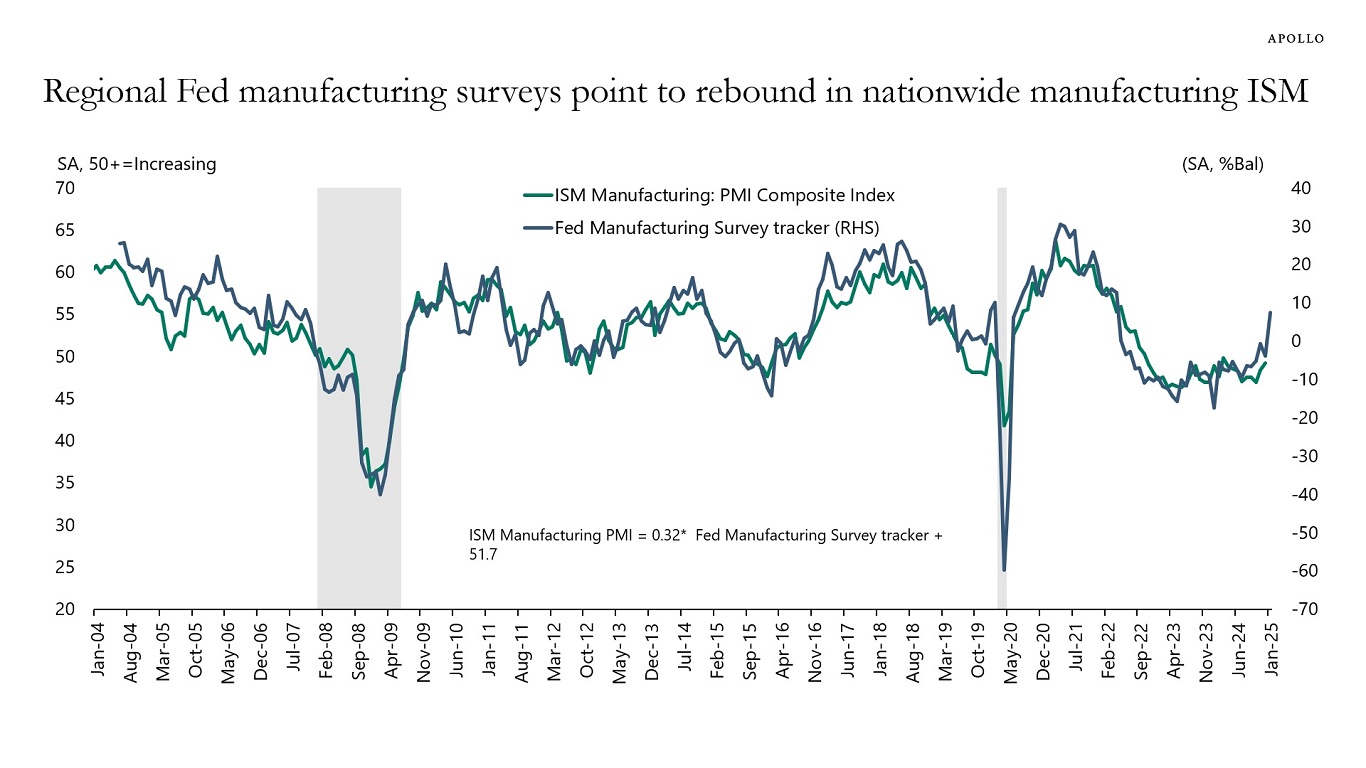

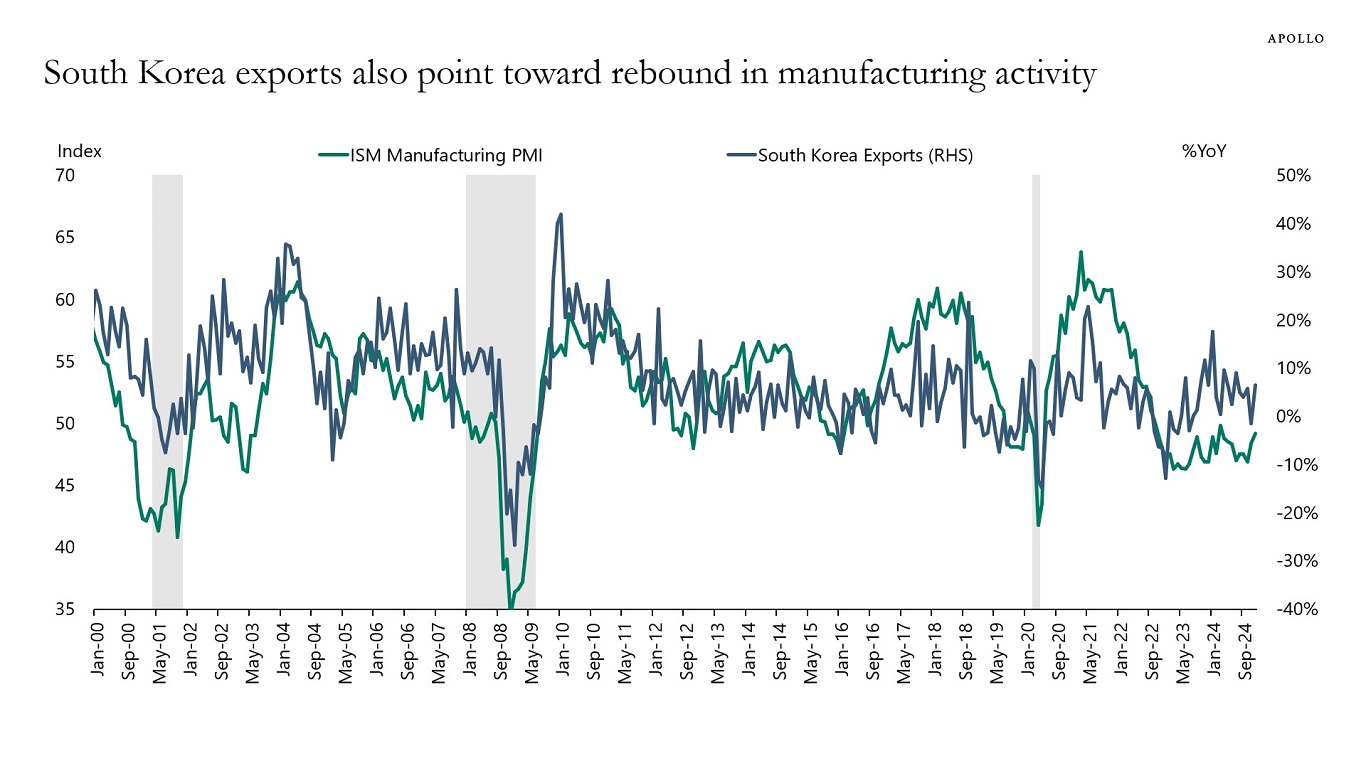

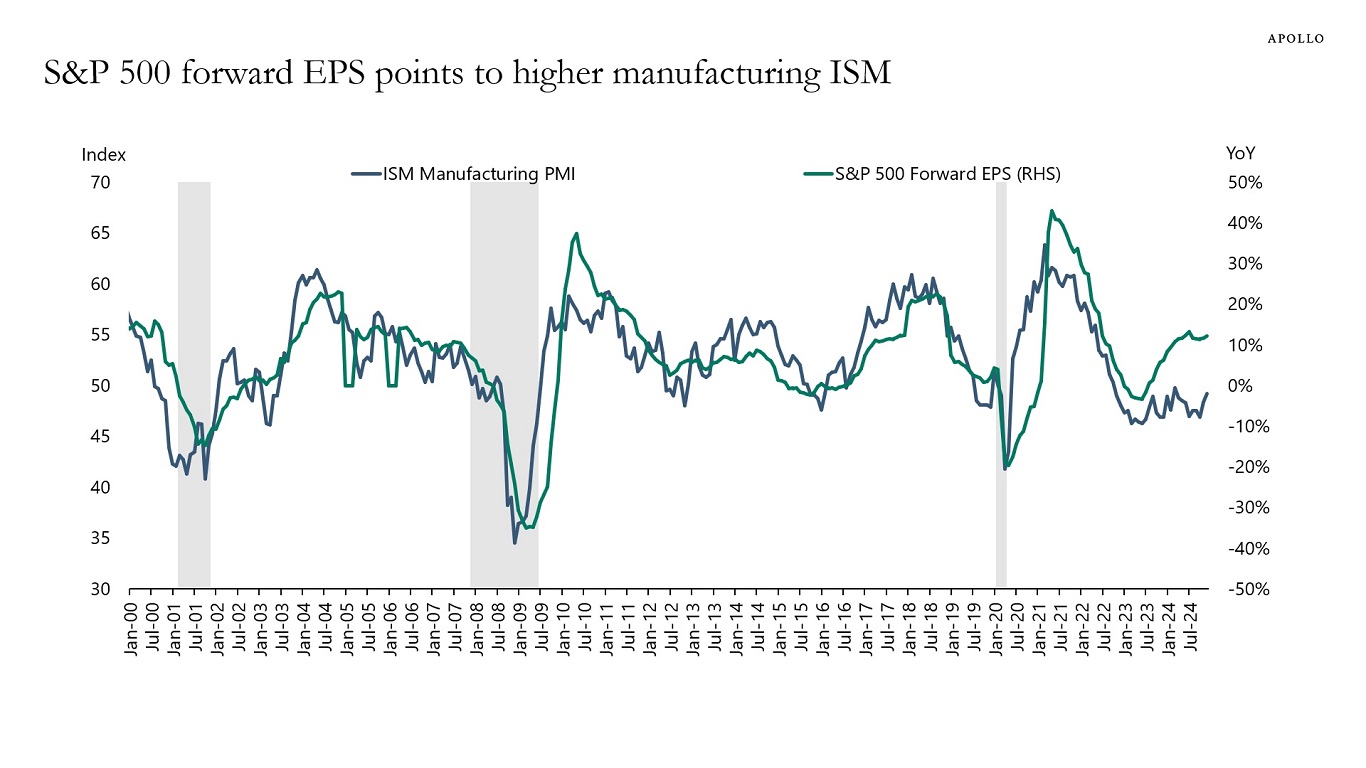

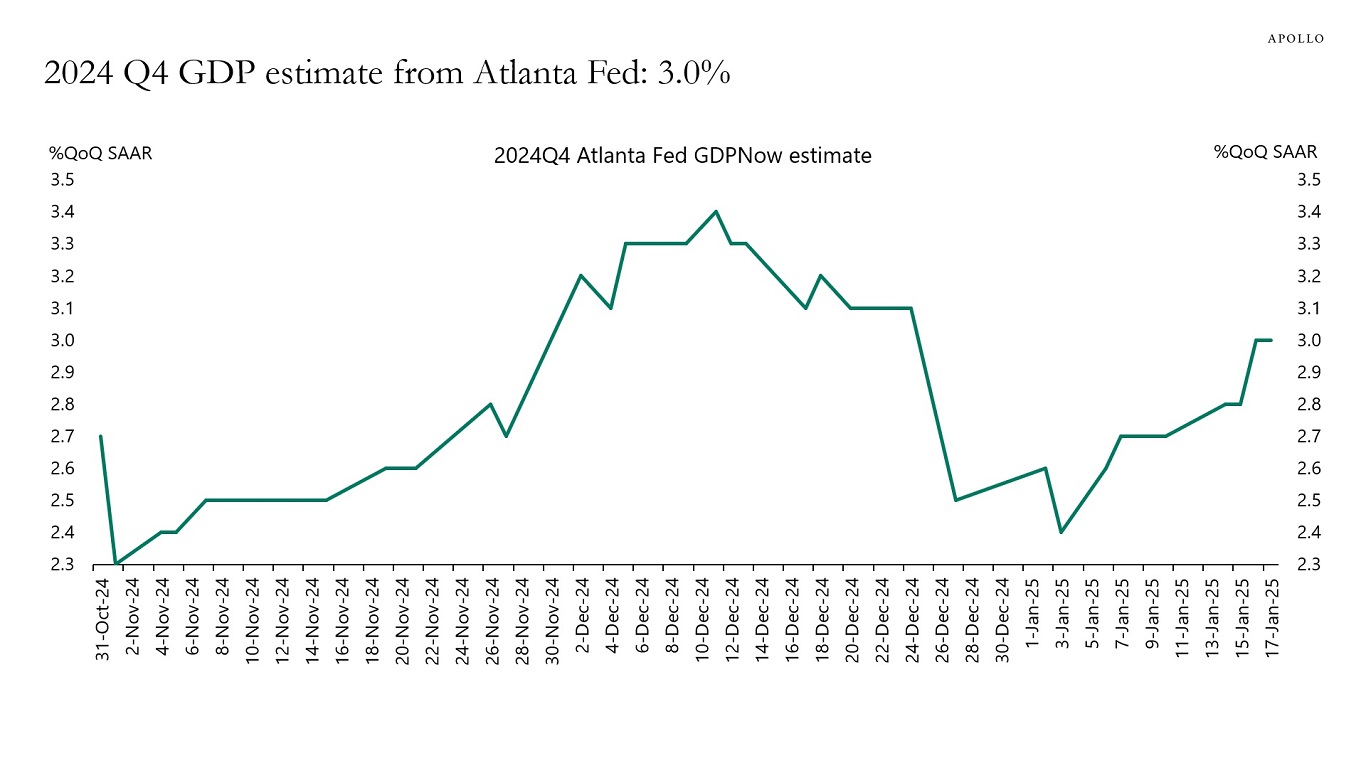

On Monday, we will get manufacturing ISM for January, and it is likely to show a big jump higher, see charts below. Based on the historical relationship with the regional Fed ISM indicators, the nationwide ISM could increase to 54, a level which would be consistent with first-quarter GDP growth of 3.4%.

