The chart book we used during our conference call yesterday is available here.

The chart book we used during our conference call yesterday is available here.

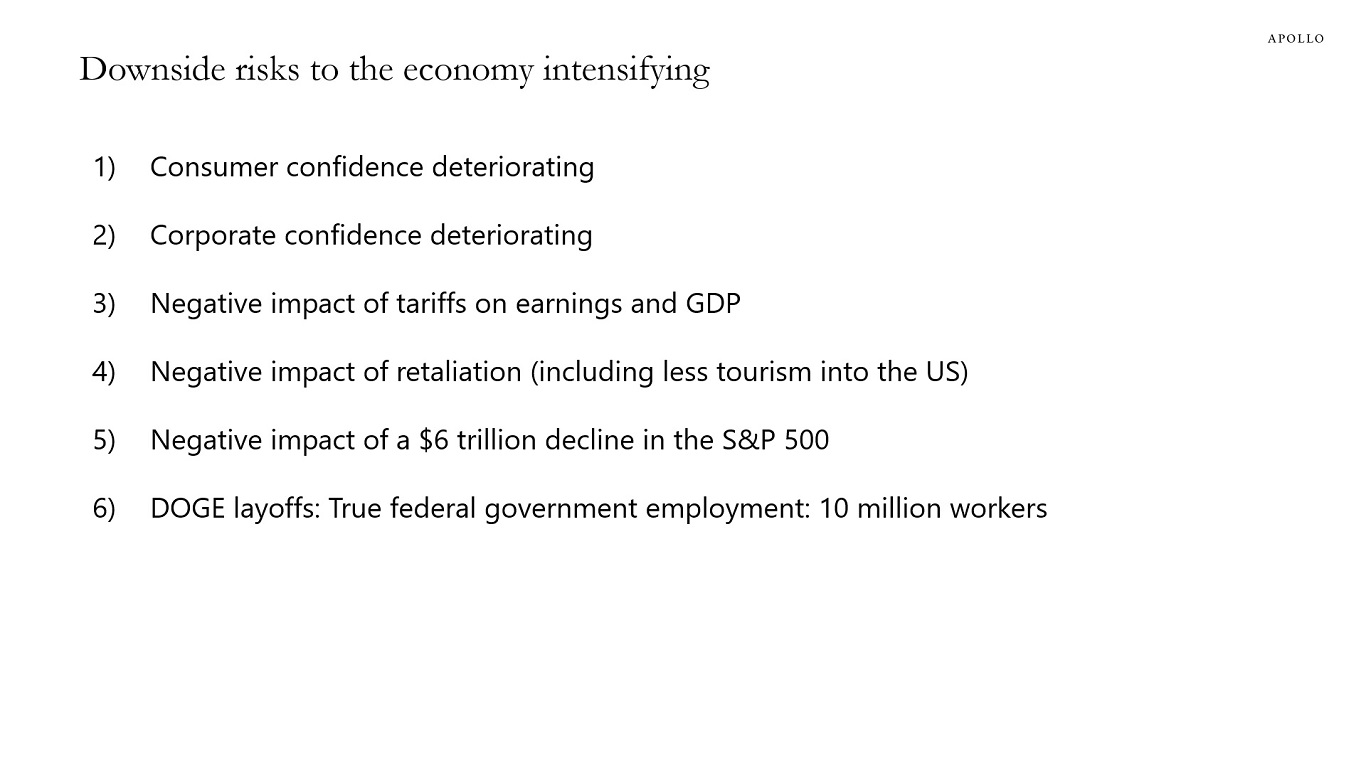

The table below shows our estimates of the impact on US GDP and inflation of tariffs and the decline in consumer sentiment and corporate sentiment.

Whether we will have a recession or not depends on the duration of this shock. If these levels of tariffs stay in place for several months and other countries retaliate, it will cause a recession in the US and the rest of the world.

We will be discussing the outlook for the economy and markets on a conference call today at 9 am EDT, you can register here.

