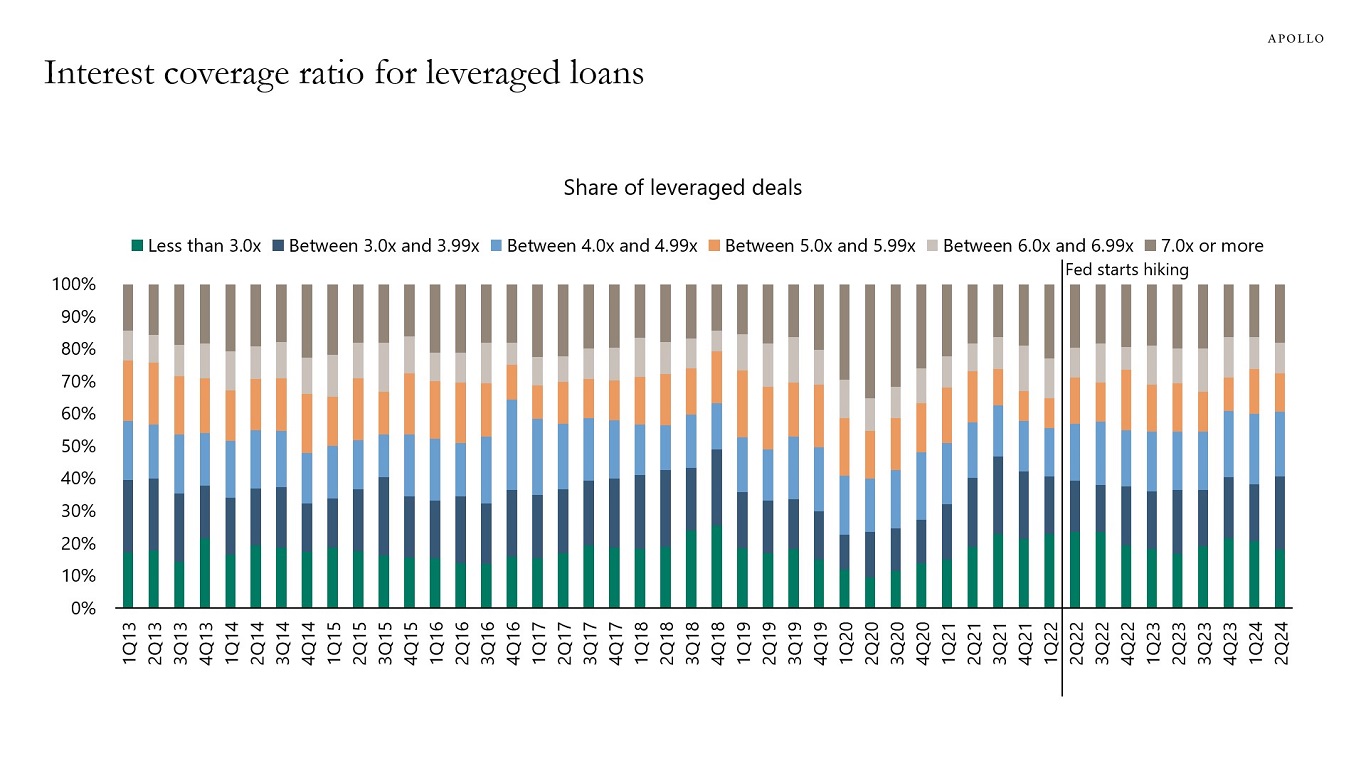

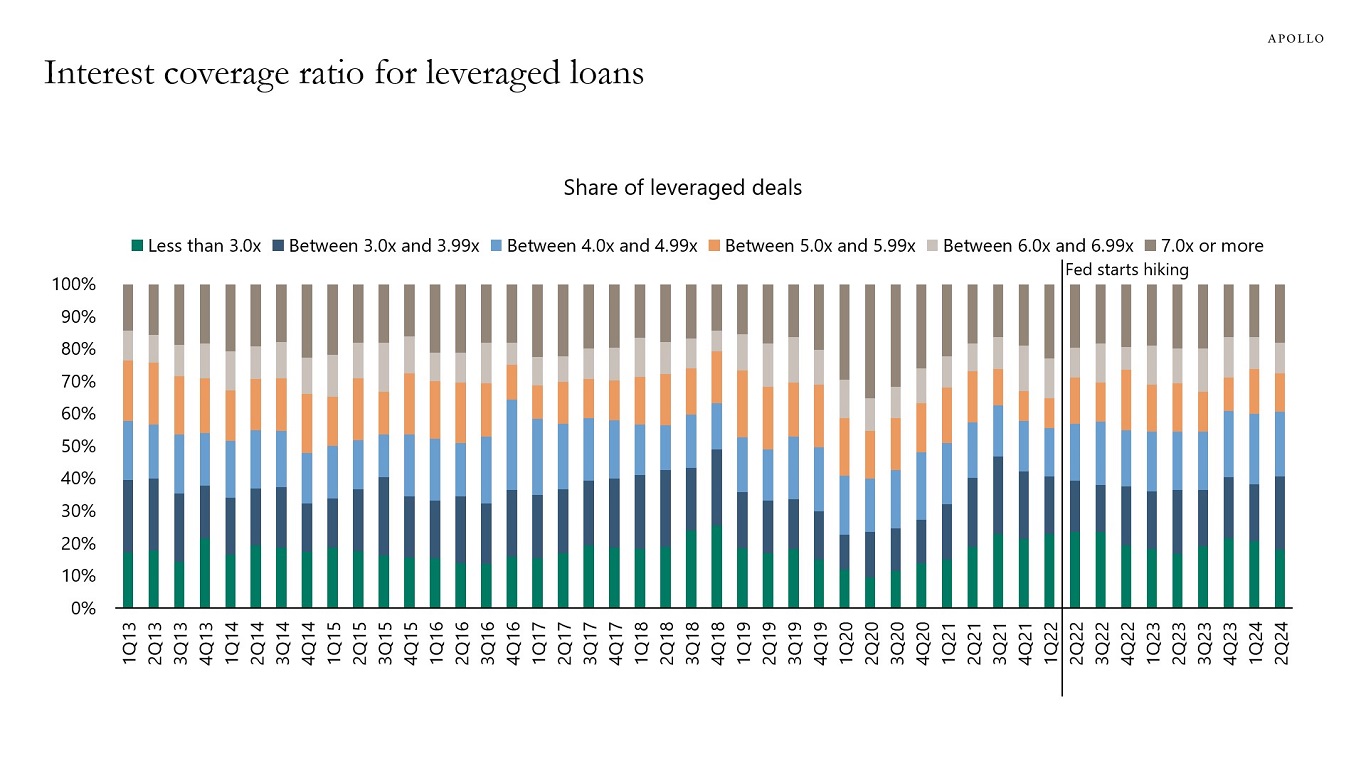

The distribution of interest coverage ratios for leveraged loan deals has remained remarkably stable during the Fed hiking cycle, see chart below. For more discussion, see here.

