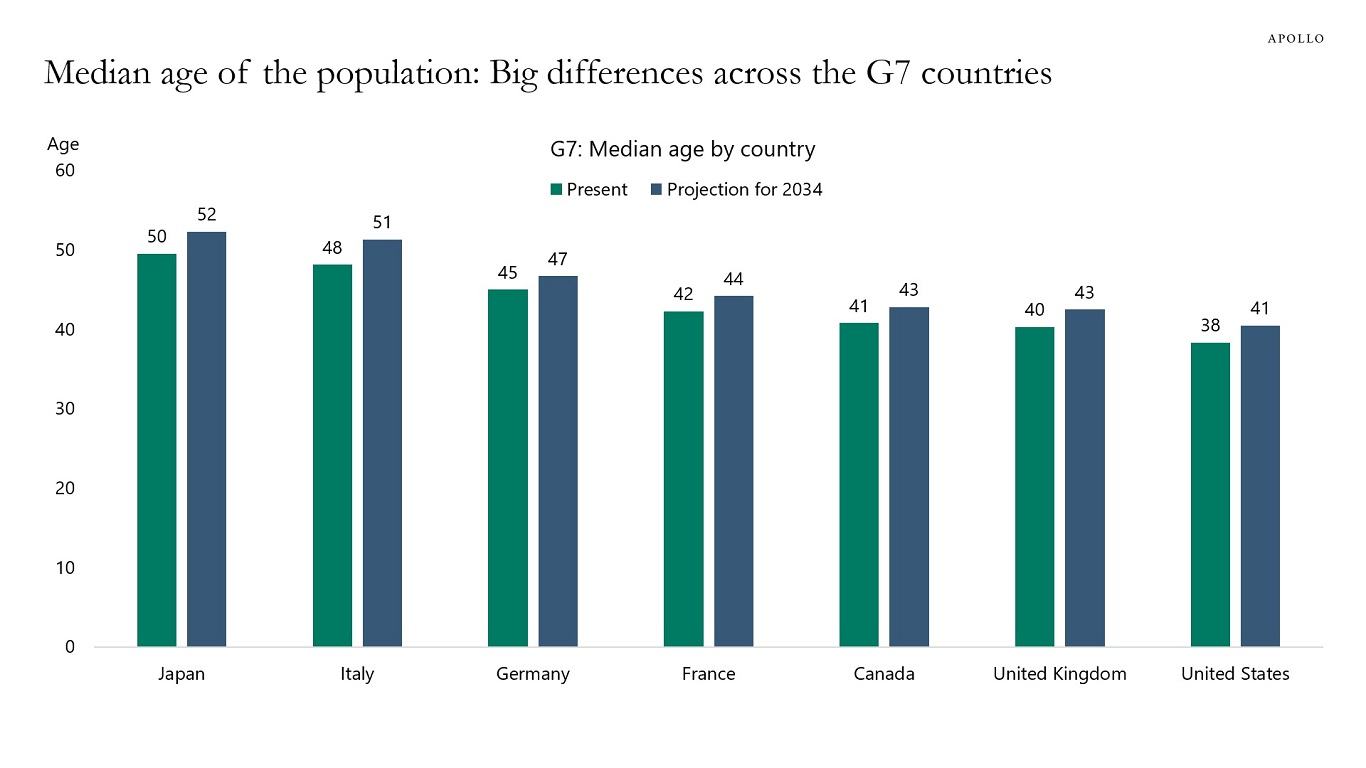

The median age of the US population is 38 years, while the median ages of the populations in Japan and Italy are 50 and 48 years, respectively, see chart below. The younger population in the US has significant implications for government spending, tax revenues, and economy-wide productivity.