There is an ongoing debate about how core PCE inflation could come down from 5.5% to 3.2% without a slowdown in the economy, but this debate ignores that the cyclical components of GDP, including housing, have slowed sharply as a result of Fed hikes, and the non-cyclical components have continued to see strong growth in particular with strong post-Covid tailwinds to restaurants, hotels, and airlines.

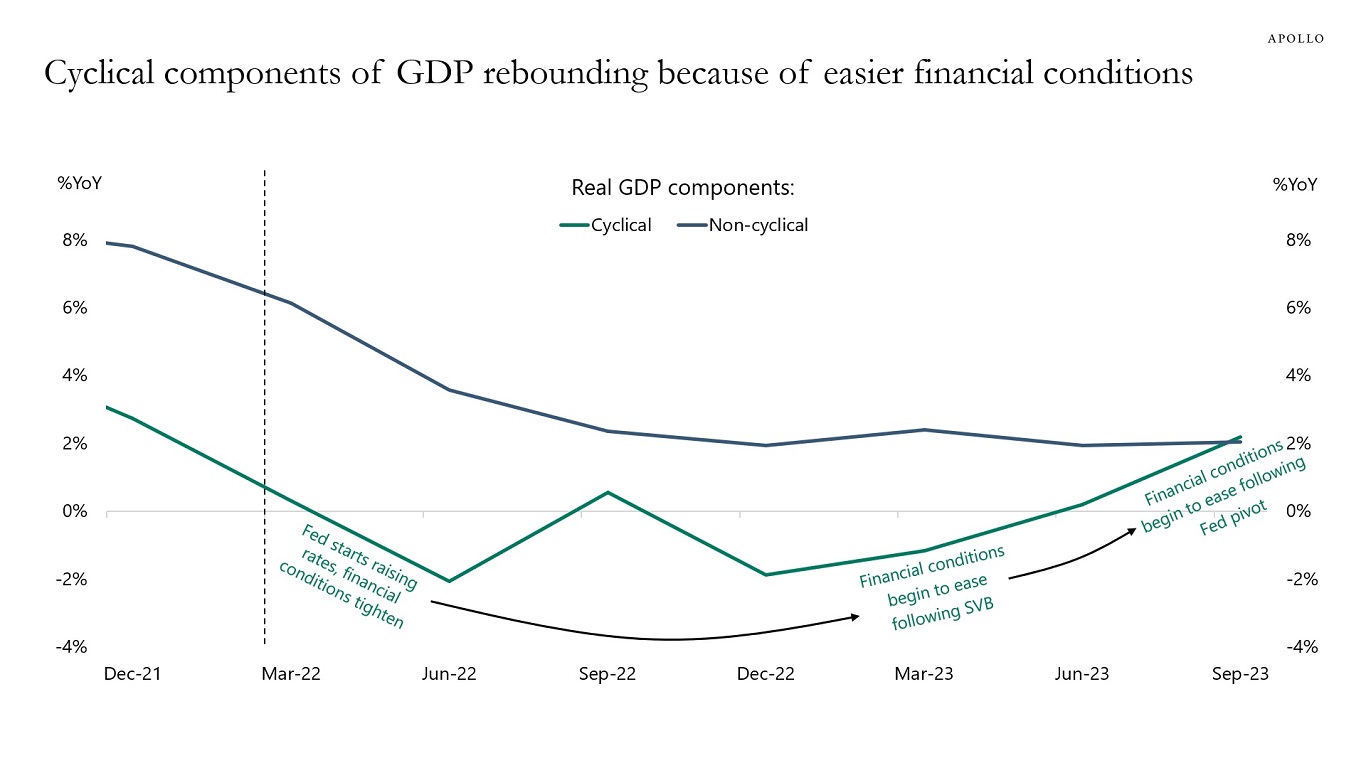

The cyclical components of GDP are the interest rate-sensitive components such as housing, capex, and durable goods, and these parts of the economy slowed significantly when the Fed started raising rates, see chart below.

Put differently, it is misleading to say that Fed hikes have not had any negative impact on the economy. Fed hikes had a very negative effect on the interest rate-sensitive parts of the economy, most notably housing, and the result was a decline in housing inflation. With housing having a 40% weight in the CPI basket, the result was a decline in headline and core inflation for both CPI and PCE.

So why did the economy not slow down more, and why did Fed hikes not result in a rise in unemployment? There are two reasons.

First, the post-Covid economy saw surprising strength in the non-cyclical components of the economy, such as eating at restaurants, staying at hotels, and flying on airplanes, etc. Consumers wanted to travel, go to concerts and sporting events after Covid, and this has kept consumer spending strong.

Second, financial conditions eased significantly following SVB, and this boosted GDP growth to 4.9% in the third quarter of 2023. Similarly, the rally in the stock market, credit markets, and Treasury markets since October and after the Fed pivot in December have also eased financial conditions significantly, likely boosting the cyclical components of GDP over the coming months.

As the chart below shows, the bottom line is that the non-cyclical components continue to grow steadily because of post-Covid strong demand for consumer services, and the cyclical components are rebounding because of easier financial conditions.

The likely scenario is that the economy will reaccelerate over the coming months, which will put renewed upward pressure on inflation and, hence, bring back a more hawkish Fed.

In short, the Fed is not done fighting inflation, and, as a result, it is too early to argue that this is a soft landing because both the cyclical and non-cyclical components of GDP are likely to be solid over the coming months, see again the chart below.