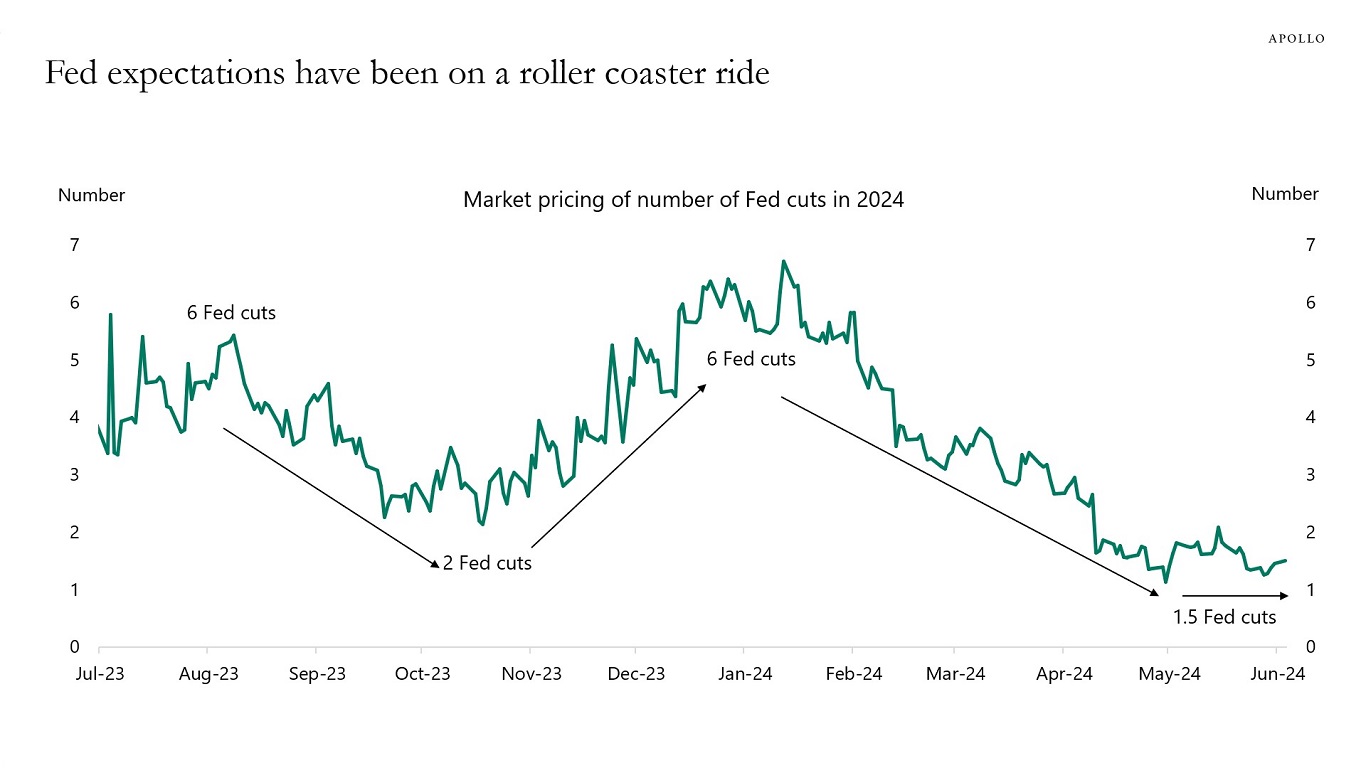

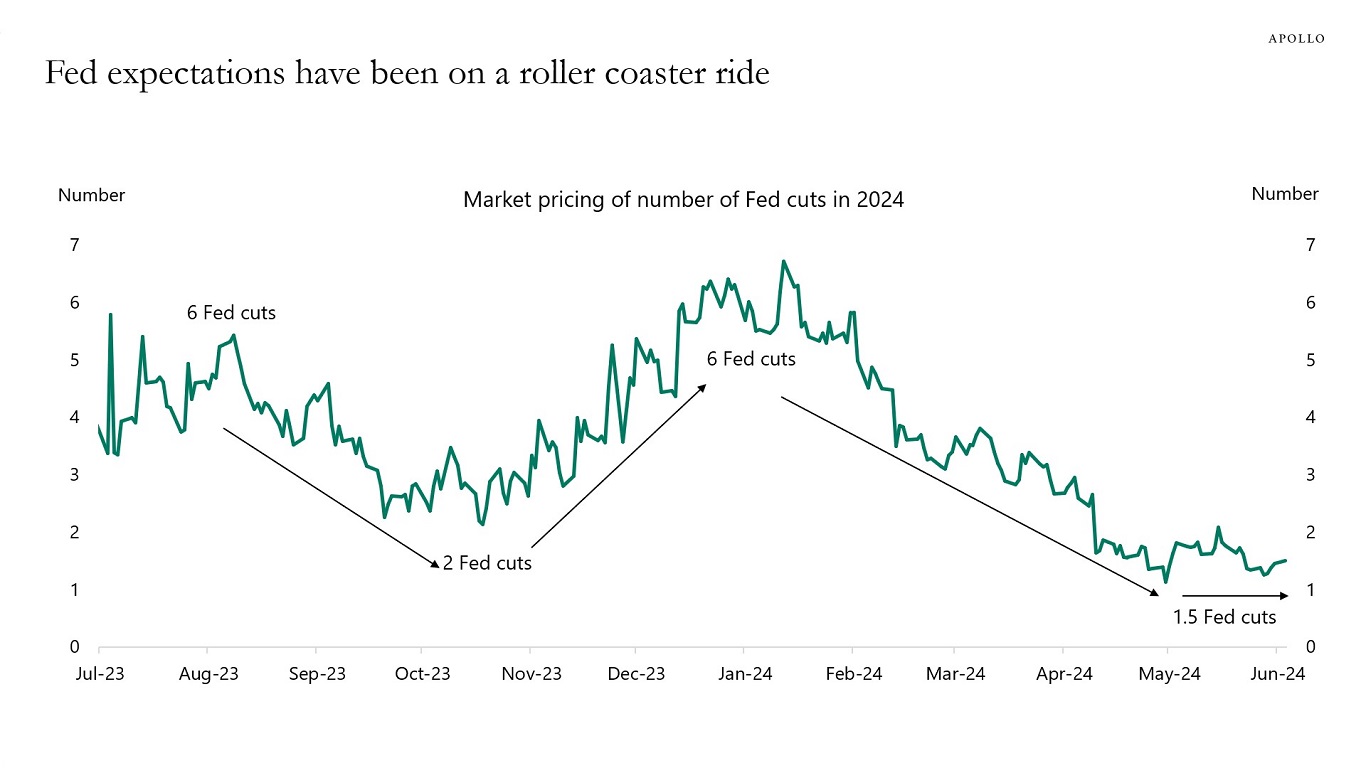

Fed expectations have been on a roller coaster ride over the past 12 months, going from six cuts to two cuts to six cuts and now 1.5 cuts, see chart below.

Fed expectations have been on a roller coaster ride over the past 12 months, going from six cuts to two cuts to six cuts and now 1.5 cuts, see chart below.

