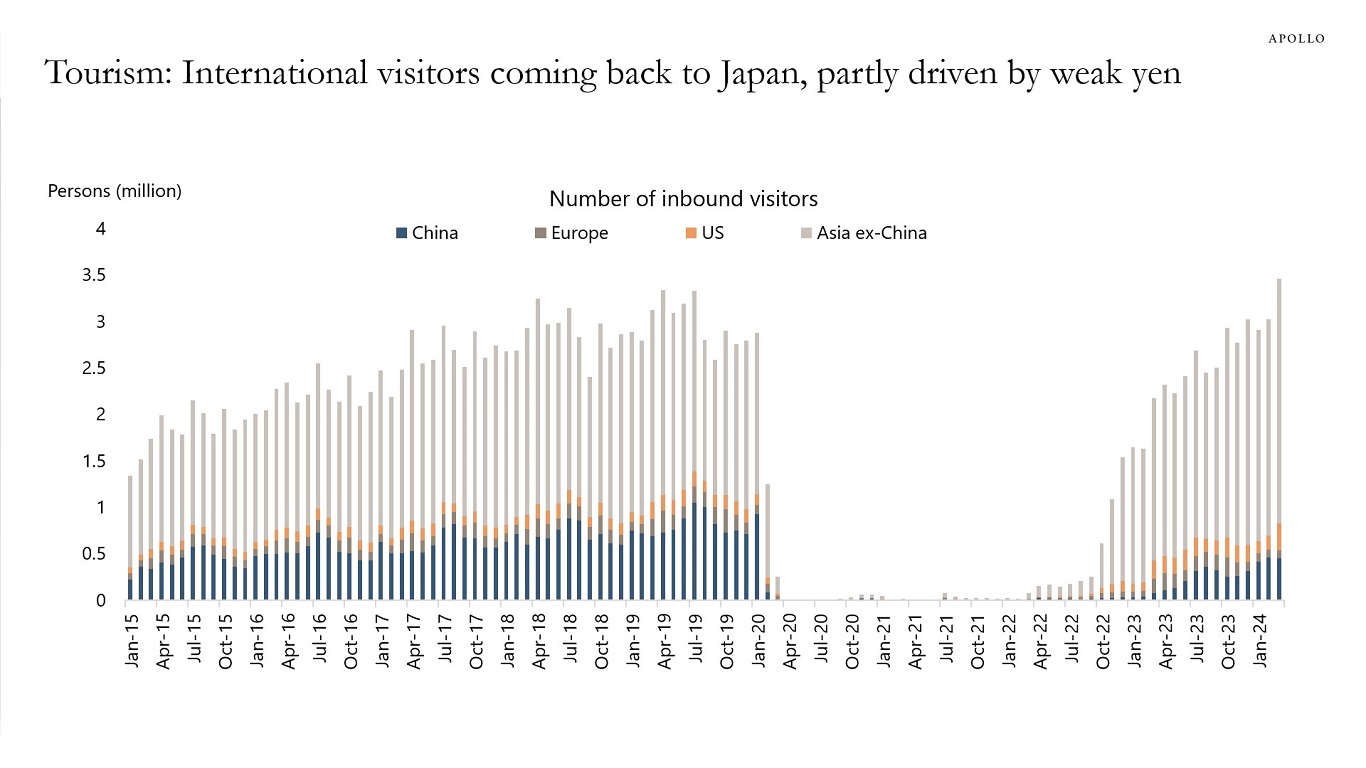

The sources of yen depreciation are the Fed keeping rates higher for longer, the BoJ keeping rates lower for longer, and worries about what higher Japanese interest rates mean for fiscal sustainability.

For more, see also our chart book available here.