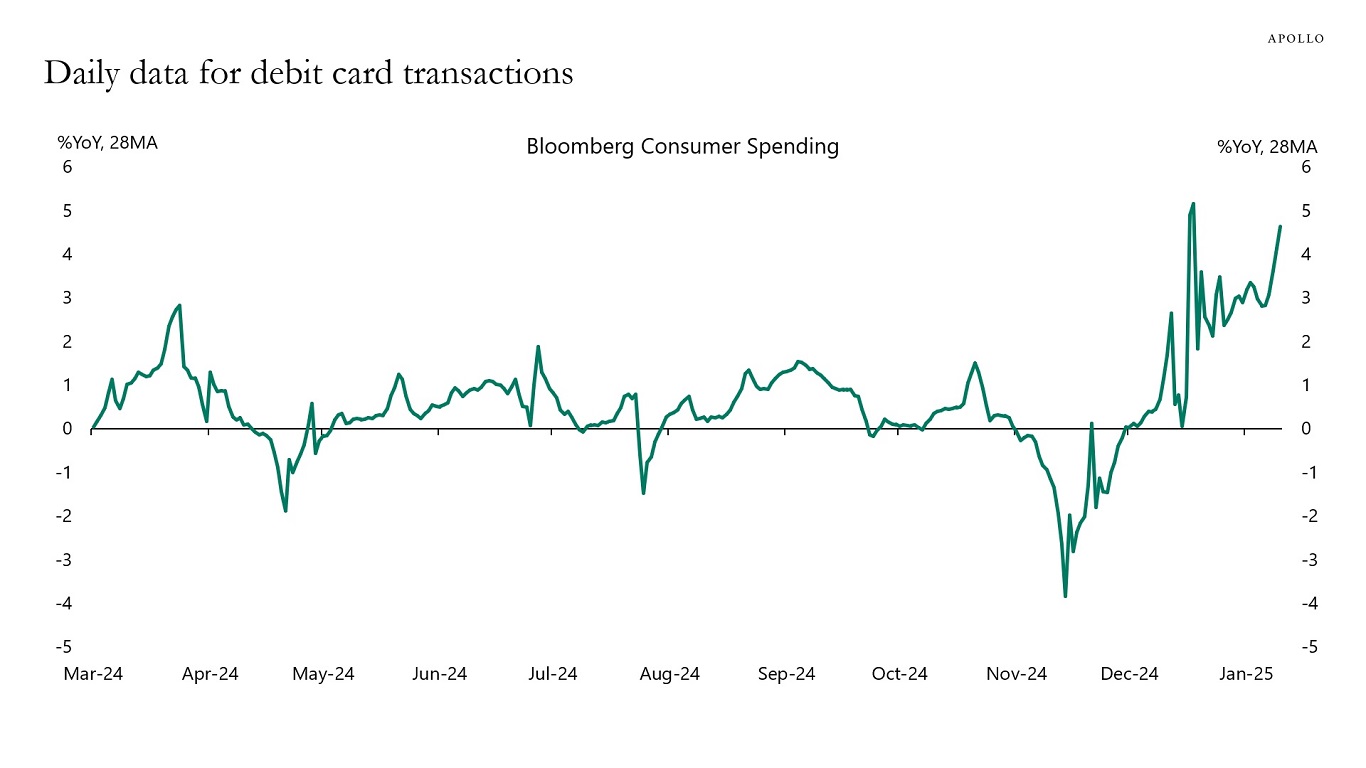

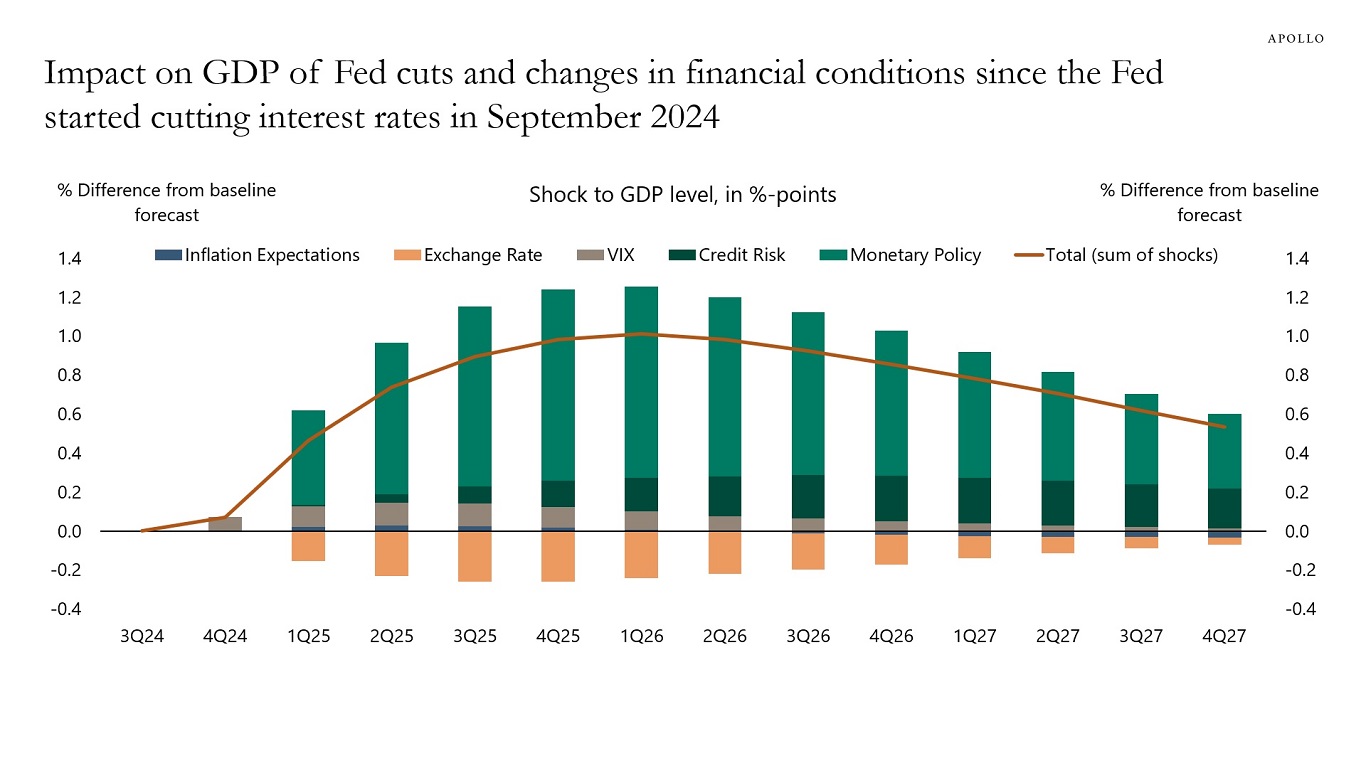

The strong momentum in the economy is driven by high stock prices, high home prices, and strong tailwinds to growth from tech capex spending, defense spending, and spending driven by the CHIPS Act, the IRA, and the Infrastructure Act.