The distribution of interest coverage ratios for leveraged loan deals has remained remarkably stable during the Fed hiking cycle, see chart below. For more discussion, see here.

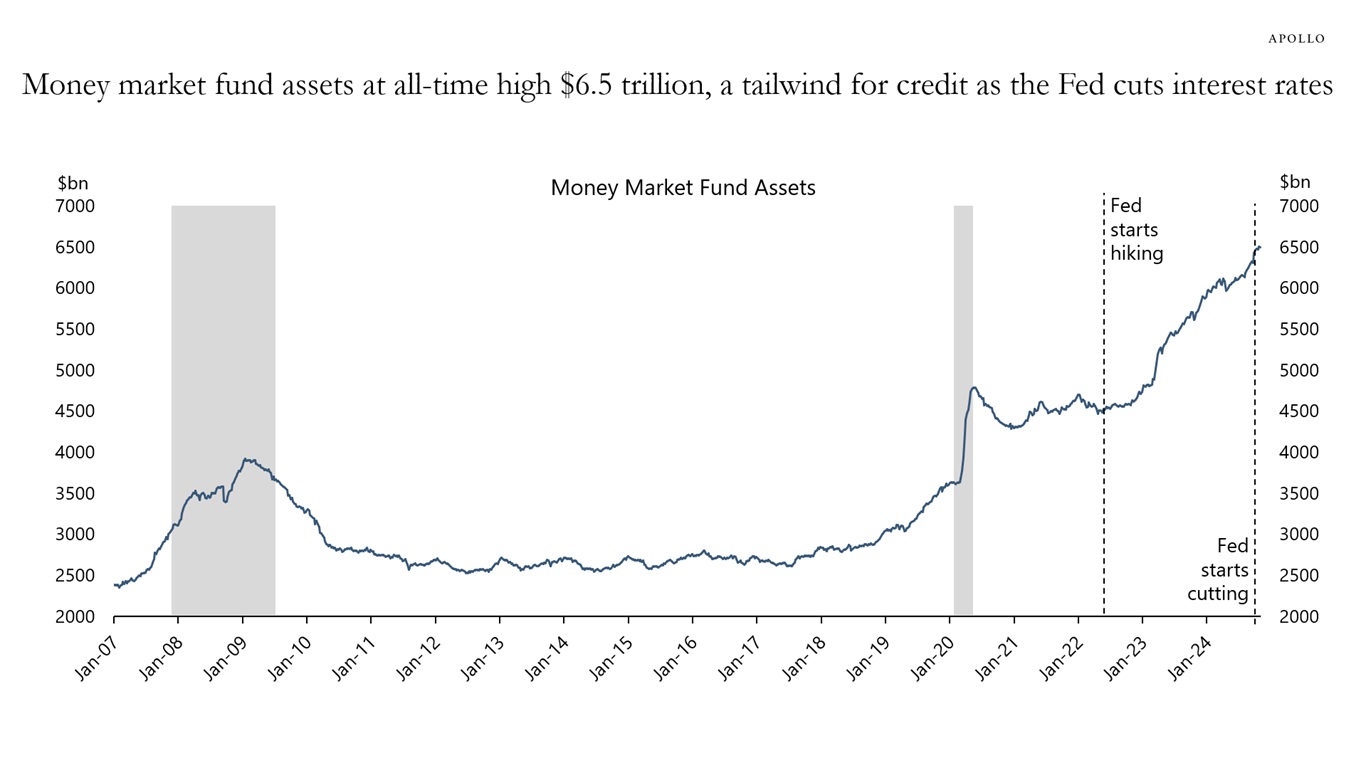

When the Fed was raising interest rates from March 2022 to September 2024, the amount of money in money market accounts increased $2 trillion as investors liked the higher level of yields, see chart below.

So what will happen with the money in money market accounts now that the Fed has started cutting interest rates? In other words, where will the $2 trillion added to money market accounts go now that the Fed is cutting?

The most likely scenario is that money will leave money market accounts and flow into higher-yielding assets such as credit, including investment grade private credit.

For more discussion, see our latest credit outlook here.

