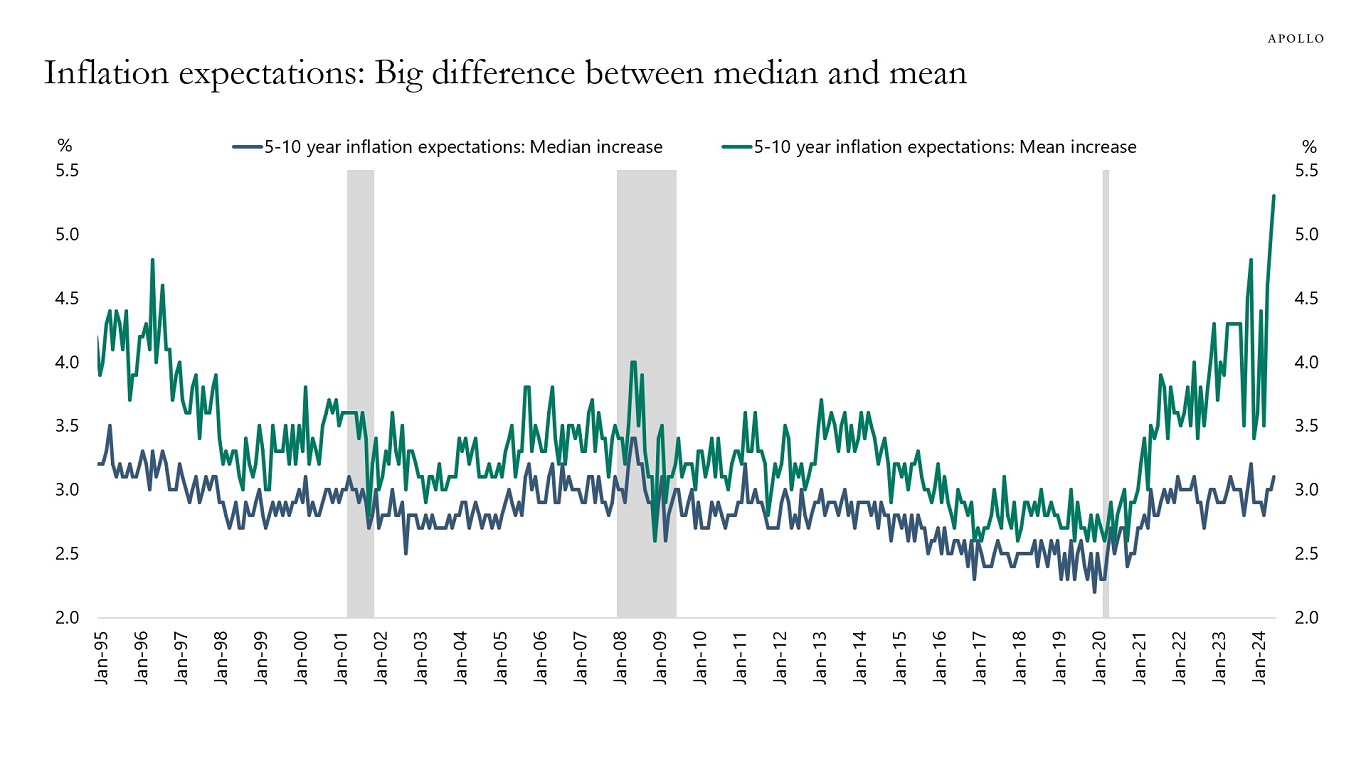

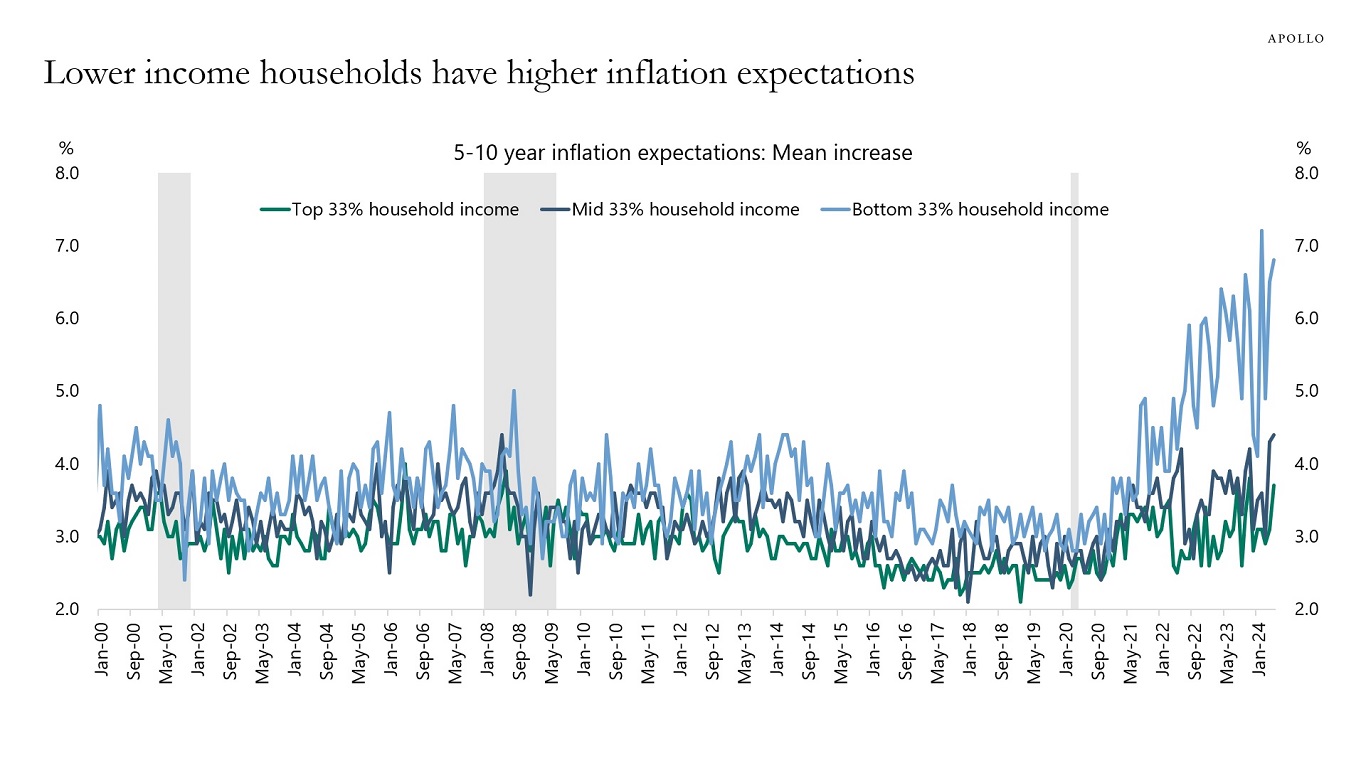

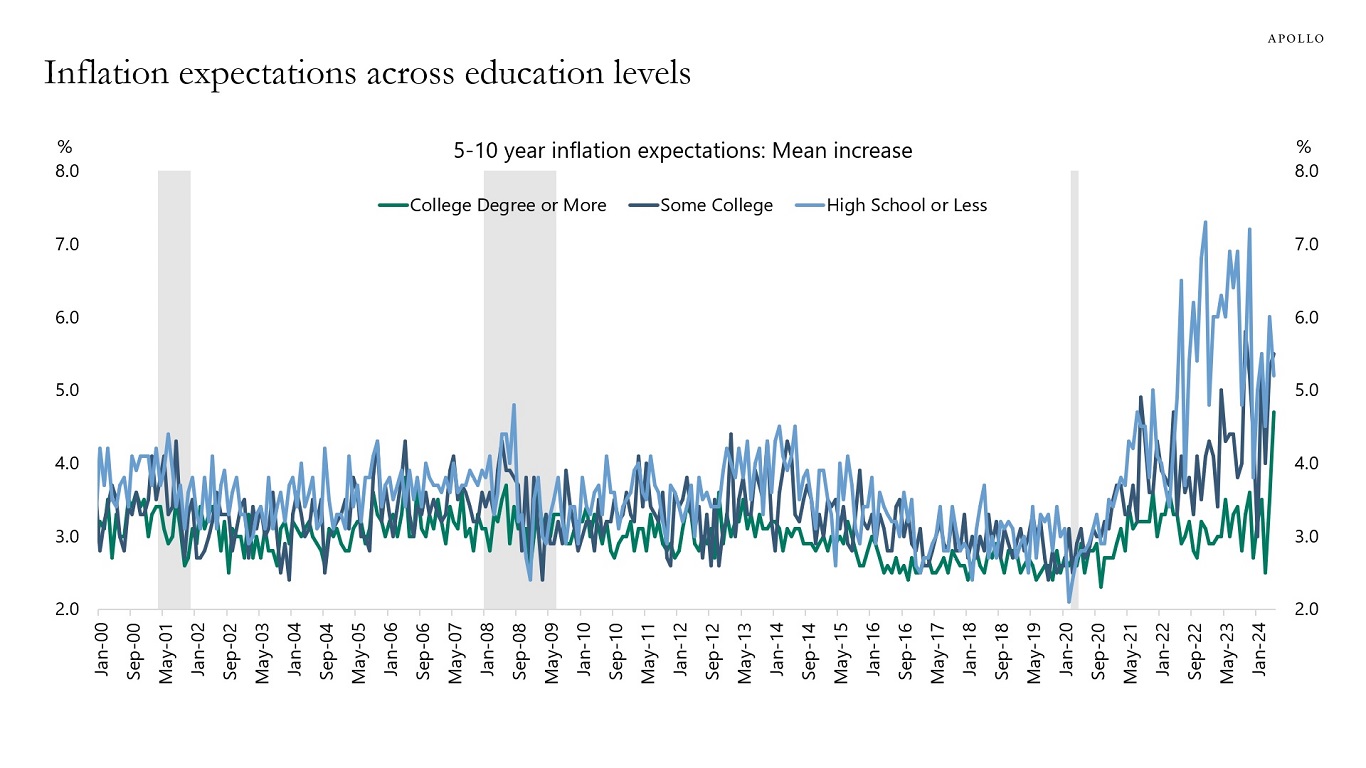

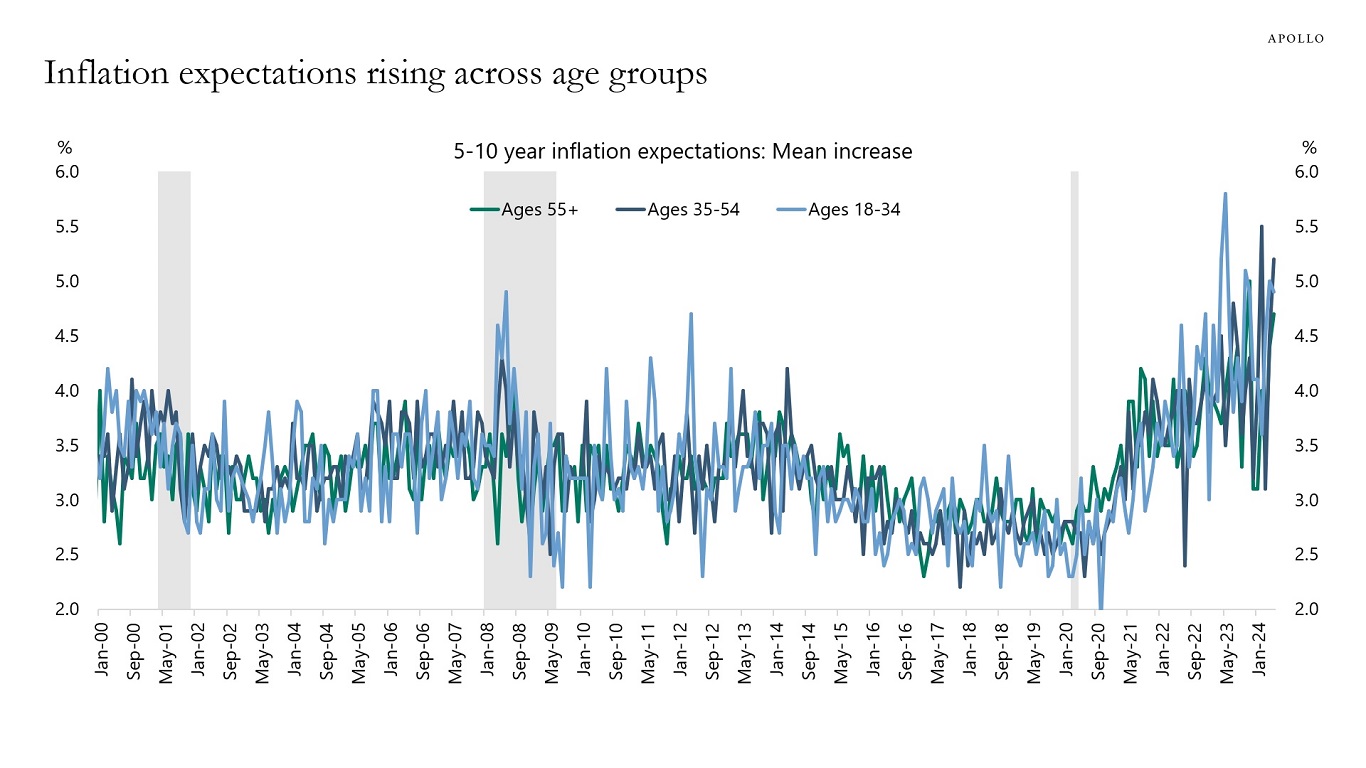