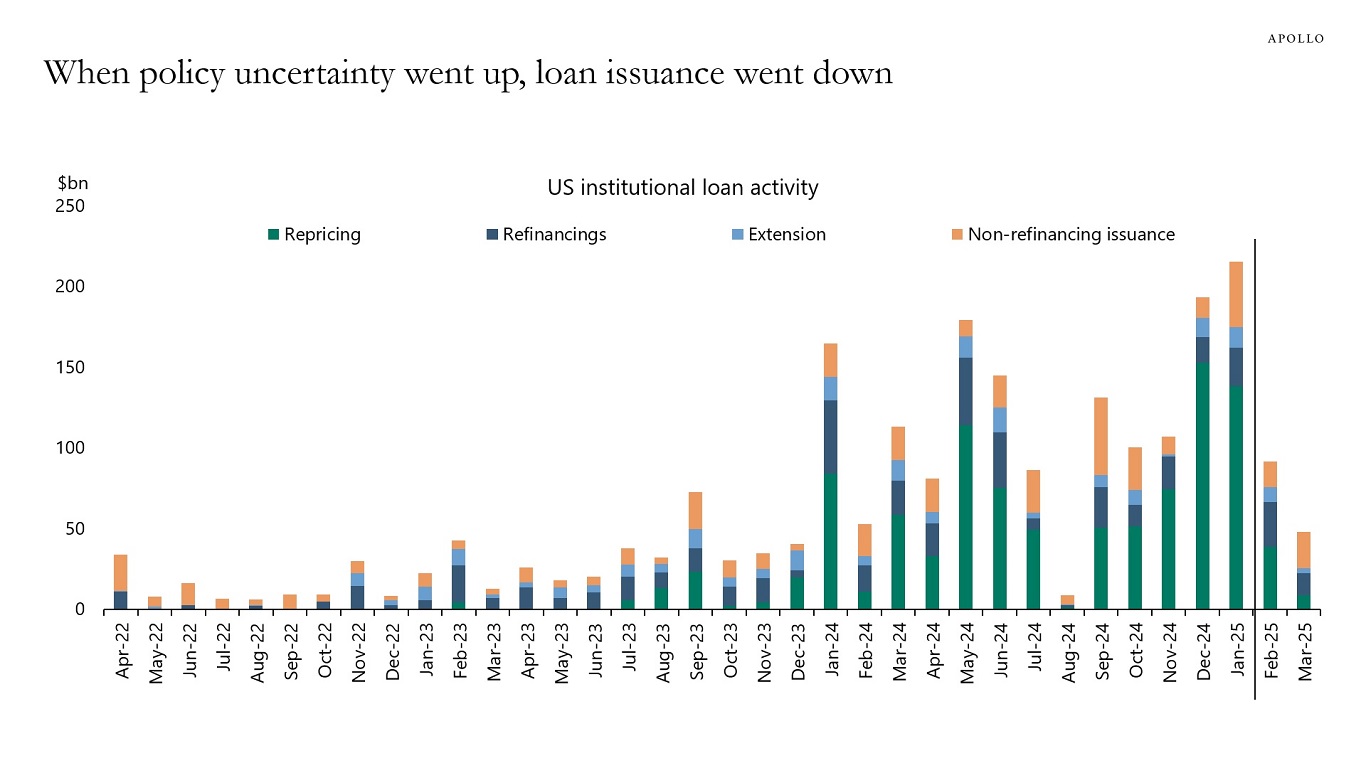

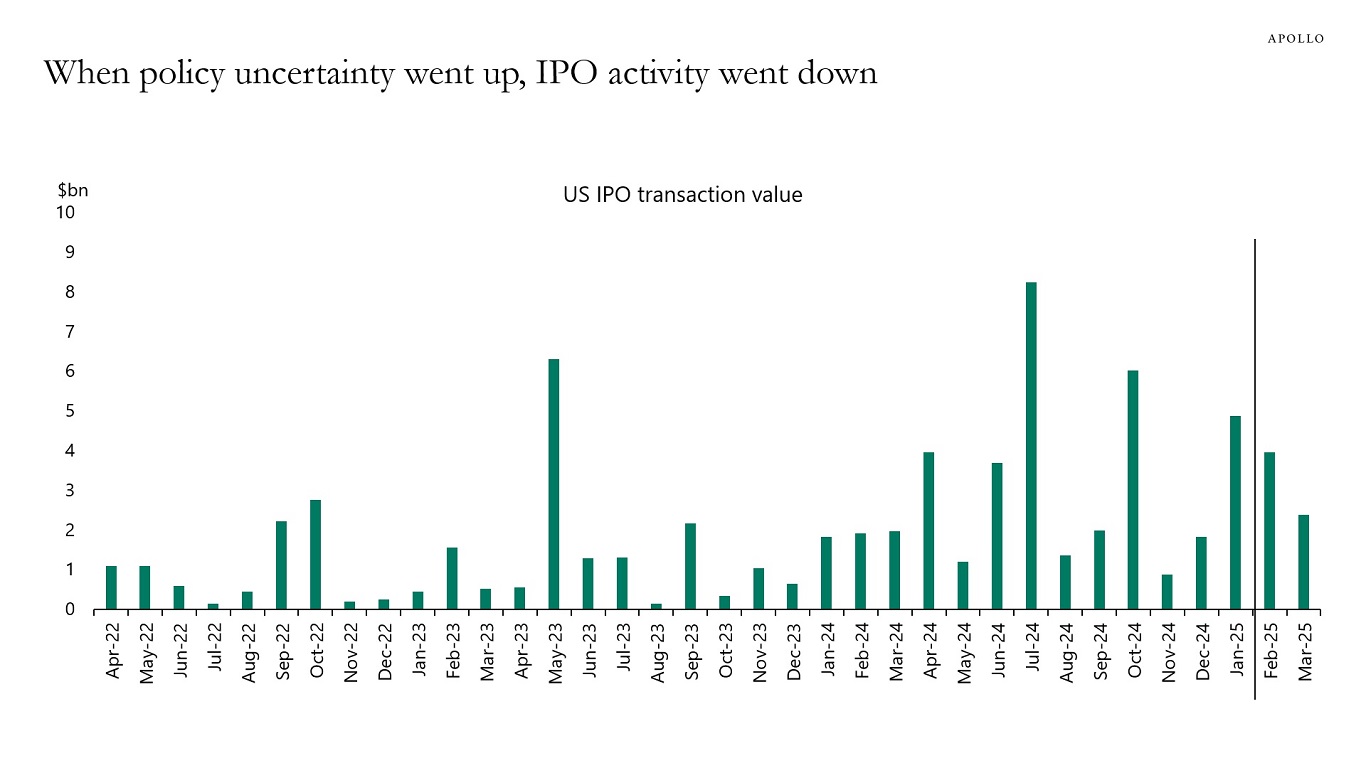

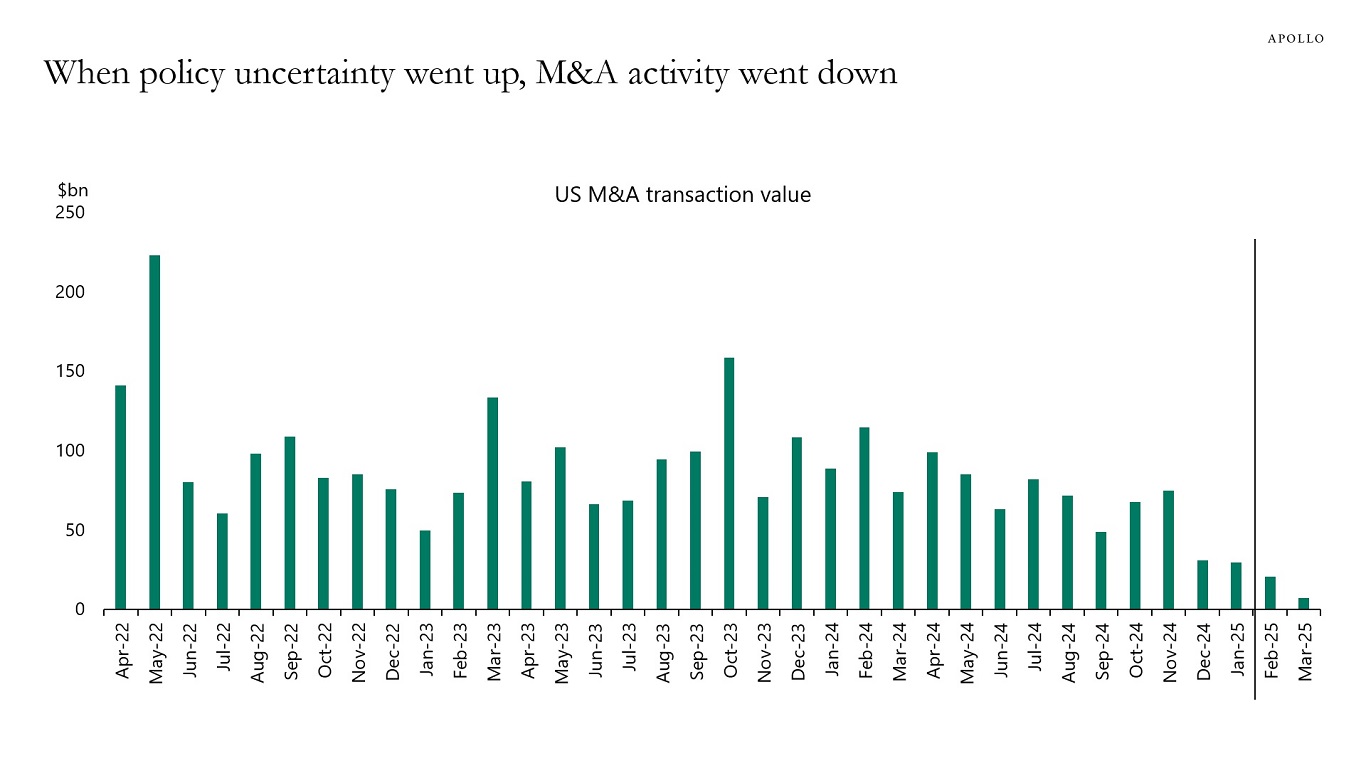

When policy uncertainty went up, capital markets activity started slowing down, with a decline in loan issuance, IPO activity, and M&A activity, see charts below.