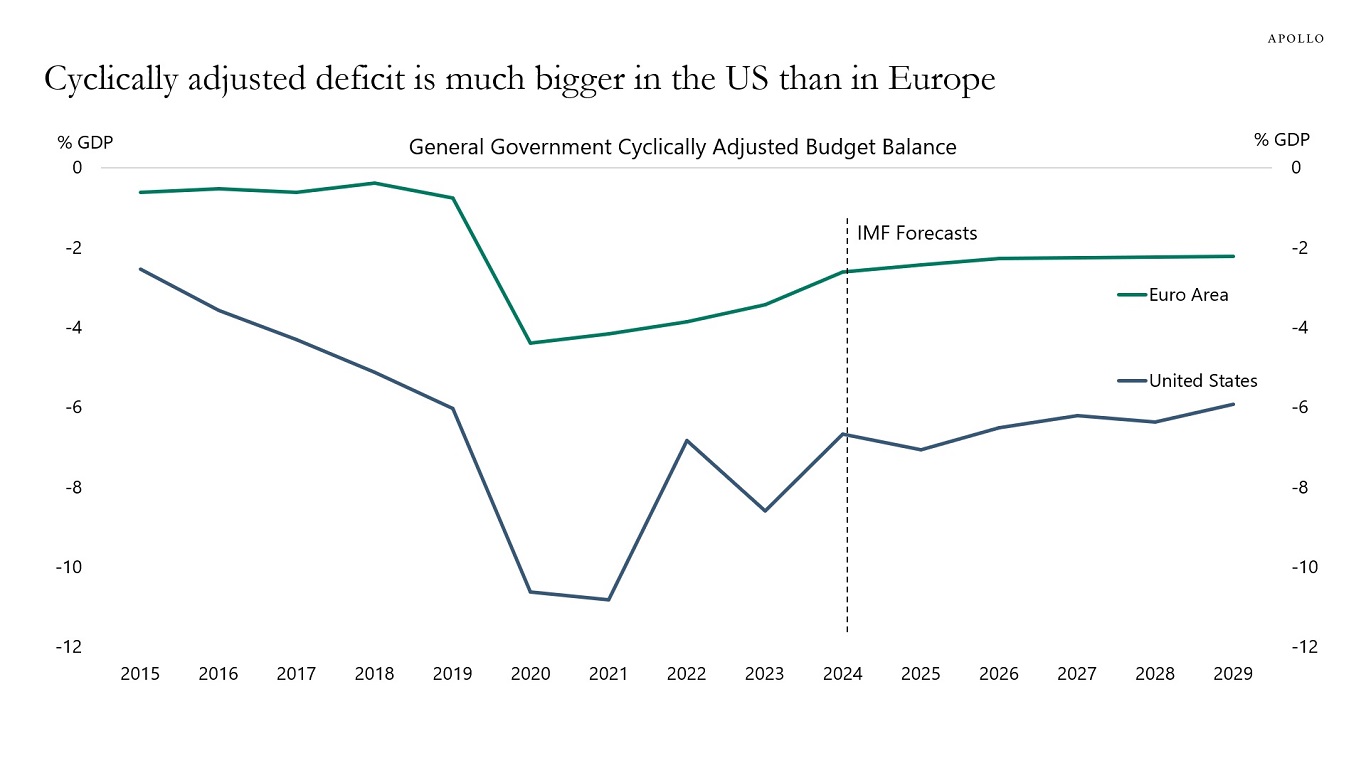

Removing the business cycle from the government budget balance shows that the US currently has a much bigger cyclically adjusted budget deficit than the Euro area, see chart below. In other words, despite the strong economy, the US is still running a significant deficit.

If the US were to enter a recession, tax revenues would decline, and unemployment benefit payments would rise. Under that scenario, it is not unreasonable to assume that the budget deficit could reach 10% of GDP, as it did during previous recessions.

