This focus provides an estimation of the effect of a Russian stop of energy imports. The main results are as follows:

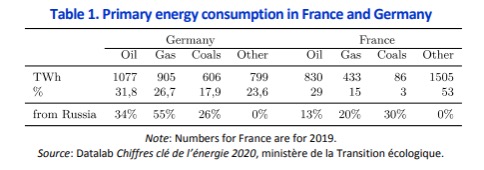

- The impact for France would be modest with a decline of around 0,15 to 0,3% in gross national income.

- For Germany, the negative impact on gross national income is real (around 0.3% and up to 3% in the most pessimistic scenarios) but overall moderate and can be absorbed.

- The same is true for the EU as a whole although there is significant heterogeneity in the magnitude of the shock across countries.

- For some EU countries, the consequences are much greater: Lithuania, Bulgaria, Slovakia, Finland, or the Czech Republic may experience national income drops of between 1 and 5%.

- These estimates take into account cascading effects along production value chains in a model with 30 sectors and 40 countries. Despite the imprecision of this type of simulation exercise, the orders of magnitude appear very robust: we can rule out with a high degree of confidence a scenario of a GDP collapse of more than 1% for France for example.

- The relatively low impact of an embargo (except for the aforementioned countries) can be explained by the fact that even in the short term companies and the economy as a whole can substitute (even very partially) sources of energy to others and intermediate or final goods to others. The analysis of historical experiences of very strong shocks (Fukushima in Japan or COVID in China) with potential effects along production value chains also shows that individual companies and the economy are able to minimize the impact of the shock. This substitution even though it is very partial helps to very significantly mitigate the impact of the shock compared to a scenario where the entire production and consumption structure is fixed.

The Economic Consequences of a Stop of Energy Imports from Russia

https://www.cae-eco.fr/staticfiles/pdf/cae-focus084.pdf