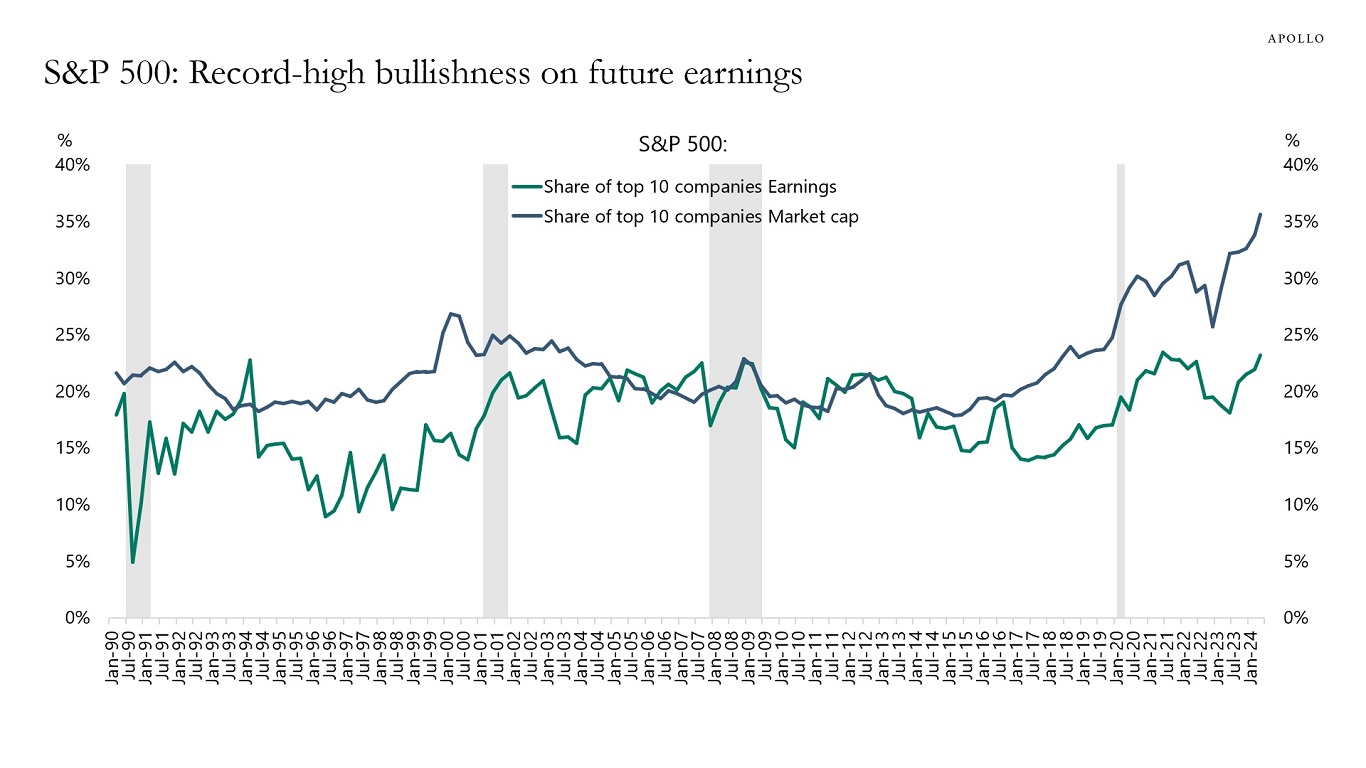

The top 10 companies in the S&P 500 make up 35% of the market cap but only 23% of earnings, see chart below.

This divergence has never been bigger, suggesting that the market is record bullish on future earnings for the top 10 companies in the index.

In other words, the problem for the S&P 500 today is not only the high concentration but also the record- high bullishness on future earnings from a small group of companies.