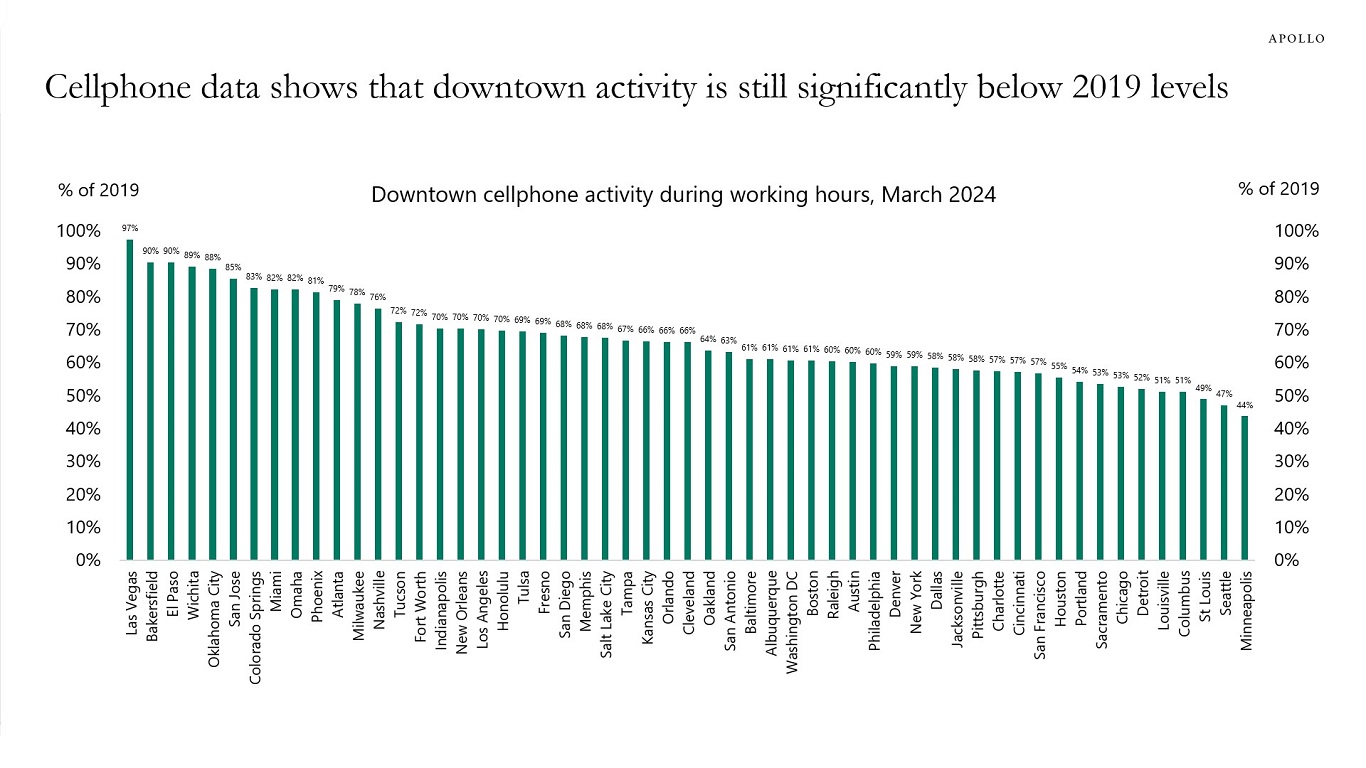

Data from downtowns shows that cellphone activity in San Francisco is at 57% of pre-pandemic levels, see chart below. Las Vegas is at 97%, and Miami is at 82% of 2019 levels. The slow recovery of downtowns combined with rates higher for longer has important implications for retail, restaurants, and offices.

