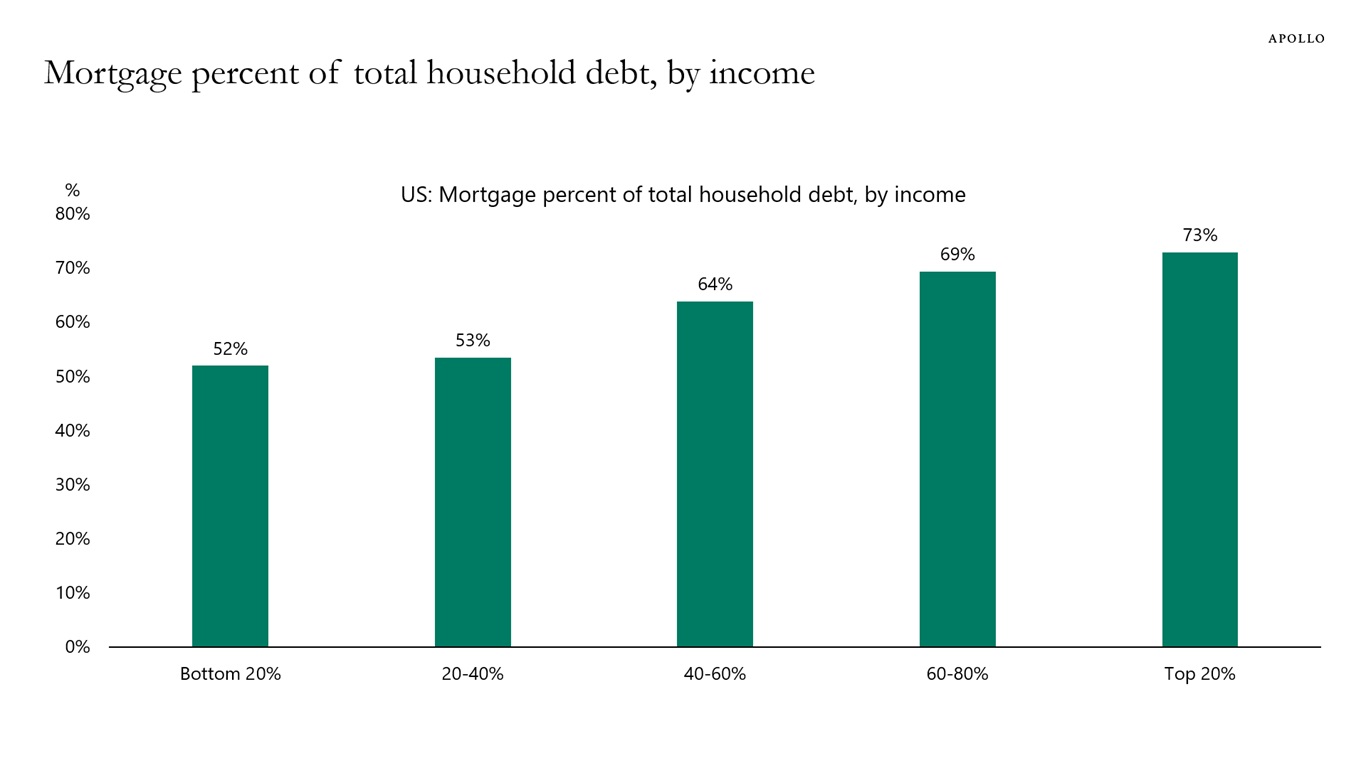

In the United States, 95% of mortgages are 30-year fixed rate, and mortgage debt makes up a smaller share of household debt for lower-income groups, which means that lower-income groups are more vulnerable to Fed hikes and interest rates staying higher for longer, see chart below.