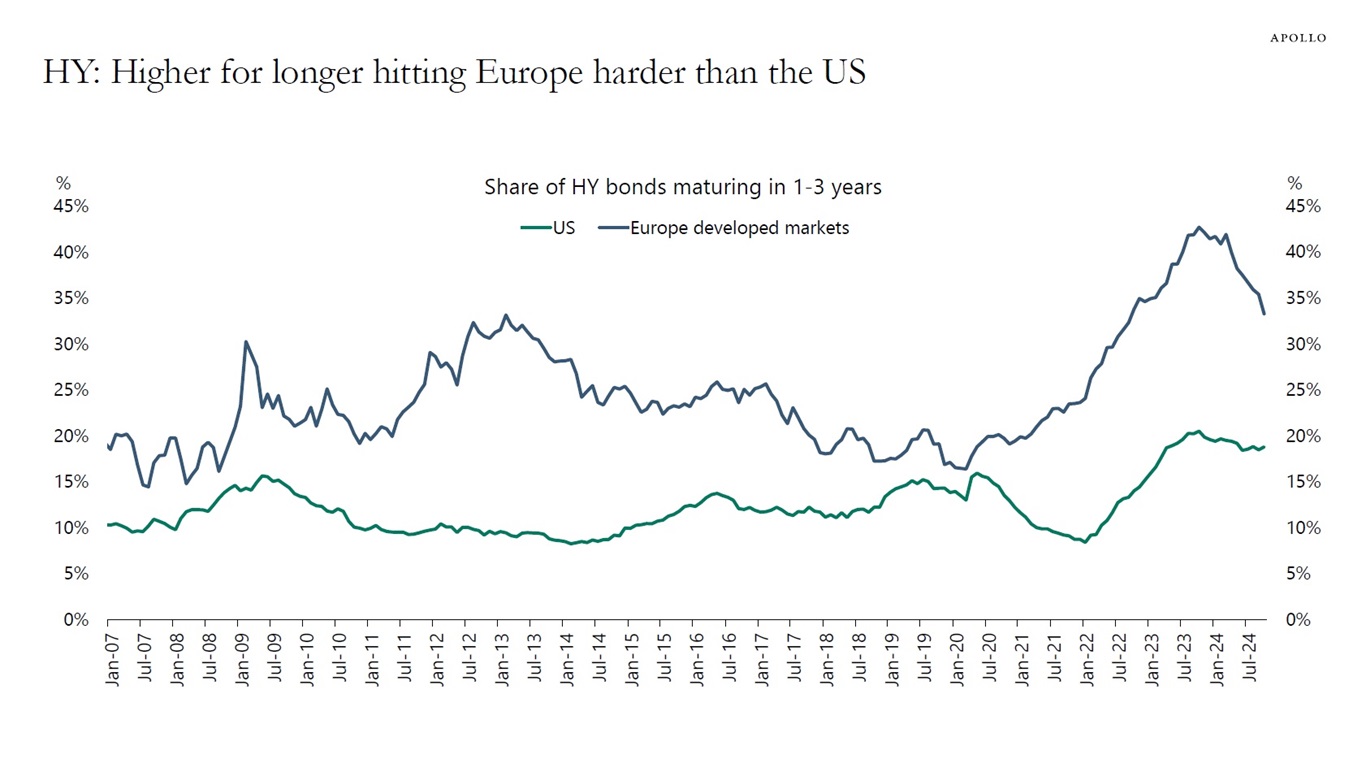

For high yield, more companies in Europe need to refinance over the coming years compared with the US, see chart below.

Put differently, if interest rates stay higher for longer, it will have a more negative impact on the European economy, indicating a bigger need for the ECB to lower interest rates.

For more discussion, see here.

