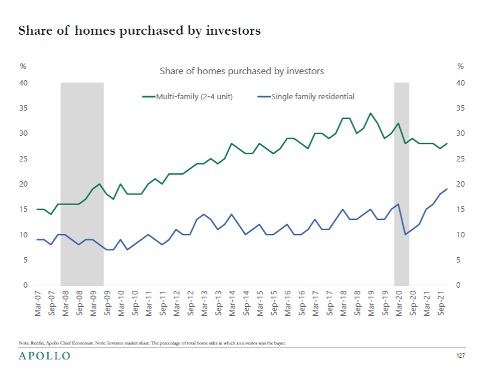

A record-high 20% of single-family homes sold are sold to investors, see chart below.

This part of the housing market is less sensitive to the Fed hiking rates and to higher mortgage rates. In that sense, a higher investor share weakens the transmission mechanism of monetary policy to the housing market.

With a high investor share combined with a high level of excess savings in the household sector, the Fed has to raise rates even more and even faster to cool the economy and inflation down. Which increases the likelihood of a harder landing.