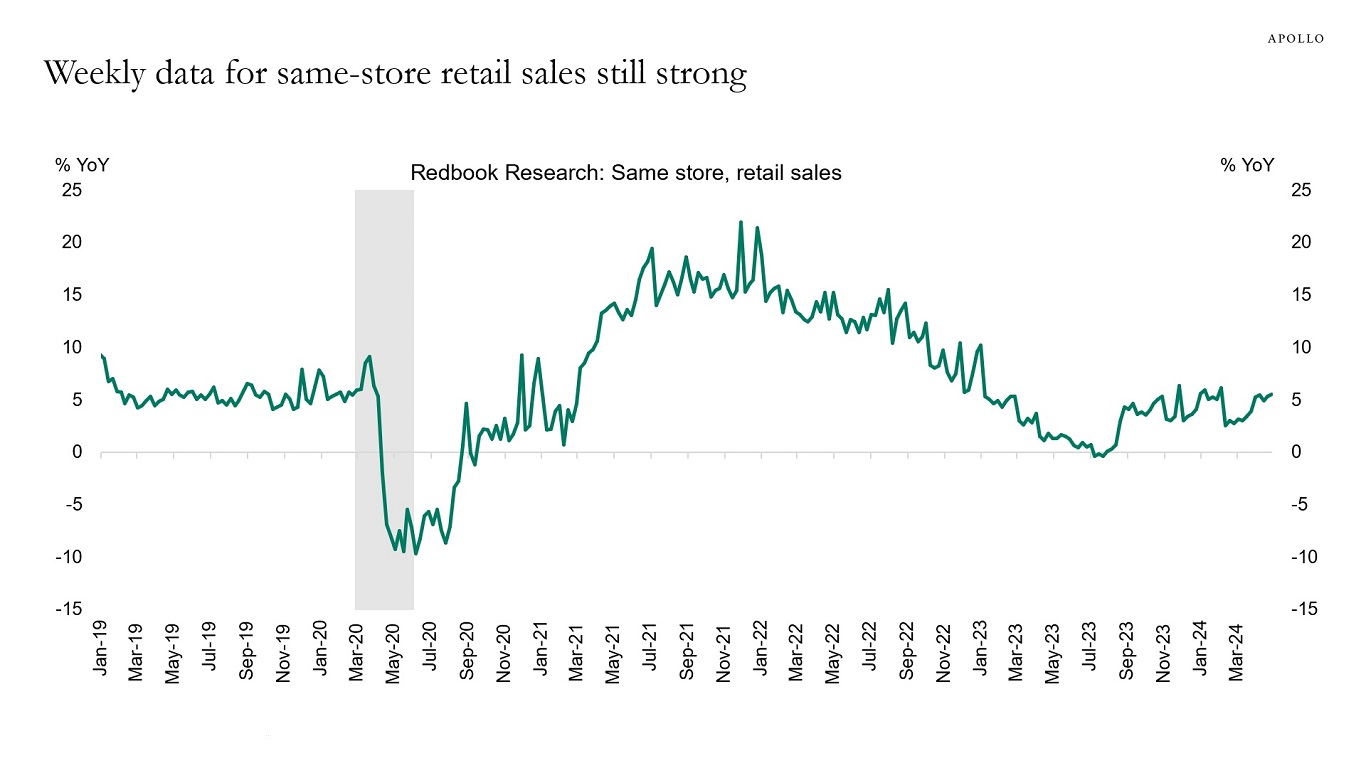

Why Is the Economy Still So Strong?

Why is the economy still so strong?

There are two reasons, lower interest-rate sensitivity and strong demand tailwinds.

Specifically:

A) Lower interest-rate sensitivity:

1) 40% of homeowners don’t have a mortgage, and 95% of mortgages are 30-year fixed that are not sensitive to the Fed raising interest rates.

2) During Covid, most firms termed out their debt at very low levels, and with the IG market having grown from $3 trillion in 2009 to $9 trillion today, see the second chart, the interest-rate sensitivity of corporate America has declined.

3) A growing share of capex spending is intangibles (R&D and software), which generally is less sensitive to Fed hikes.