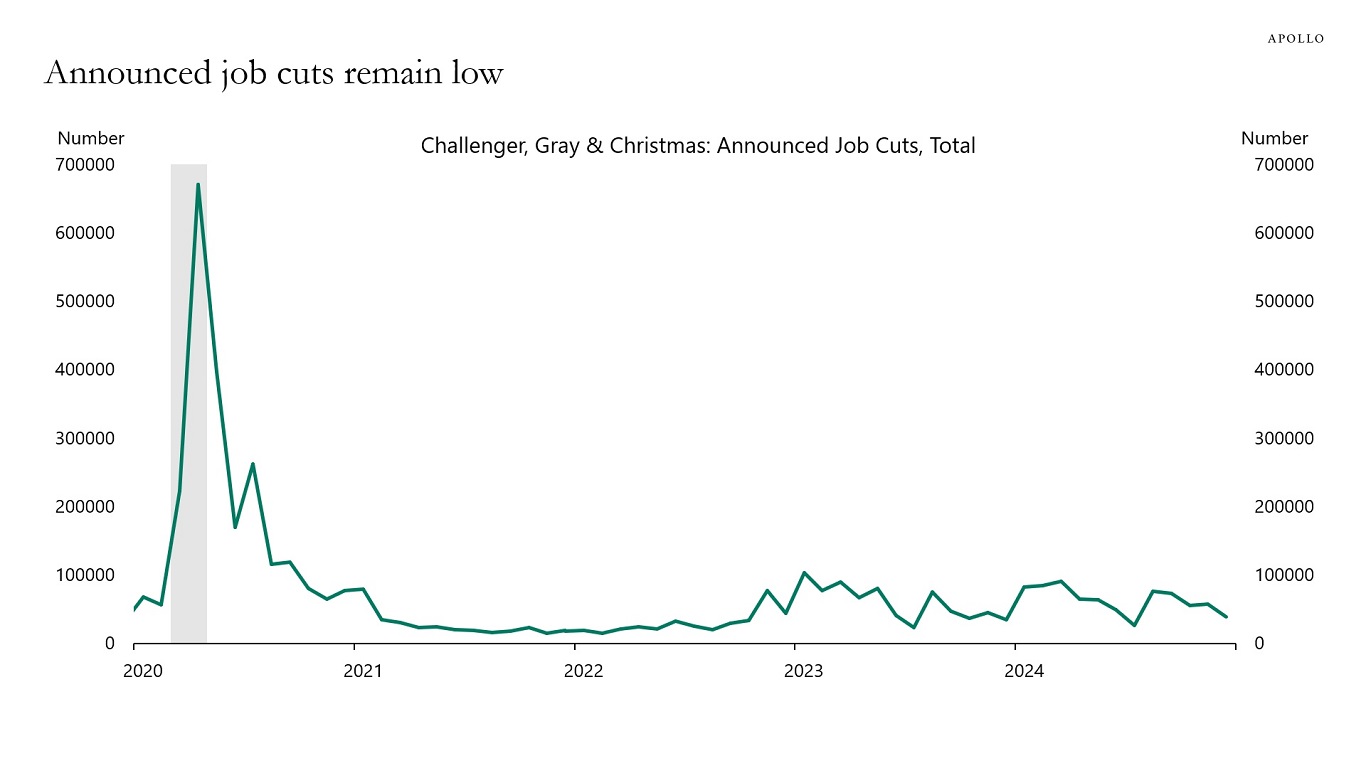

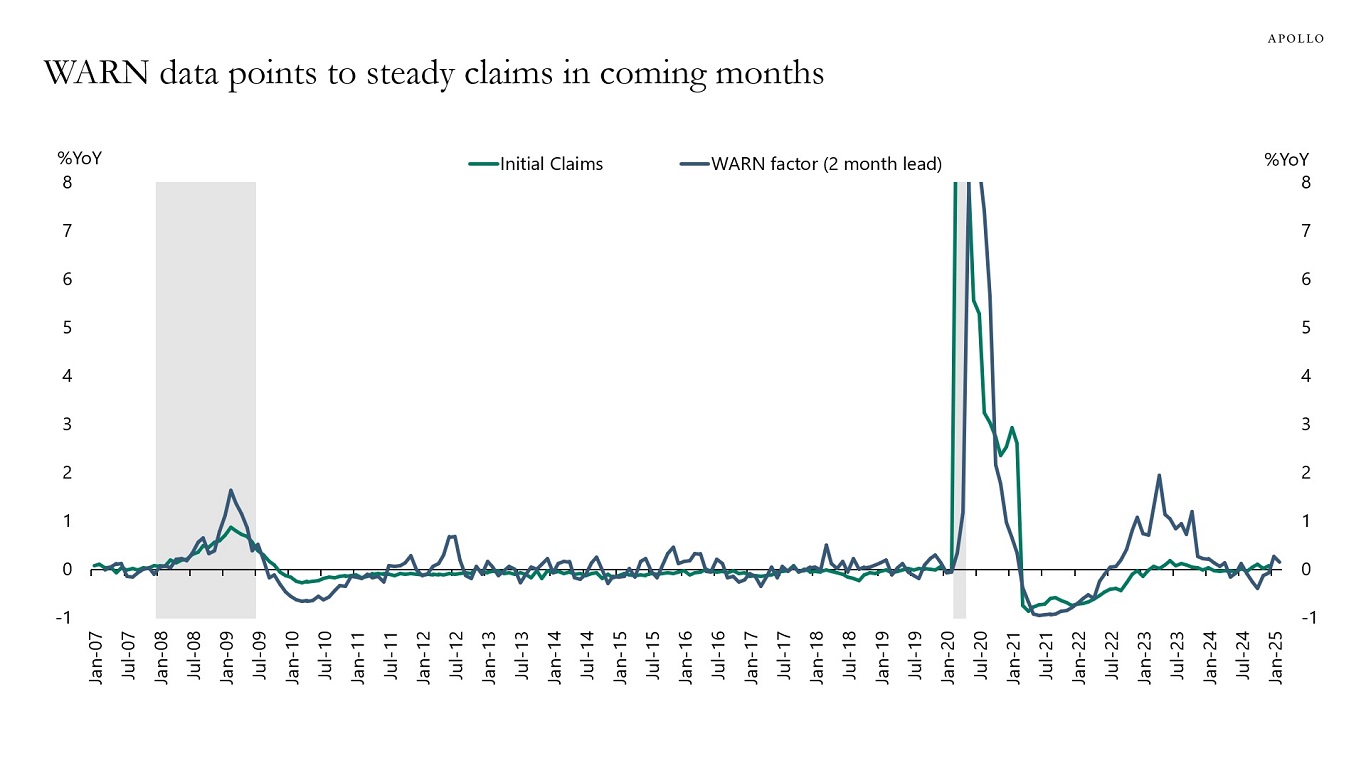

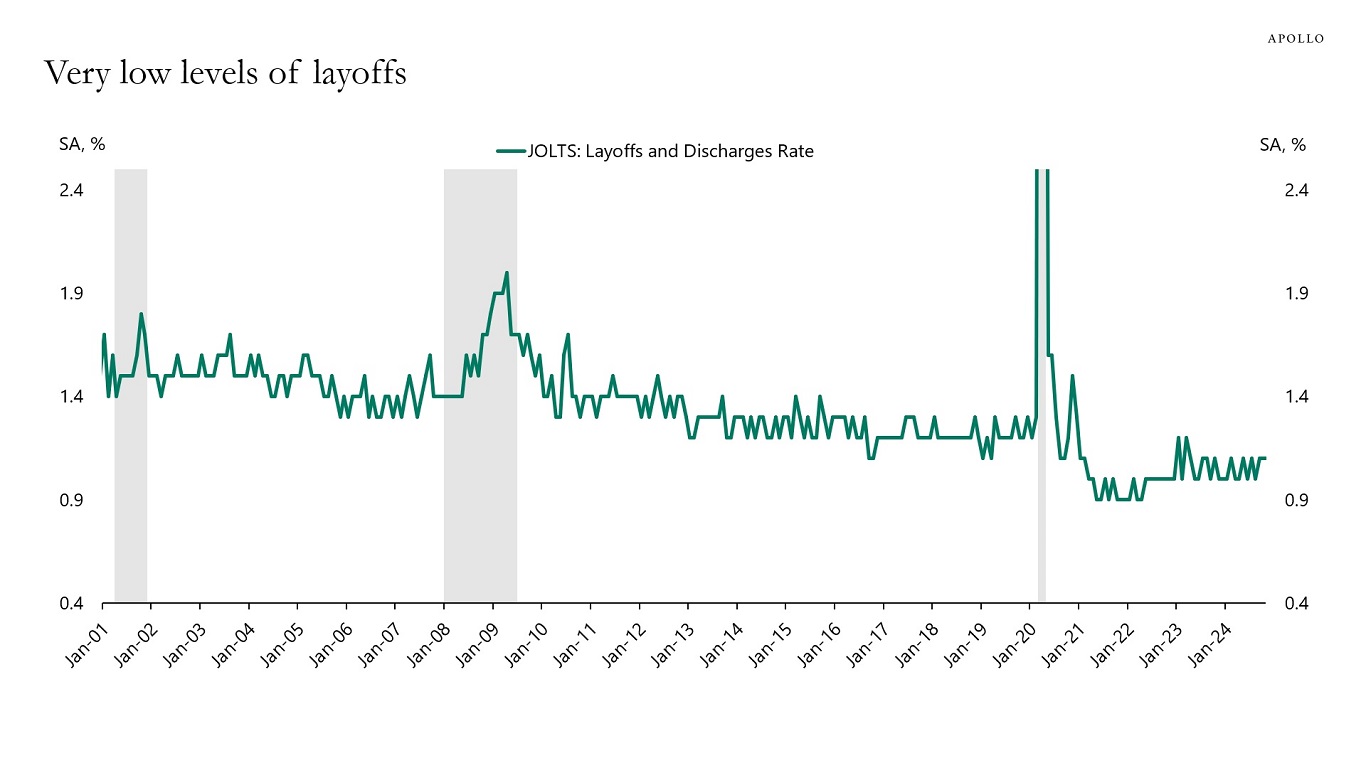

