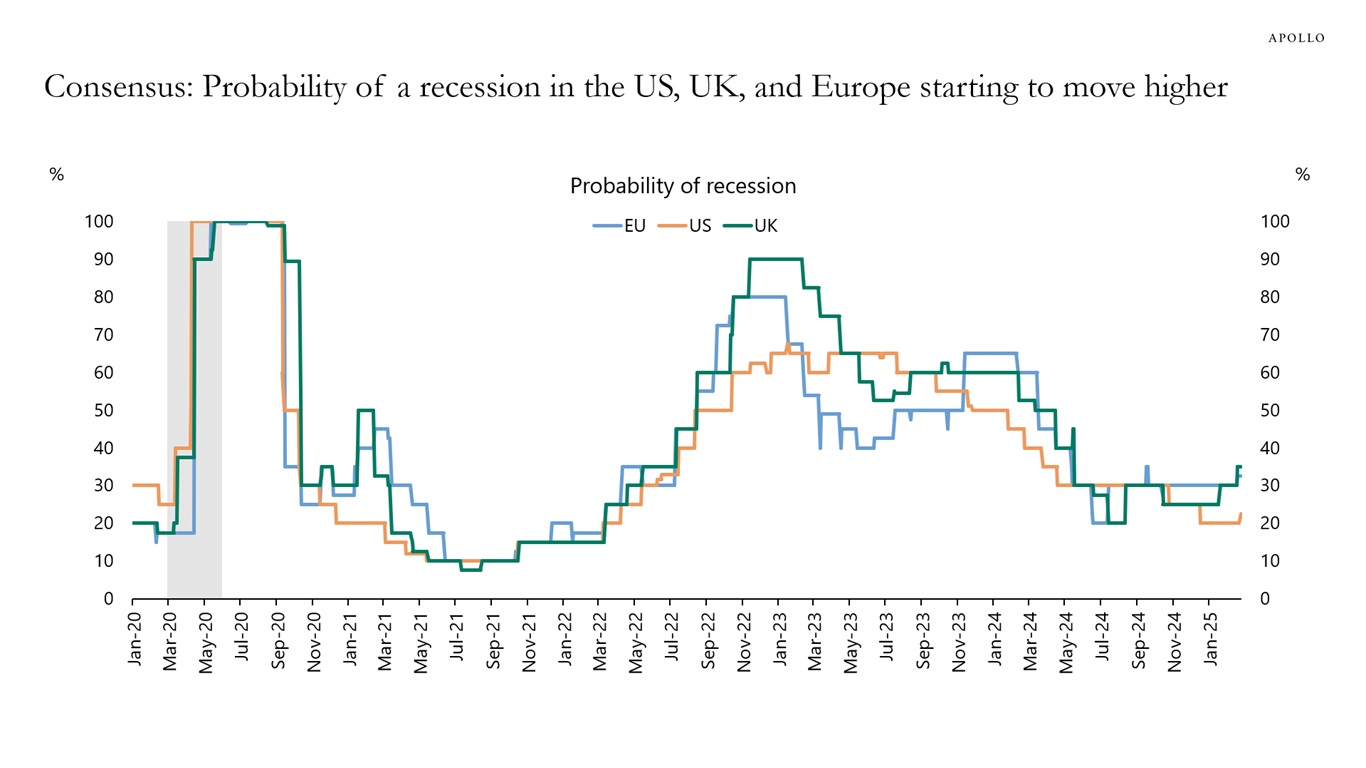

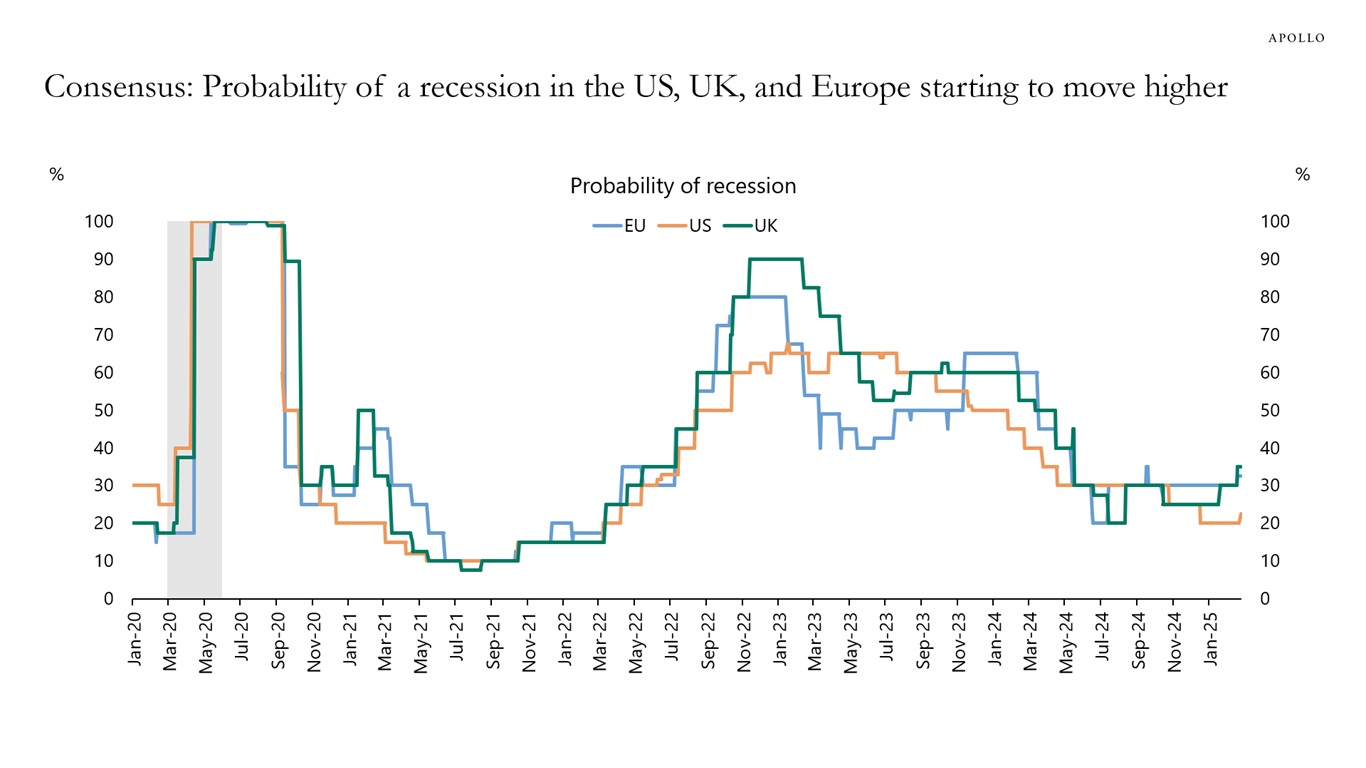

Since 2023, the likelihood of a recession has declined steadily. But in recent weeks, the probability of a recession over the next 12 months has ticked higher in the US, UK, and Europe, see chart below.

Since 2023, the likelihood of a recession has declined steadily. But in recent weeks, the probability of a recession over the next 12 months has ticked higher in the US, UK, and Europe, see chart below.

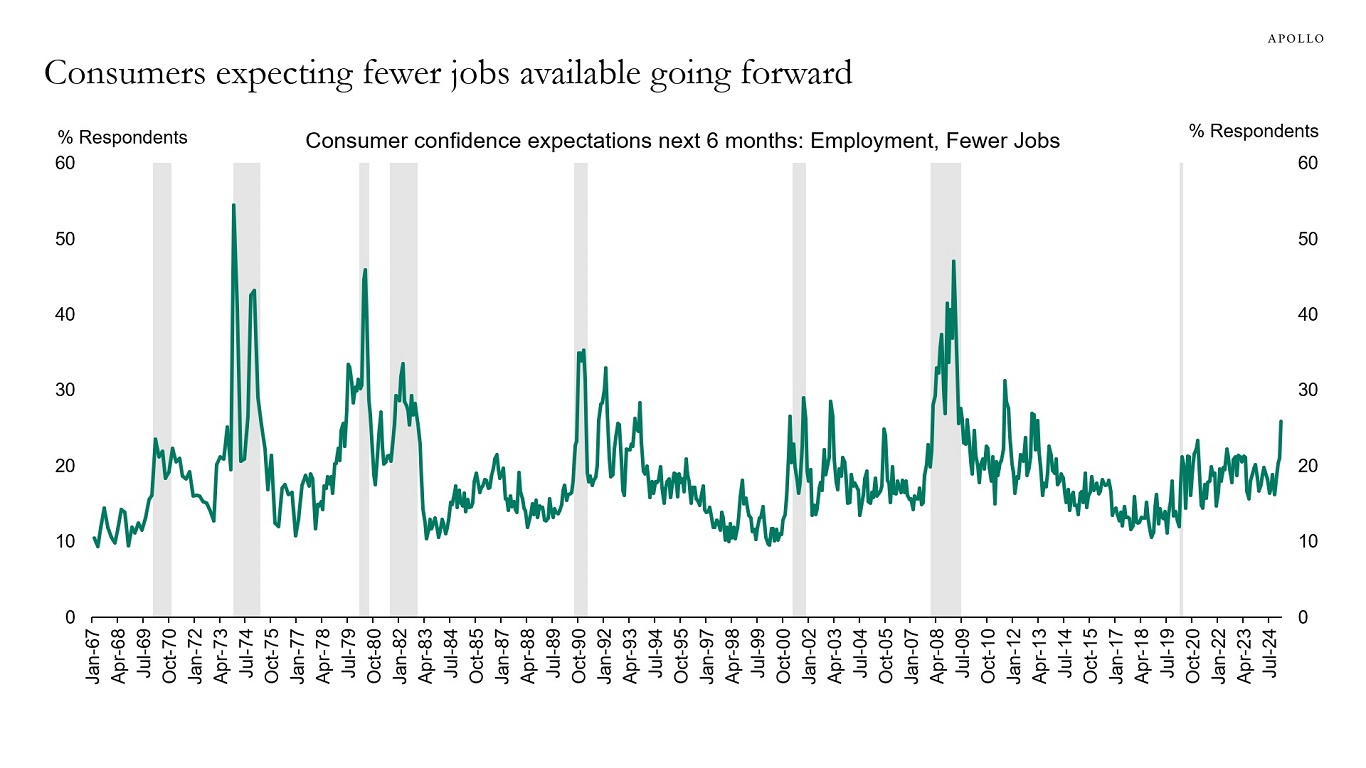

The Conference Board consumer confidence survey for February shows a big jump in the share of consumers who are worried about fewer jobs being available, see the first chart below.

Total employment in the US economy is about 160 million. With 3 million federal employees potentially worrying about their jobs and 6 million federal contractors worrying about their jobs, the risks are rising that households may begin to hold back purchases of cars, computers, washers, dryers, vacation travel plans, etc.

We remain bullish on the economic outlook, but we are very carefully watching the incoming data for signs if this is an inflection point for the business cycle.

On Saturday, we will be publishing our usual daily and weekly indicators for the US economy to monitor if the weakness in sentiment seen in the charts below is starting to show up in actual spending decisions for consumers and firms.

The world has moved from globalization to segmentation.

Specifically, we have gone from a world of globalization where goods were flowing over borders, people were moving across borders, and the rules for businesses were predictable and harmonized across countries.