B) Strong cyclical and structural demand tailwinds:

1) Fiscal spending, including the CHIPS Act, Inflation Reduction Act, and Infrastructure Act, is still a strong tailwind to growth.

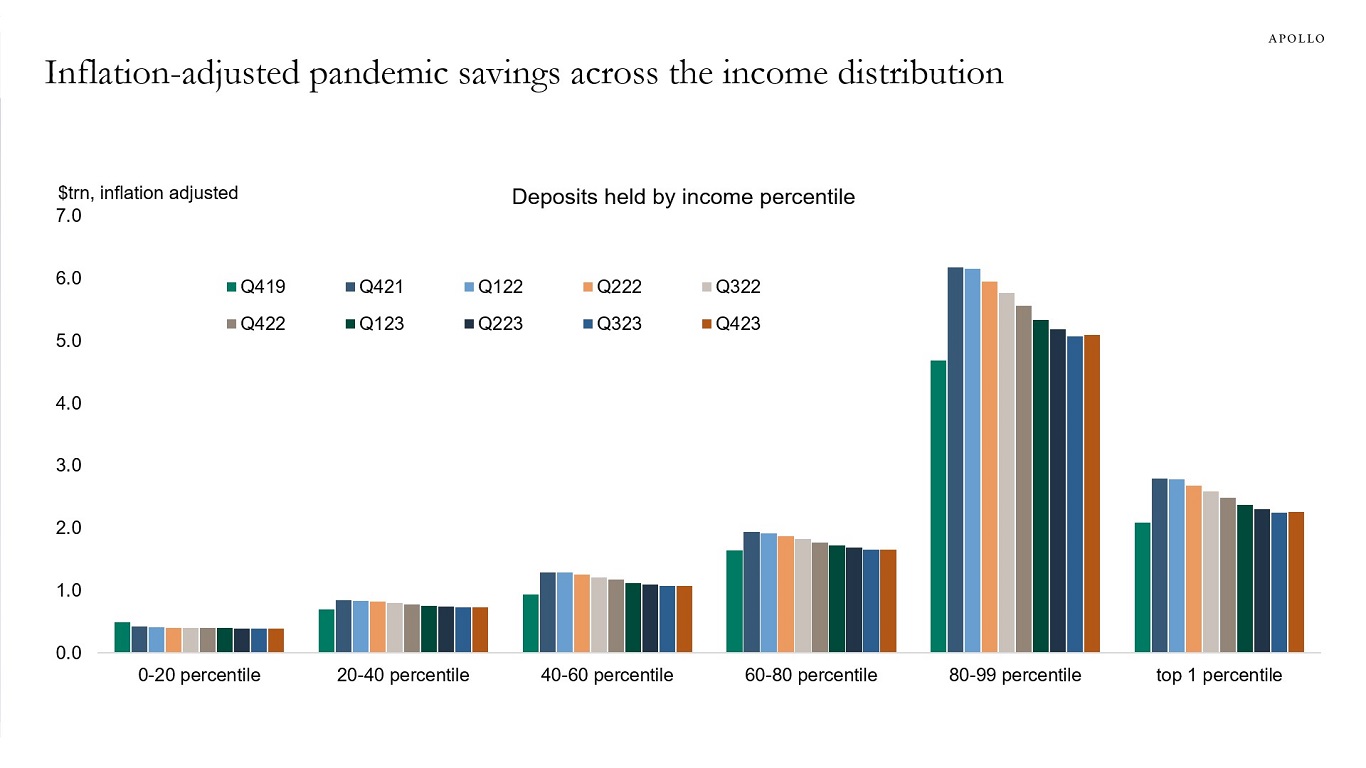

2) Excess savings have recently started to rise again for higher income households, see the third chart.

3) Immigration has been unusually strong, supporting overall employment growth.

4) The Fed turning dovish in December 2023 has eased financial conditions significantly, which continues to boost consumer spending and capex spending.

5) Higher interest rates give higher cash flow to households that own fixed-income assets.