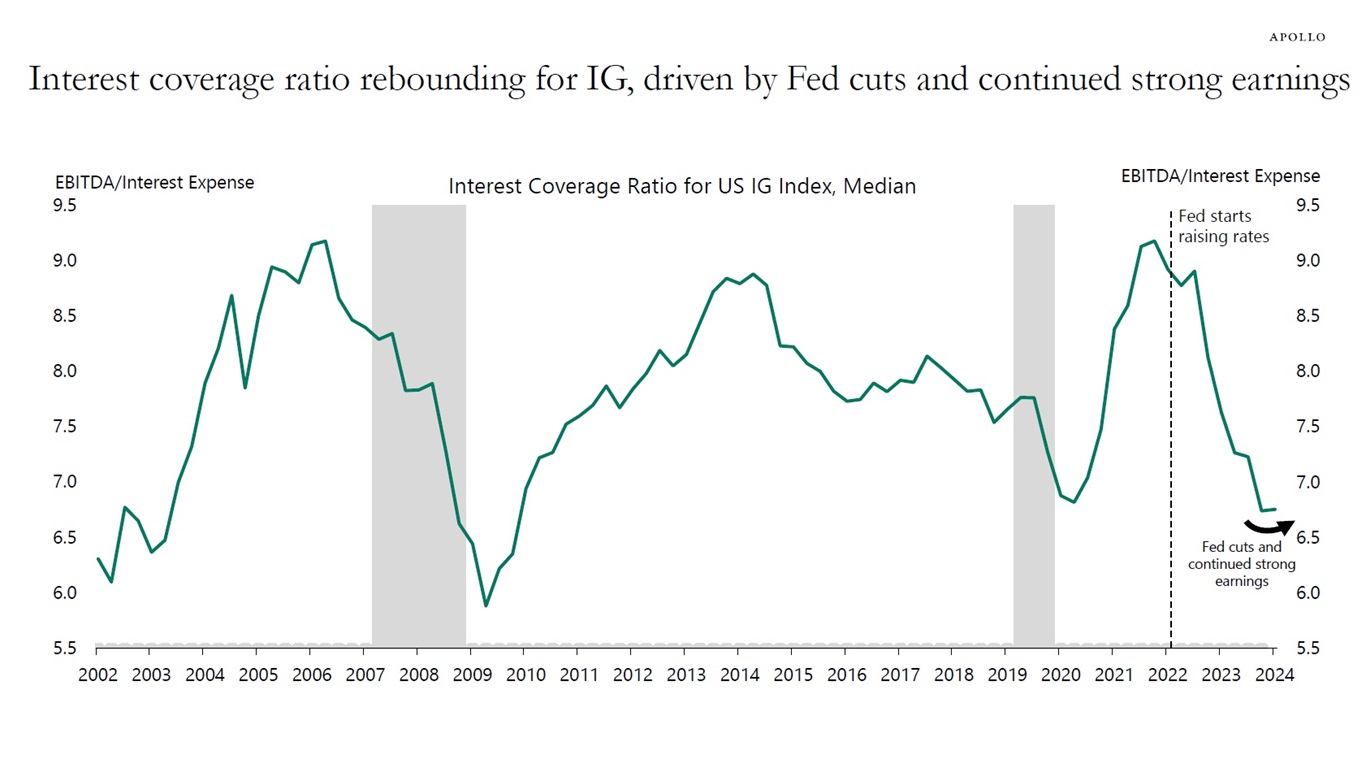

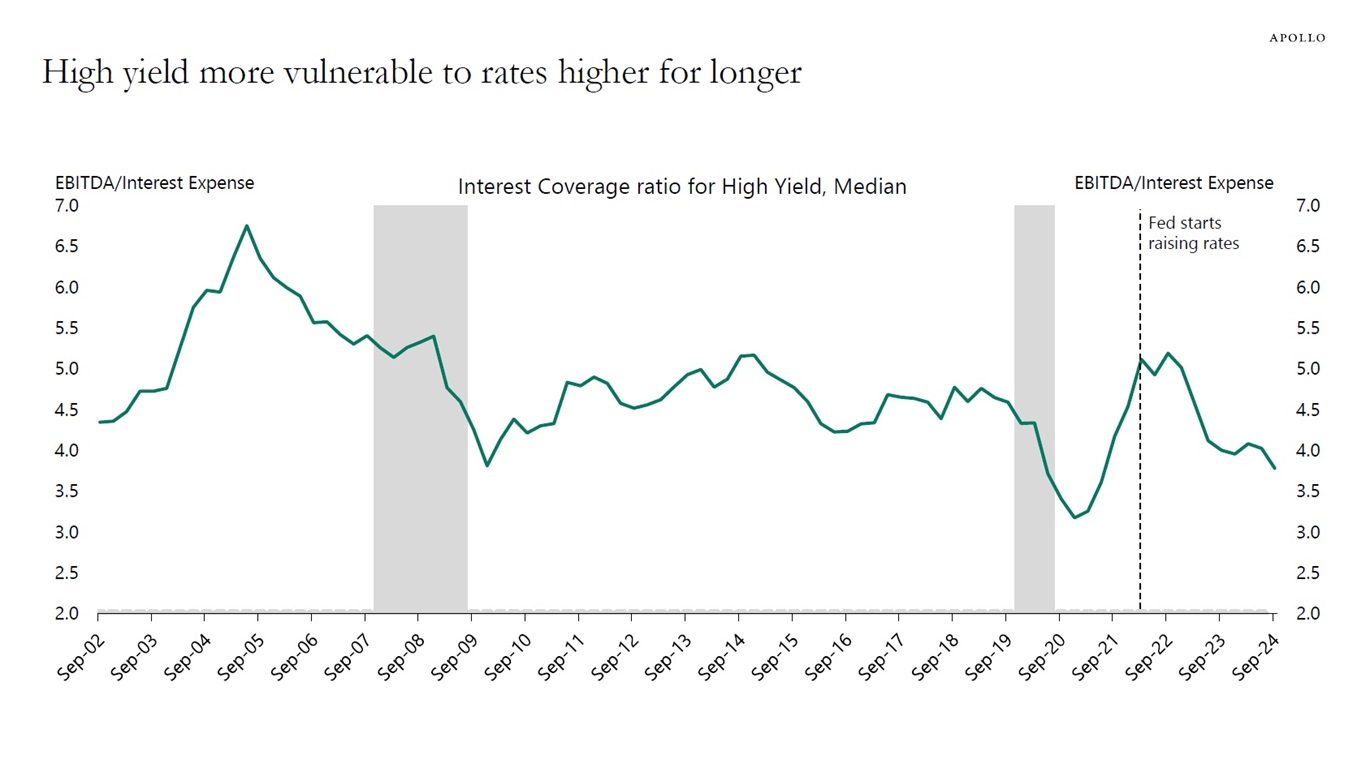

The median interest coverage ratio for the investment grade credit index is just below 7, and for high yield, it is just below 4. Lower-rated credits are more vulnerable to interest rates staying higher for longer because lower-rated credits, by definition, have higher debt-servicing costs.

Recent developments in interest coverage ratios show that Fed cuts and continued strong earnings are starting to help investment grade companies, see charts below. Meanwhile, high yield companies are still seeing a downtrend in coverage ratios driven by higher debt-servicing costs.

The Fed cutting interest rates and continued strong earnings will be helpful for both investment grade credit and high yield credit. But as interest rates stay elevated, debt-servicing costs will weigh more heavily on high yield companies, and investment grade credits with lower debt-servicing costs will be more attractive.

This happens to be exactly how monetary policy works: Companies with higher debt-servicing costs and lower coverage ratios are hit harder by Fed hikes and interest rates staying higher for longer.

For more discussion, see here.

