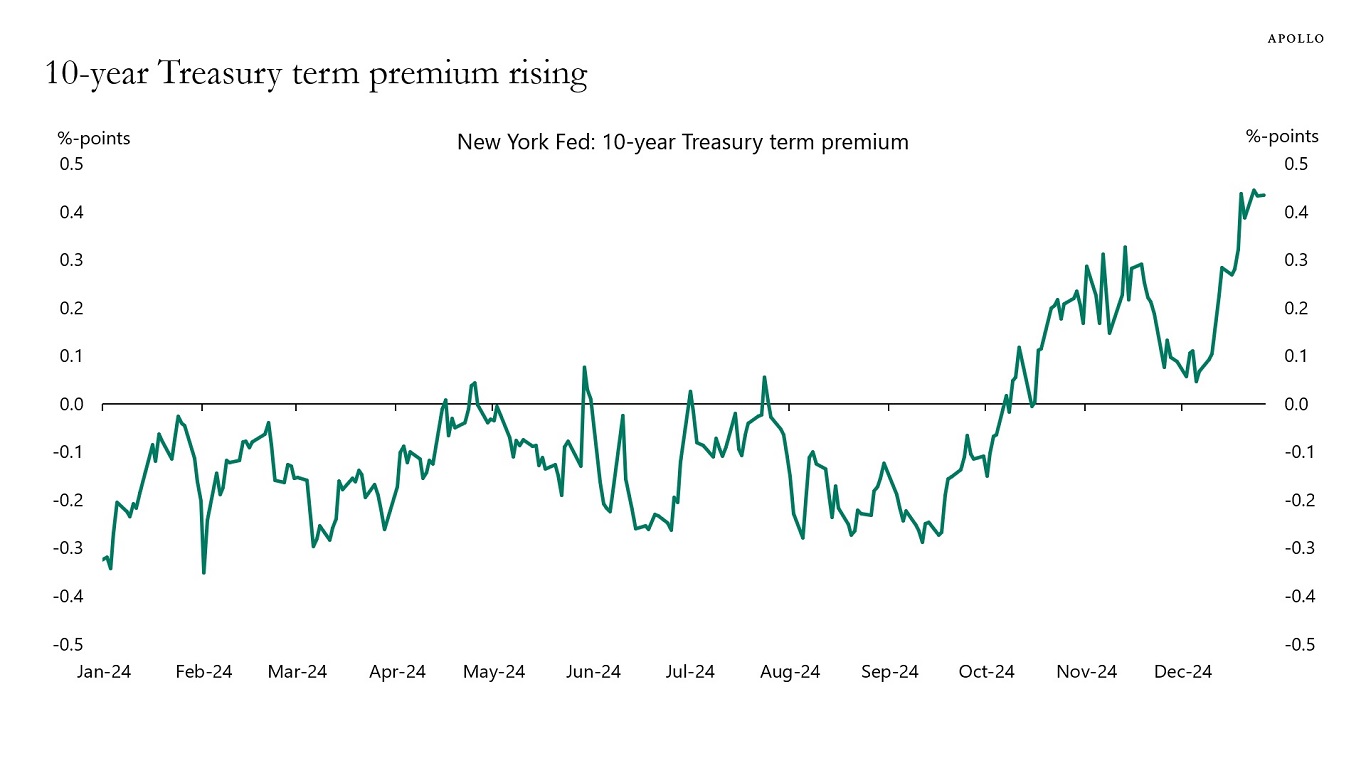

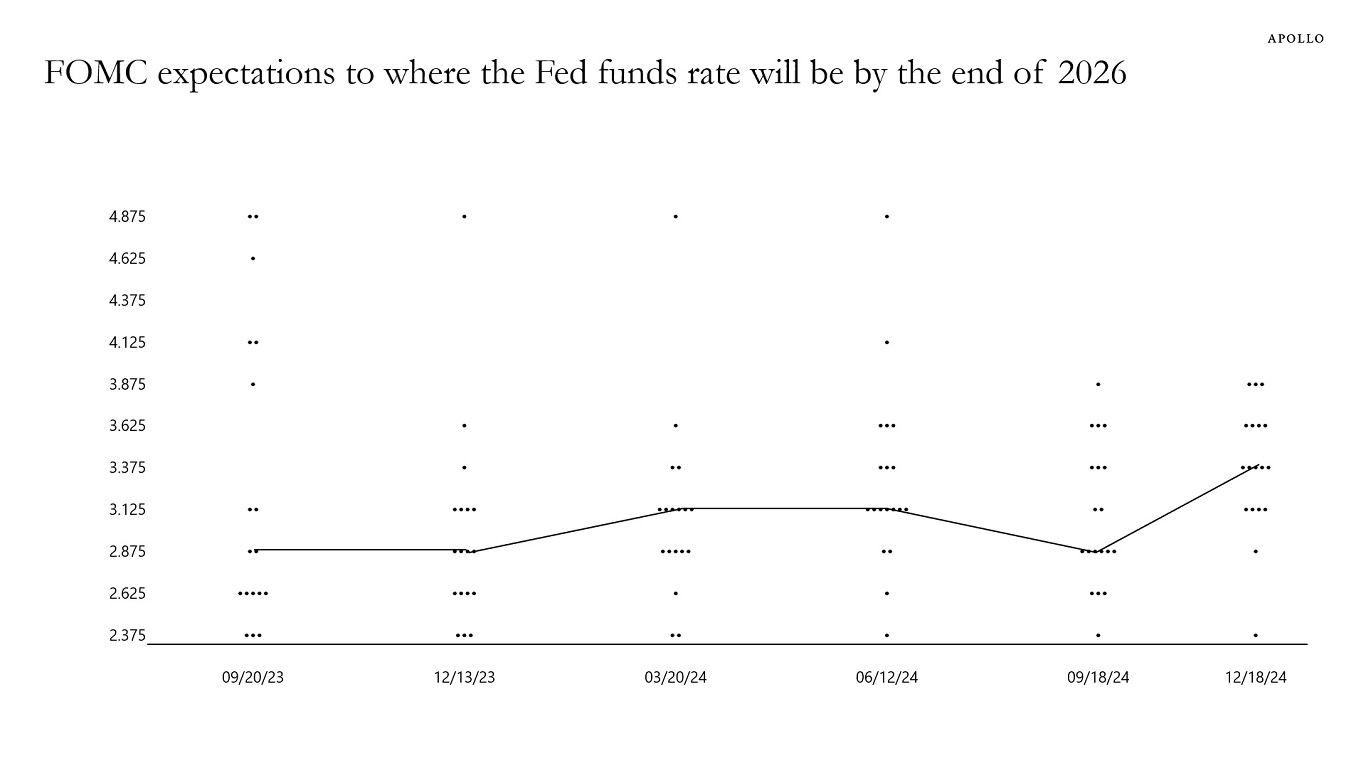

The term premium for 10-year Treasuries has increased 75 basis points (bps) over the past three months, see chart below.

In other words, 10-year rates have increased an additional 75 bps more than what can be justified by changing Fed expectations, which is likely a reflection of emerging fears in markets about US fiscal sustainability.

Combined with the significant decline in the Fed’s Reverse Repo Facility (RRP) usage and the dramatic increase in T-bill issuance in 2024 (which needs to be rolled over into longer duration), the risks are rising that rates markets will be more volatile in 2025.