6) After 14 years of very low interest rates from 2008 to 2022, the demand for higher all-in yields remains extremely strong from insurance companies, pension funds, and retail investors, which has contributed to easy financial conditions that have been offsetting Fed hikes. The AI story has also boosted household wealth and eased financial conditions.

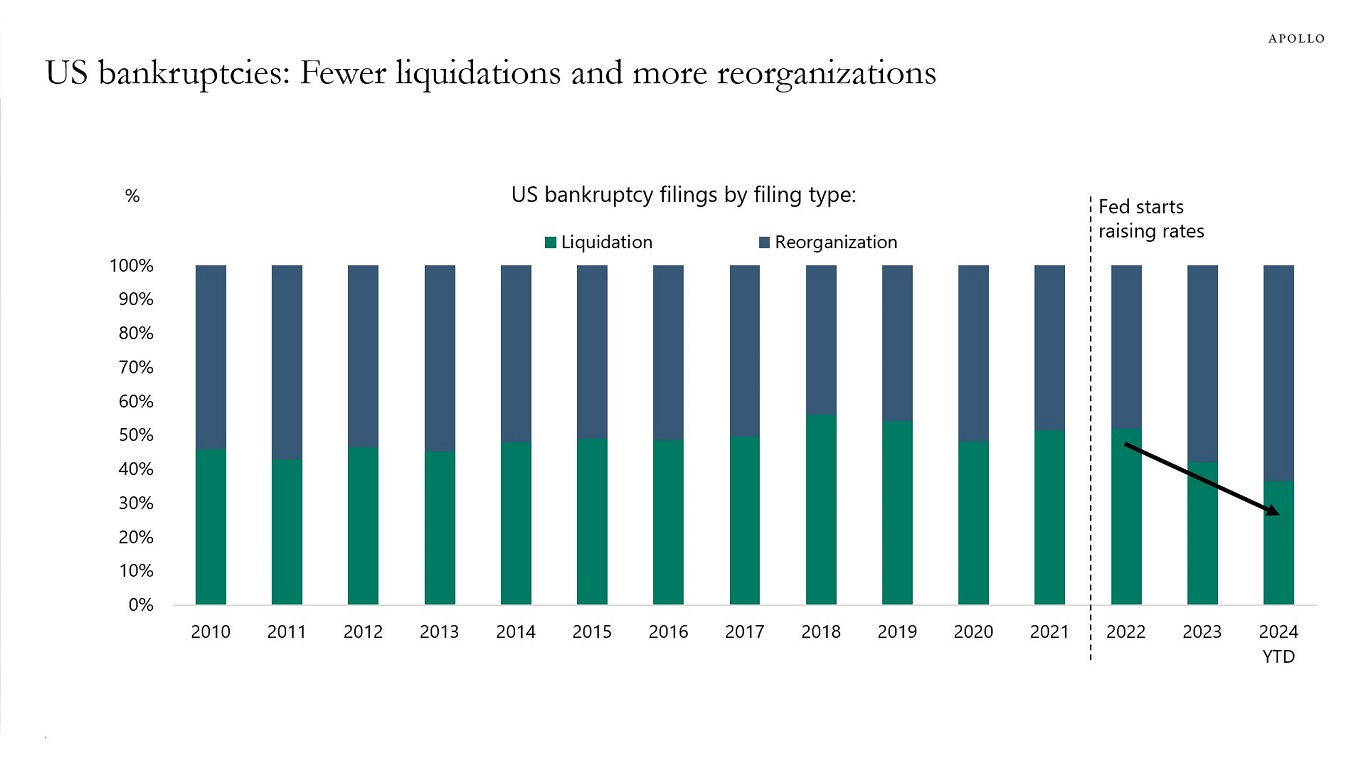

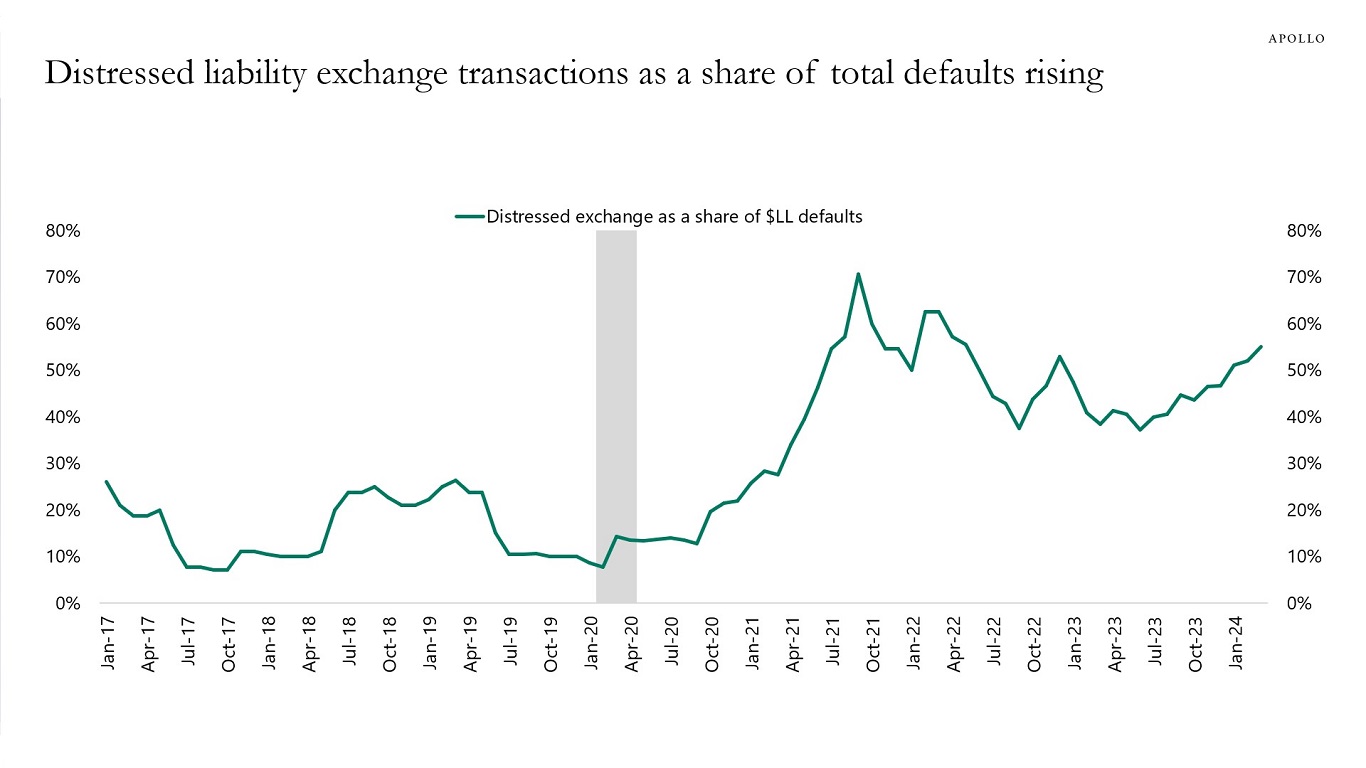

7) Corporates that got into trouble once the Fed started hiking have not been liquidating their assets but instead doing reorganizations and distressed exchanges, and this has kept many firms alive that would otherwise have gone out of business, see the fourth and fifth charts.

In summary, the economy is strong for two reasons:

A) Consumers and firms locked in low interest rates during Covid, which made the economy less sensitive to higher interest rates (i.e., bullet points No. 1 to 3 above), and

B) Strong demand tailwinds coming from fiscal, excess savings, immigration, and easy financial conditions (i.e., bullet points No. 1 to 7 above).

