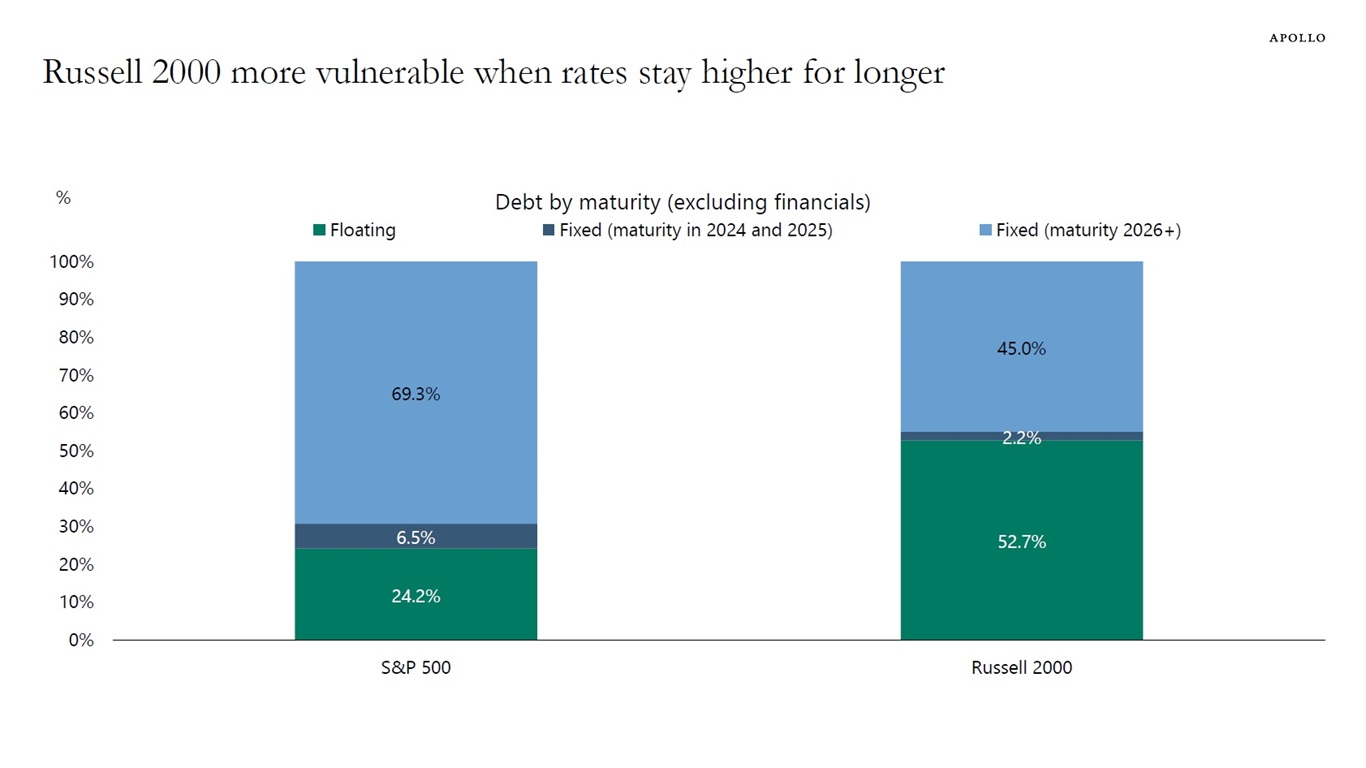

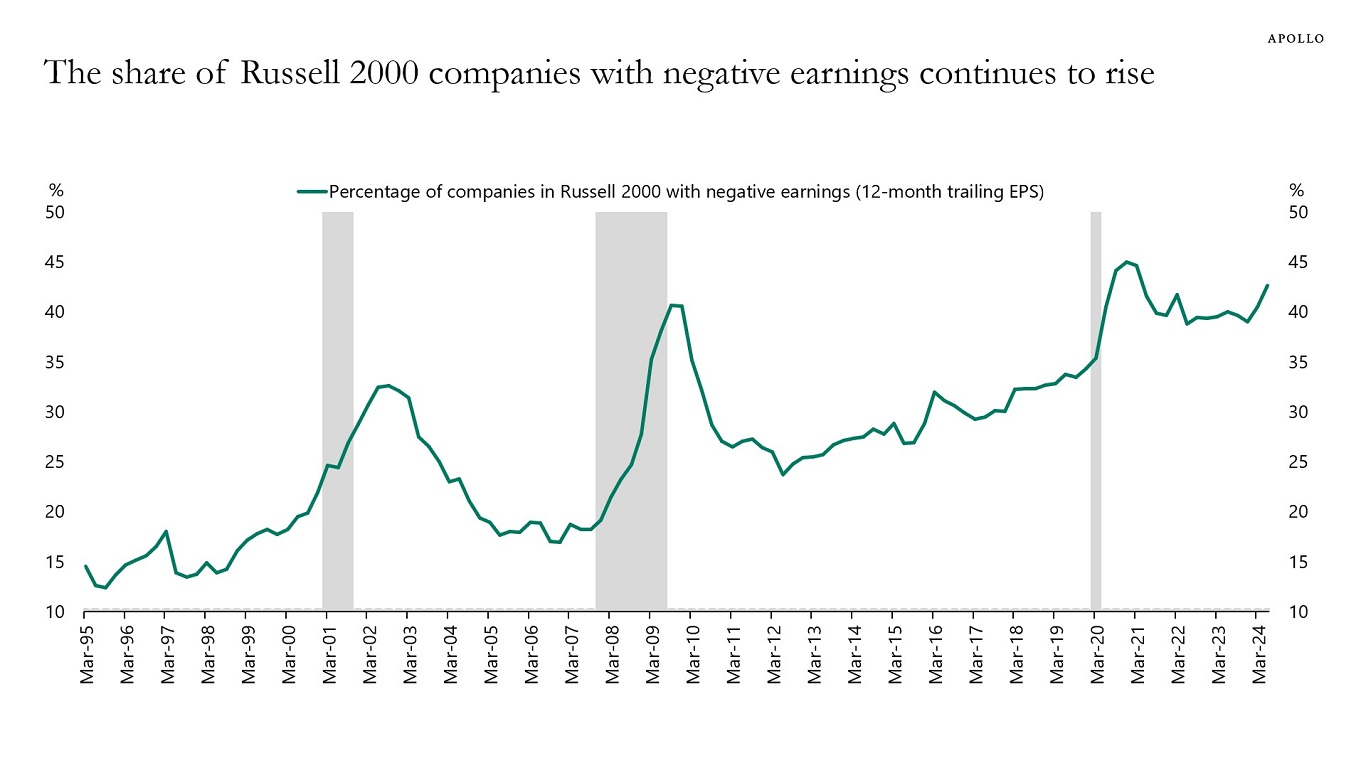

More than 50% of debt for Russell 2000 companies is floating rate. For the S&P 500, it is 24%, see chart below. With interest rates higher for longer, small-cap companies remain more vulnerable than large-cap companies.

More generally, companies and capital structures with no earnings, no revenues, and no cash flows will continue to struggle with high debt servicing costs.

The bottom line for both equity and debt investors is to invest in companies that have earnings.