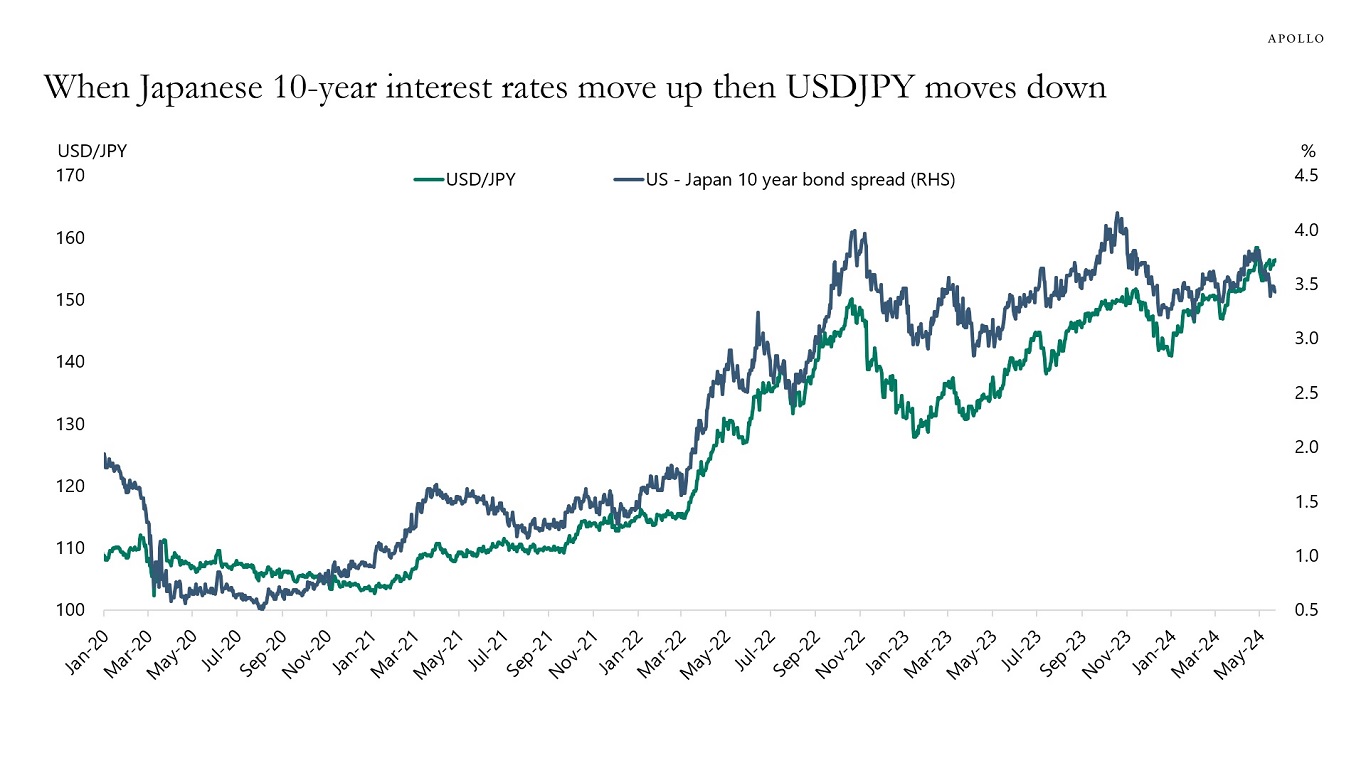

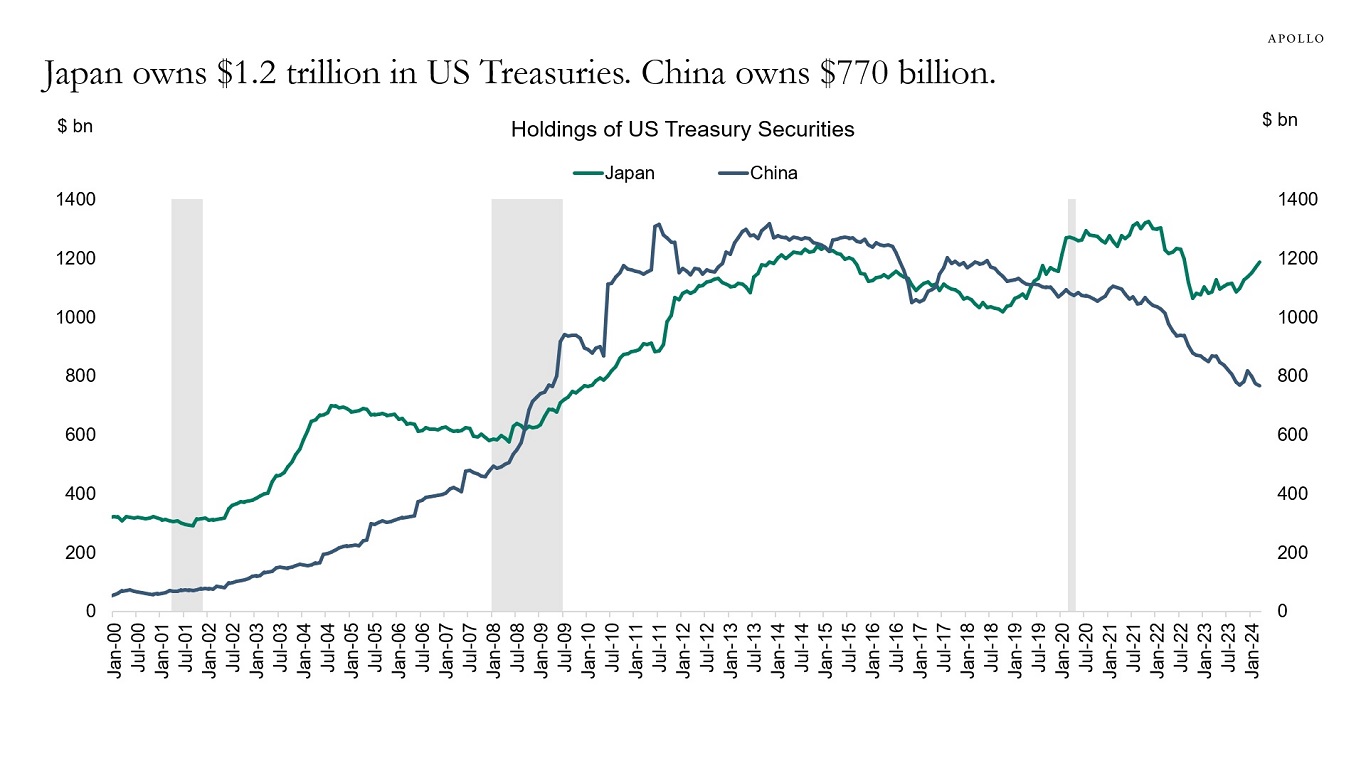

Japan owns $1.2 trillion of US Treasuries, and with 10-year interest rates on JGBs rising above 1% for the first time in more than a decade, Japanese investors will begin to find their own yen-denominated bonds relatively more attractive compared with US rates.

Put differently, as Japanese yields move higher, the global savings glut will shrink, putting upward pressure on the US term premium, see also Bernanke’s speech from March 2013 discussing this dynamic.

Any decline in USDJPY driven by such Japanese repatriation could be magnified once the Fed begins to cut interest rates. Then USDJPY would move lower not only because of higher long rates in Japan but also because of lower short rates in the US.

The bottom line is that rising long-term interest rates in Japan put upward pressure on long-term US Treasury yields, steepen the US yield curve, and put downward pressure on USDJPY.

For more, see also our chart book looking at Japanese demand for US Treasuries available here.