In the new world, economies, markets, and policies are more segmented. Tariffs and geopolitical considerations limit the flow of goods. There are more restrictions on immigration. Countries have different industrial policies, which have made the rules for businesses more unpredictable and idiosyncratic.

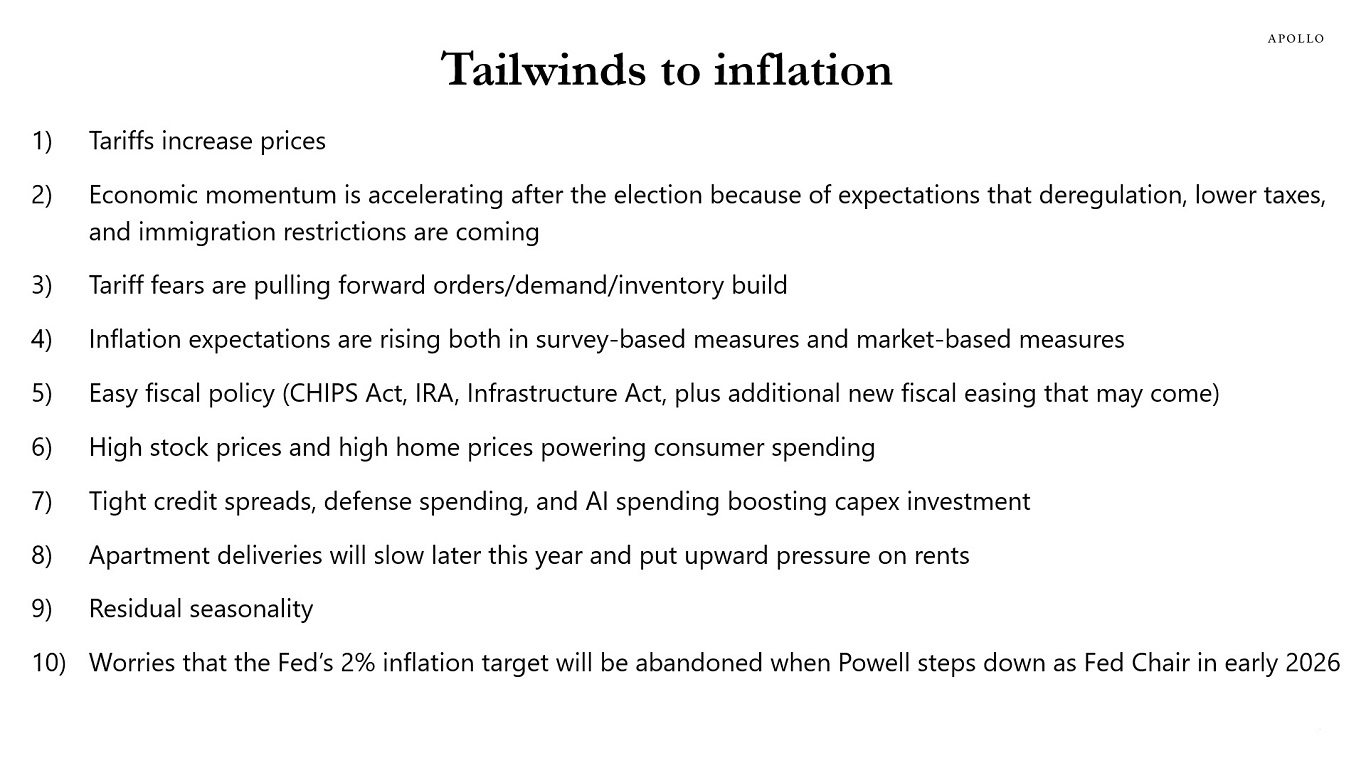

The consequence of moving from a global economy to a segmented economy consisting of many separate “islands” is permanently higher inflation everywhere. Imported goods are more expensive, domestically produced goods are more expensive, less immigration makes domestic labor more expensive, and different industrial policies in different countries reduce competition.

The bottom line is that globalization was putting downward pressure on inflation. Segmentation, or deglobalization, is putting upward pressure on inflation.

For markets, the conclusion is straightforward. An increasingly segmented global economy is putting structural upward pressure on inflation in goods markets and labor markets, which will keep interest rates structurally higher for longer.

There is a long list of forces pushing inflation higher, including tariffs, rising wage growth, higher inflation expectations, easy fiscal policy, easy financial conditions, residual seasonality, and a slowdown in apartment deliveries putting upward pressure on rents later this year, see complete list below. Our latest inflation outlook is available here.

