Fed Chair Powell told the audience at Jackson Hole that “the time has come for policy to adjust,” acknowledging recent progress on inflation, and setting the scene for a rate cut today—the first reduction in more than four years.

While the announcement provided investors with much-needed clarity about the timing of the first rate cut, there remains a large deal of disagreement around the magnitude of rate cuts throughout the rest of the year and into 2025. It seems as though overnight investors have replaced concerns about a stubbornly high inflation with a possible recession that will force the Fed to cut rates more aggressively.

In our view, recent economic data—including the July and August payrolls reports—point to an economy that is slowing down but not heading into a recession. This was very much the outcome that the Fed was working towards given the resilience and stamina of the US economy over the past three years. While employment gains have been more moderate over the last three months, average hourly earnings have increased, and the unemployment rate declined in August. On top of that, recent economic indicators continue to point to a strong economy. Initial jobless claim applications fell to the lowest since July, US retail sales accelerated in July by the most since early 2023, and gross domestic product rose at a 3% annualized rate during the second quarter, up from the previous estimate of 2.8%. Other indicators continue to signal robust growth: Restaurant bookings, TSA travel data, hotel bookings and box office revenue remain strong.

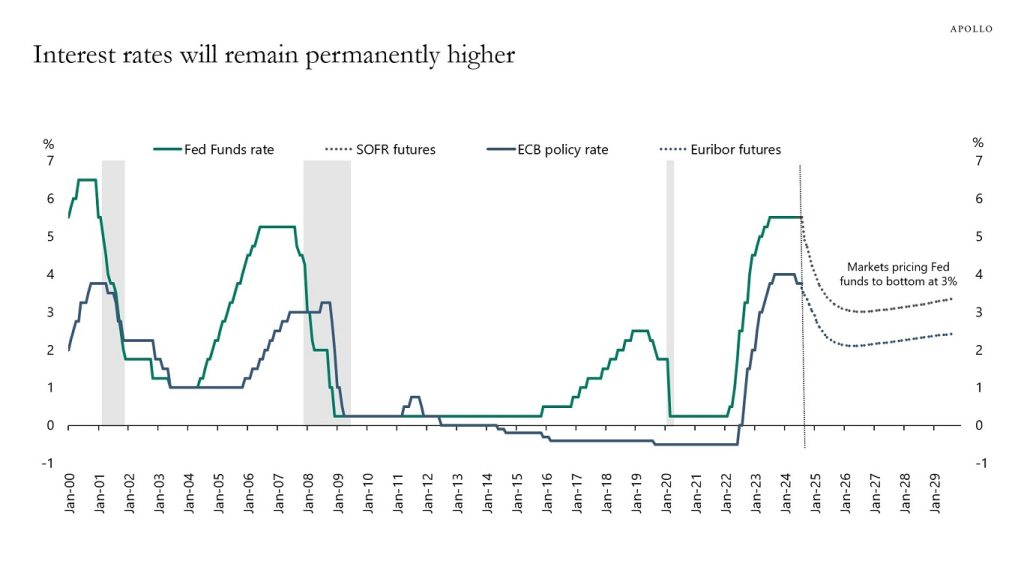

Even if the Fed embarks on an easing cycle, we believe that interest rates will remain relatively higher for longer. If we assume the interest rate futures market is correct in pricing in at least four rate cuts in 2024—which we believe is overblown—short-term interest rates would by the end of 2024 be around 4.5%, a level that would still be the highest for overnight rates since 2007 (excluding the Fed’s current hiking cycle). Furthermore, if we take in the expectations for additional ~five rate cuts in 2025, rates will reach 3% by the end of next year, which is nearly double the average 1.8% rate over the past decade.

A soft landing remains our base case, driving our broadly constructive view on direct lending. Our expectation remains that it will take longer for inflation to come down to the central bank’s 2% target range, and as a result the curve will continue to steepen, meaning long rates are going to decline less than short rates. The combination of a strong economic backdrop along with elevated yields further out the curve is favorable for high-quality private credit. With private credit spreads of 5%-6% and Original Issue Discounts of 2% factored in, investors should still be able to command solid returns over the coming years. We continue to believe that the opportunity set to lend to bigger businesses on a first lien, senior secured basis at elevated yields remains attractive.