With this backdrop, it is not surprising that inflation and labor costs remain high, and these 10 forces will keep the economy strong for at least several more quarters.

Eventually, the Fed will get inflation back to 2%, but it is increasingly clear that it will require a meaningful slowdown in the labor market and the housing market.

In short, GDP and earnings should remain strong for the rest of 2024.

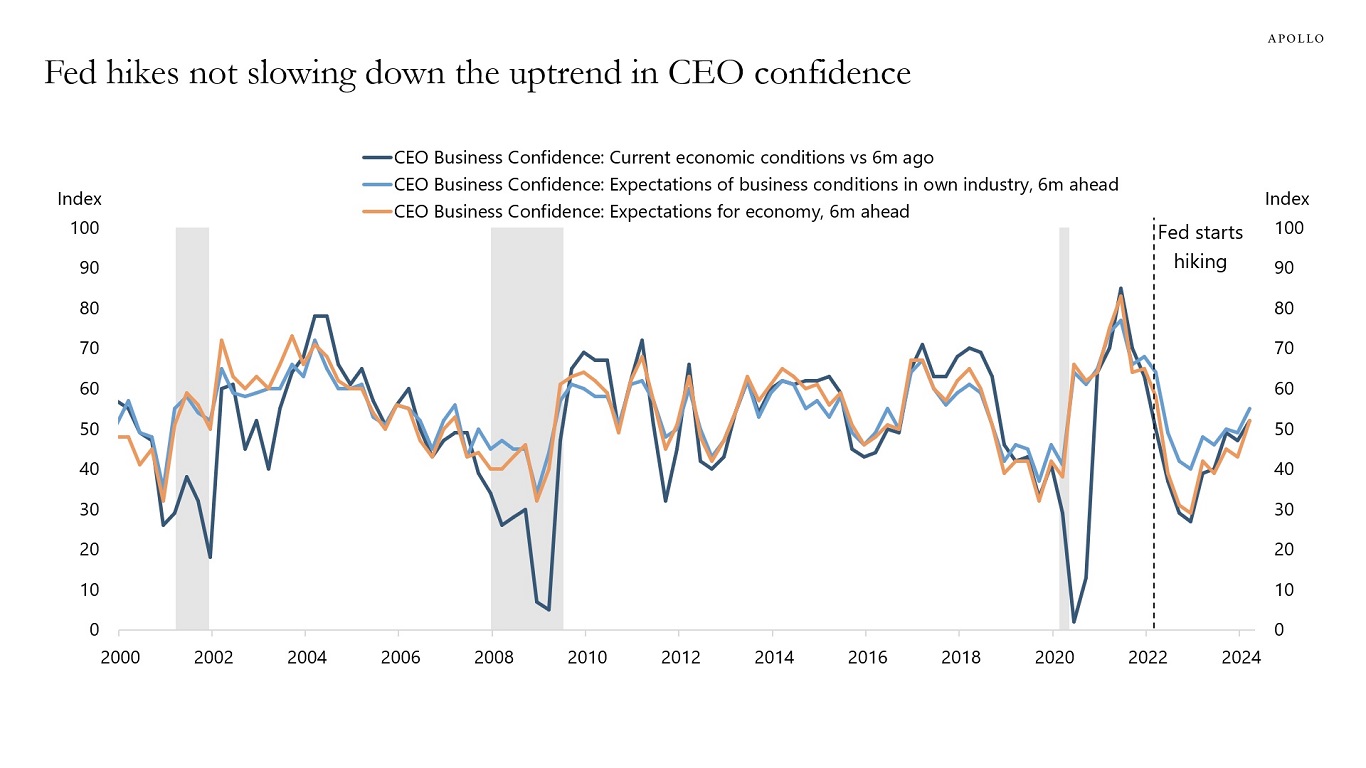

CEOs Are More and More Bullish Despite Fed Hikes

CEO confidence continues to rebound, and there are no signs of Fed hikes weighing on how CEOs view current conditions, future business conditions, and expectations to the economy, see chart below.