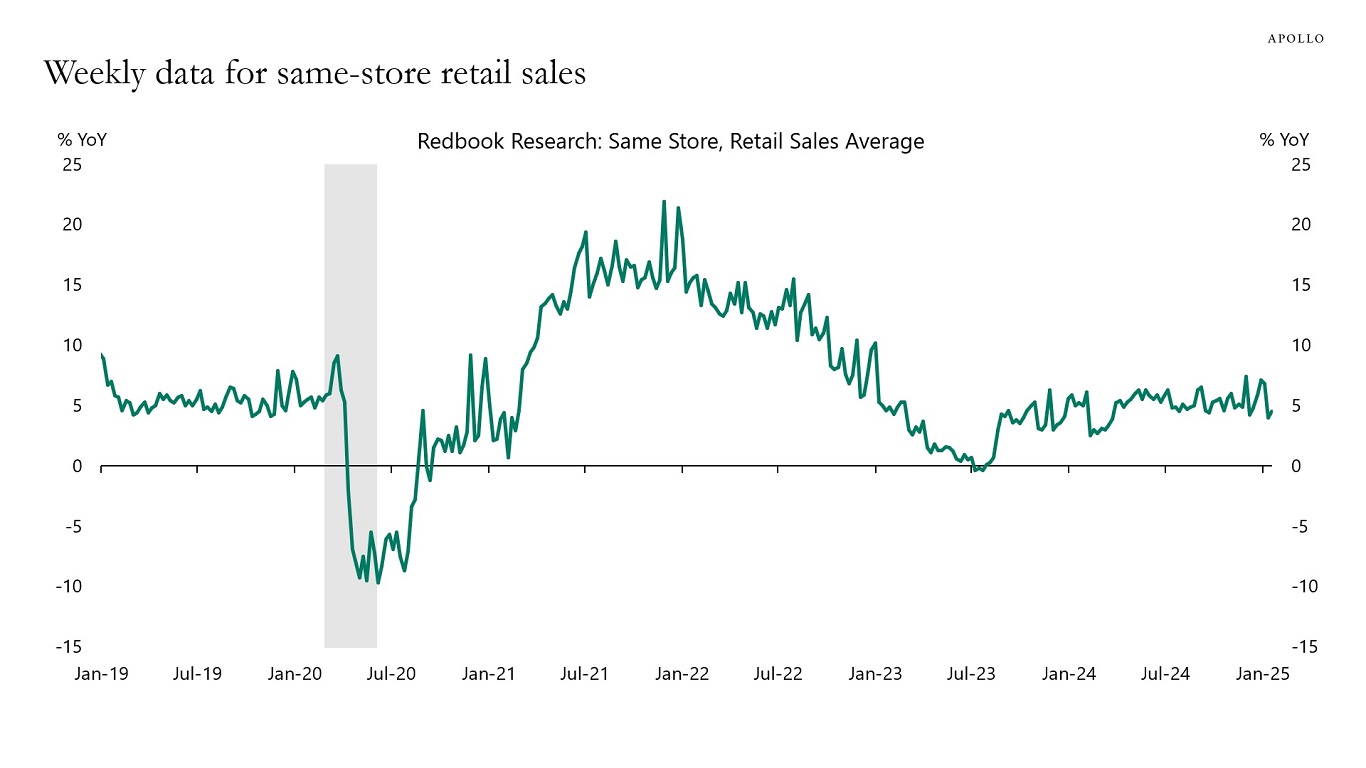

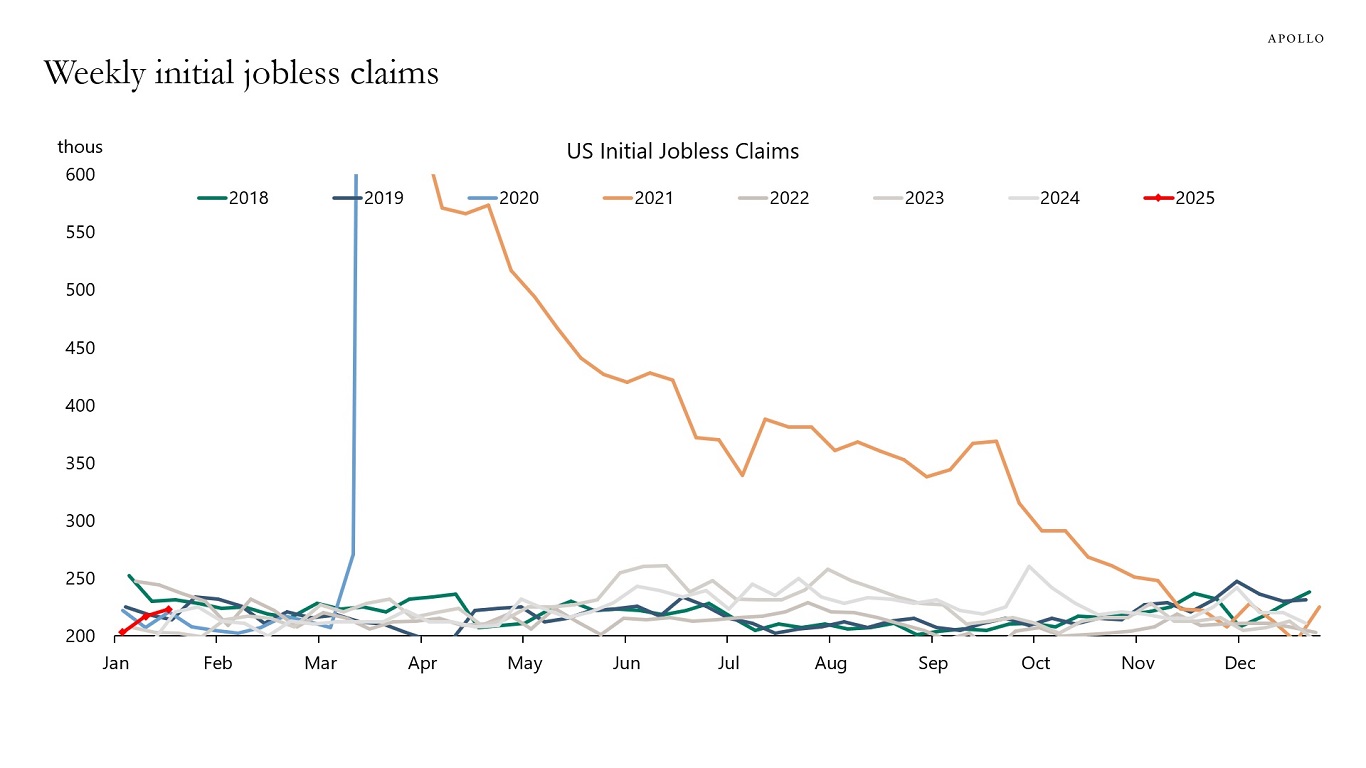

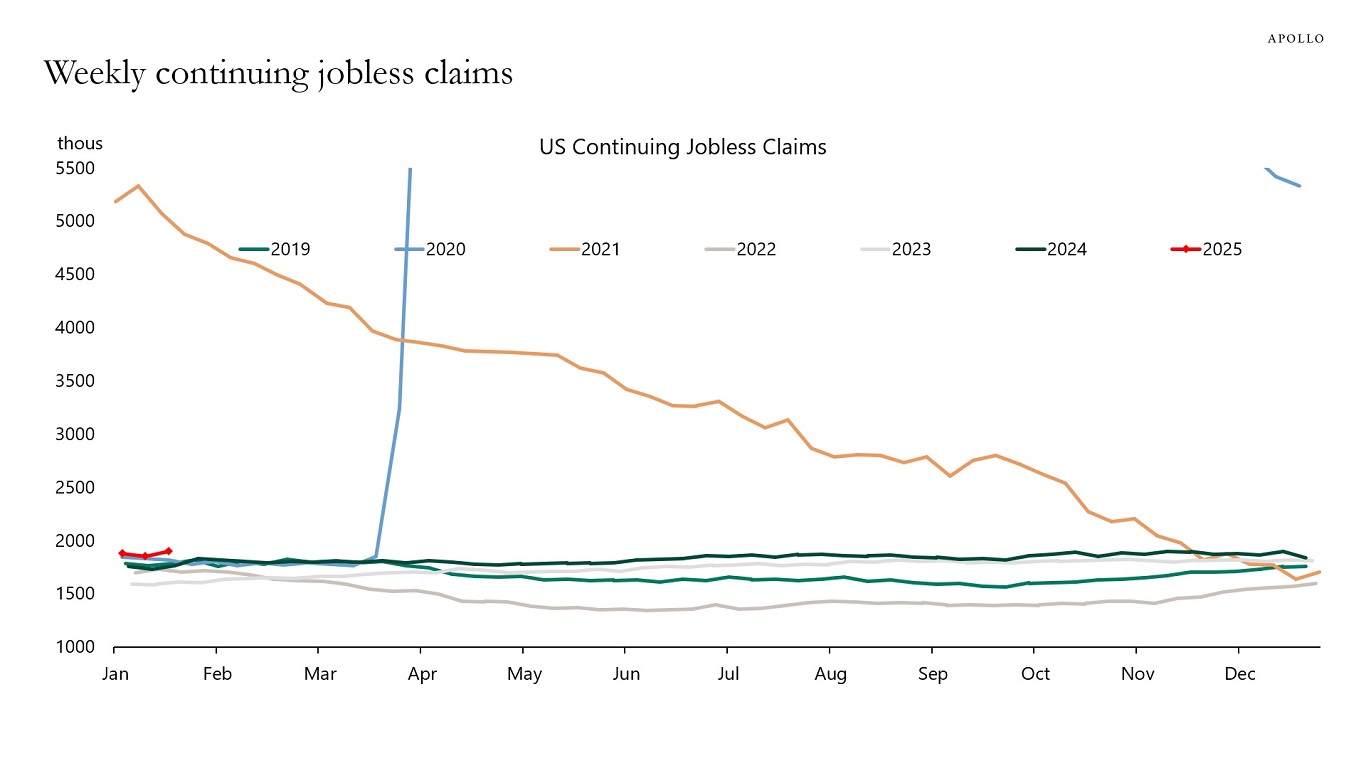

Combined with low jobless claims and higher animal spirits since the election, the bottom line is that the US economy is entering 2025 with accelerating momentum.

