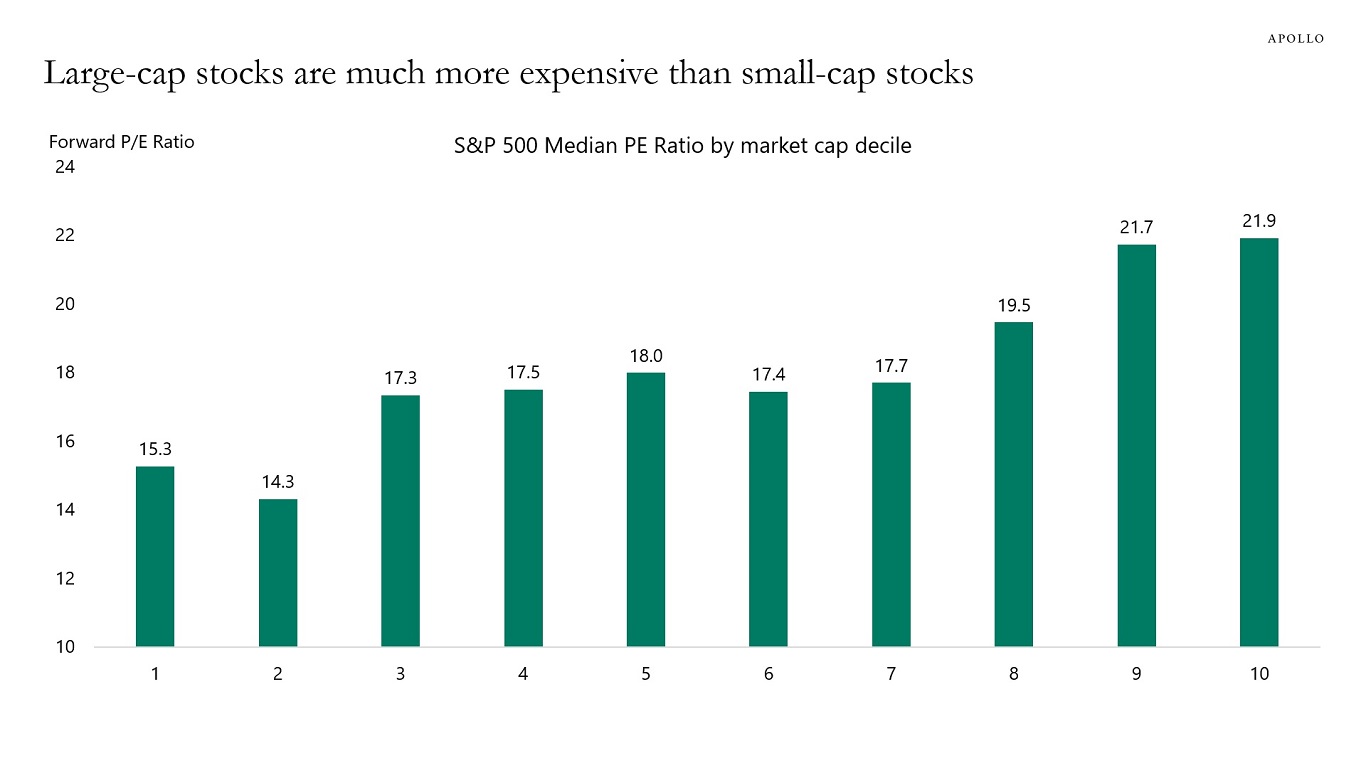

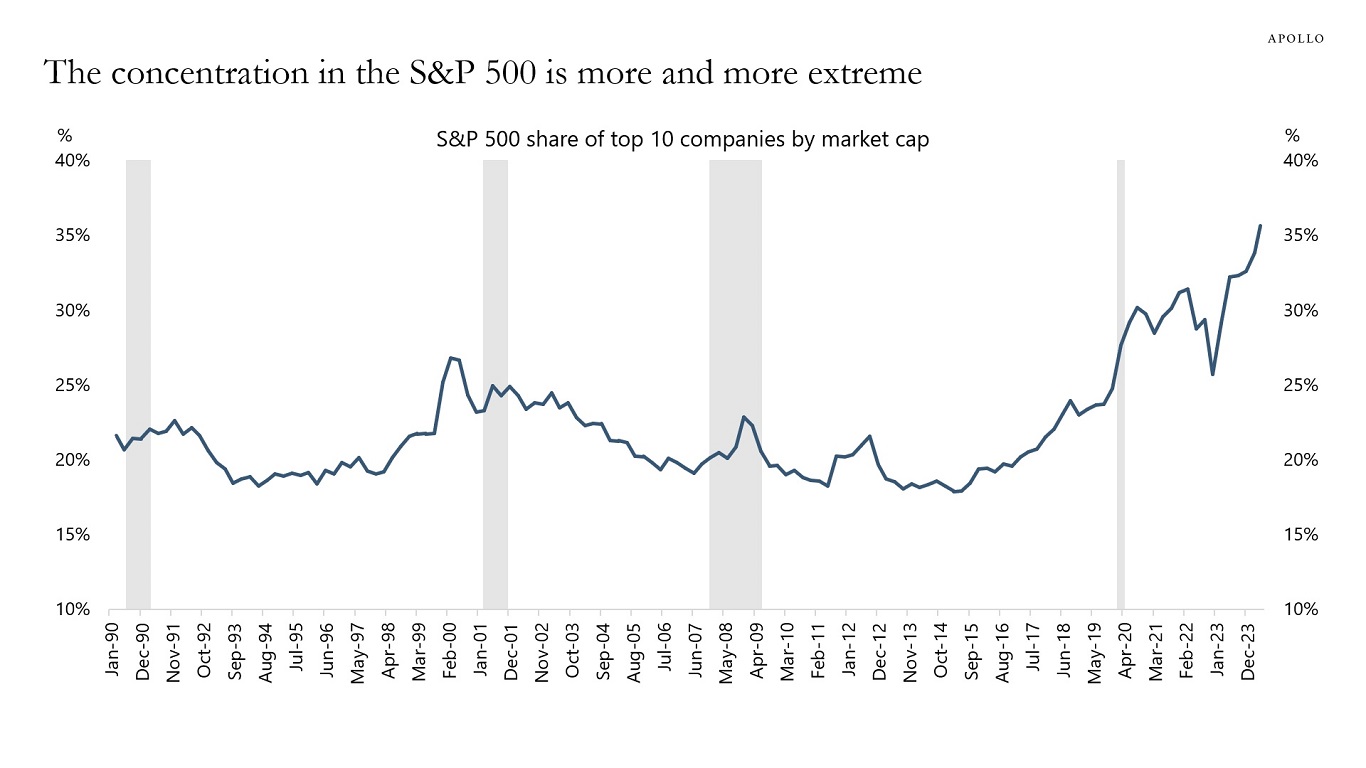

Looking at P/E ratios for companies in the S&P 500 ranked by market cap shows that large-cap companies are much more expensive than small-cap companies, see chart below.

Why are P/E ratios low for small-cap companies and high for large-cap companies?