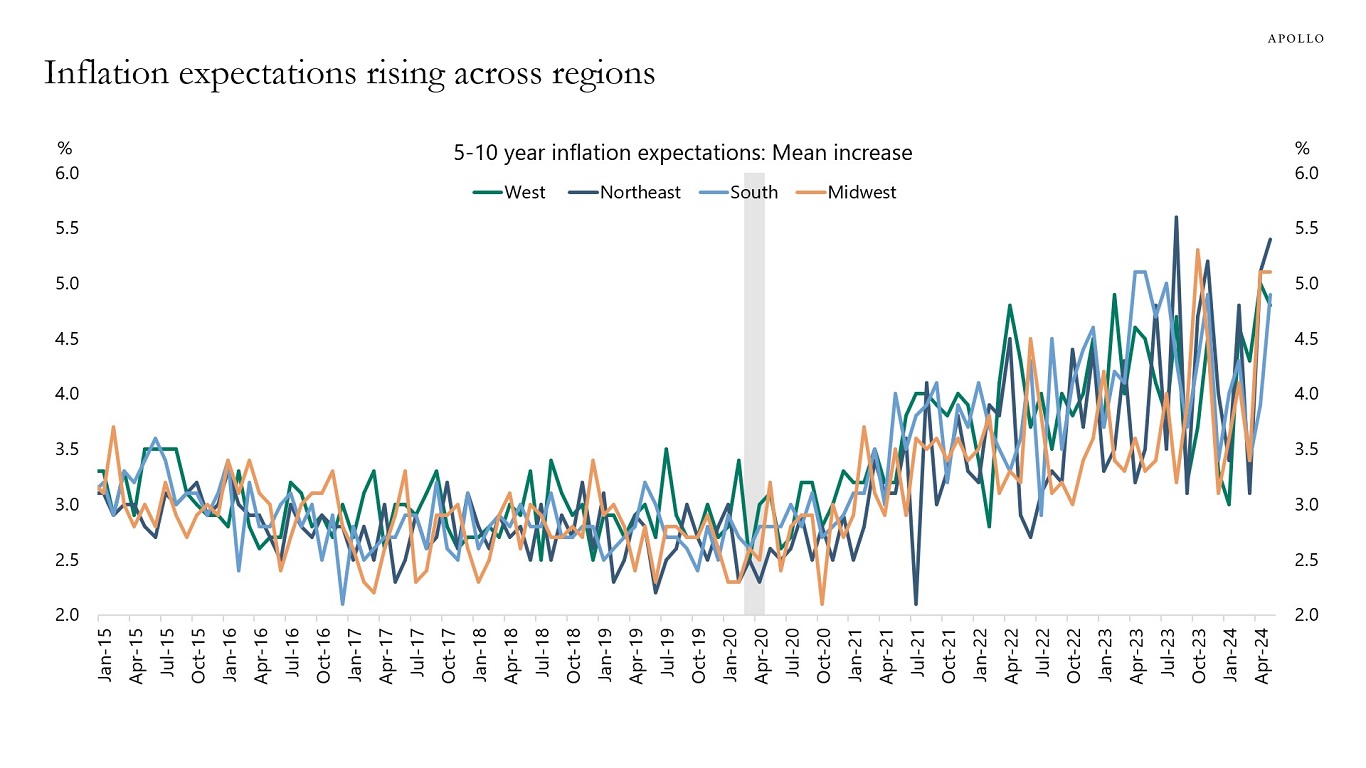

There is a major gap opening up between the mean and the median of long-term inflation expectations, which means that half of the population has long-term inflation expectations that are dramatically higher than the other half, see charts below and in this chart book. This is a very significant challenge for the Fed because it cannot cut interest rates when inflation expectations are out of control.