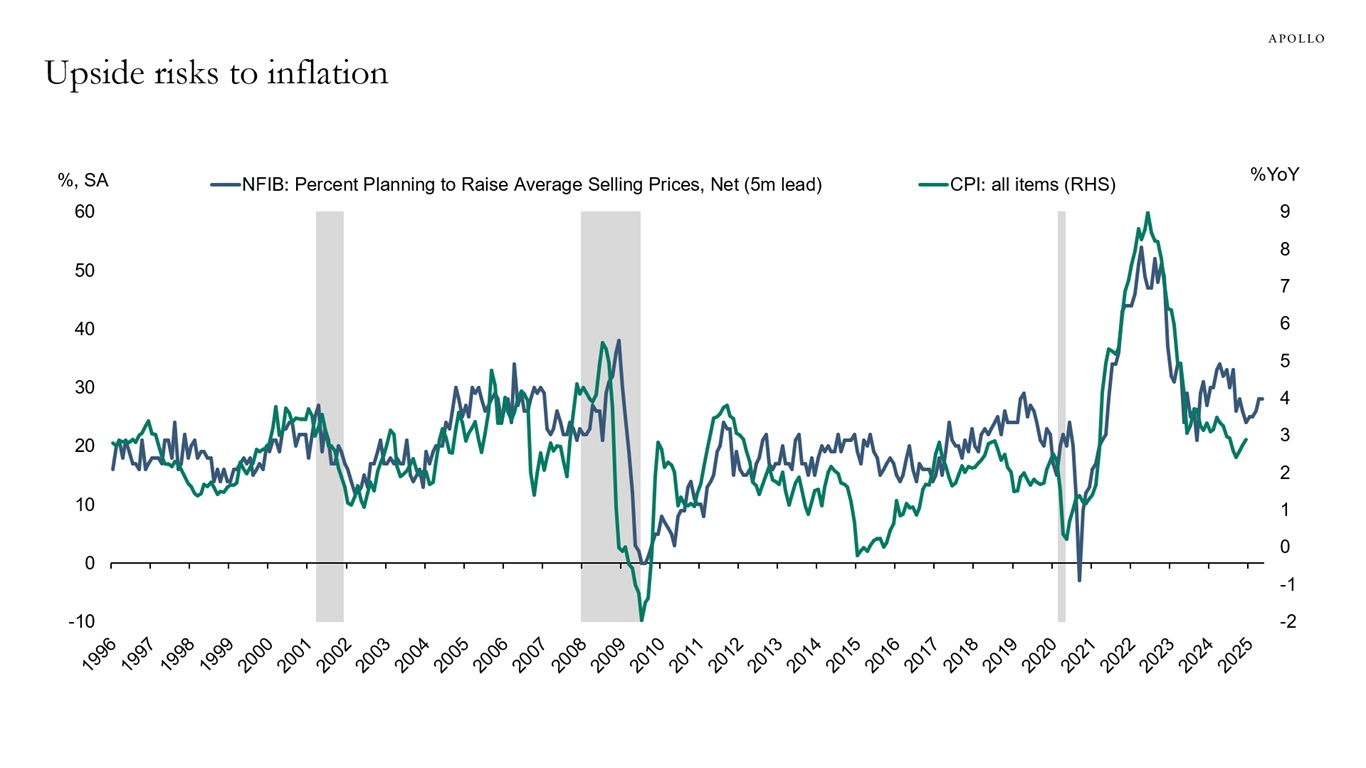

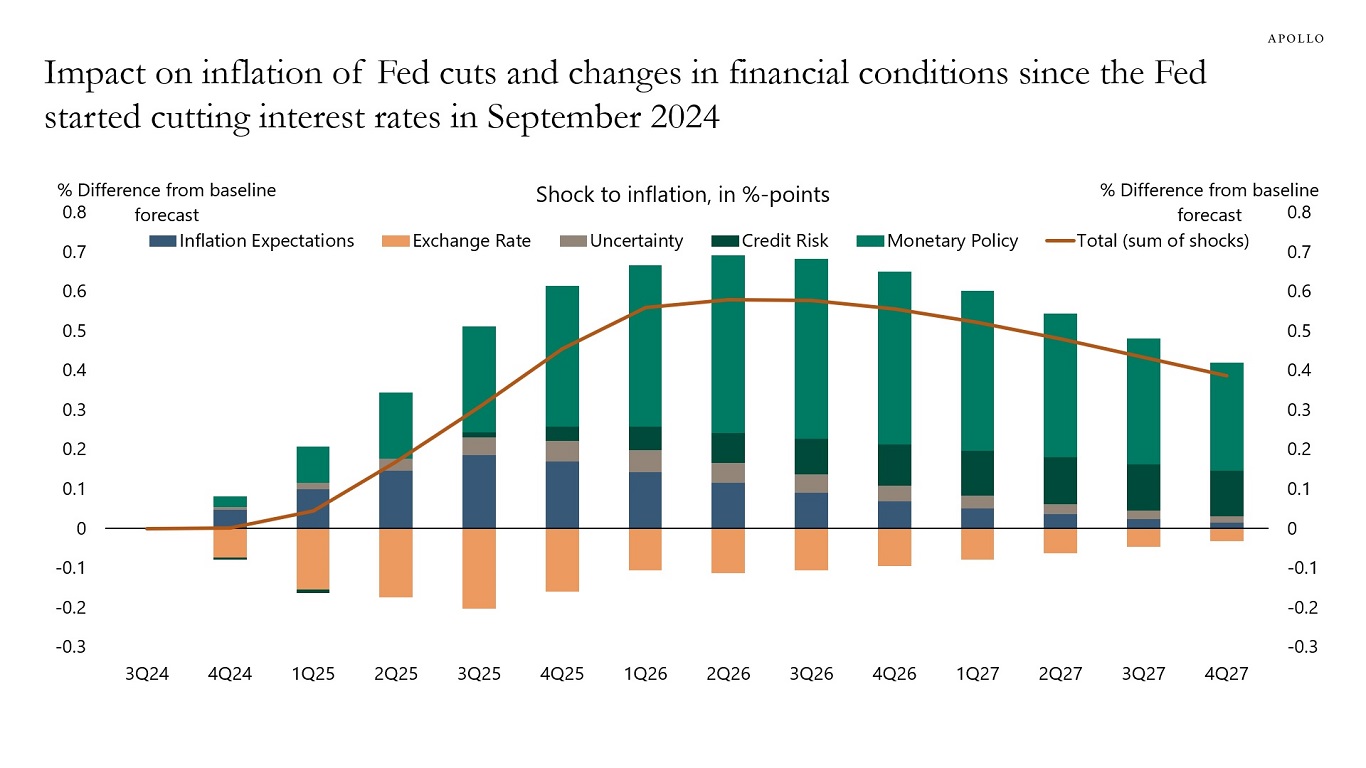

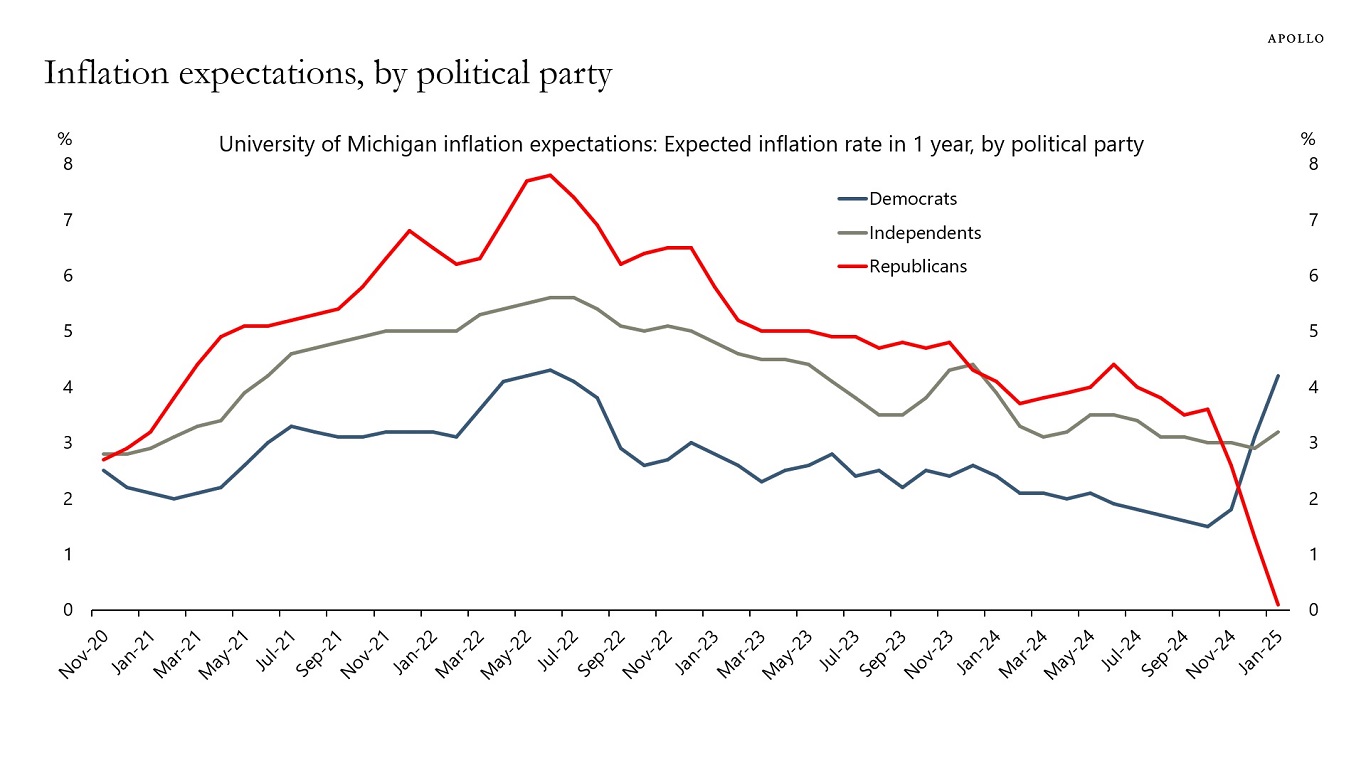

The narrative that the economy is slowing and inflation is moving down to 2% is wrong, see again charts below.