In short, CEOs are becoming increasingly bullish on the outlook for their businesses and the economy. This suggests that r-star may be higher than the Fed currently thinks.

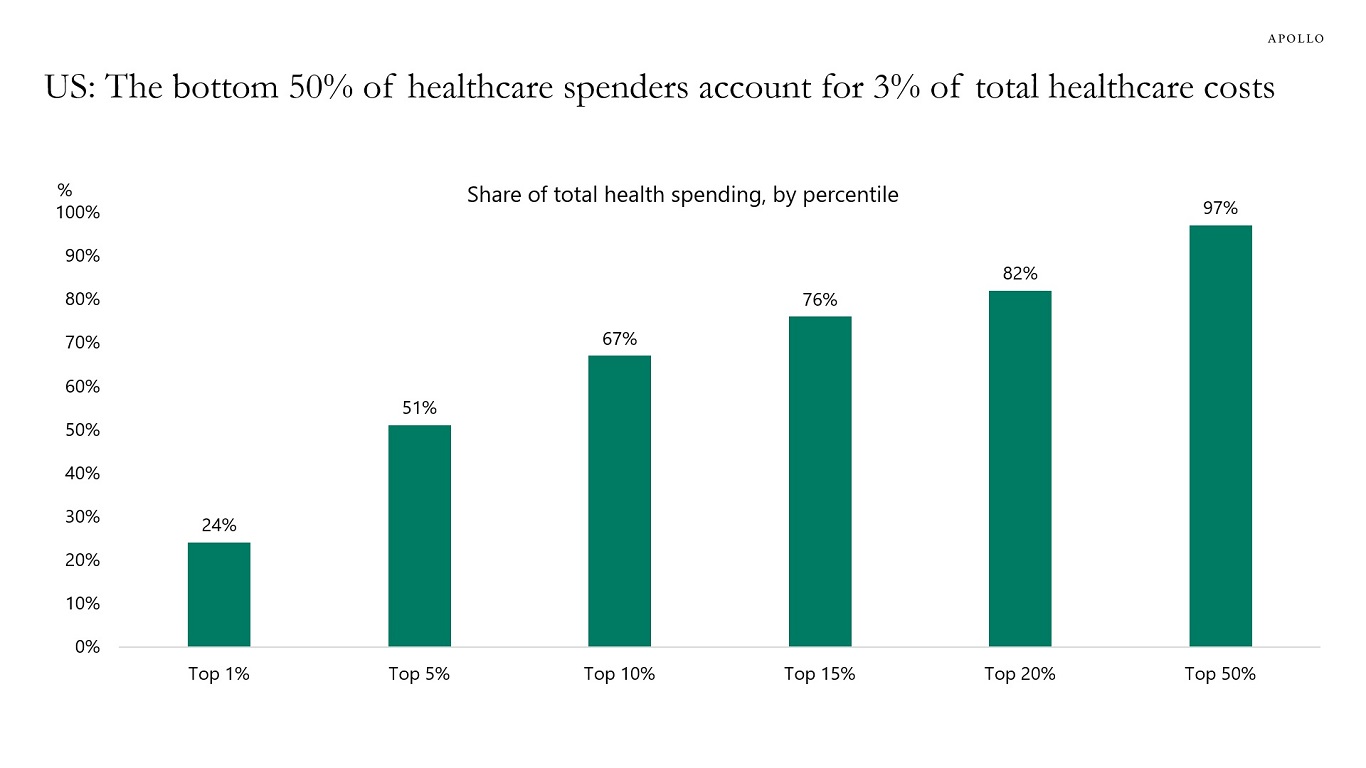

Distribution of Healthcare Costs

The top 5% of healthcare spenders account for 51% of total healthcare spending, see chart below. The bottom 50% account for 3% and their average annual healthcare costs are $385. People with health spending in the top 1% have annual average costs of $166,980.