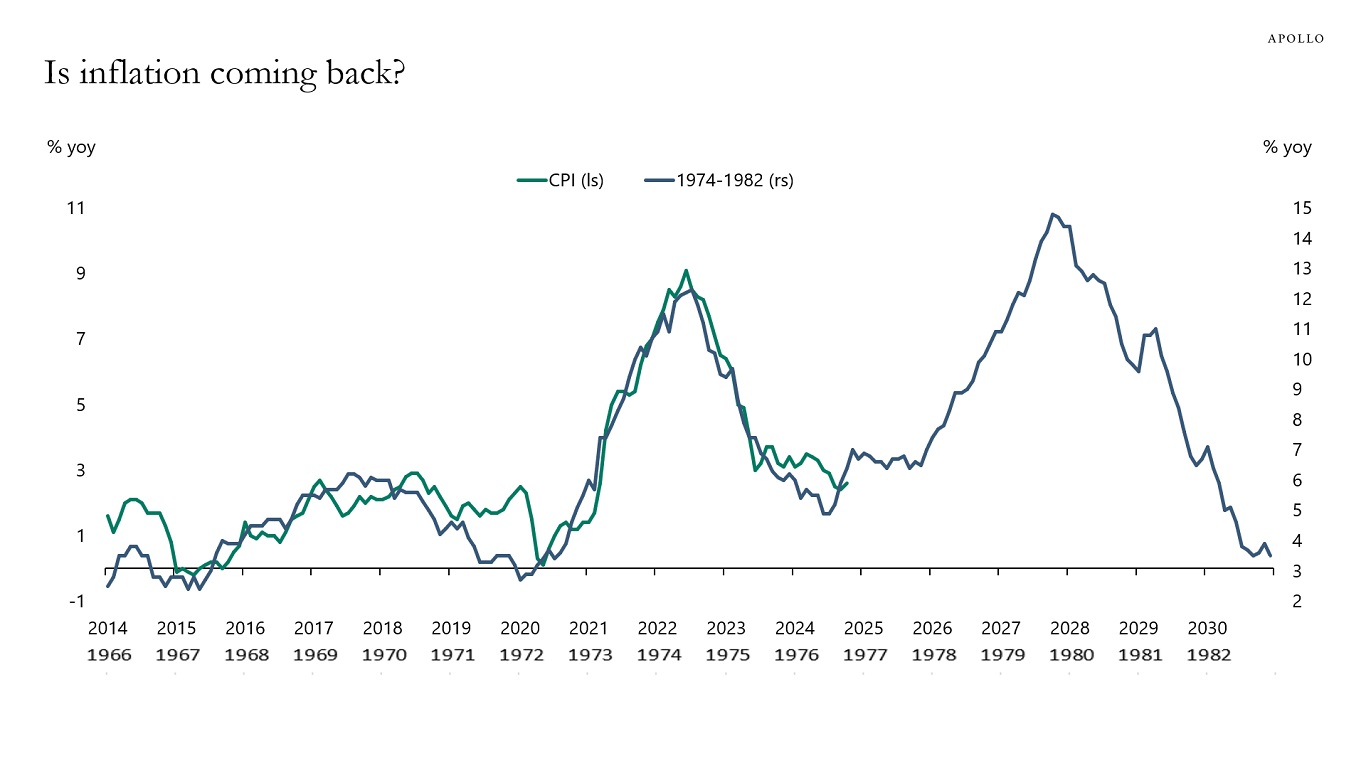

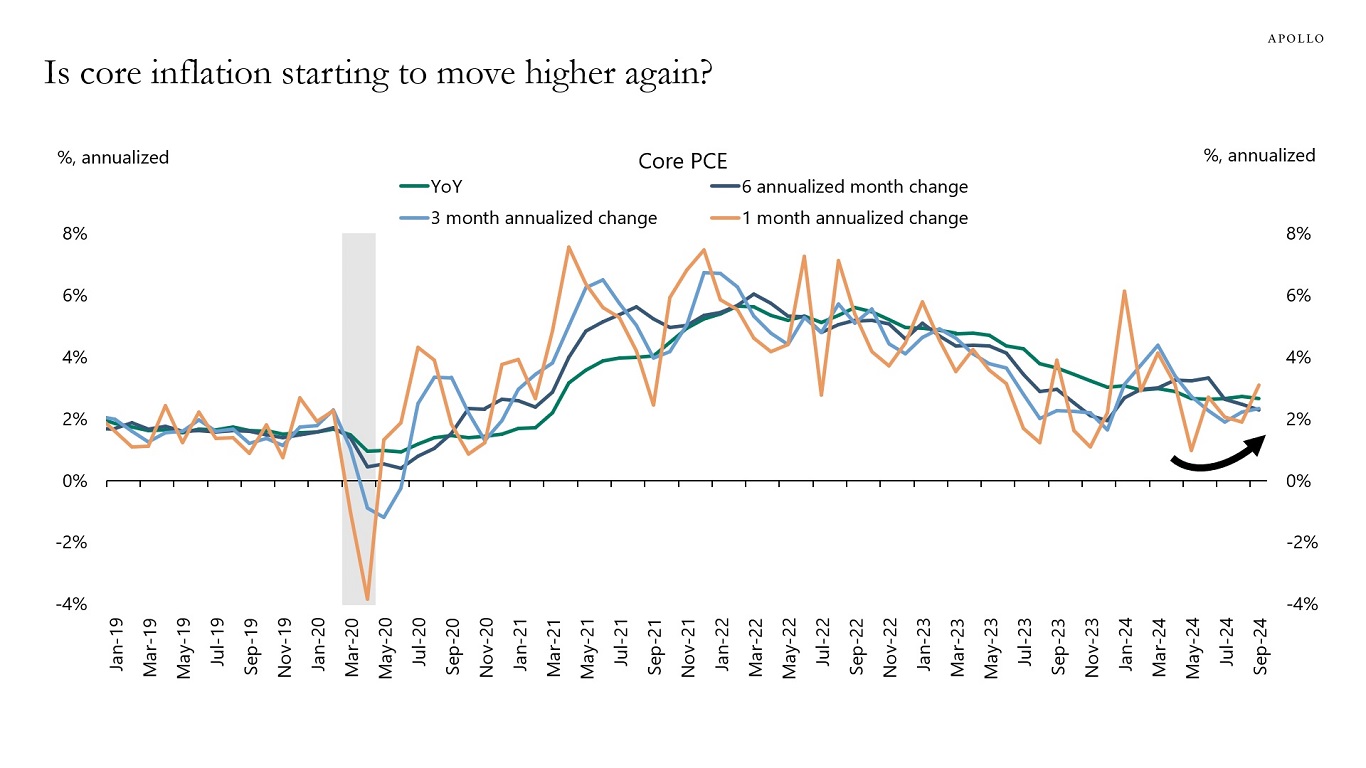

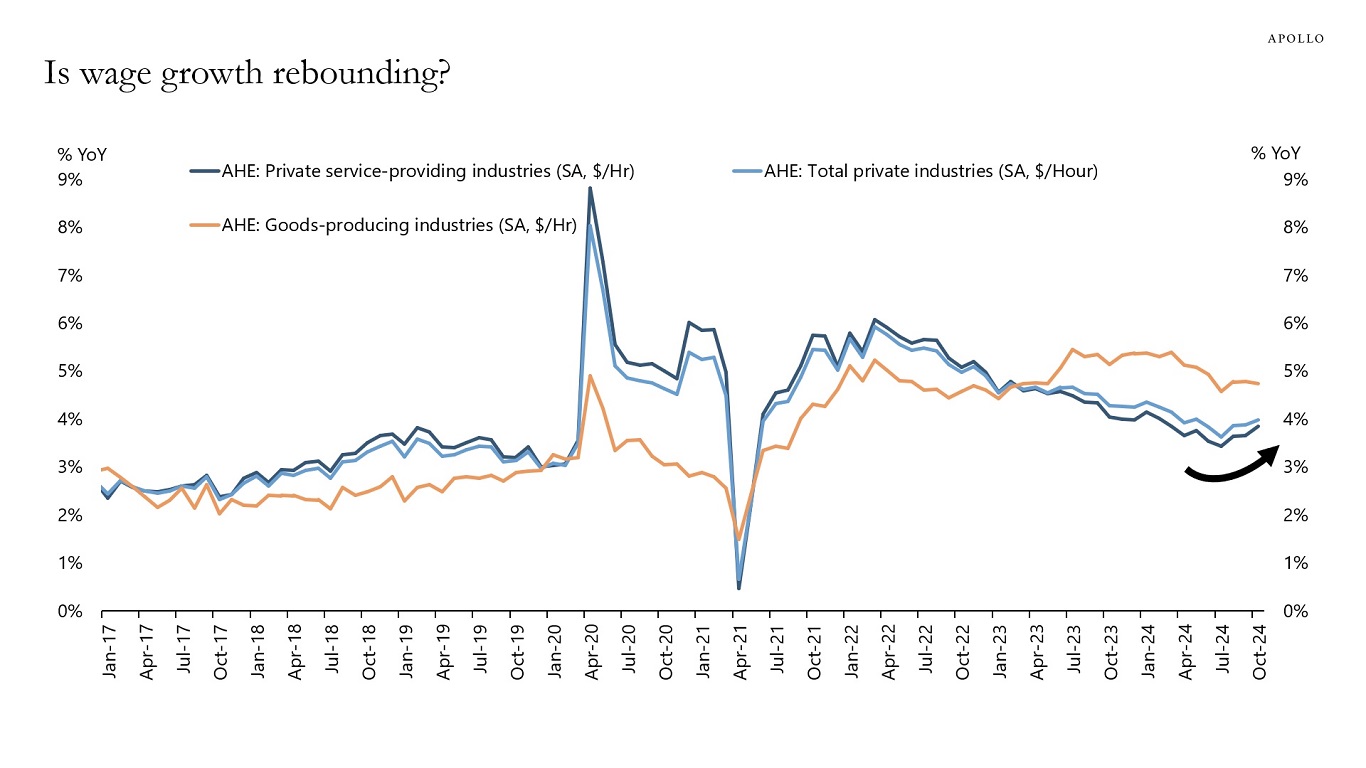

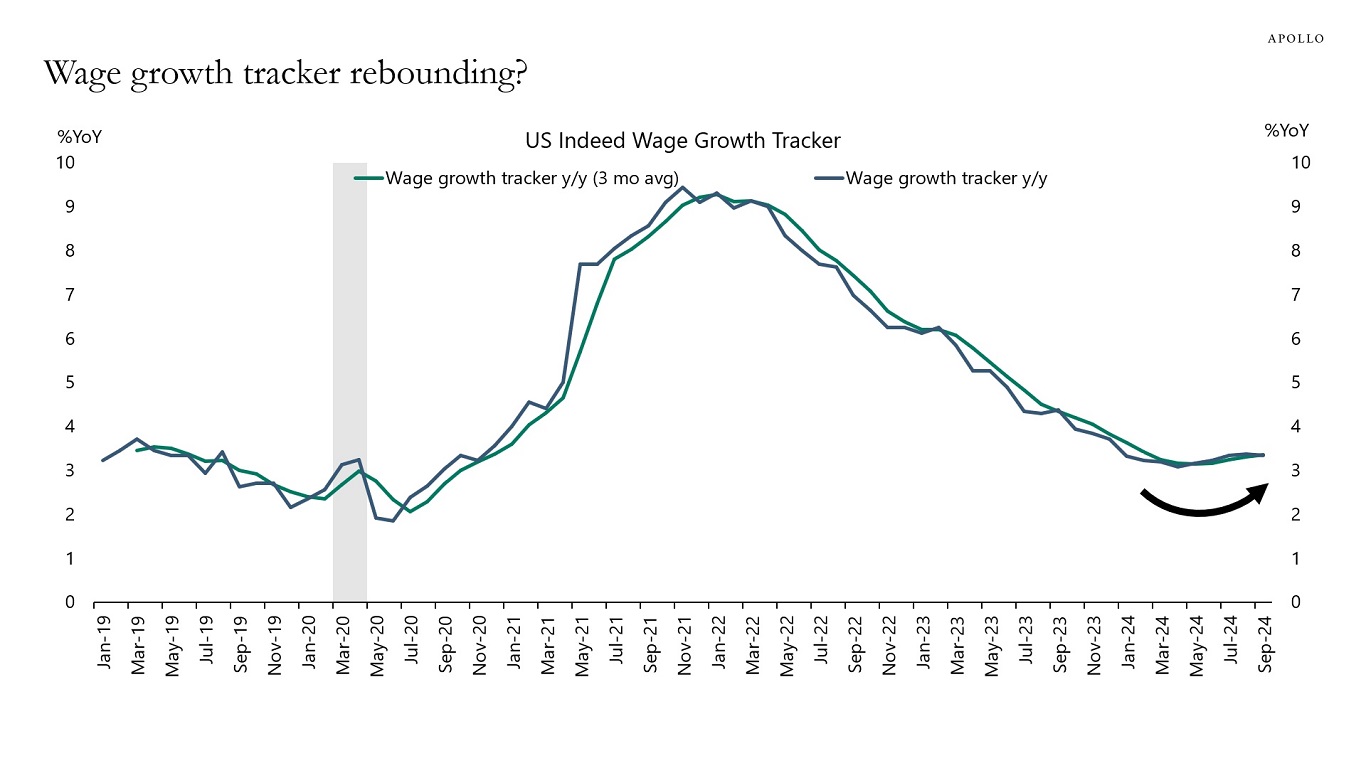

This week, we got higher CPI, PPI, and retail sales, and the incoming data continues to be strong.

Combined with the observed acceleration in average hourly earnings in recent months, the risks are rising that inflation could begin to move higher again, see charts below and our weekly chart book.