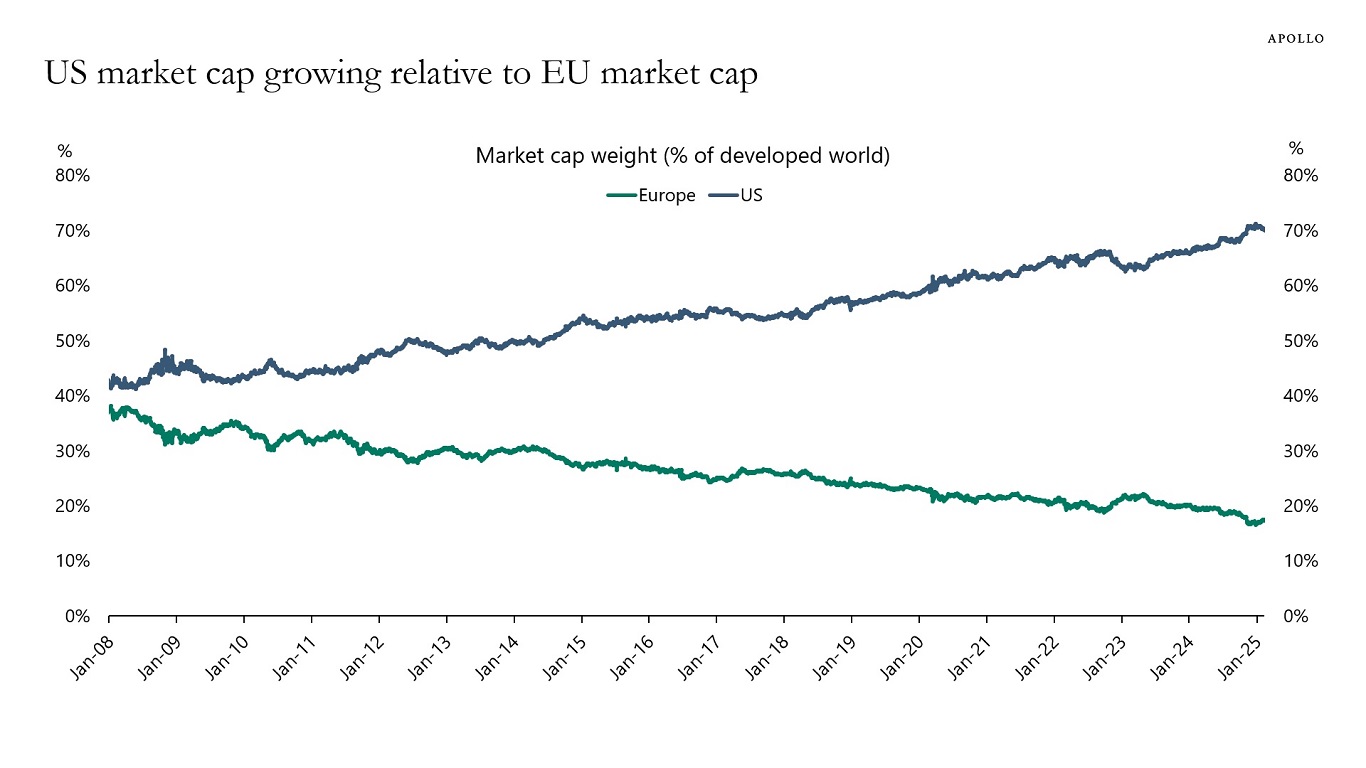

Global equity investors are not only highly concentrated in tech stocks, they are also highly concentrated in US stocks, see chart below. It goes against page one in the finance textbook, which says that investors should be diversified.

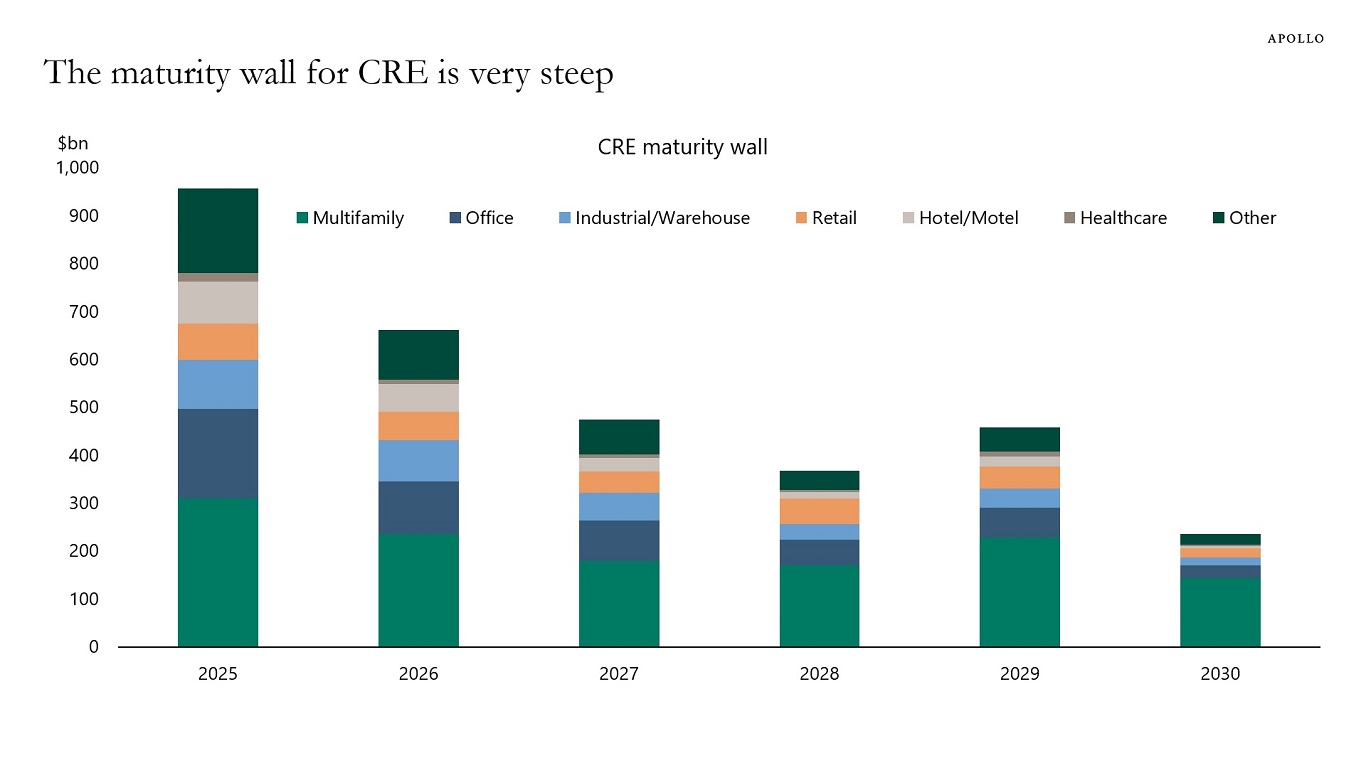

Rates higher for longer continues to be a headwind to the outlook for CRE, see chart below.