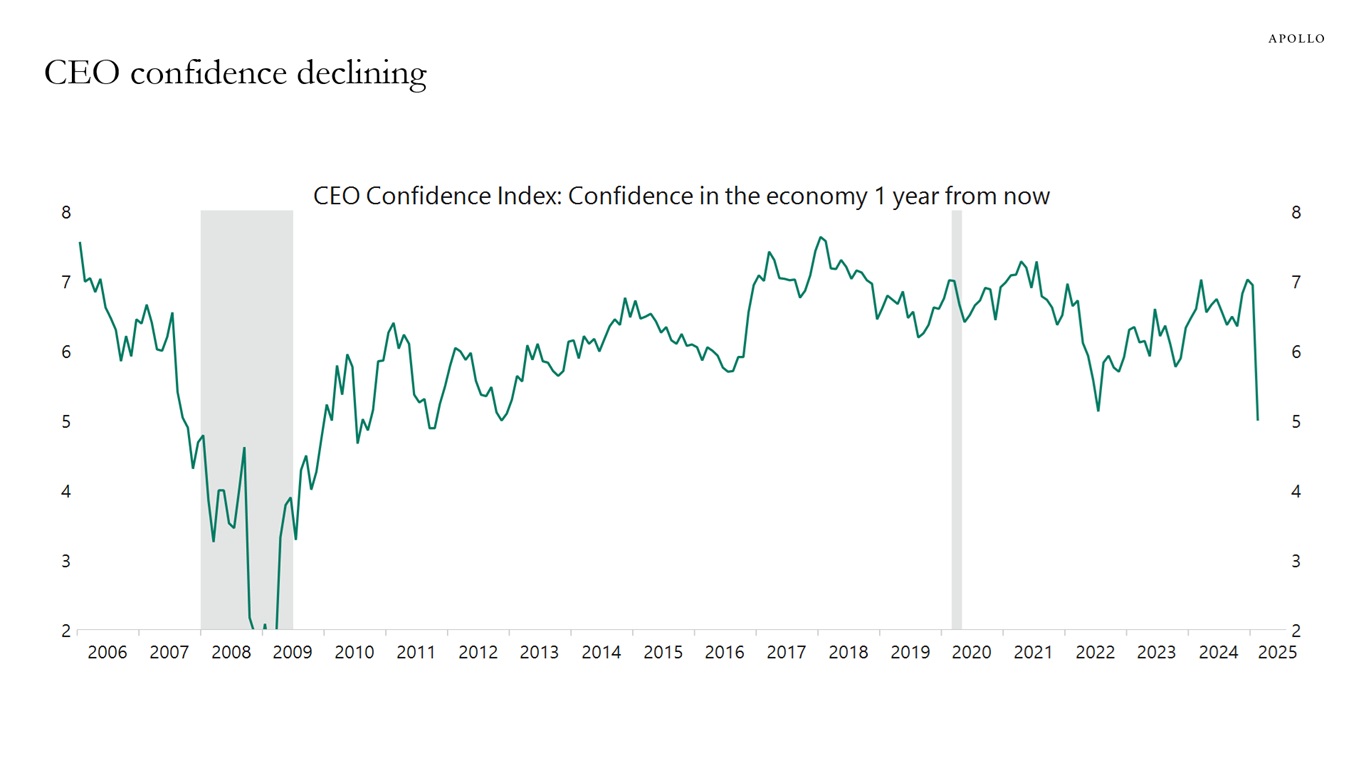

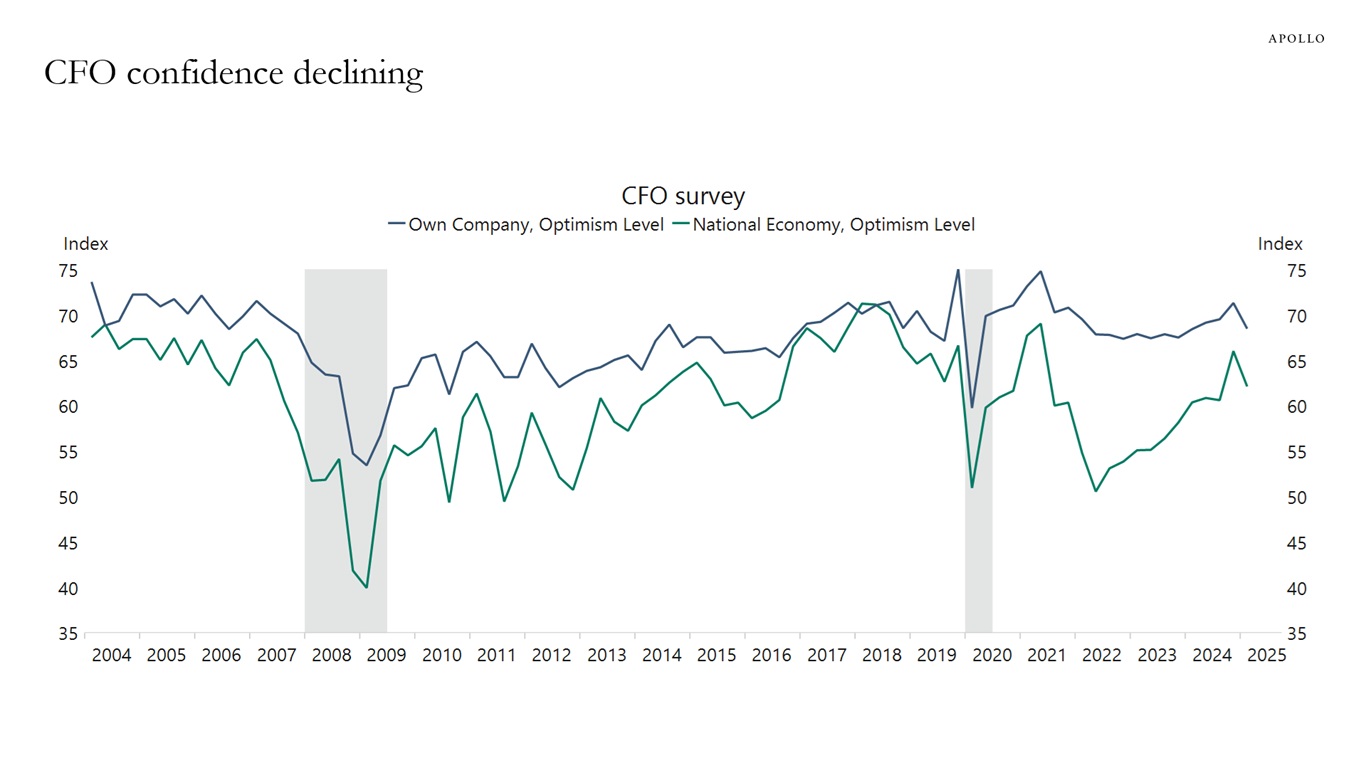

Surveys of CEOs and CFOs show that corporate confidence has declined in recent months, see charts below.