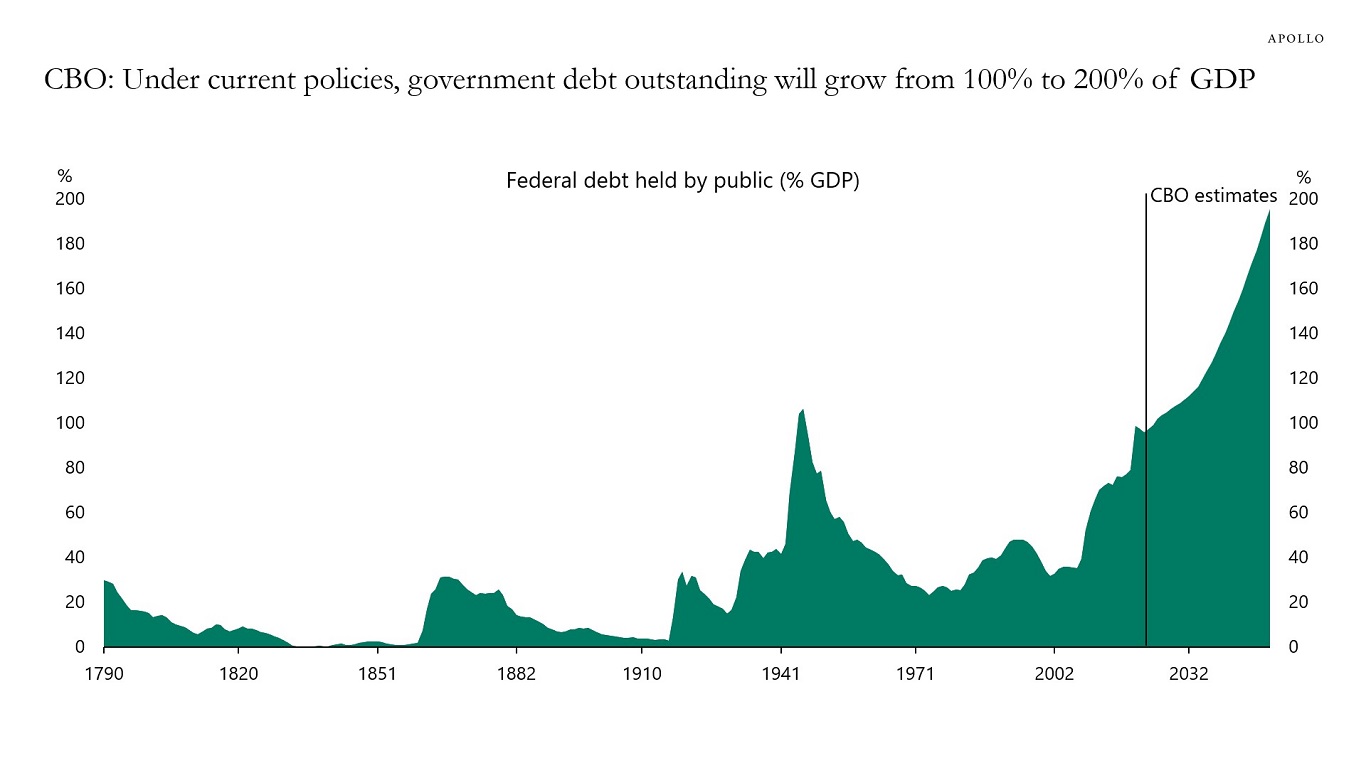

In this chart book, we take a data-driven look at the US fiscal situation. We also discuss where in financial markets the first signs might appear that US fiscal policy is unsustainable.

The population is aging, there is not enough retirement savings, and retirement asset allocation is distorted with too much money in daily liquid equities highly concentrated in the Magnificent Seven. The bottom line is that more retirement savings are needed and better retirement products are needed. Our chart book, available here, looks at the growing retirement savings challenge.

Listen to Apollo Chief Economist Torsten Sløk and Jim Vanek, Co-Head of Global Performing Credit at Apollo, discuss their views on what’s next for credit markets amid the Fed’s shift to easing monetary policy and the election of Donald Trump as the next US President.