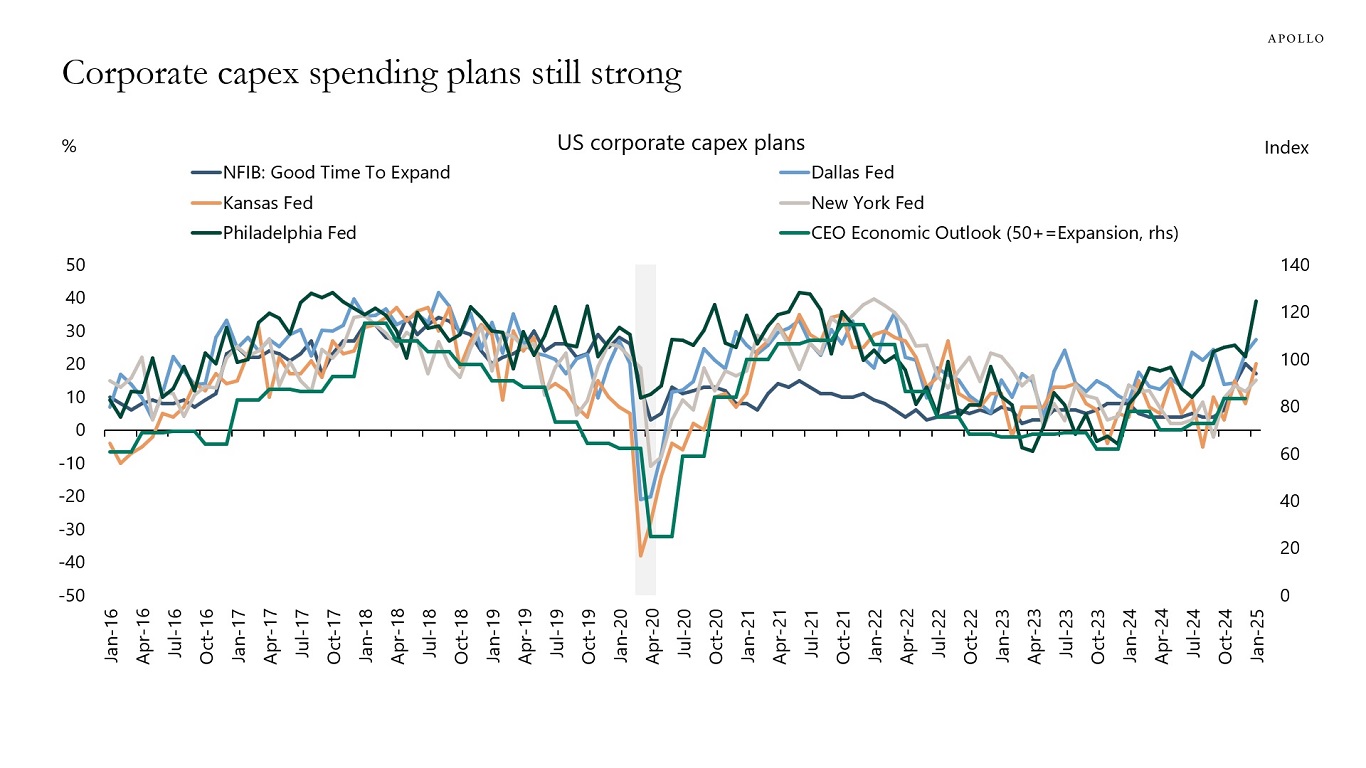

The incoming economic data remains strong. But we are starting to worry about the downside risks to the economy and markets from: 1) the impact of DOGE layoffs and contract cuts on jobless claims and 2) persistently elevated policy uncertainty weighing on capex spending decisions and hiring decisions.

Specifically:

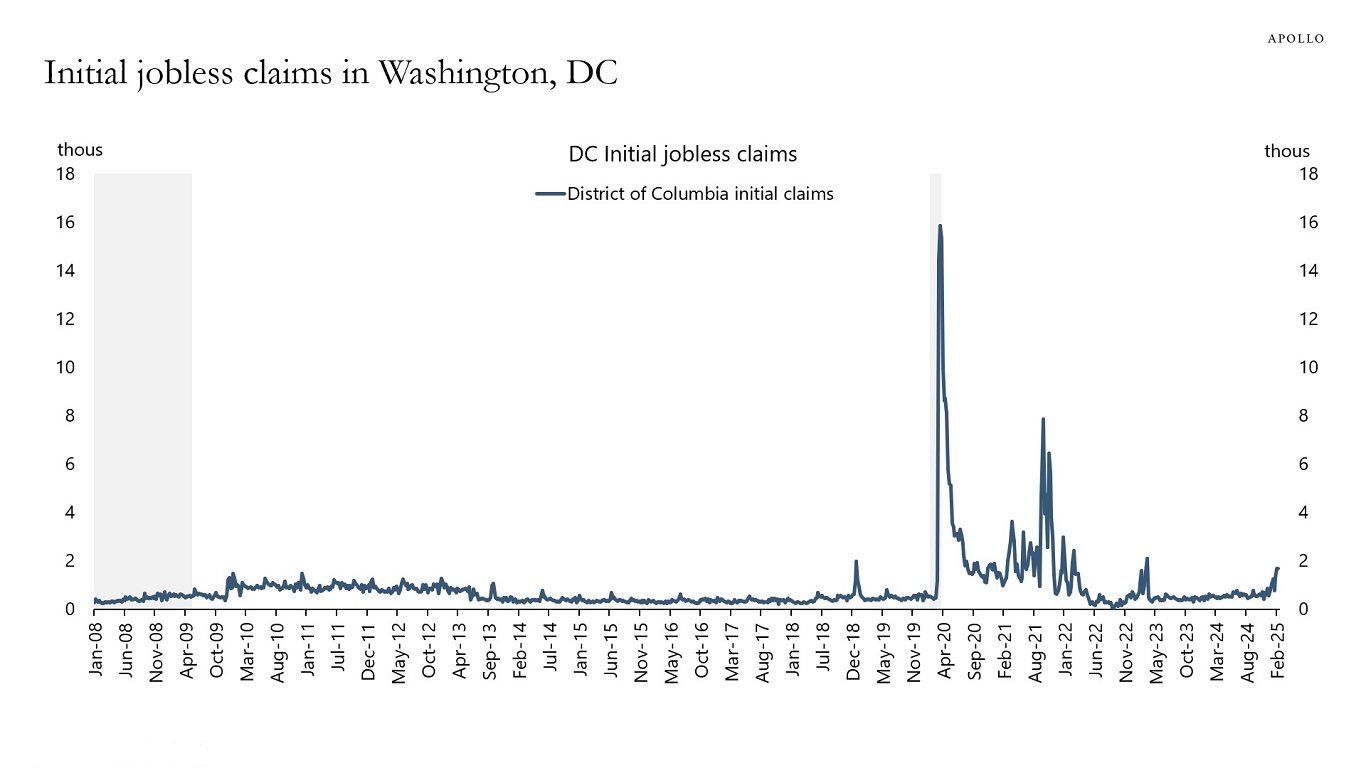

1) The consensus expects total DOGE-related job cuts to be 300,000, and the number of people filing for unemployment benefits has been rising in Washington, DC, but not in Virginia, Maryland, and Washington, DC combined, see the first two charts. Total employment in the United States is 160 million, with 7 million unemployed. Also, about 5 million people change jobs every month. In that context, 300,000 federal jobs lost is not much. However, studies show that for every federal employee, there are two contractors. As a result, layoffs could potentially be closer to 1 million. Any increase in layoffs will push jobless claims higher over the coming weeks, and such a rise in the unemployment rate is likely to have consequences for rates, equities, and credit.