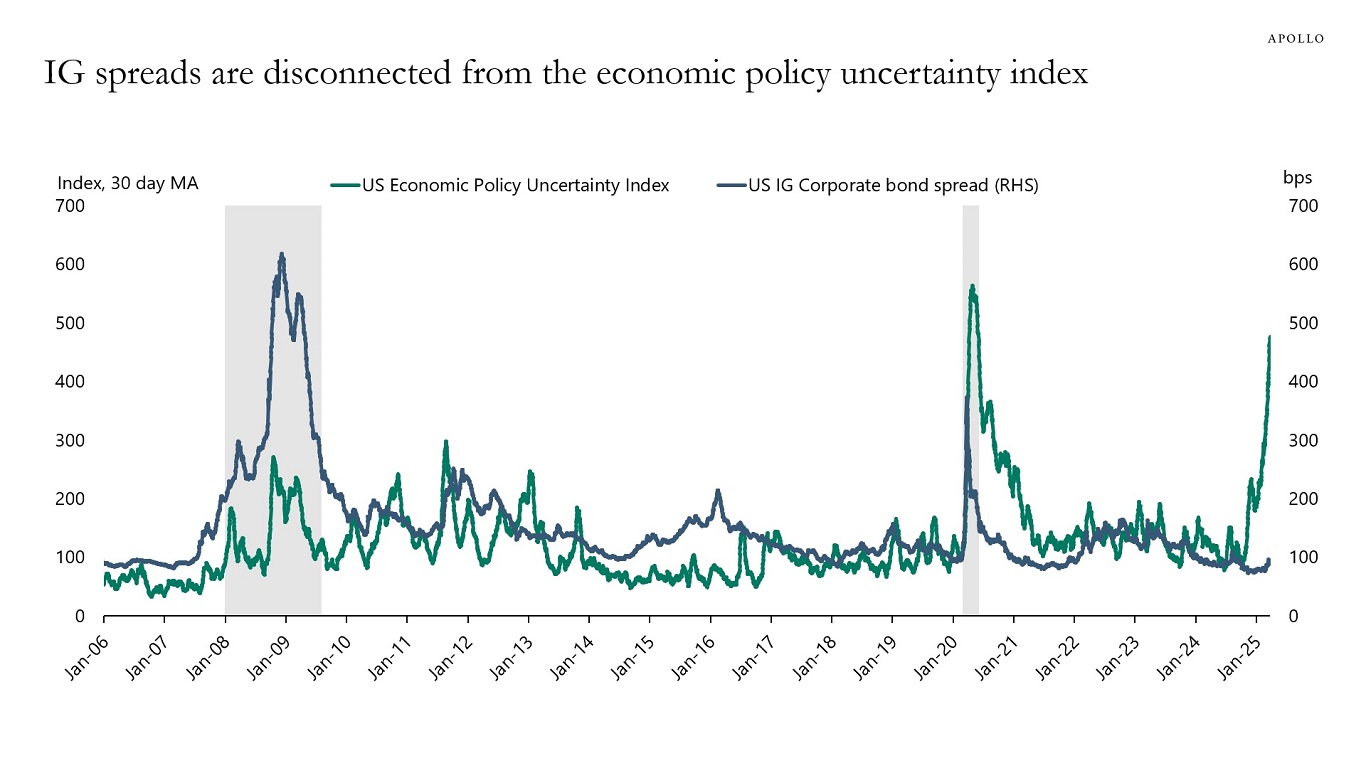

If uncertainty stays elevated for an extended period, it will have a more negative impact on the economy, see chart below, which shows the impulse responses of a temporary and a permanent shock to economic policy uncertainty in a vector autoregression model with GDP and economic policy uncertainty.