Because Fed hikes and higher costs of capital are weighing on highly leveraged small-cap companies with low coverage ratios.

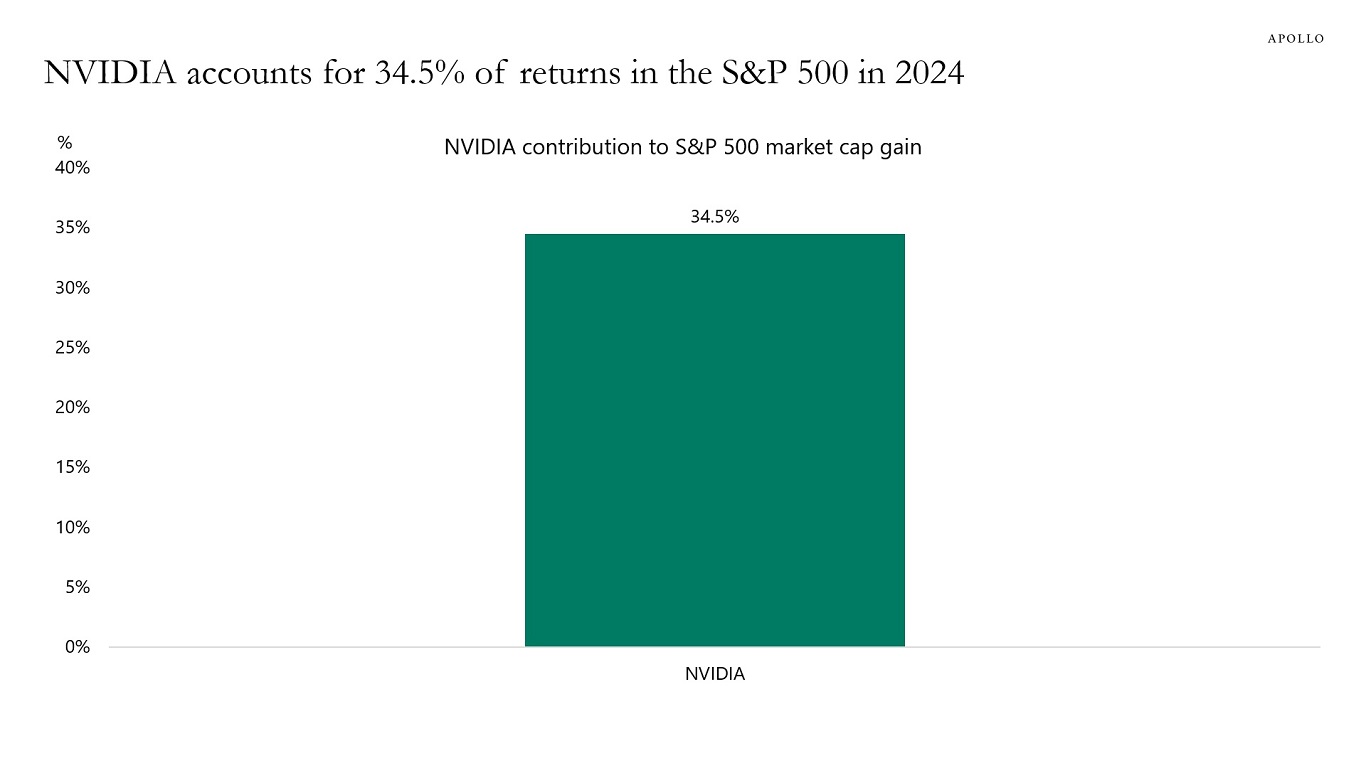

And the AI story has boosted valuations of mega-cap names.

With the Fed keeping interest rates higher for longer, and the AI narrative pushing valuations and index concentration to extreme levels, the downside risks to equities are growing.