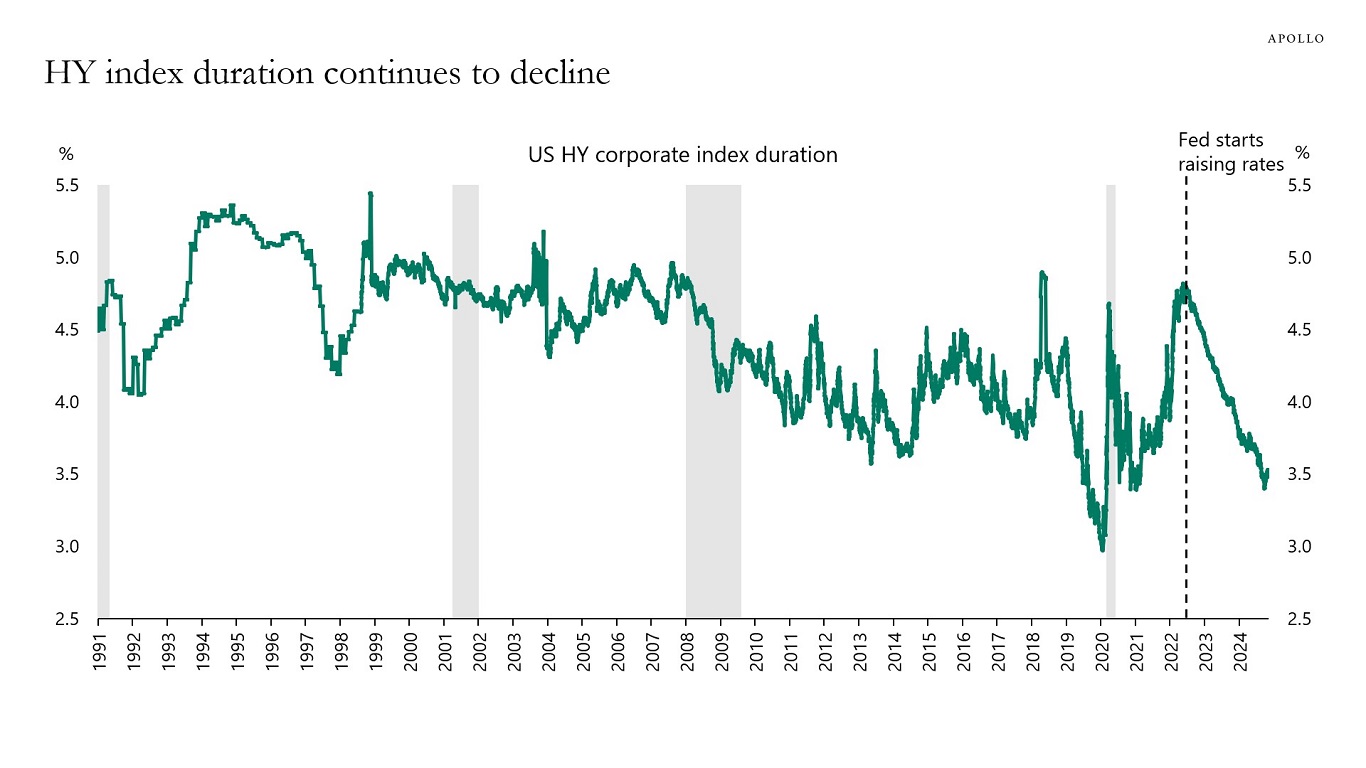

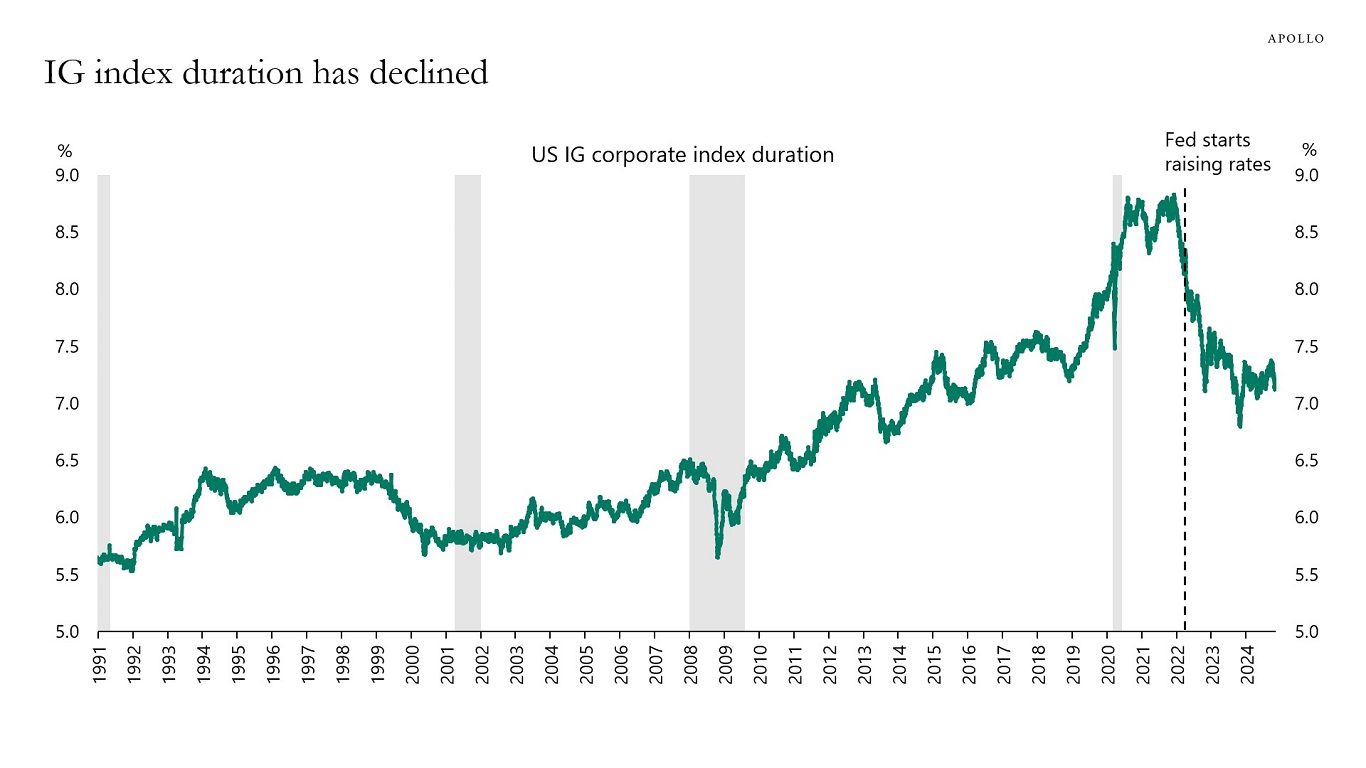

Modified duration measures the expected change in a bond’s price to a 1% change in interest rates. The charts below show that since the Fed started raising rates, index duration has declined both for high yield and investment grade, with high yield duration currently standing at 3.5% and investment grade duration at close to 7%.

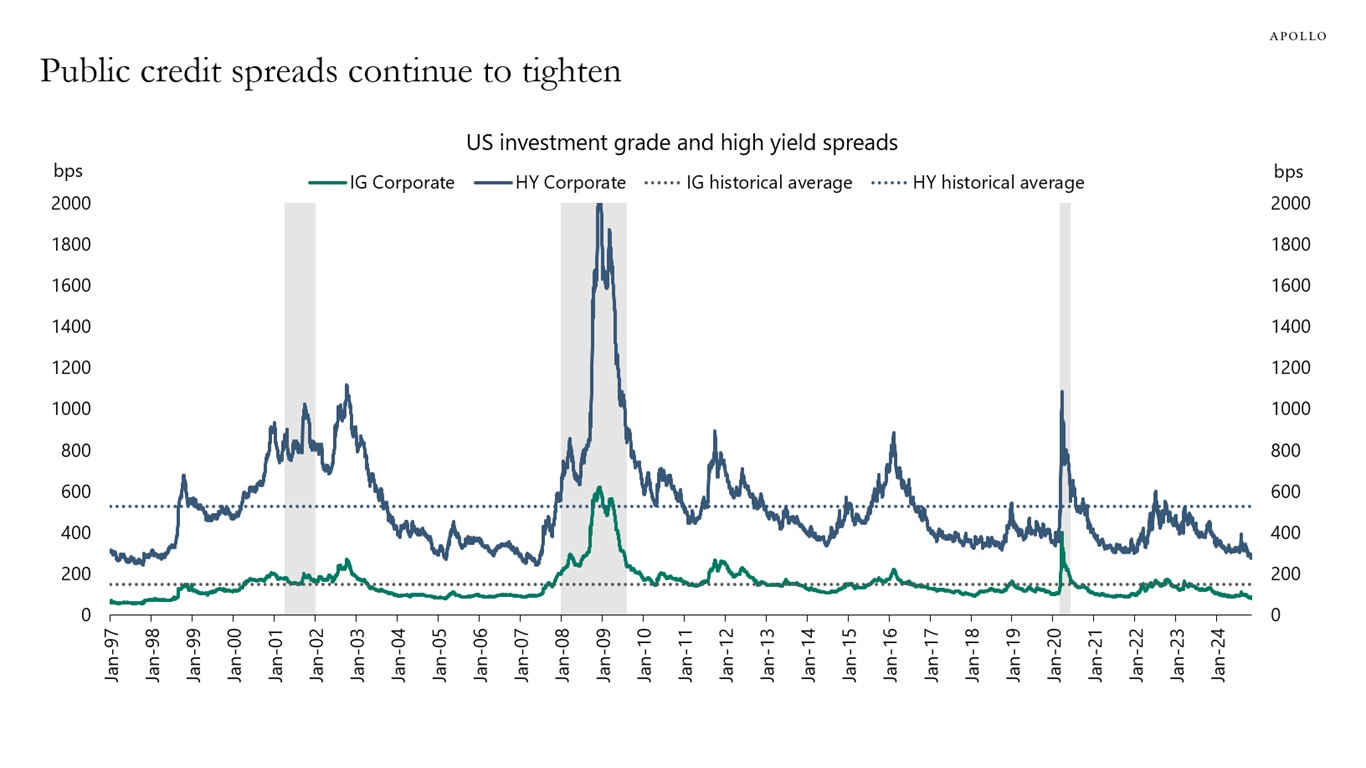

Spreads for public investment grade credit have tightened to just 74 basis points on the index, see the first chart.

But what matters for pension funds, insurance, and households is all-in yields, and all-in yields remain high, in particular for private credit, see the second chart.

For more discussion, see also here.