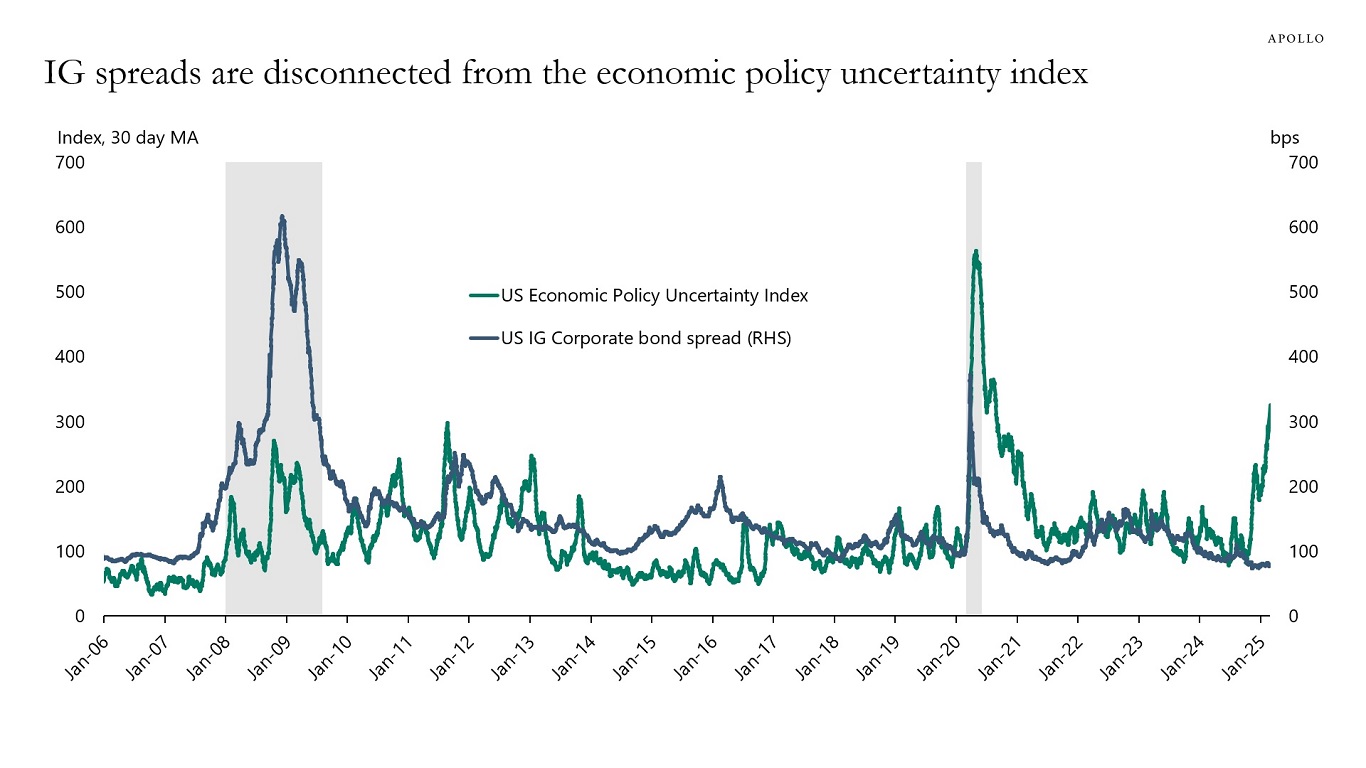

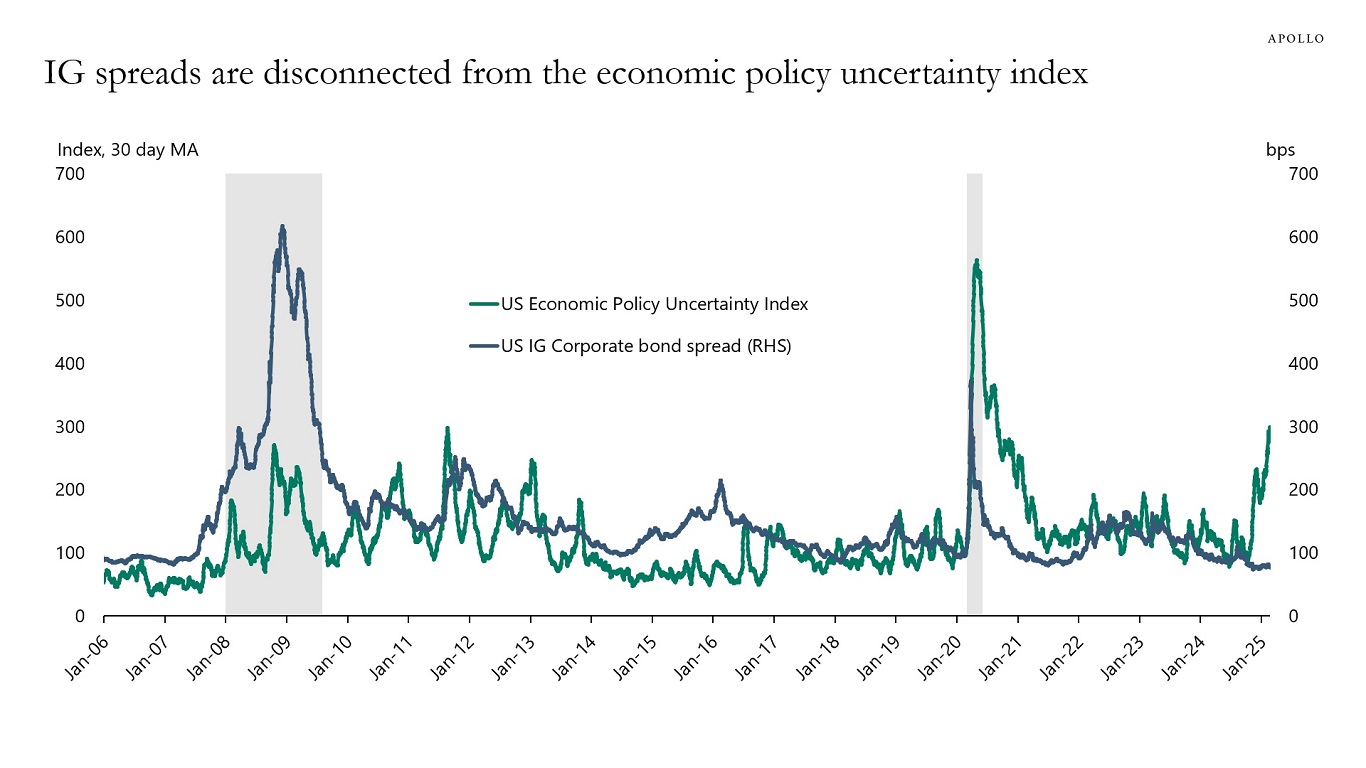

2) Credit spreads have not responded the way they normally do to rising policy uncertainty. Economic policy uncertainty is spiking higher, but credit spreads are not widening, see the third chart. The question is if persistently elevated policy uncertainty will begin to have a negative impact on capex spending and hiring decisions.

The bottom line is that the incoming data remains strong, see the fourth chart. But the near-term downside risks to the economy and markets are growing.

Our chart book with daily and weekly indicators for the US economy is available here.

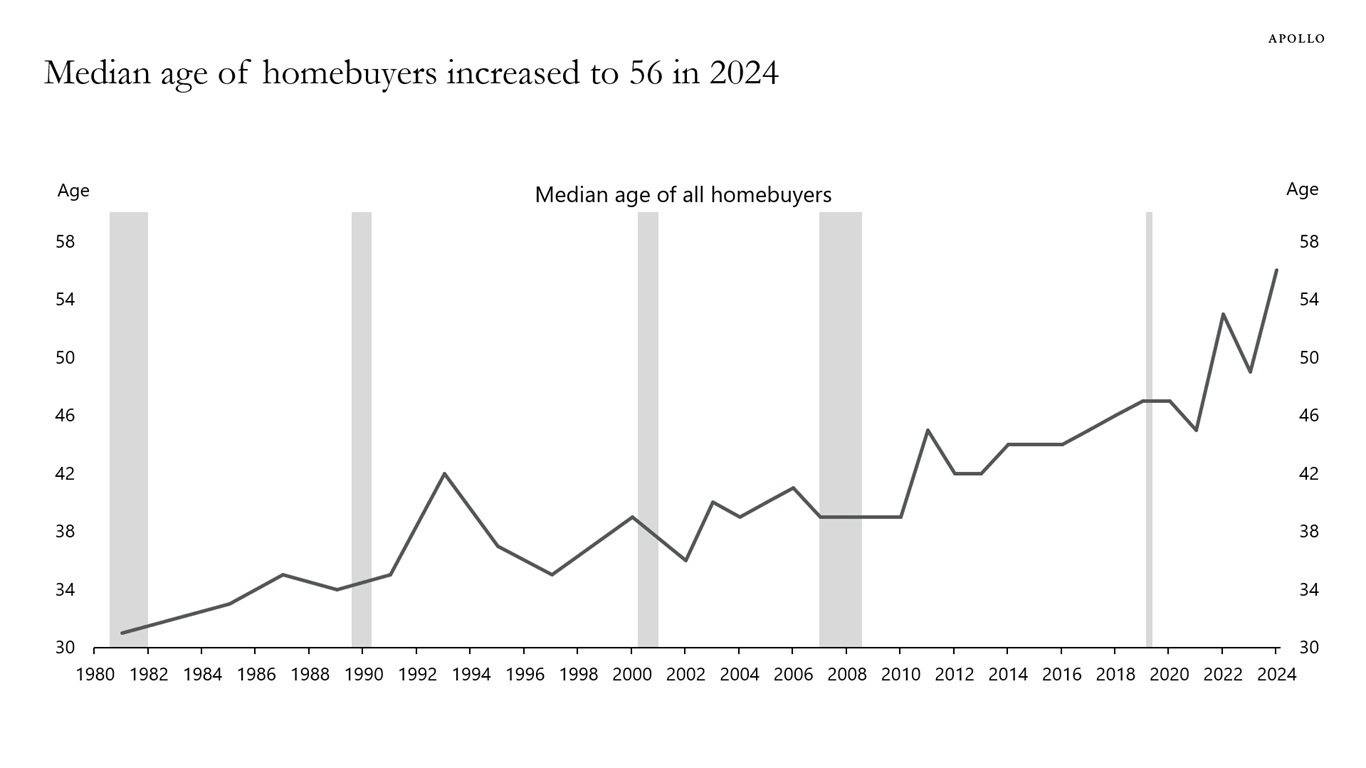

Rising home prices and high mortgage rates have pushed the median age of homebuyers to a record-high 56 years old in 2024, up from 45 in 2021.

In 1981, the median age of homebuyers was 31 years old, see chart below.

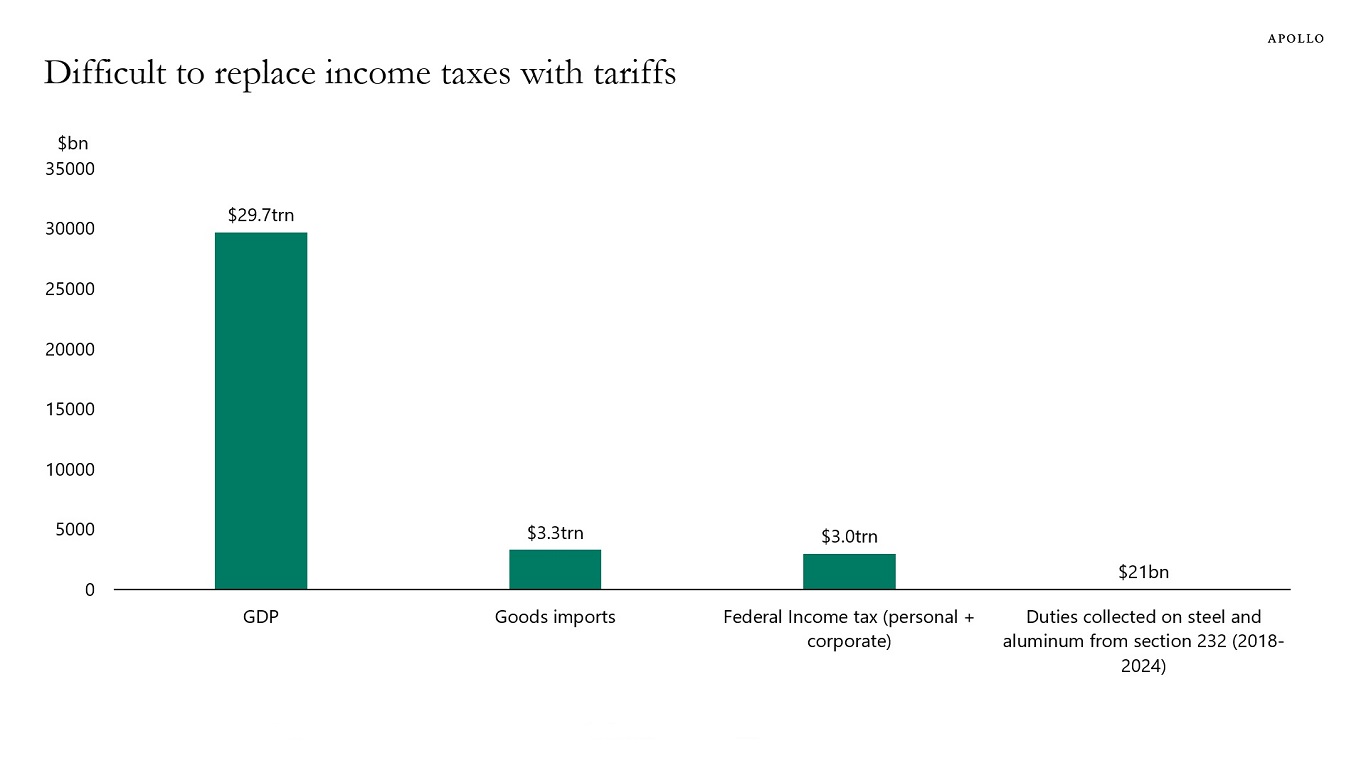

Total revenue raised from income taxes is currently around $3 trillion, and total imports into the US are also around $3 trillion, see chart below.

This means that tariffs would have to be at least 100% on all imported goods for tariffs to replace income taxes.

The challenge is that it is unclear what will happen to sales if all imported products double in price. Given higher prices result in lower sales, it may require as much as 200% tariffs on all imported goods for the total tariff revenue to replace income taxes.

In addition, such a scenario would also involve significantly higher prices of cars, computers, electronics, imported medicine, clothing, shoes, imported energy, etc. for US consumers.

The bottom line is that it is challenging to replace income taxes with tariffs, and higher tariffs will have implications for consumer prices and consumer demand for imported goods.

Below are some questions I have been getting from clients recently. All risk managers should be asking themselves these questions.